In 2020, the gift and estate tax exemption is $11.58 million per person. With indexation, the value was $5.49 million in 2017 and with the temporary

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Since the enactment of the tax cuts and jobs act in 2017 — which doubled the exemption from estate and gift taxes through 2025 — many taxpayers have taken a “wait and see” approach before implementing large lifetime gifting transactions.

Estate tax changes in 2025. This increase expires after 2025. A certain amount of each estate, $5 million in 2011, indexed for inflation, is exempted from taxation by the federal government. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Starting january 1, 2026, the exemption will return to $5 million adjusted for inflation. Couples can pass on $22.8 million. The tax cuts and jobs act of 2017 increased the federal gift and estate tax basic exclusion amount (bea) to $11.58 million per individual, or $23.16 million per couple, adjusted for.

Making large gifts now won’t harm estates after 2025 on november 26, 2019, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to. In 2026, the estate tax exclusion will return to $5 million (adjusted for inflation). This increase in the estate tax exemption is set to sunset at the end of 2025, meaning the exemption will likely drop back to what it was prior to 2018.

Specifically, the federal estate tax exemption would not expire at the end of 2025. The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

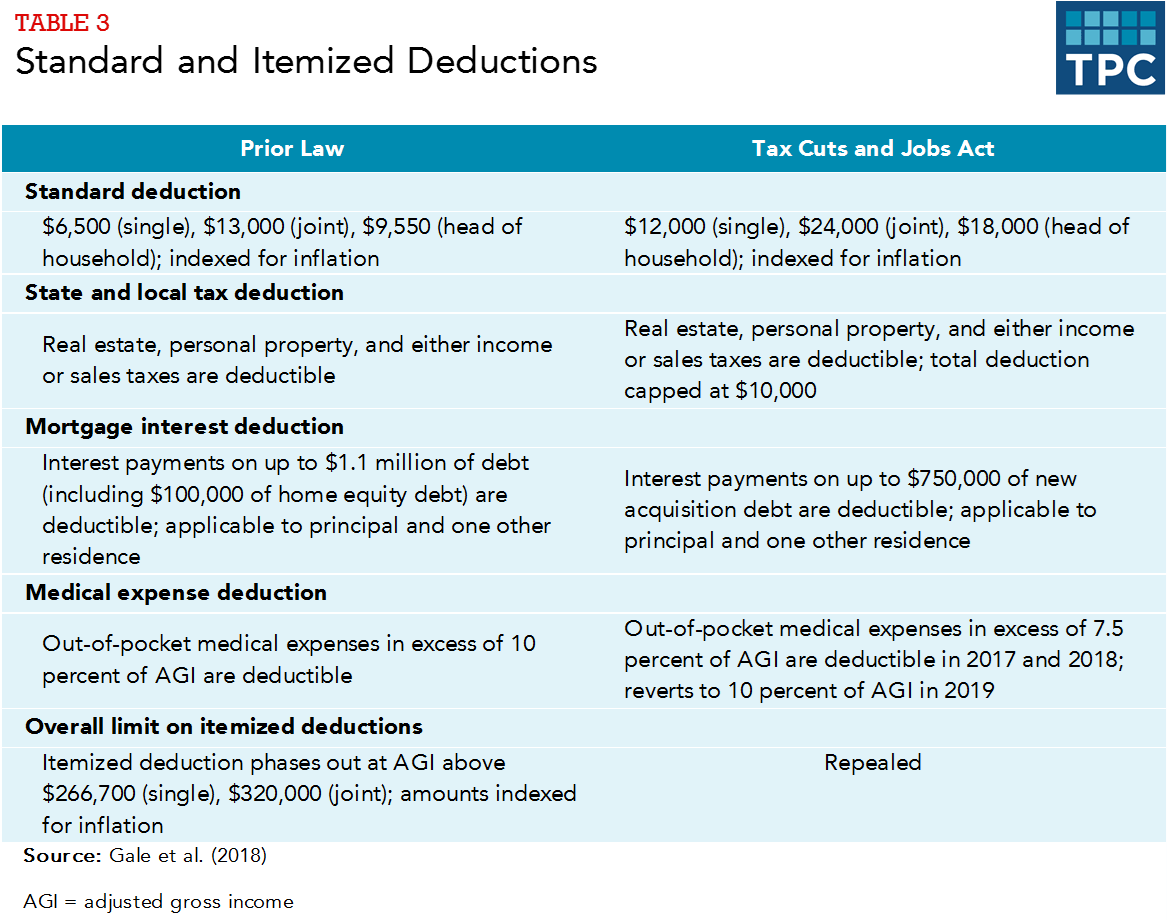

No changes were made to the additional standard deduction for the elderly and blind. Anticipating law changes in 2022. This exemption decreased the number of individuals who’d.

With inflation, this may land somewhere between $6 million and $7 million. Under the current tax law, the higher estate and gift tax exemption will sunset on december 31, 2025. This federal estate tax exemption under the 2017 trump tax cuts would be set to expire at the end of 2025.

The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when adjusted for inflation is expected to be about $6.2 million. Yahoo finance’s recent article, “irs says millionaires can keep estate tax benefits after 2025,” says that the exemption increase was a big priority for republicans in the 2017 tax overhaul. As the irs released on november 22, 2019, “the treasury department and the internal revenue service today issued final regulations confirming that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

Under the current law, this increased exemption will sunset at the end of december 31, 2025 to $5 million per person adjusted for inflation. The announcement was issued as final regulations. The bill introduced by the house ways & means committee is attempting to change this and roll back the 2017 trump tax cuts.

Up to $10 million (adjusted for inflation) can now be excluded from the gross estate of a decedent who died after tax year 2017 when determining estate tax. The tcja temporarily increased the bea from $5 million to $10 million for tax years 2018 through 2025, with both dollar amounts adjusted for inflation. Yahoo finance’s recent article, “irs says millionaires can keep estate tax benefits after 2025,” says that the exemption increase was a big priority for republicans in the 2017 tax overhaul.

The current exemption amount from the estate tax is $11.7 million, townsend explained wednesday during schwab’s impact conference. This change to the estate tax will be in effect through tax year 2025.

Presidents Budget Would Add More To Debt With Tax Cut Extensions Committee For A Responsible Federal Budget

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Corporation Tax Income Forecast Uk 2021 Statista

Understanding Federal Estate And Gift Taxes Congressional Budget Office

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Estate Tax Exemptions 2020 – Fafinski Mark Johnson Pa

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

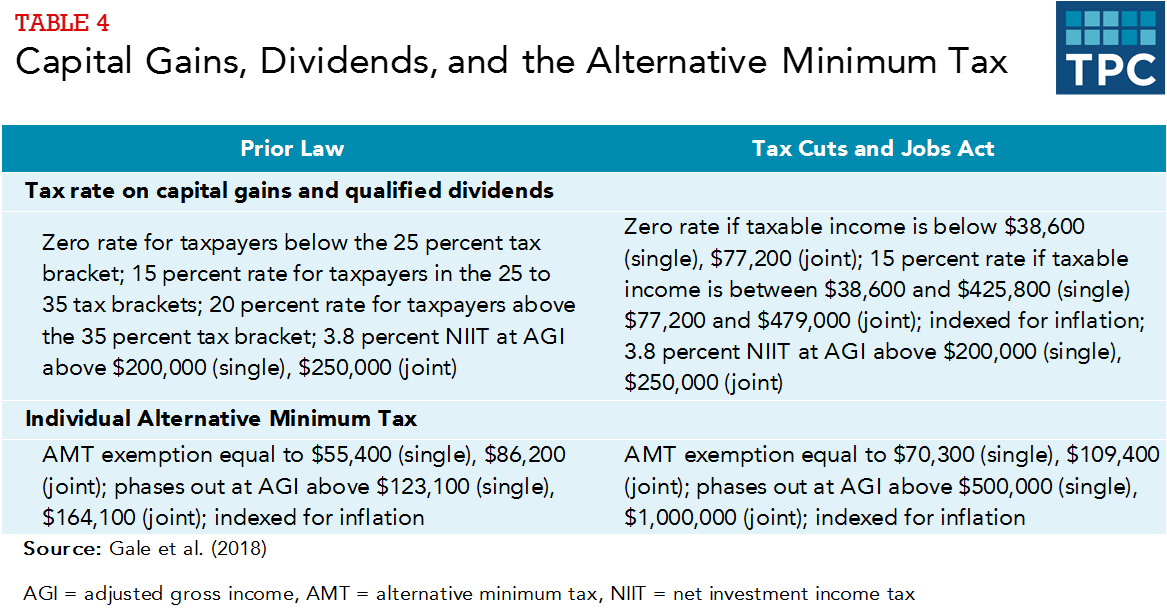

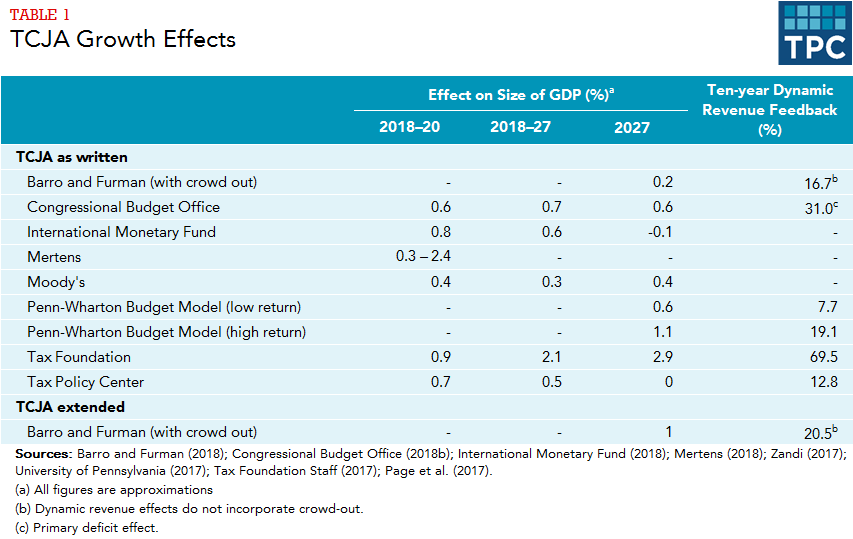

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

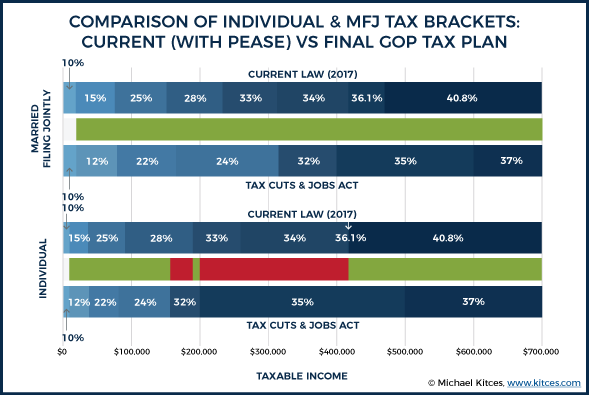

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

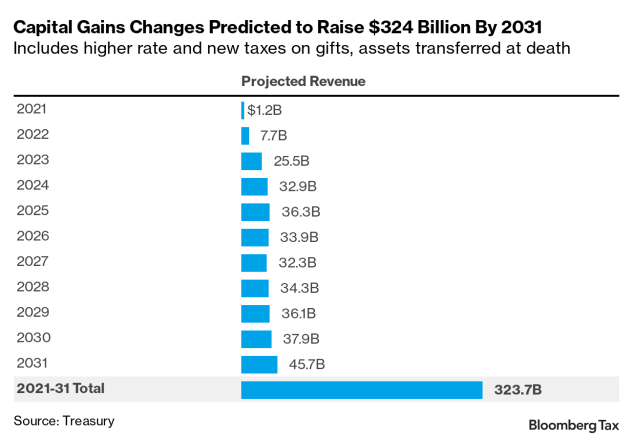

Tax Pros Perplexed By Scope Of Bidens Capital Gains Overhaul

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know – Inside Indiana Business

How The Tcja Tax Law Affects Your Personal Finances

Estate Taxes Under Biden Administration May See Changes