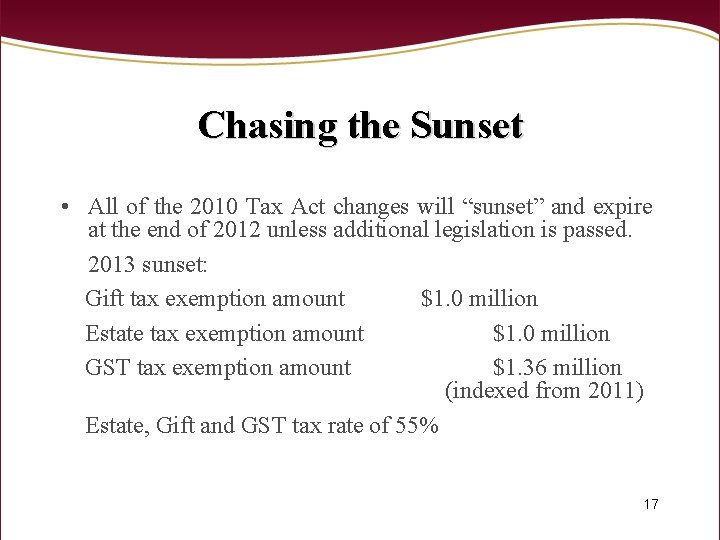

Starting january 1, 2026, the exemption will return to $5 million adjusted for inflation. Full repeal of the estate tax occurs in 2010.

How Much Life Insurance Do I Need – Christopher Johnson Pasadena Sunset Beach Resort Vacation Resorts Beautiful Beaches

The gift tax lifetime exemption stays at $1,000,000, while the estate tax exemption jumps to $1,500,000 in 2004, $2,000,000 in 2006, and $3,500,000 in 2009.

Estate and gift tax exemption sunset. (2021, expires in 2025) 40%. Under the current tax law, the higher estate and gift tax exemption will sunset on december 31, 2025. The estate tax exemption will return to $1,000,000 and the

The scheduled sunset of the estate and gift tax exemption amount raised several practical questions, including: The maximum gift and estate tax rate is. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

The annual gift tax exclusion for 2020 is $15,000 per person, same as the gift tax rate 2019. However, the favorable estate tax changes in the tcja are currently scheduled to sunset after 2025, unless congress takes further action. 31, 2025, and will return to the obama exemption of $5 million, adjusted for inflation.

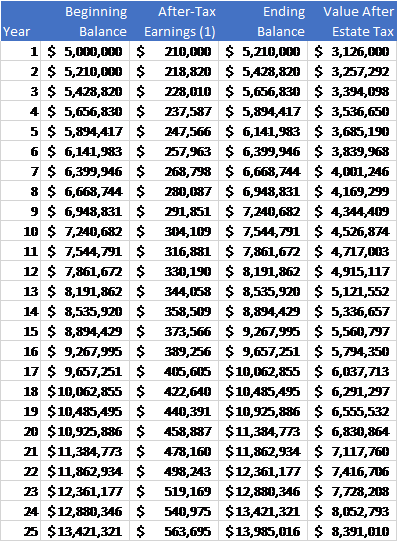

The current exemption amount is $10,000,000 per person, adjusted for inflation in 2019 to $11,400,000. The tcja temporarily increased the bea from $5 million to $10 million for tax years 2018 through 2025, with both dollar amounts adjusted for inflation. The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when adjusted for inflation is expected to be.

The current exemption will sunset on dec. This means that to use up your extra estate exemption before it sunsets, you could consider making gifts either directly to heirs, to an irrevocable trust, or to a 529 plan. The sunset provision is important to anyone who may have already used up the old estate and gift tax exemption.

The $11.7 million exemption applies to gifts and estate taxes combined—whatever exemption you use for gifting will reduce the amount you can use for the estate tax. (1) whether the increased exemption presents a “use it. In 2020, the gift and estate tax exemption is $11.58 million per person.

This means that few families pay the estate and gift tax, and a married couple with less than $22,800,000 (the two spouses' combined exemptions) can leave all of their assets to their children or other beneficiaries without paying estate tax. With inflation, this may land somewhere between $6 million. This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is $11.7m.

Estate and gift tax planning were among the many areas of tax law impacted by the tax cuts and jobs act (the “act”), which took effect on january 1, 2018. On december 31 st 2017, the tax cuts and jobs act (tcja) doubled the federal lifetime gift and estate tax exemption from around $5.5m to about $11m. The estate tax provisions will reappear in 2011 as if the act had never been enacted.

The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when adjusted for inflation is expected to be about $6.2 million. The irs refers to this as a “unified credit.”. Once you have completed the gift, you can file form 709 with your tax return to report your use of the estate exclusion and avoid gift tax on those gifts now.

Under the current law, this increased exemption will sunset at the end of december 31, 2025 to $5 million per person adjusted for inflation. Said another way, you should keep reading if your estate value exceeds $11,580,000 ($5,790,000 if unmarried). In 2017 the lifetime gift and estate tax exemption amount was $5.49 million per individual.

The adjusted exemption in 2026 is projected to be between $6 million and $7 million. This increase in the estate tax exemption is set to sunset at the end of 2025, meaning the exemption will likely drop back to what it was prior to 2018. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Making large gifts now won’t harm estates after 2025 on november 26, 2019, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

Sunrise Sunset The Federal Estate Tax Is Back

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

House Passes The Build Back Better Tax Proposals

Pin On Mosaicos

Proposed Tax Changes In 35 Trillion Spending Package

No Federal Estate Tax On Large Gifts When Exemption Sunsets – Ross Law Firm Ltd

Sunrise Sunset The Federal Estate Tax Is Back

High Net-worth Families Should Review Their Estate Plans Pre-election

Sunrise Sunset The Federal Estate Tax Is Back

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Tax Transition Planning And The Modern Family

Will The Lifetime Exemption Sunset On January 1 2026 – Agency One

Royal Suva Yacht Club Suva Fiji Hd Wallpaper Beautiful Islands Fiji Photos Suva Fiji

Venable Llp 600 Massachusetts Avenue Washington Dc Ppt Download

Give Gift Money Now Before The Sunset Of Property Tax Laws In 2025

Sunrise Sunset The Federal Estate Tax Is Back

2020 Estate And Gift Tax Exclusions – Davenport Evans Hurwitz Smith Llp

Will The Lifetime Exemption Sunset On January 1 2026 – Agency One

Preparing For Sunset