In addition to state and county tax, the city of chicago has a 1.25% sales tax. This is the total of state and county sales tax rates.

Moving To Glen Ellyn Il 60137 – Fun Facts Shopping Areas

Dupage county, il sales tax rate.

Dupage county sales tax calculator. There is no county sale tax for bloomingdale, illinois. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Illinois has a 6.25% sales tax and dupage county collects an additional n/a, so the minimum sales tax rate in dupage county is 6.25% (not including any city or special district taxes).this table shows the total sales tax rates for all cities and towns in dupage county.

Sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. Create your own online store and start selling today. The median property tax in dupage county, illinois is $5,417 per year for a home worth the median value of $316,900.

Create your own online store and start selling today. Dupage county has one of the highest median property taxes in the united states, and is ranked 27th of the 3143 counties in order of median property taxes. Illinois has a 6.25% statewide sales tax rate , but also has 897.

The base sales tax rate in dupage county is 7% (7 cents per $1.00). There also may be a documentary fee of 166 dollars at some dealerships. General merchandise sales tax is remitted directly to state of illinois.

The bloomingdale, illinois, general sales tax rate is 6.25%.the sales tax rate is always 7.5% every 2021 combined rates mentioned above are the results of illinois state rate (6.25%), the illinois cities rate (0.5%), and in some case, special rate (0.75%). The dupage county clerk's office calculates the tax rates (set within statutory limits) for every taxing district in dupage county. The illinois state sales tax rate is currently %.

For example, the county tax for a property sold at $123,456 will be rounded up to $123,500 and multiplied by 0.11%. Our dupage county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in illinois and across the entire united states. The base sales tax rate in dupage county is 7% (7 cents per $1.00).

How 2021 sales taxes are calculated in bloomingdale. The minimum combined 2021 sales tax rate for dupage county, illinois is. Dupage county collects, on average, 1.71% of a property's assessed fair market value as property tax.

Try it now & grow your business! To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). The taxes can be different in the case of a.

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. Change or reclassifying property between assessment categorizations.

The dupage county sales tax rate is %. The tax levies are adopted by each taxing district's board and the equalized assessed value of the properties in each district is certified by the supervisor of assessments. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Try it now & grow your business!

The current total local sales tax rate in dupage county, il is 7.000%.the december 2020 total local sales tax rate was also 7.000%. There is also between a 0.25% and 0.75% when it comes to county tax. Has impacted many state nexus laws and sales tax.

The 2018 united states supreme court decision in south dakota v. 2020 tax year (payable in 2021) The base sales tax rate in dupage county is 7% (7 cents per $1.00).

Illinois Income Tax Calculator – Smartasset

Dupage County Il Treasurer – Sample Tax Bill

Chicago Leasers Clarification Please – Ask The Hackrs – Forum Leasehackr

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work – Chicago Real Estate Closing Blog

Dupage Sales Tax Reduction Makes Buying A Car Cheaper

Www2illinoisgov

Highest Property Tax Counties In Us – Property Walls

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

North Central Illinois Economic Development Corporation – Property Taxes

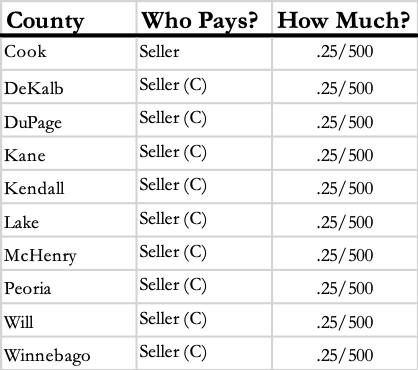

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Income Tax Calculator – Smartasset

Chicago Sales Tax – Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts

Cookcountyclerkilgov

Illinois Sales Tax Rates By City County 2021

Chicago Il Property Tax Rate – Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware

Property Tax Village Of Carol Stream Il

Economy In Dupage County Illinois

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Dupage County Il Treasurer – Sample Tax Bill