If this money was not reported to your employer, such as a scenario in which you earned cash tips, you should report these funds using irs form 4137. A lot of people get the idea that doordash is under the table work, or that grubhub income can go without being reported.

Doordash Taxes Made Easy Ultimate Dashers Guide Ageras

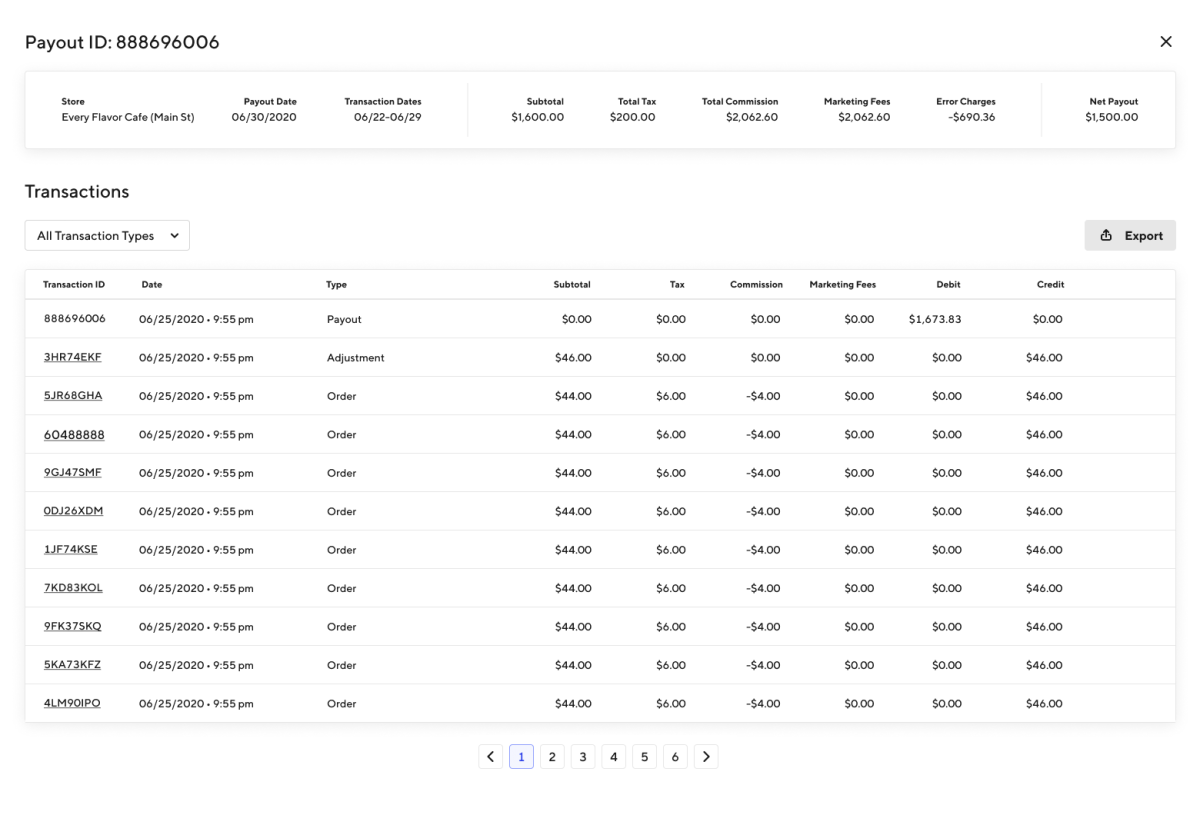

Per irs guidelines, gross volume processed via the tpso, which in doordash's case is the subtotal and tax on orders processed.

Does doordash report income to irs. You lose your job, but work for door dash & earn $1,000 a week. You may be wondering what exact taxes you have to pay as a self employed individual. Log into your checking account every pay day and put at least 25% of your dd earnings in savings.

It’s only that doordash isn’t required to send you a 1099 form if you made less than $600. If you have any questions about what to report on your taxes, you should consult with a tax. Does 1099 income get reported to.

Fica stands for federal income insurance contributions act. Unemployment will deduct from your benefit what you earned & give you less, but you’ll still collect something. Careful—you can’t deduct both mileage and gas at the same time!

Since doordash does not withhold your taxable income for you, no matter the amount you make, you have to report the amount to the irs. Do i have to file taxes for doordash if i made less than $600? Get a mileage tracker app if you drive and hold on to all your business receipts.

Does doordash report to irs? Just google it or talk to a local tax professional. If you receive income, you are required to report it and pay taxes.

At the end of every quarter add up your income for the quarter and pay at least 25% of that online to the govt. The $600 threshold is not related to whether you have to pay taxes. As an independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings.

You can still collect something because you have lost income. The irs will know how much money you made on the app, but they will not know all the things that should be subtracted to get your net income, like fees, commissions, tolls, miles. There's also the issue of fica taxes.

Yet weekly applications for jobless aid remain at historically high levels. They'll also send that form to the irs. Is it necessary to pay taxes if i made less than $600 on ve to pay taxes if i made less than $600 with doordash?

It's your job to track your earnings. Does doordash take out taxes? Does doordash report to irs?

Typically you will receive your 1099 form before january 31, 2021. However, if your business claims a net loss for too many years, or fails to meet other requirements, the irs may classify it as a hobby, which would prevent you from claiming a loss related to the business. If you made over $600 they will report it to the irs.

How do i report income paid in cash? Yes we have to pay taxes. Since doordash does not withhold your taxable income for you, no matter the amount you make, you have to report the amount to the irs.

Doordash does not provide a breakdown of your total earnings between base pay, tips, pay boosts, milestones, etc. Some confuse this with meaning they don’t need to report that income on their taxes. Se stu soldi ùn hè micca statu infurmatu à u vostru patronu, cum'è un scenariu in quale avete guadagnatu cunsiglii di soldi, avete da rapportà questi fondi cù l'irs form 4137.

For one thing, there's the lack of withholding. You do not get quarterly earnings reports from dd. You are required to report and pay taxes on any income you receive.

Incentive payments) and driver referral payments. Since you're an independent contractor instead of an employee, doordash won't withhold any taxable income for you — leading to a higher bill from the irs. Doordash does not automatically withhold taxes.

Report it all, they will take some back, but it beats getting charged for anything. It will look like this: The internal revenue service allows you to take a tax deduction for legitimate losses incurred in the operation of your business.

Since doordash does not withhold your taxable income for you no matter the amount you make you have to report the amount to the irs. Instead, dashers are paid in full for their work, and must report their doordash pay to the irs and pay taxes themselves when it comes time. Jan 20, 2021 · doordash gives restaurants a choice about how they offer their delivery services.

What happens if you dont report doordash income? Because dashers are not employees, doordash does not withhold fica taxes from their paycheck. The standard mileage deduction (56 cents per mile in 2021) is calculated by.

We calculate the subtotal of your earnings based on the date the earnings were deposited. The most important box on this form that you’ll need to use is box 7 “nonemployee compensation.”. The answer varies slightly from traditional employees who file a form w2 instead of a 1099.

There are many deductions for self employment. With zero withheld, your taxes will pile up and you will have a big tax bill due tax day. Can you write off gas for postmates?

It is often argued that if the irs does not know you made the money, then you do not have to report it. Doordash does not provide a breakdown of your total earnings between base pay, tips, pay boosts, milestones, etc. This sounds like a real drag, but actually it’s a blessing in disguise.

These items can be reported on schedule c. Grubhub, uber eats, doordash, instacart and others report our earnings to the irs through a 1099 form.

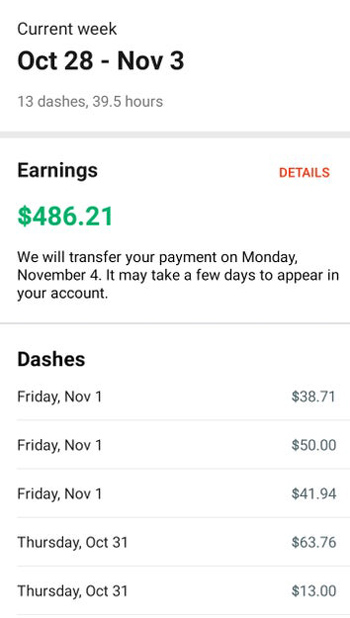

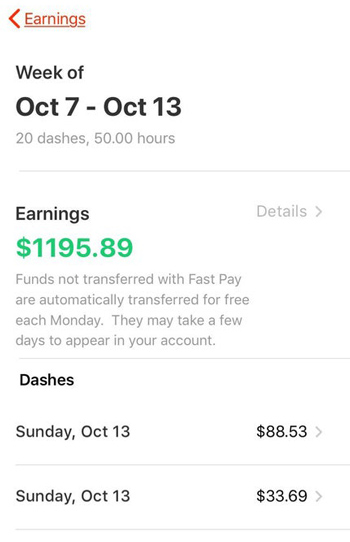

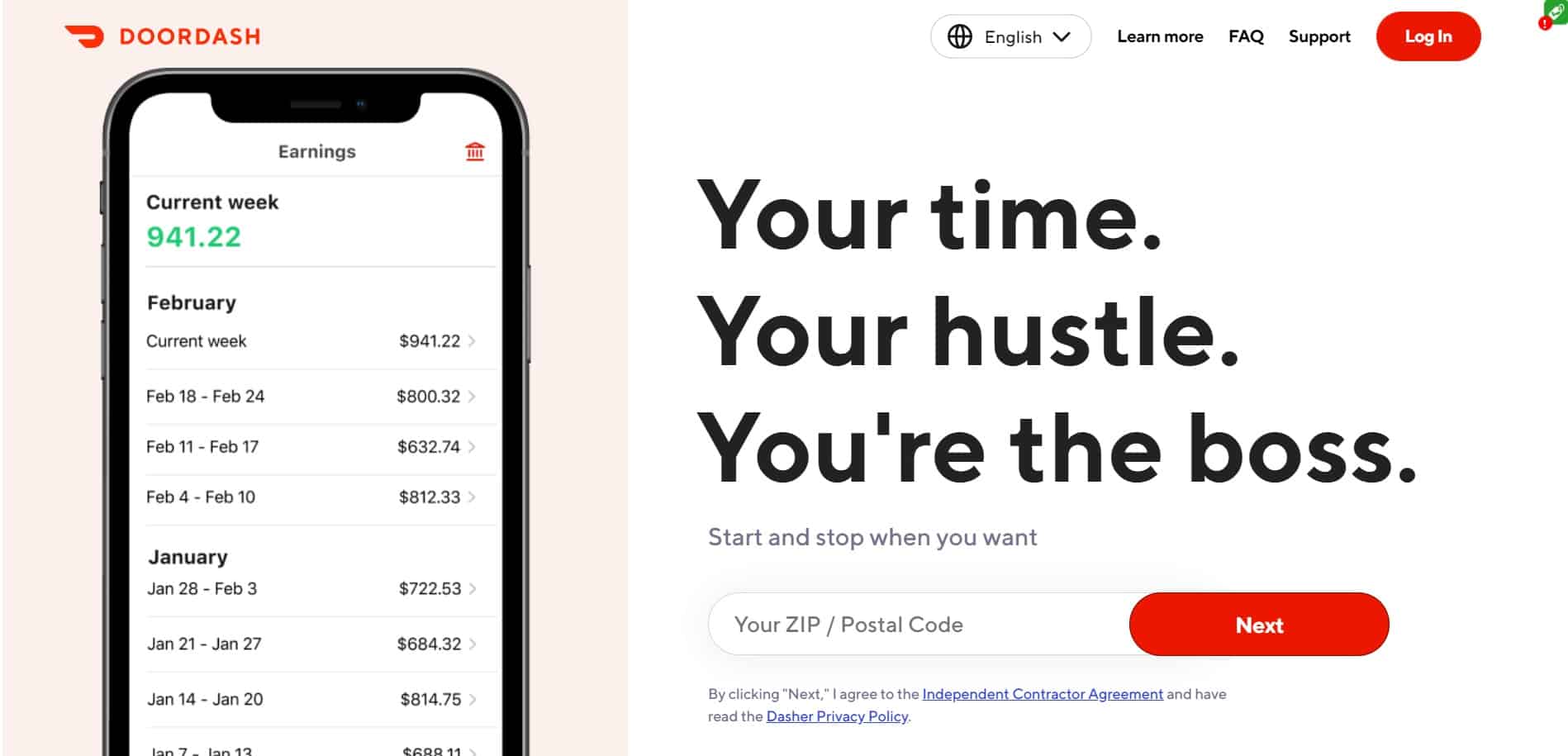

See How Much Doordash Drivers Make Income Ranging From 1900week To 3 Orders – Ridesharing Driver

Do I Owe Taxes Working For Doordash Net Pay Advance

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Doordash 1099 Critical Doordash Tax Information And Write-offs Ridestercom

See How Much Doordash Drivers Make Income Ranging From 1900week To 3 Orders – Ridesharing Driver

Doordash 1099 Critical Doordash Tax Information And Write-offs Ridestercom

How To Do Taxes For Doordash Drivers 2020 – Youtube

Doordash Taxes And Doordash 1099 Hr Block

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 – Entrecourier

See How Much Doordash Drivers Make Income Ranging From 1900week To 3 Orders – Ridesharing Driver

A Step-by-step Guide To Filing Doordash Taxes1099write-off

Do I Owe Taxes Working For Doordash Net Pay Advance

Is Doordash Worth It Earnings Tax Deductions And More The Compounding Dollar

Prepare For Tax Season With These Restaurant Tax Tips

Doordash 1099 Taxes Your Guide To Forms Write-offs And More

Doordash Driver Canada Everything You Need To Know To Get Started

How Much Does Doordash Pay – Dailyworkhorsecom

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 – Entrecourier