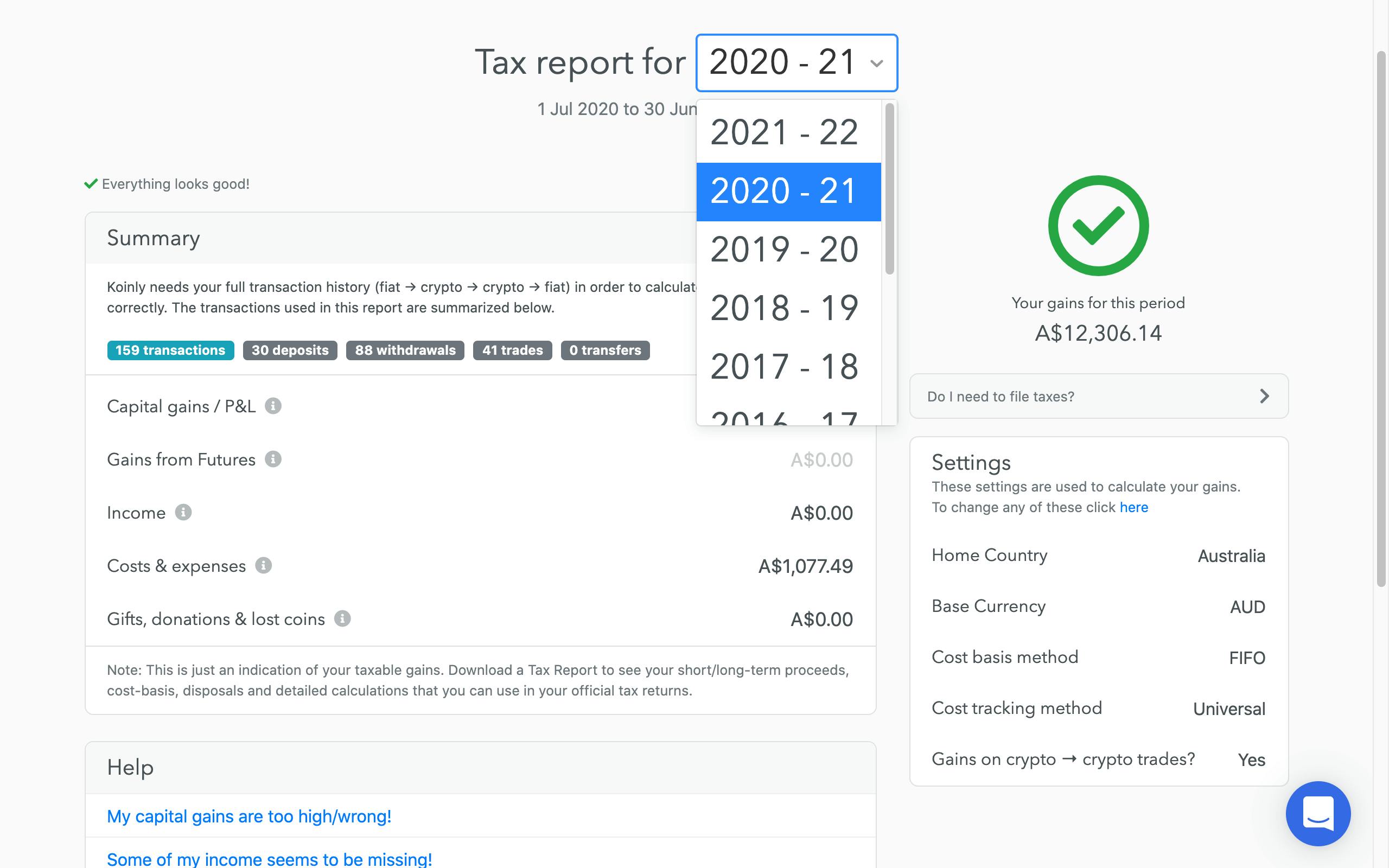

You can then generate your necessary gains, losses, and income reports in aud terms to use for your tax reporting. Depending on your circumstances, taxes are usually realised at the time of the transaction, and not on.

Find A Qualified Cryptocurrency Tax Agent In Australia Findercomau

Additional accounts $50 per client / per year.

Crypto tax accountant australia. We were one of the first accounting firms in brisbane to offer crypto tax accounting and that is because we are passionate users and investors of digital currency and blockchain technology ourselves. The best crypto tax calculator in australia: Even with the right tools and the right qualifications, it’s not easy to account for digital currency investments and perform tax calculations that actually meet australia's tax legislation.

Cointracking can then help you take care of all the crypto tax reporting requirements beyond crypto airdrops: Cointracking is the best crypto tax software for australian investors, enabling the importing of trades from hundreds of exchanges, including defi/dexes, binance smart chain, matic, nfts, and more!. Up to 100,000 transactions per client.

Covers defi, dexs, derivatives, and staking. Any reference to 'cryptocurrency' in this guidance refers to bitcoin, or other crypto or digital currencies that have similar characteristics as bitcoin. Cryptocurrency tax returns generally start from $2,500.

Cryptocurrency accountants or munro’s cryptocurrency accountants is a seasoned 45 years old accounting firm that provides tax and business advisory in the state of australia. With experience reporting cryptocurrency assets across the world, cryptocate specialises in highly accurate reporting that is compliant with your local tax guidelines. If you’re interested in minimising your tax to pay each year, especially if you are making considerable amounts of money through wise cryptocurrency trading, then our accountants at accounting tax solutions can provide you with the solutions on how to achieve this.

Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year. We’re constantly evolving so we can stay at the very forefront of the accounting industry, a leader in innovation and new technologies, utilising cutting edge tax knowledge and. Bitcoin & crypto tax preparation.

Effective crypto tax reports by a crypto accountant. We started in 2018, and have worked closely with accountants and tax lawyers to provide a solution that is suitable in an accounting practice. Call 0402 882 075 to speak to a crypto tax agent in melbourne today.

We take the complexity out of cryptocurrency tax reporting by preparing accurate cryptocurrency tax documentation for your accountant. However, at kova tax, we specialise in (and love) cryptocurrency. Tax on chain is a specialist accounting firm servicing both private and business clients who are active in the cryptocurrency space and are participating in decentralised networks.

Cryptocate is an innovative cryptocurrency tax consultancy. It is unlike the unsolicited tax advisory institute you can find randomly. The way cryptocurrencies are taxed in australia mean that investors might still need to pay tax, regardless of if they made an overall profit or loss.

From reporting to more complex crypto and tax advice, kova tax always is happy to chat and discuss. Cryptotaxcalculator is an australian made software company, specifically designed to satisfy the unique ato reporting requirements. Find a cryptocurrency tax accountant or tax agent in australia maximise your tax return with help from a cryptocurrency tax expert.

This information is our current view of the income tax implications of common transactions involving cryptocurrency. Get an accurate tax report for your bitcoin and cryptocurrency assets from australia’s award winning cryptocurrency tax accountants about crypto tax plus crypto tax plus provides online, personalised, accurate, and practical crypto related tax services to investors, trader, and enthusiasts alike. Our cryptocurrency tax accountants provide professional crypto tax advice and accounting service.

Ensure your investments are working for you (08) 9427 5200 contact us now. Australia's first crypto accounting and tax tool which has been vetted by a chartered accountant.

The creation, trade and use of cryptocurrency is rapidly evolving. Bitcoin brisbane is one of the first crypto companies in brisbane and we have used kova tax for accounting and tax matters;

Accurate Business Accounting Services Facebook

Australian Cryptocurrency Ato Tax Prep 2021 Koinly

Crypto Tax Reports Kova Tax

Crypto Tax In Australia – The Definitive 2021 Guide

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

Cryptocurrency Accounting Services Cryptocurrency Accountant Melbourne Crypto Tax Melbourne Numbers Talk

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax Tips Australia 2021 Crypto Tax Accountant Qa – Youtube

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

Crypto Tax In Australia – The Definitive 2021 Guide

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Top 10 Crypto Tax Accountants In Australia – Crypto News Au

Top 10 Crypto Tax Accountants In Australia – Crypto News Au