The new/renewed tax credit is unknown. The bill also includes millions of dollars in funding for electric vehicle charging infrastructure.

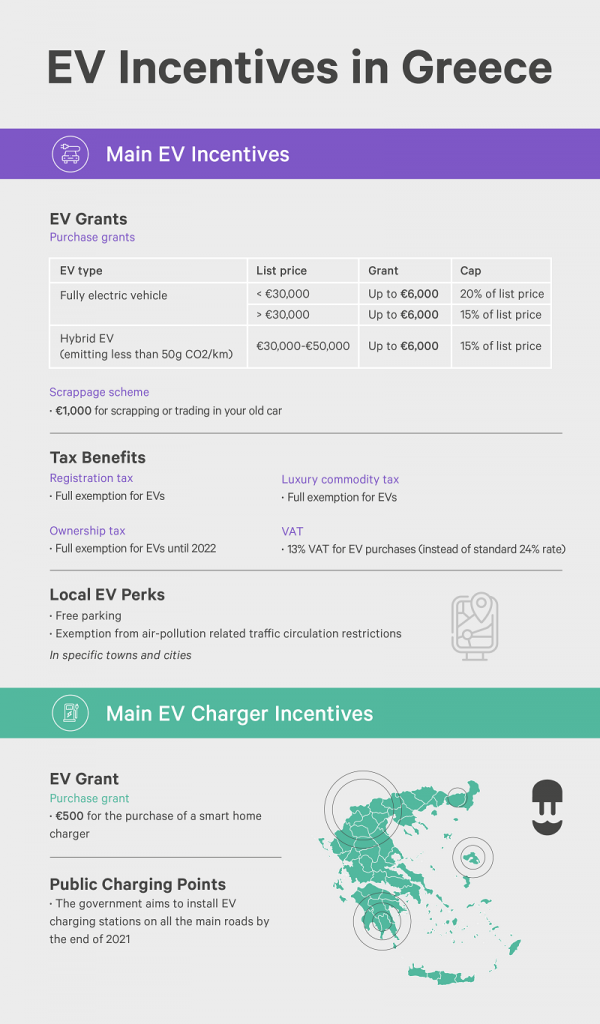

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Tax credits allowed by this act meet the goals, purposes, and objectives of these.

Ev charger tax credit 2022. Receive a federal tax credit of 30% of the cost of purchasing and installing an ev charging station. The 2022 chevy bolt starts at around $31,000. There are currently three primary proposals under discussion in washington that could materially change these federal income.

Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022. Consumers who purchase and install a residential electric vehicle charger or purchase qualified residential fueling equipment before december 31, 2021 are eligible to receive 30% of ev installation up to a $1000 tax credit. Receive a federal tax credit of 30% of the cost of purchasing and installing an ev charging station (up to $1,000 for residential installations and up to $30,000 for commercial installations).

The only way in which we would have not benefited from the ev tax credit would have been if we had not owed any taxes federal income tax for 2019. Congress recently passed a retroactive (now includes 2018, 2019, 2020, and through 2021) federal tax credit for those who purchase (d) ev charging infrastructure. Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for 5 years add an additional $4,500 for evs assembled in the us using union labor

The current $7,500 is a tax credit that offsets your tax burden at the end of the year. However, this credit has a deadline of december 31, 2021, and may decrease in 2022, so it’s recommended that companies looking to install ev charging systems do so before that deadline. The tax credit now expires on december 31, 2021.

Because the $7,500 tax credit isn't available with these expensive used ses, instant availability seems to be the only reason to get one. The big news for ev shoppers may not be the tax credit increases but that the measure turns the credit into a refund for eligible vehicles purchased as of jan. For example, someone who purchased an ev in january 2021 and then filed their taxes in april 2022 might not receive their tax refund until june 2022.

The credit amount will vary based. The ev tax credit is currently a nonrefundable credit, so the government does not cut you a check for the balance. 2 mayer brown | electric vehicle and charging station tax credits:

The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles. Here’s how you would qualify for the maximum credit: The credit amount varies depending on the class of vehicle and the date it

Also, if our total tax bill had been less than $7,500, we could not have used the entire credit. Michaelc and texas22step like this. Tax credit for electric vehicle chargers enel x securing america s clean fuels infrastructure act aims to raise tax credit 500 5 000 10 ev charger incentives in.

Electric vehicle charging credit summary the bill provides under the personal income tax law (pitl) and corporation tax law. While the bill is a step in the right direction, how effective is the incentive if it doesn’t apply to the most popular evs on the market? Under the current tax credit structure it’s entirely possible that the buyer of an ev might not receive the benefit of the tax credit until nearly 18 months from the time of purchase.

For additional details, please visit afdc.energy.gov. But they wouldn't be eligible for the bonus. If you’ve bought and installed ev charging stations since 2017, you’re eligible for this federal tax credit.

Let's say you owed the federal government $10,000. Assessing proposed changes june 15, 2021 biden administration fy 2022 budget green act clean energy for america act including battery evs and fuel cell vehicles, purchased after january 1, 2022. Section 30c of the irc provides a nonrefundable investment tax credit equal to 30 percent of the cost of alternative fuel vehicle refueling property, which includes ev charging stations and hydrogen refueling stations.

A tax credit is available for the purchase of a new qualified pevs.the minimum credit amount is $2,500, and the credit may be up to $7,500, based on each vehicle's traction battery capacity and the gross vehicle weight rating. We would have been able to take the credit only up to the amount our tax liability for 2019. The incentive brings its price closer to just $18,500.

Current ev tax credits top out at $7,500. The second one cites a price drop, so nobody wanted it for $37k.

How To Choose The Right Ev Charger For You – Forbes Wheels

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Ev Incentive Hike Faces Tortuous Path Through Congress – Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations

Netherlands Ev Ev Charger Incentives Complete Guide Wallbox

Used Ev Tax Credit Union-built Bonus Part Of House Social And Climate Bill Now Headed To Senate

Electric Vehicle Tax Credits What You Need To Know Edmunds

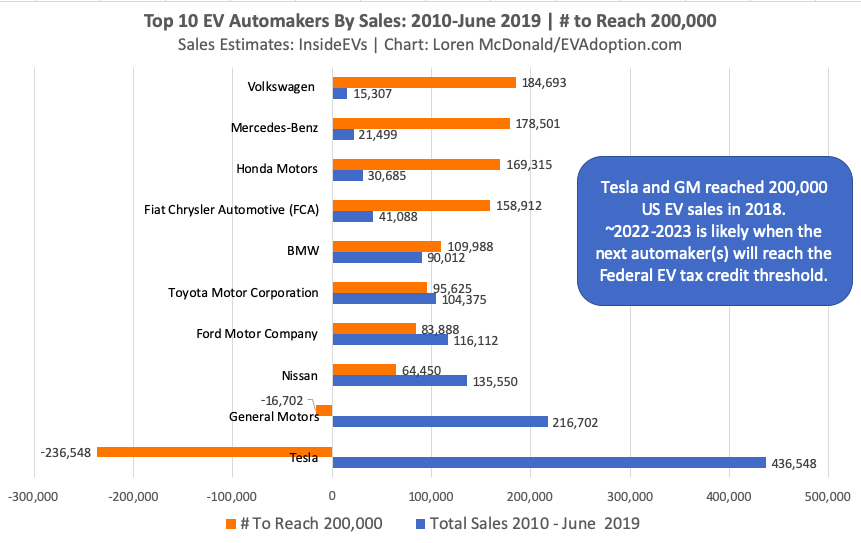

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Democrat Climate Plan Adds Tax Breaks For Evs That Cost Up To 80000

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

A Complete Guide To Ev Ev Charging Incentives In The Uk

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

What Are The Different Levels Of Electric Vehicle Charging – Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations

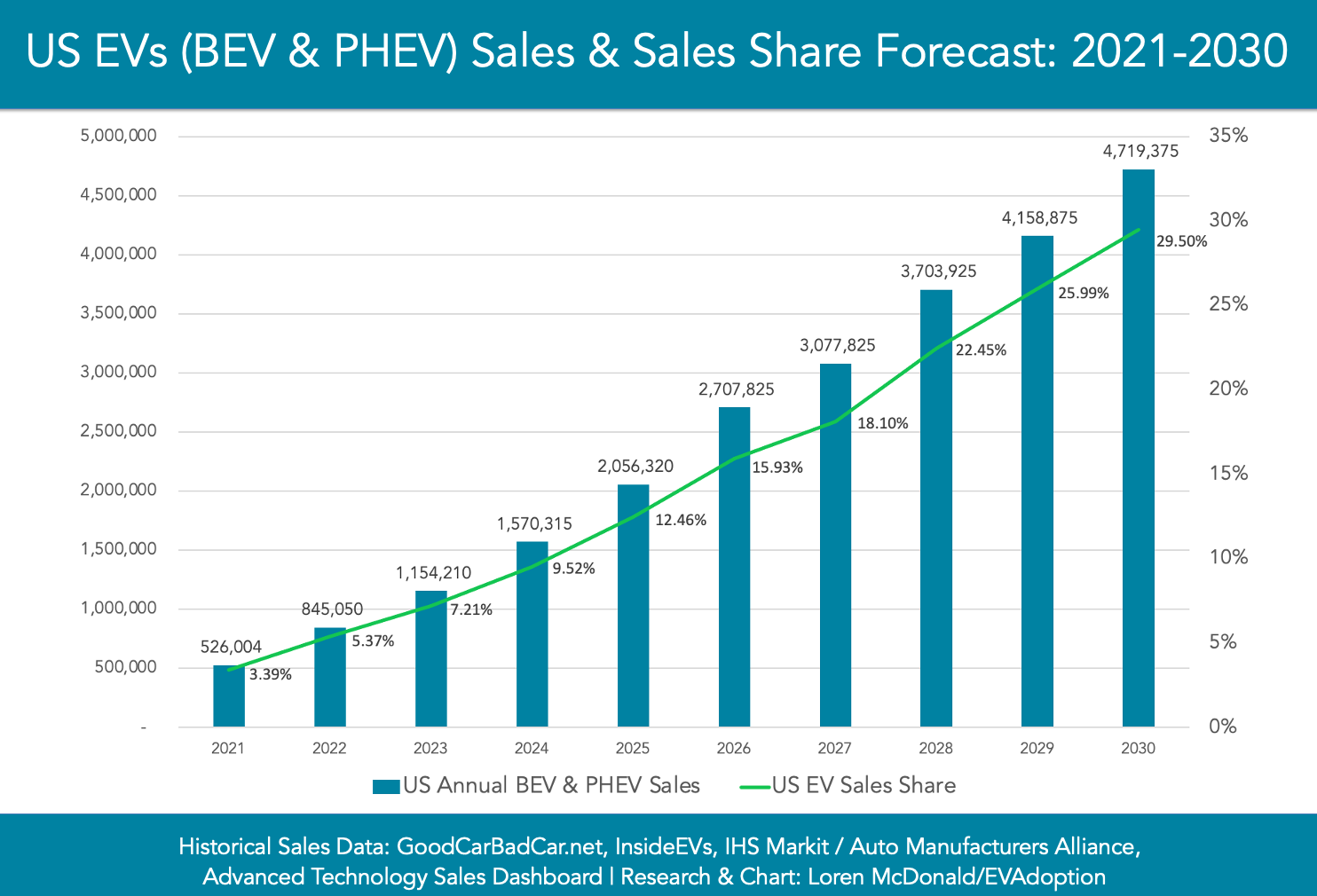

Ev Sales Forecasts Evadoption

How Do Electric Car Tax Credits Work Kelley Blue Book