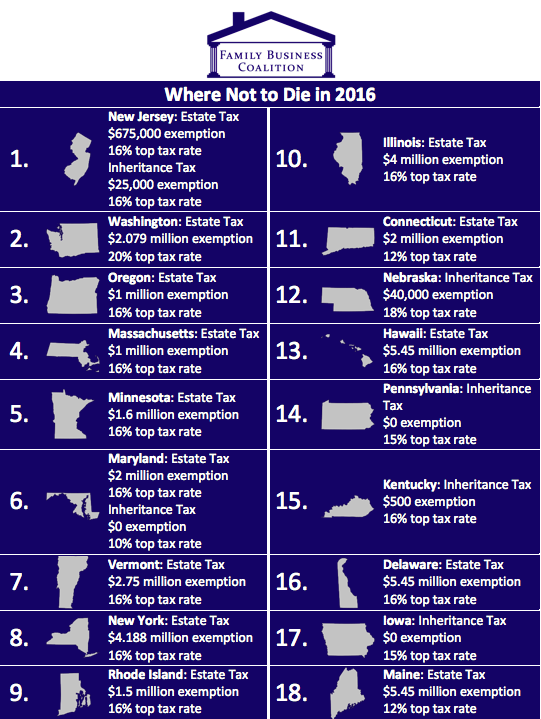

If you inherit property in kentucky, for example, that state’s inheritance tax will apply even if you live in a different state. Children in north carolina inheritance law.

What To Do When You Inherit A House – Complete Guide To Selling Fast

Even though estate taxes are the subject of much debate, and many people don’t like the idea of the estate tax, estate taxes affected less than 1/4 of 1% (0.18% if you are keeping score) of all decedents in 2015.

Do you pay taxes on inheritance in north carolina. Questions answered every 9 seconds. The inheritance tax of another state may come into play for those living in north carolina who inherit money. Inheritance taxes are levied on heirs after they have received money from the deceased.

However, if you inherit an estate worth over $11.18 million in standard assets such as bank accounts, you may be required to pay taxes (federal estate tax). You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. Ad a tax advisor will answer you now!

However, state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than $11.18 million. However, the federal government still collects these taxes, and you must pay them if you are liable. The class c group can end up paying tax rates anywhere from 6% to 16%.

Neither north carolina nor the u.s. However there are sometimes taxes for other reasons. An inheritance tax is a state levy that americans pay when they inherit an asset from someone who’s died.

Calculate how much tax will be owed on your estate upon your death. This should include the federal estate transfer tax as well as state inheritance taxes. There is no inheritance tax in north carolina.

North carolina inheritance tax and gift tax. There is no inheritance tax in nc. When a loved one or benefactor dies and leaves property or money to you, you might have to pay inheritance and estate taxes on it.

I just inherited money, do i have to pay taxes on it? While 2010 has an unlimited exemption with the tax repealed, you will only be able to have a $1,000,000 exemption starting in 2011 with a 55 percent maximum estate tax on values over this amount. One of the first questions many people ask is whether the inheritance will result in income tax to them.

The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides. However, state residents should remember to take into account the federal estate tax if. North carolina does not collect an inheritance tax or an estate tax.

Spouses and certain other heirs are typically excluded by states from paying inheritance taxes. The answer is probably not. There’s no inheritance tax at the federal.

6 hours ago capital gain tax rates by state 2020 & 2021 calculate. Do you have to pay taxes on inheritance in north carolina. Nc capital gains tax on real estate.

In some states the executor may be required to obtain an inheritance tax waiver from the state tax authorities before the assets in the deceased’s. Like most other states that impose this tax, the kentucky inheritance tax rates are straightforward and easy to understand. There is no inheritance tax in north carolina.

These are some of the taxes you may have to think about as an heir. When you are receiving an inheritance, you may wonder if you are required to pay a tax on the inheritance. North carolina does not collect an inheritance tax or an estate tax.

If you live in a state that does have an estate tax, you may be expected to pay the death tax on the money you inherit from a death in nc. Many states do not collect inheritance taxes from spouses or children. If you own real estate in another state, your estate may need to file and pay an estate or inheritance tax in that state.

For example, let's say a family member passes away in an area with a. However, if you inherit an estate worth over $11.18 million in standard assets such as bank accounts, you may be required to pay taxes (federal estate tax). Spouses and certain other heirs are typically excluded by states from paying inheritance taxes.

1 hours ago the capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Class a beneficiaries pay no taxes on their inheritances. Calculate the capital gains tax on a sale of real estate.

Children in north carolina inheritance law. South carolina does not tax inheritance gains and eliminated its estate tax in 2005. Does north carolina have an inheritance or estate tax?

Ad a tax advisor will answer you now! Class b beneficiaries pay a tax rate that can vary from 4% to 16%. I just inherited money, do i have to pay taxes on it?

Put another way, that means that you have a 99.8% chance of never having to worry about estate taxes. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. The answer is probably not.

The inheritance tax of another state may come into play for those living in north carolina who inherit money. Questions answered every 9 seconds.

Guide To Nc Inheritance And Estate Tax Laws – Hopler Wilms Hanna

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What North Carolina Residents Need To Know About Federal Capital Gains Taxes

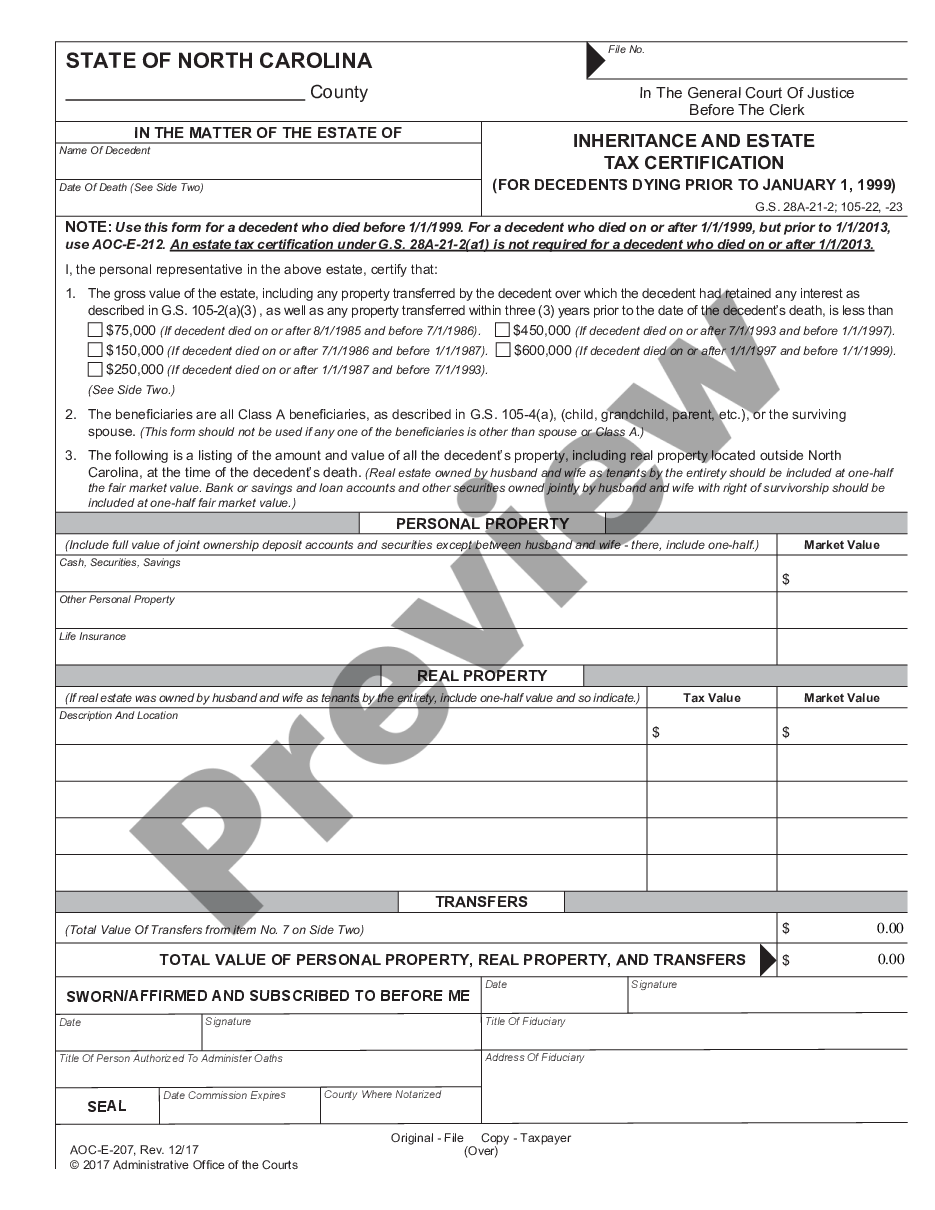

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Does North Carolina Collect Estate Or Inheritance Tax

State Estate And Inheritance Taxes

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms

Tax Concerns For North Carolina Inheritances – North Carolina Estate Planning Blog

Is There An Inheritance Tax In Nc An In-depth Inheritance Qa

States With An Inheritance Tax Recently Updated For 2020

Guide To Nc Inheritance And Estate Tax Laws – Hopler Wilms Hanna

Taxes State Ncpedia

Heres Which States Collect Zero Estate Or Inheritance Taxes

State Estate And Inheritance Taxes Itep

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms