It imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for use here (i.e., use tax). To receive many of the connecticut exemptions, a nonprofit corporation needs to first be granted 501c3 status by the irs.

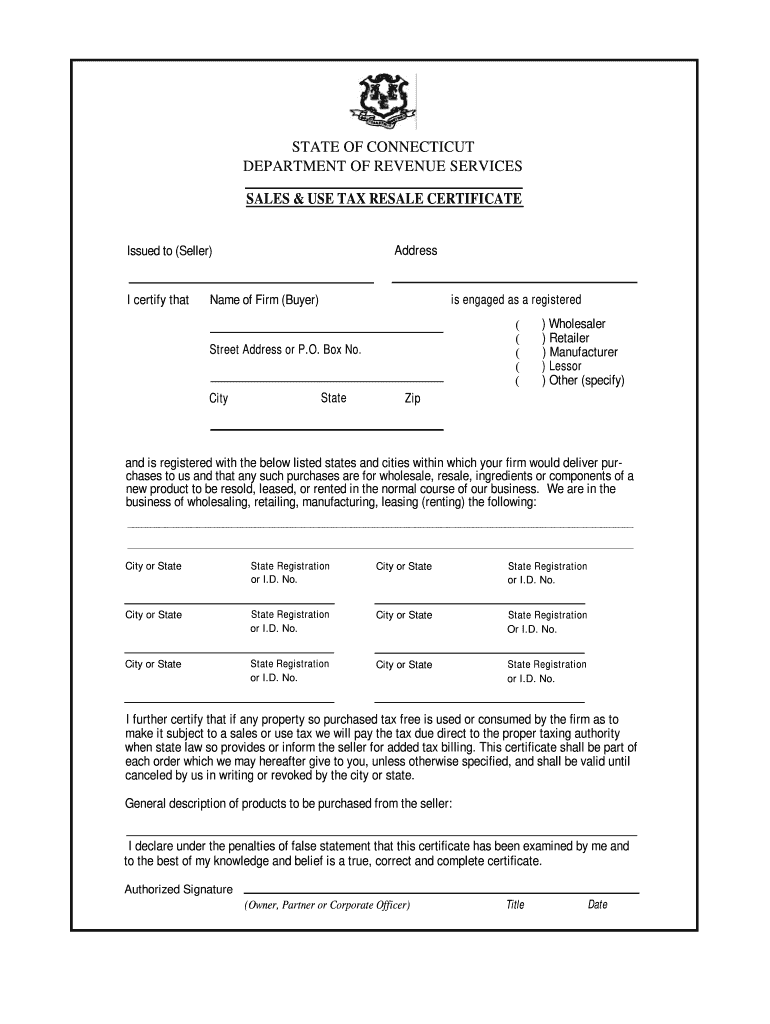

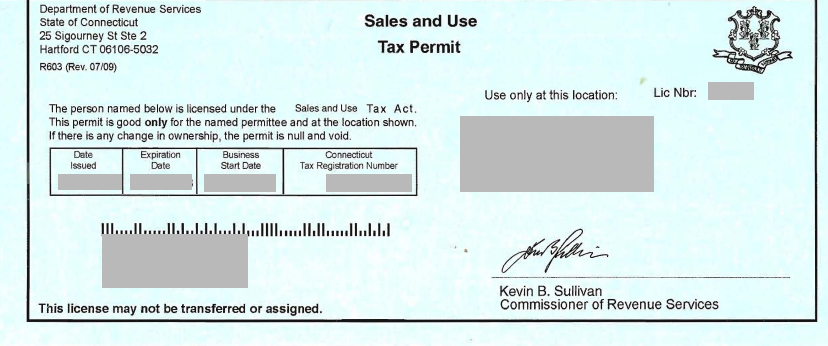

Ct Resale Certificate – Fill Online Printable Fillable Blank Pdffiller

Managing the sales tax process, it is crucial to review, identify and understand the state's manufacturing sales tax exemptions.

Ct sales tax exemptions. See if your manufacturing or biotech company is eligible for a 100% or 50% tax exemption. A list of common sales tax exemptions in connecticut is available from the department of revenue services. How to register for a sales tax permit in connecticut.

Counties and cities are not allowed to collect local sales taxes It is the seller's responsibility to keep this. Connecticut nonprofit corporations are eligible for exemptions on corporate, sales and use, and admissions taxes at the state level.

In connecticut, drop shipments are generally exempt from sales taxes. Find out more about the available tax exemptions on film, video and broadcast productions in connecticut. For other connecticut sales tax exemption certificates, go here.

44 rows sales and use tax exemption for purchases made under the buy connecticut provision :. Beginning on the july 1st, 2011, the state of connecticut levies a 6.35% state sales tax on the retail sale, lease or rental of most goods. Investments that help your business create jobs and modernize may be eligible for tax relief, including:

A guide to exemptions in connecticut, new jersey and new york. This permit is issued pursuant to. 3) • sales tax fact sheet 137 (see p.

Connecticut, new jersey, and new york each provide exemptions for certain nonprofit organizations from the payment and collection of sales tax on. Sales/occupancy excise tax exemption for diplomatic personnel: This page discusses various sales tax exemptions in connecticut.

Such retailers are supposed to submit resale exemption certificates to the sellers. While the connecticut sales tax of 6.35% applies to most transactions, there are certain items that may be exempt from taxation. 4) • sales tax fact sheet 141 (see p.

The following is a list of items that are exempt from connecticut sales and use taxes. (b) sales of tangible personal property by any organization that is exempt from federal income tax under section 501(a) of the internal revenue code of 1986, 2 or any subsequent corresponding internal revenue code of the united states, as from time to time amended, and that the united states treasury department has expressly determined, by. Our connecticut sales tax book educates and identifies manufacturers on the state's sales tax exemptions and associated requirements.

Manufacturing machinery and equipment tax exemption. Sales and use tax exemption. Minnesota • sales tax fact sheet 142 (see p.

No local jurisdictions apply an additional sales tax, therefore the state rate is fixed at 6.35%. You can learn more by visiting the sales tax information website at www.ct.gov. Several exemptions are certain types of safety.

Phone numbers for the sales tax division of the department of revenue services are as follows: This is not a complete list of exemptions but it does include purchases commonly made by individual consumers. The connecticut state sales tax rate is 6.35%, and the average ct sales tax after local surtaxes is 6.35%.

The state imposes sales and use taxes on retail sales of tangible personal property and services. Connecticut is a member of the streamlined sales and use tax agreement, an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. The state imposes sales and use taxes on retail sales of tangible personal property and services.

Tax exemption number central connecticut state university 1615 stanley st new britain, ct 06053 the connecticut state agency or municipality named on this certificate is exempt from connecticut sales and use taxes on the purchase or lease of tangible personal property and services, except for meals and lodging. It imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for use here (i.e., use tax). Retailers purchasing goods for resale are not subject to connecticut's sales tax.

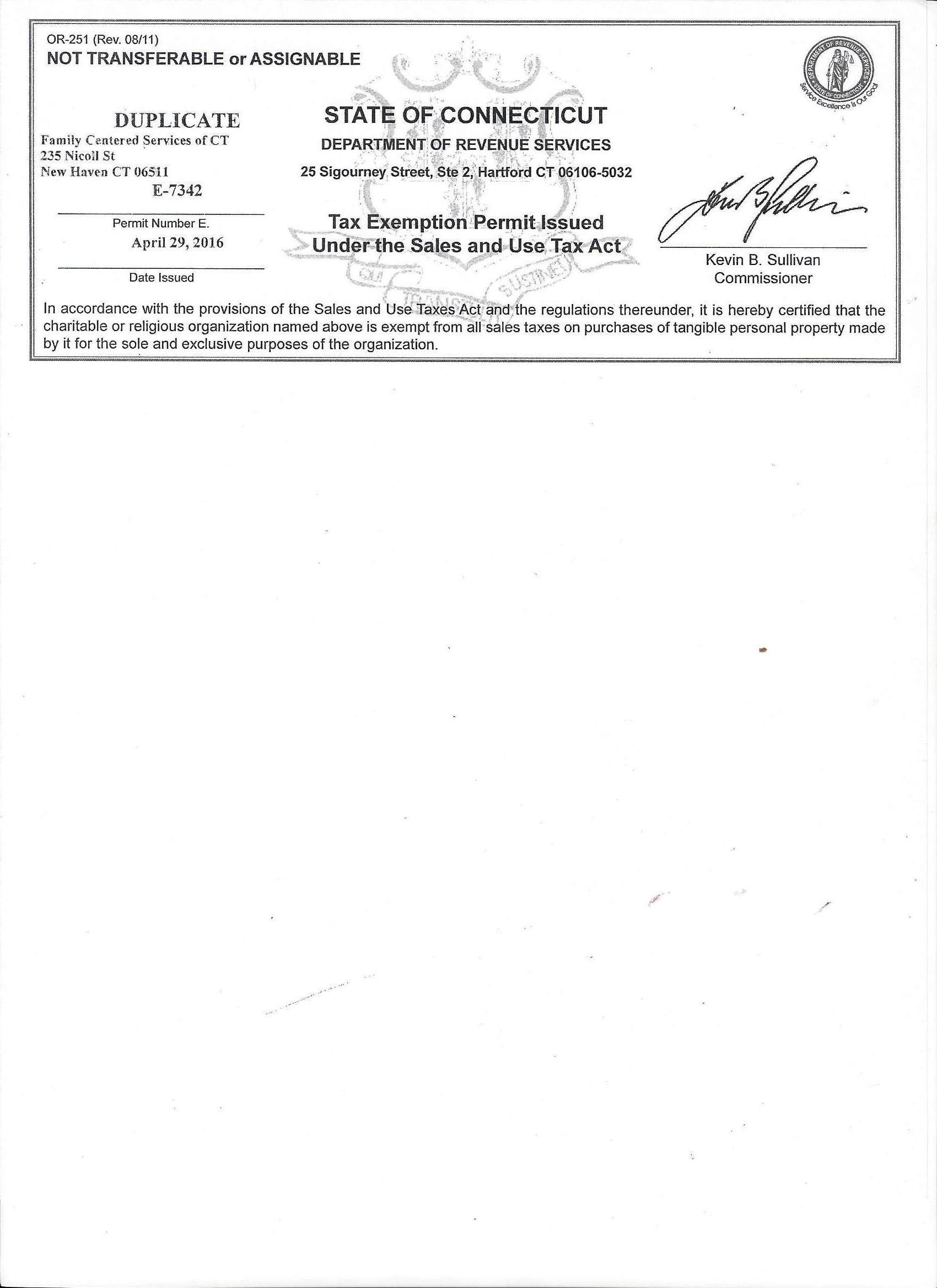

Tax exemption programs for nonprofit organizations. Obtaining a duplicate sales tax permit. Ct use tax for individuals.

Sales tax exemptions in connecticut. (sales exempt from tax) • ap 102: The individual identified as the drop shipper is required to collect tax only if the customer is not.

The connecticut sales tax is administered by the connecticut department of revenue services. For a complete list of exemptions from connecticut sales taxes, refer to conn. Exemptions from sales and use taxes.

Applying for a sales tax permit (resale number) retailers & advertisements. You may apply for tax relief on the purchase of tangible personal property for qualifying retention and expansion projects, or projects that significantly contribute to a targeted industry cluster. Manufacturing and biotech sales and use tax exemption.

What is exempt from sales tax in connecticut?

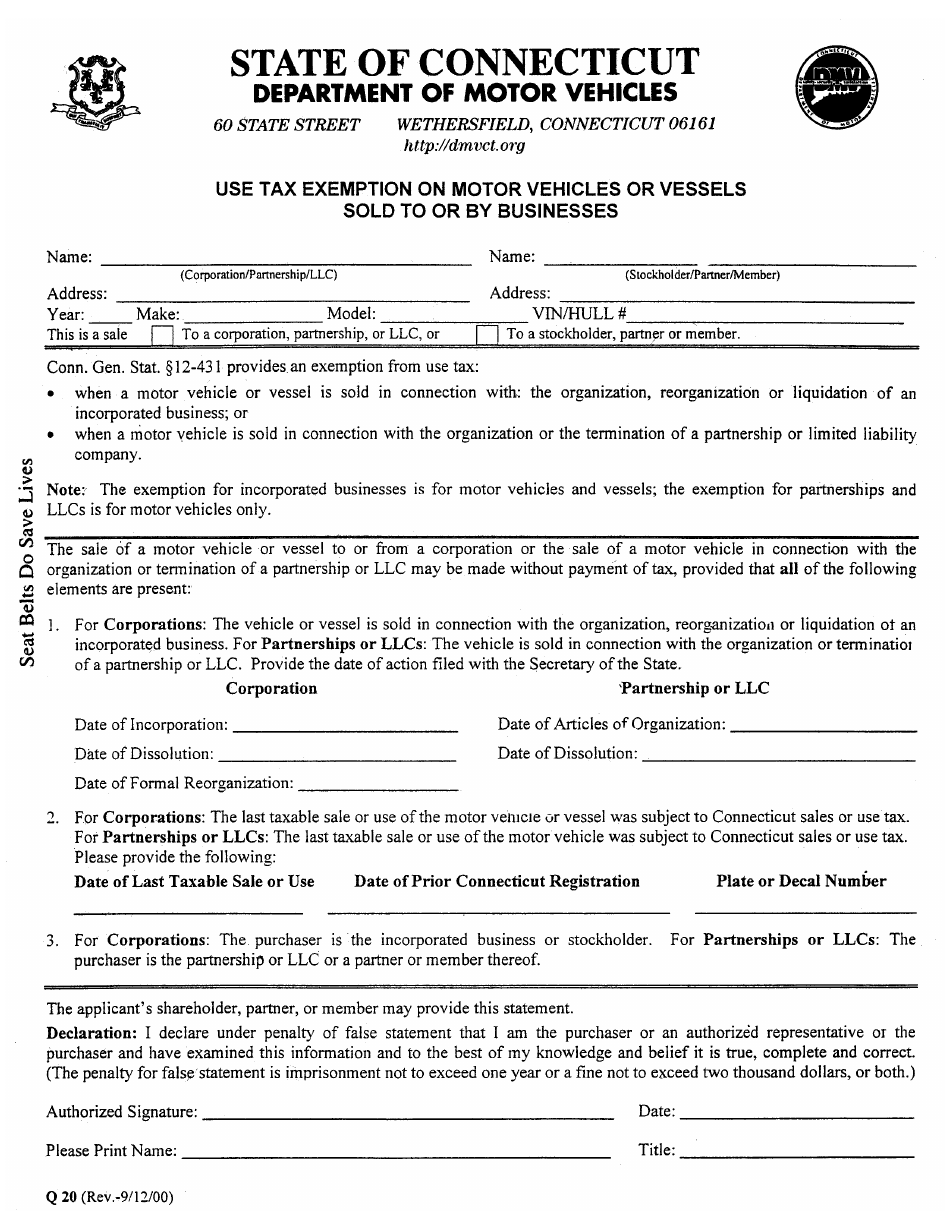

Section 12-426-16a – Sales Of Or Transfers Of Title To Motor Vehicles Snowmobiles Vessels And Airplanes Conn Agencies Regs 12-426-16a Casetext Search Citator

Form Cert-141 Fillable Contractors Exempt Purchase Certificate

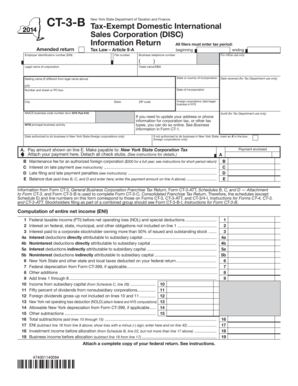

Fillable Online Tax Ny Form Ct-3-b2014tax-exempt Domestic International Sales – Tax Ny Fax Email Print – Pdffiller

Form Ct-3-b Tax Exempt Domestic International Sales Corporation Disc Information Return

Tax-exempt-certificate – Connecticut Science Center

Form Cert-126 Fillable Exempt Purchases Of Tangible Personal Property For Low And Moderate Income Housing Facilities

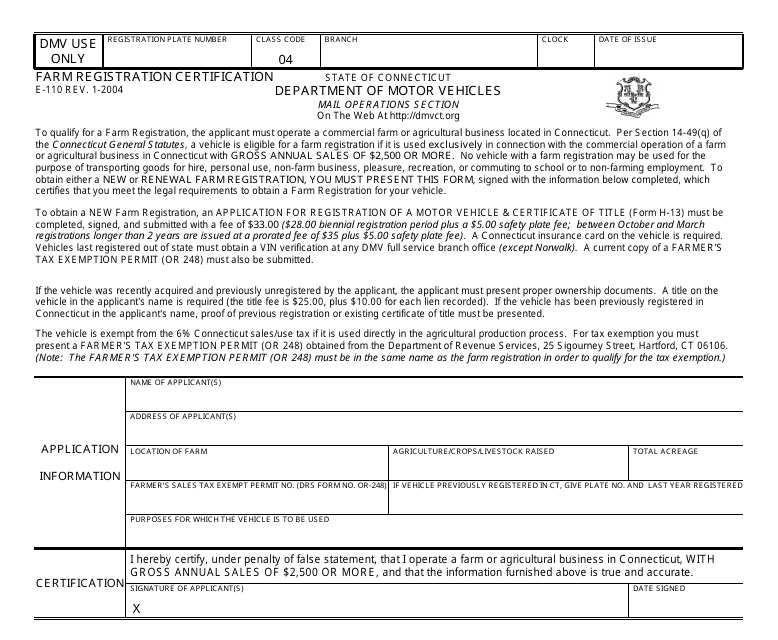

Form E-110 Download Fillable Pdf Or Fill Online Farm Registration Certification Connecticut Templateroller

Form Ct-206 Fillable Cigarette Tax Exemption Certificate

Sales Tax Exemption For Building Materials Used In State Construction Projects

How To Get A Resale Certificate In Connecticut – Startingyourbusinesscom

Policies And Forms

Connecticut Cuts Sales Tax Permit Period To Two Years

Form Q-20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller

Form Reg-8 Fillable Farmer Tax Exemption Permit

Portalctgov

Tax-exempt Connecticut Science Center

Budgets And Other Financial Reporting Information Mill Hill School Pta

Cgactgov

Farm Registration Certification – Connecticut Free Download