A tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. In addition, increasing revenue from sales tax and title ad valorem tax (tavt) has provided enough revenue to maintain current service levels while allowing the county to levy the rollback millage rate.

Coweta County Georgia Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Coweta county's millage rate for 2021 will be 5.756 mills for property owners in the unincorporated areas of the county.

Coweta county property tax rate. County property tax facts coweta. Coweta county assessor's office services. Property taxes (no mortgage) $16,276,900:

You are now exiting the coweta county, ga website. For example take the assessed value of $400,000 x.020 (tax rate/millage rate) = $8,000 in annual property taxes. The state millage rate on all real and personal property has been phased out.

The information should be used for informational use only and does not constitute a legal document for the description of these properties. 2017 tax rates unincorporated coweta county = 29.31 mills city of grantville = 35.34 mills city of newnan = 30.27 mills city of senoia = 36.20 mills 2017 effective tax rates (per $1,000 of assessed value) unincorporated coweta county = $11.72 city of grantville = $14.14 city of newnan = $12.11 city of senoia = $14.48. In 2015 the state millage rate was.05.

The 2018 united states supreme court decision in south dakota v. The newnan city council sets the millage rate each year in the summer based on digest information provided by coweta county. Get driving directions to this office.

The 2020 millage rate of 3.643 was set by council in august. The median property tax on a $177,900.00 house is $1,867.95 in the united states. The millage rate for coweta county is slightly lower than the millage rate for fulton county.

What is the property tax rate in georgia county coweta? Coweta county collects, on average, 0.81% of a property's assessed fair market value as property tax. To figure out your annual taxes you multiple the tax rate by the assessed value.

The coweta county tax assessor is the local official who is responsible for assessing the taxable value of all. Coweta's maintenance and operations millage rate accounts for approximately 23 percent of the property tax bill for properties in the unincorporated portions of the county. The median property tax on a $177,900.00 house is $1,476.57 in georgia.

The coweta county commissioners voted this week to set the 2021 millage rate for general operations, as well as the fire district tax. The fire district millage, which funds the coweta county fire department, accounts for 12 percent, and debt payment on the bonds. Rokovitz february 26, 2020 page 1 of 11 1.

Many had hoped the millage rate would be rolled back, but the coweta board of education voted a tiny savings to the average homeowner of less than $20 a year. The median property tax (also known as real estate tax) in coweta county is $1,442.00 per year, based on a median home value of $177,900.00 and a median effective property tax rate of 0.81% of property value. (770) 254 2680 (phone) (770) 254 2649(fax) the coweta county tax assessor's office is located in newnan, georgia.

Of this increase, $233,700,585 (91%) was new growth, while $22,731,076 (9%) was inflationary growth on existing property. The median property tax in coweta county, georgia is $1,442 per year for a home worth the median value of $177,900. By viewing the web pages at the local government services division's website, taxpayers should obtain a general understanding of the property tax laws of georgia that apply statewide.

Muscogee county of the 159 counties in georgia, property tax rates in muscogee county are sit about in the middle. The average county and municipal millage rate is 30 mills. The typical homeowner in richmond county pays a reasonable $1,214 in property taxes annually, but that makes the effective tax rate a fairly expensive 1.16%.

The median property tax on a $177,900.00 house is $1,440.99 in coweta county. Faq for coweta county boundary change prepared by: Stop critical race theory (crt)!

There is a $60,000 per transaction limit when paying with an echeck. The coweta county school system accounts for 63 percent. Coweta county property tax collections (total) coweta county georgia;

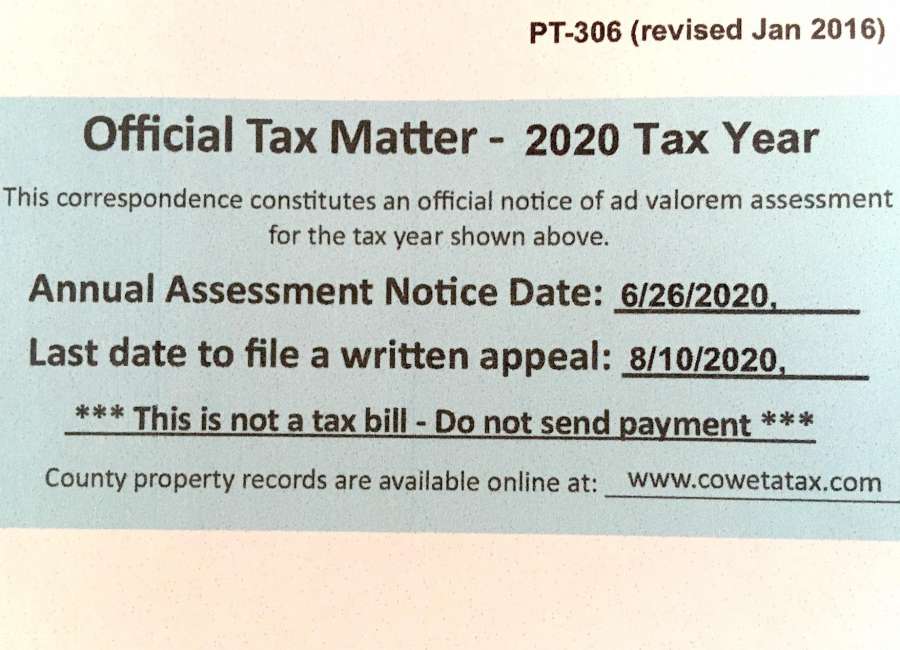

Vote no new sales taxes. Each year, the board of tax assessors is required to review the assessed value for property tax purposes of taxable property in the county. On january 1, 2016, there was no state levy for ad valorem taxation.

Maintaining the current 18.59 mills, the coweta county school system board of education will increase the property taxes it will levy this year by 0.46 percent over the rollback millage rate. Will my property taxes change? The 2019 millage rate was 3.989 mills per thousand dollars of assessed value, which is slightly less than the 4.0 millage rate for 2018.

Coweta county is ranked 1368th of the 3143 counties for property taxes as a percentage of median income. Has impacted many state nexus laws and. The coweta county sales tax rate is %.

On a real estate tax appeal you can only debate the fair market value of your property. This page contains local information about a specific county. You can use the georgia property tax map to the left to compare coweta county's property tax to other counties in georgia.

The coweta county, ga website is not responsible for the content of external sites. The average yearly property tax paid by coweta county residents amounts to about 2.06% of their yearly income.

2

2

2

Amy Dees – Home Facebook

Coweta County Georgia Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Coweta County Georgia Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Sets Millage Rates – The Newnan Times-herald

2

2

One For Coweta Sales Tax Increase Passes News Tulsaworldcom

Property Values Skyrocket But Taxes Havent Been Set – The Newnan Times-herald

2

2

2

Coweta School Board Approves 2021-22 Budget Winters Media

2

2

Coweta County Georgia Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Coweta County School Board Approves 2020-21 Budget Winters Media