New jersey did as well until its estate tax was repealed in 2018. As of 2019, iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania have their own inheritance tax.

Historical Arkansas Tax Policy Information – Ballotpedia

The following table outlines probate and estate tax laws in arkansas

Does arkansas have an inheritance tax. The process, however, can take longer for contested estates. Inheritance laws of other states may apply to you, though, if you inherit money or assets from someone who lives in a state that has an inheritance tax. Estate tax of 10 percent to 16 percent on estates above $1 million;.

Arkansas does not have an inheritance tax. For federal tax purposes, inheritance generally isn’t considered income. Inheritance tax rates differ by the state.

Arkansas does not have an inheritance tax or a gift tax. Of those seven states, maryland and new jersey are the only ones that have both types of state level taxes. Arkansas inheritance and gift tax.

For example, let's say a family member passes away in an area with a. As of 2021, the six states that charge an inheritance tax are: Arkansas does not impose these taxes on its residents.

You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. Does arkansas have an inheritance tax? Arkansas does not have a state inheritance or estate tax.

In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely. An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. State rules usually include thresholds of value—inheritances that fall below these exemption amounts aren't subject to the tax.

Arkansas also does not assess an inheritance tax, which is the second type of tax seen at the state level. Inheritance tax is only applied if the amount is above each state’s threshold and is assessed on the amount that exceeds that threshold. The federal government does not impose an inheritance tax, so the recent tax changes from the trump administration did not affect the inheritance taxes imposed by the states.

Inheritance tax of up to 16 percent; In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely. Kansas does not assess an inheritance tax either.

Each state sets its own exemption level and tax rate. Most states, including arkansas, allow a surviving spouse and minor children to take an interest in the homestead of the decedent. However, another state’s inheritance tax rules could apply if you inherit money from someone who passes away in another state.

It is also possible the exemptions for the federal estate tax could shrink at some point. This article covers probate, how to successfully create a valid will in arkansas, and what happens to your estate if you die without a will. Arkansas also does not assess an inheritance tax, which is the second type of tax seen at the state level.

Here are some tax rates and exemptions that you should be aware of: Arkansas does not have a state inheritance or estate tax. Although arkansas does not collect an inheritance tax or estate tax now, there is a possibility it could put one or both in place between now and the end of your life.

There is no federal inheritance tax. Arkansas probate and estate tax laws. Arkansas does not have an inheritance tax or a gift tax.

Arkansas also has no inheritance tax. Spouse, child, cousin, etc.) only 12 states (and the district of columbia) possess estate tax, and five have an inheritance tax. Arkansas also provides to the surviving spouse and minor children a small property allowance from the estate (up to a $4,000 value) along with personal property necessary for family use and occupancy of their dwelling.

Be careful when it comes to bequeathing property from out of state. Arkansas does not have a state inheritance or estate tax. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

First and foremost, residents of arkansas are not subject to state mandated estate or inheritance tax. Estate tax of 3.06 percent to 16 percent for estates above $5.9 million; Be careful when it comes to bequeathing property from out of state.

The pennsylvania inheritance tax, for. But 17 states and the district of columbia may tax your estate, an inheritance or both, according to the tax foundation. Inheritance taxes are paid by the person receiving the property and vary depending on how the heir was related to the deceased (example:

We have already discussed the fact that kansas does not have an estate tax, gift tax or inheritance tax. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax.

This is a quick summary of arkansas probate and estate tax laws. Inheritance tax is a state tax on assets inherited from someone who died. Inheritance tax of up to 18 percent;

There are only seven states that have an inheritance tax. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if. There are only seven states that have an inheritance tax.

This does not mean, however, that arkansas residents will never have to pay an inheritance tax. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will. But 17 states and the district of columbia may tax your estate, an inheritance or both, according to the tax foundation.

However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will. However, it is still possible that an arkansas resident may be subject to an inheritance tax if he or she inherits property located in another state that does impose an inheritance tax.

Thankyou Lord Amen Faith Quotes Inspirational Quotes Quotes About God

And Speaking Of Taxes Republicans Stand Up For The Super Wealthy Call For More Bank Account Stimulus For Rich – Arkansas Times

Arkansas Retirement Tax Friendliness – Smartasset

Pin On Unashamed

Albert Bierstadt Albert Bierstadt South Dakota New Mexico

Download Free Will Forms F5 Free Download Last Will And Testament Forms Last Will And Testament Will And Testament Estate Planning

Is There An Inheritance Tax In Arkansas

Pin On Apartments For Sale In Dhaka – Dom-inno

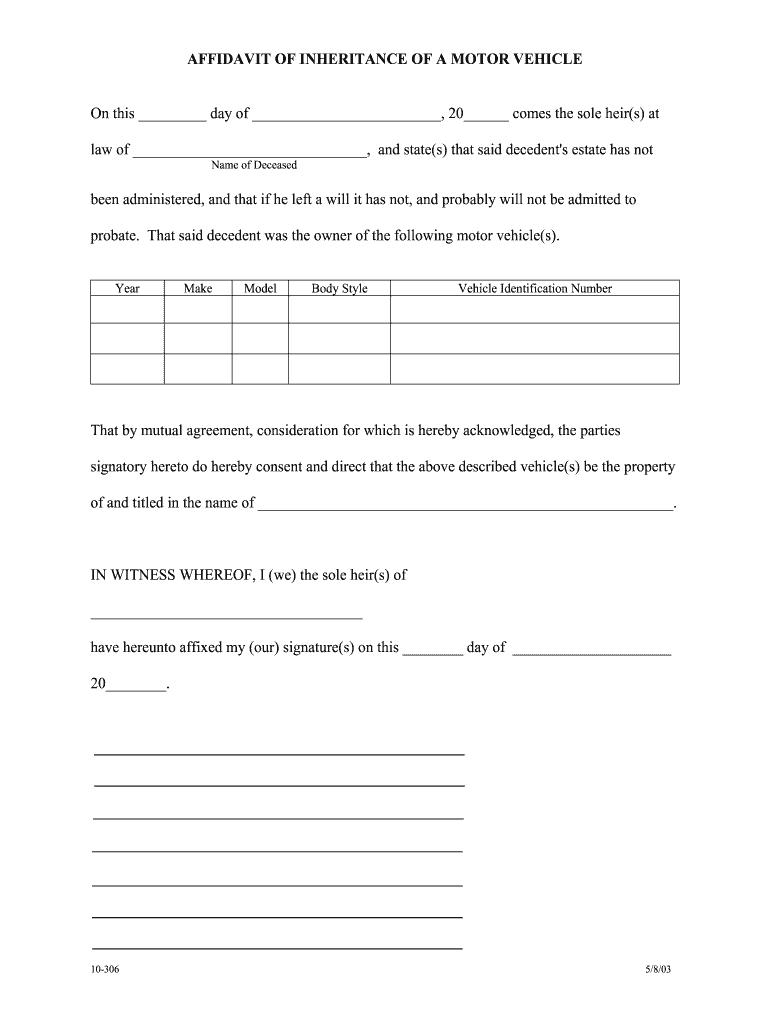

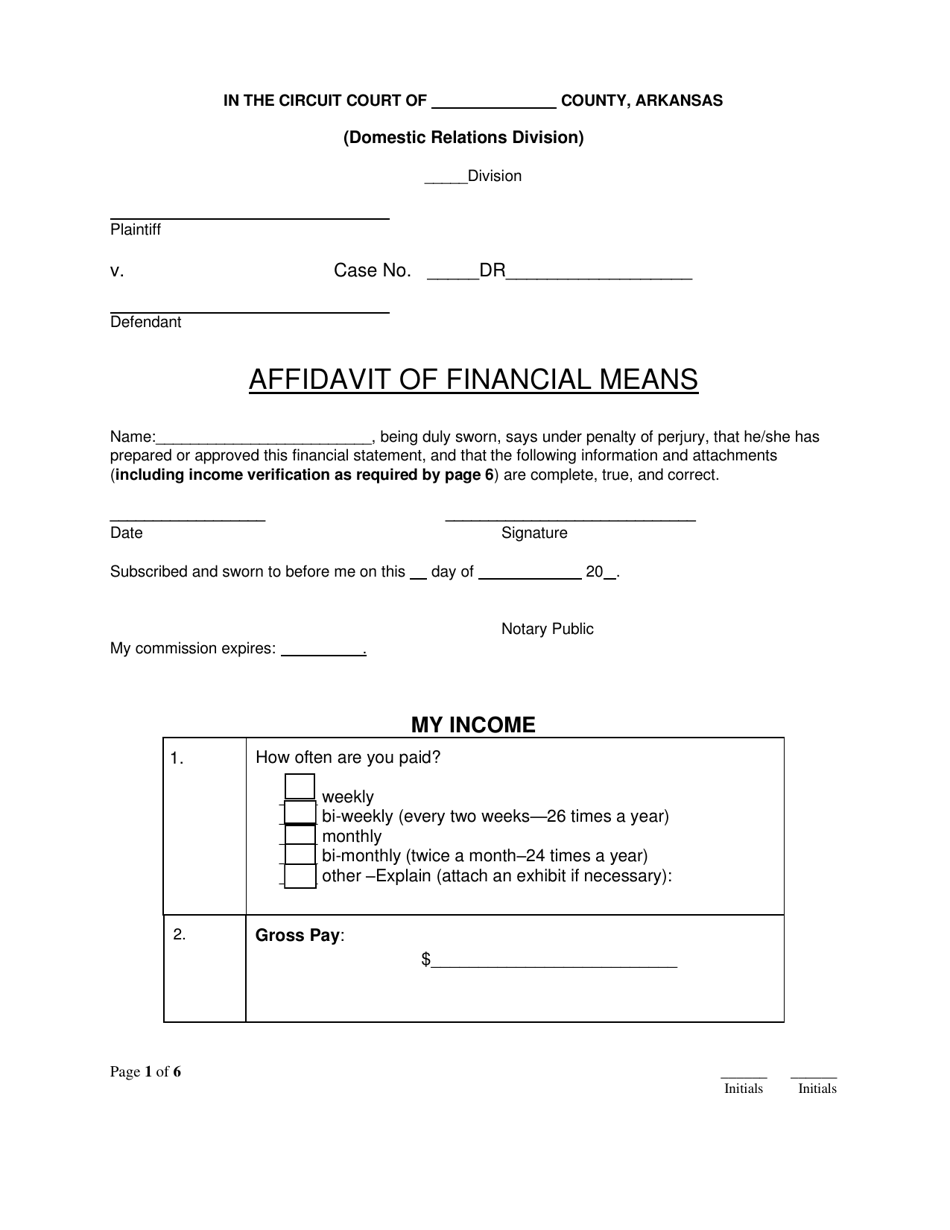

Affidavit Inheritance Form – Fill Online Printable Fillable Blank Pdffiller

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Arizona Real Estate

Arkansas State Tax Refund – Ar State Income Tax Brackets Taxact

Who Inherits When Your Spouse Or Parent Dies Without A Will

How Is Arkansas Probate Law Different

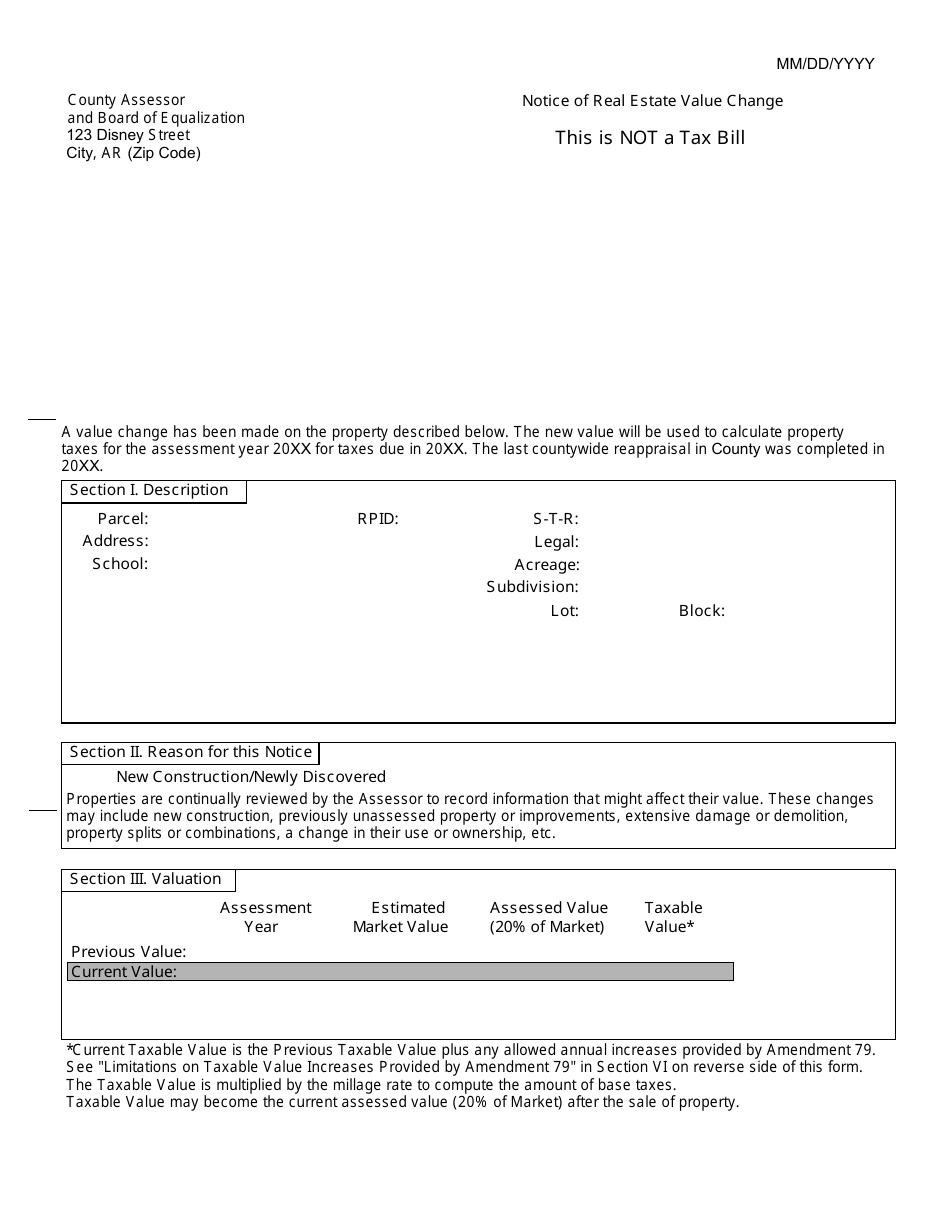

Form A-15 Download Printable Pdf Or Fill Online Notice Of Real Estate Value Change Arkansas Templateroller

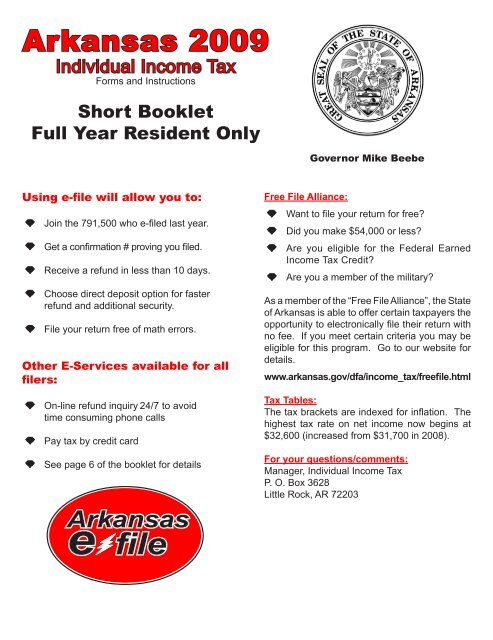

Individual Income Tax – Arkansas Department Of Finance And

Arkansas Affidavit Of Financial Means Download Fillable Pdf Templateroller

Arkansas Retirement Tax Friendliness – Smartasset

Title Insurance Is A Vital Form Of Indemnity Insurance Which Helps To Insure You Against Financial Loss Arising From Title Insurance Indemnity Insurance Title

Historical Arkansas Budget And Finance Information – Ballotpedia