The proposal in congress would cut the federal exemption in half. In 2022, the exemption drops from $11.7 million to $6 million.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

· the current $11,700,000 federal estate tax exemption amount would drop to $5 million (adjusted for inflation) as of january 1, 2022.

Estate tax exemption 2022 proposal. Gifts made at or below the proposed exemption amounts will not help you avoid losing the exemption. A reduction in the federal estate tax exemption amount from its current $11.7 million to $6.0 million effective january 1, 2022. On november 10, 2021, the irs announced that the 2022 transfer tax exemption amount is $12,060,000 ($10,000,000 base amount plus an inflation adjustment of $2,060,000).

The exemption will increase with inflation to approximately $12,060,000 per person in 2022. The new exemption amount would be $5 million, indexed for inflation dating back to 2010. The proposed bill seeks to effectively eliminate discounts for transfers of certain closely held business interests.

The proposed change would apply to estates of decedents dying, and gifts made, after december 31, 2021. If enacted, the current $11.7 million per person estate and gift tax exemption would be reduced to $6.02 million for 2022 based on current estimates. The gift, estate, and gst (generation skipping transfer) tax exemptions are $11.7 million per person (adjusted for inflation).

The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022. Under the committee proposal, on january 1, 2022, the estate, gift and gst tax exemption amounts, currently $11.7 million per individual ($23.4 million combined for a married couple), would be. This would be in effect for tax years 2021 through 2031, after which the cap would be reduced to the current level of $10,000.

1, 2022, the unified estate and gift tax exemption would be reduced to $5 million, adjusted for inflation. If passed, both the federal and new york estate tax exemptions for 2022 would be about $6 million. Projections from the joint committee staff currently show that the exemption would be approximately $6.02 million per person for 2022.

This would eliminate the provision in the tax law passed in 2017, commonly referred to as the tax cuts and jobs act (tcja), that temporarily raised the estate tax exemption to $11.2 million. The $11.7m per person gift and estate tax exemption will remain in place, and will be increased annually for inflation until it’s already scheduled to sunset at the end of 2025. The proposed reduction in the estate tax exemption would.

The federal estate tax exemption is currently $11.7 million and the new york estate tax exemption is currently approximately $5.9 million (adjusted for inflation). The tax rate applicable to transfers above the exemption is currently 40%. Drastic changes to the “grantor trust rules” which would have potentially pulled many life insurance trusts (ilits) and other.

Estate planning related highlights of committee proposal. Decrease of valuable estate and gift tax exemptions, effective january 1, 2022 time is now of the essence for utilizing gift and estate tax exemptions. A provision of the proposed legislation that would become effective jan.

Under current law the exemption for estate, gift, and generation skipping transfer (gst) tax of $11,700,000 reverts back to $5 million (which when indexed for inflation would be approximately $6,020,000 in 2022) for decedents dying and gifts made after december 31, 2025. While plans exist to reverse that in 2025, this provision reverts the exclusion to the 2010 level of $5 million per individual—indexed for inflation. For example, assume you were single now and made a gift of $6 million.

Accelerating changes that were already slated to occur beginning jan. Effective january 1, 2022, these exemptions will decrease to $5 million per person adjusted for inflation from 2011. This may be before the estate tax exemption decreases on january 1, 2022.

Reduction of estate, gift, and gst tax exemptions as of january 1, 2022. No changes to the current gift and estate exemption provisions until 2025. The new proposal allows single and married filing joint taxpayers to deduct up to $72,500 per year in state and local income and real estate taxes.

Tax Return Form And 2021 Planner On Pink Surface Free Stock Photo In 2021 Accounting Tax Return Tax Consulting

750 Tax Pictures Download Free Images On Unsplash

Clothing Business Plan Template Awesome Retail Clothing Store Business Plan Exe Business Plan Template Simple Business Plan Template Business Proposal Template

Texas Estate Planning Statutes With Commentary 2019-2021 Edition Paperback – Walmartcom In 2021 Estate Planning Estate Administration How To Plan

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Purchase Order Template 27 Free Docs Xlsx Pdf Forms Purchase Order Template Letter Template Word Invoice Template Word

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

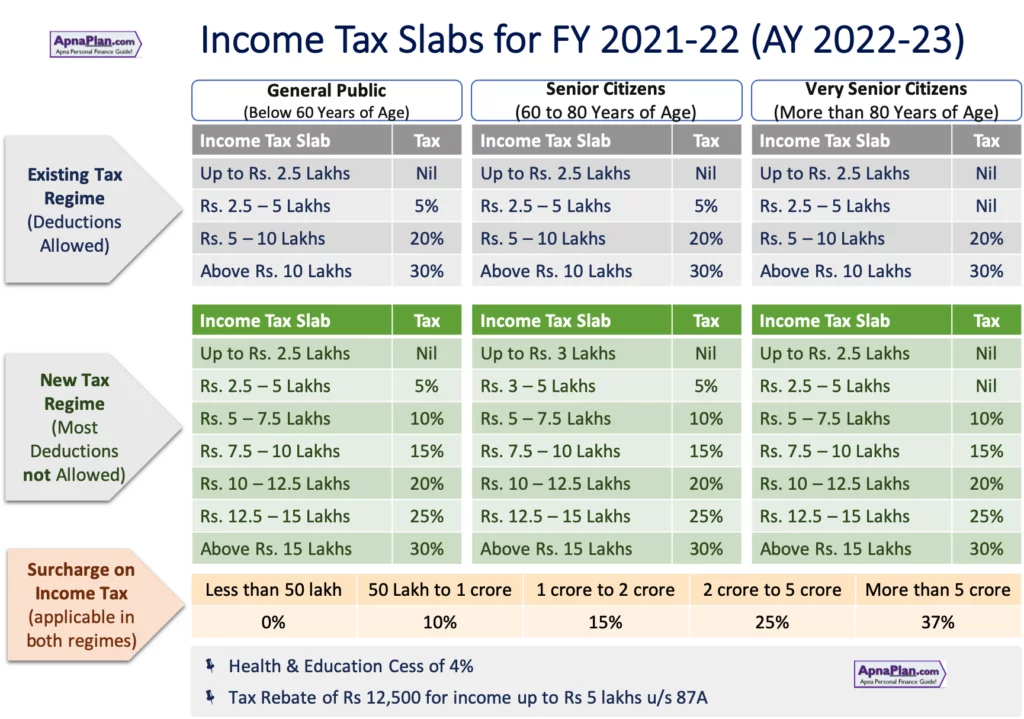

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

Growing Your Tsp – Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720000 More Tax Free

Certified Financial Planner Cfp Review Pusat Pengembangan Akuntansi Ppa Feb Ui

Ztzso1gbnoxmam

Tax Director Resume Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Manager Resume Accountant Resume Sample Resume

Latest Income Tax Slab Rates For Fy 2021-22 Ay 2022-23 Budget 2021 Key Highlights – Basunivesh

Your Qi Is Critically Essential To Your 1031 Exchanges Success Heres Why Ipx1031 1031exchange Qi In 2021 Success Woman Business Owner Tax Advisor

Maintenance Tracking Spreadsheet Check More At Httpsonlyagameinfomaintenance-tracking-spreadsheet

Pin On Estructuras