President biden’s proposed build back better act includes major changes to estate and gift taxes to fund the social and education spending plan. 3 version introduced an increase to the cap, with a slightly higher increase in the nov.

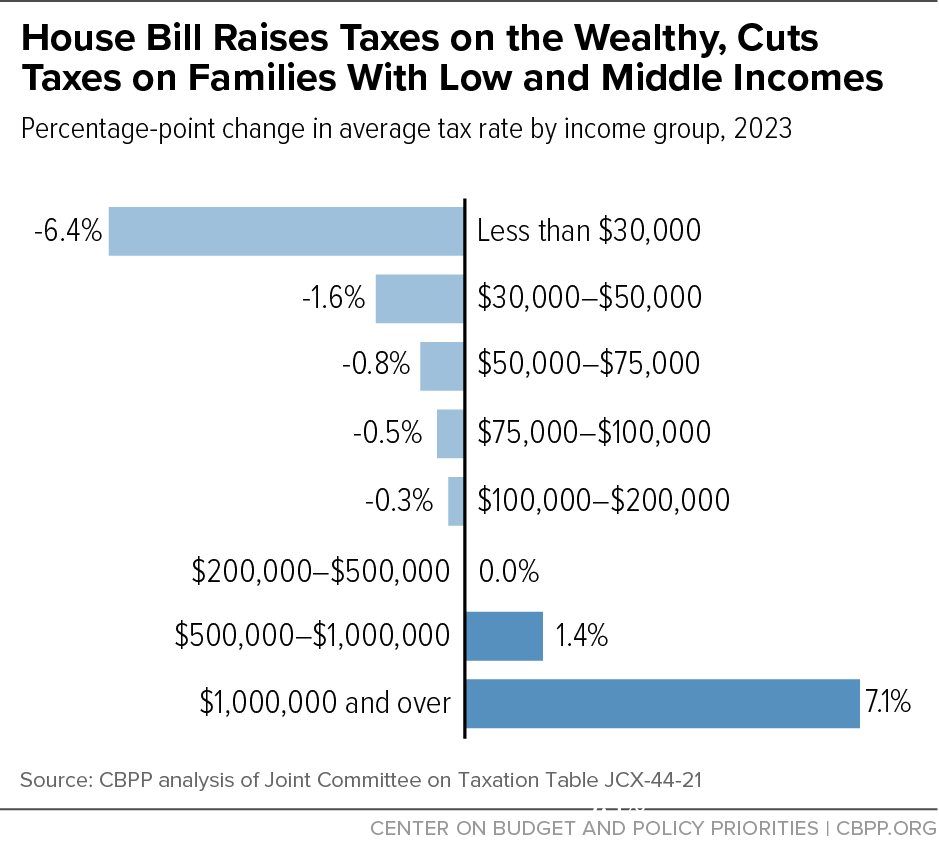

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Trusts and estates will be limited to $40,000.

Estate tax changes build back better. Build back better act (bbba) tax changes. On friday, october 29, 2021, a new version of the “build back better” bill was released and all of the estate planning provisions we were concerned about were removed from the bill. The house ways and means committee recently released its plan to pay for president biden's proposed build back better act.

House of representatives passed president biden’s priority social legislation called the build back. Here’s what you need to know. House of representatives on friday greenlighted the roughly $2 trillion build back better act, meaning the fate of billions of dollars in housing funding is now in the hands of the senate.

Inclusion of grantor trust assets in the grantor's estate; We have another update for our clients about the legislation pending in congress and this time it is good news! 5376) would revise the estate and gift tax and treatment of trusts.

This provision applies for the 2021 tax year. On september 13, the house ways and means committee, led by chairman richard e. Don’t worry, that’s not the bill that would have changed tax laws.

Tax changes for estates and trusts in the build back better act (bbba) the build back better act (bbba; The house rules committee earlier today released a modified version of h.r. Estate and gift tax changes — the ways and means version of the bbba included many significant changes for both estate and gift taxes and the tax treatment of trusts.

The house ways and means committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement president biden’s social and education spending programs. Currently, the country has a 37% tax on adjusted gross income (agi) for people making at least $10 million a year. On november 1, 2021, the house rules committee reported out the build back better act reconciliation bill, which leaves out most of the proposed changes to.

On october 28, 2021, the house ways and means committee issued a revamped proposal in furtherance of president biden’s “build back better agenda.” The legislation contains a variety of changes across the tax code, but the following summary focuses on the provisions that most directly impact estate tax planning. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022.

Prior versions of the build back better act didn’t contain a modification to the $10,000 cap, but the nov. A deemed realisation event for sales to and from the grantor and a grantor trust; It would eliminate the temporary increase in exemptions enacted in the tax cuts and jobs act (tcja;

For more on the nontax provisions of the bill, see, house passes. The house of representatives on friday morning passed h.r. The bill encompasses a wide range of budget and spending provisions and has been the focus of protracted negotiations for the past several weeks.

28, 2021, president joe biden announced a framework for changes to the u.s. Tax system to raise revenue for a $1.75 trillion version of the build back better plan. Some of these proposed measures were written into the build back better act (the act) draft published in september 2021.

The build back better act includes a 5% surtax imposed on magi that have in excess of $10 million, as well as an additional 3% surtax if the magi exceed $25 million. Elimination of the 'bonus' estate tax exemption; The cap on the state and local tax (salt) deduction will be raised from $10,000 to $80,000 through 2030.

Many of the changes to the internal revenue code proposed by that plan would directly impact gift and estate tax planning. The bbb adds a surtax of 5%, and an. There’s a 3.8% investment income tax for high earners who own businesses and a limit on how business owners can use losses to reduce their taxes.

Those included a restoration of the unified credit from $11,700,000 per person to approximately $6,000,000 per person, including grantor trusts in the grantor’s estate. Three versions of the build back better act have attempted to make significant changes to current gift, estate, and trust income tax law. The estate tax exemption and current “build back better” legislation headlines indicate president biden will be signing the infrastructure investment and jobs act on monday november 15, 2021.

Whats Actually In Bidens Build Back Better Bill And How Would It Affect You Us News The Guardian

Us Treasury Pushes Back As Budget Office Warns Bidens Bill Will Swell Deficit – As It Happened Us News The Guardian

Climate In In Bidens Build Back Better Spending Bill Explained – The Washington Post

Biden Can Whip Inflation And Build Back Better – Wsj

Biden Can Whip Inflation And Build Back Better – Wsj

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Whats Actually In Bidens Build Back Better Bill And How Would It Affect You Us News The Guardian

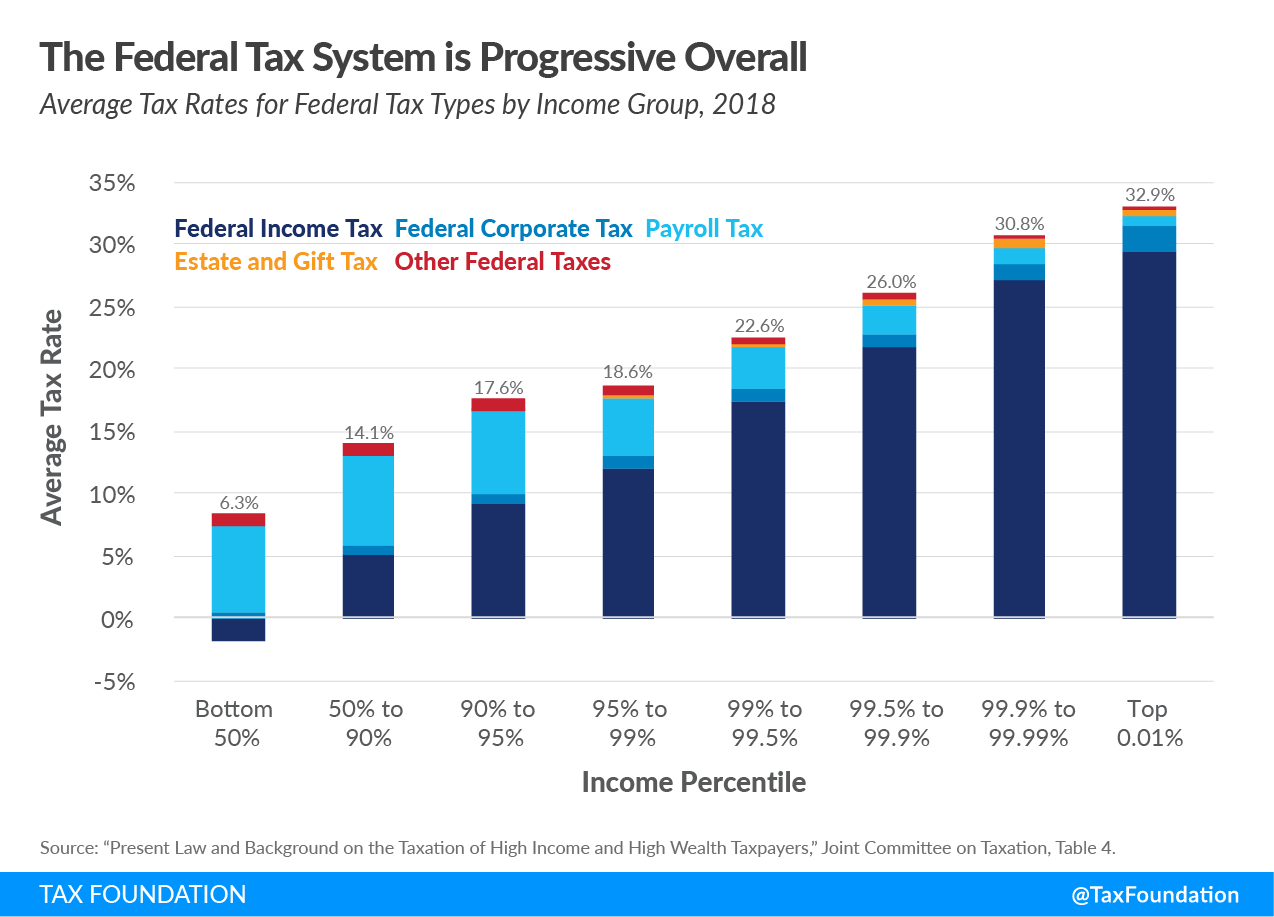

How Progressive Is The Us Tax System Tax Foundation

Build Back Better Plan May Clear House This Week As White House Says Bill Will Combat Inflation – Marketwatch

Democrats Put 401k And Ira Restrictions Back Into Build Back Better

Hwdg3f7jb38ddm

Tf6zkrqm5ftxgm

Its Fantastic Getting To See Our Client Jeremy Turner Of Turner Properties In The Oxford Times Property Section Times Property Being A Landlord Oxford

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

How Progressive Is The Us Tax System Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Politifact Taxes

Whats Actually In Bidens Build Back Better Bill And How Would It Affect You Us News The Guardian

Build Back Better May Not Have Passed A Decade Ago – The New York Times