Property tax reductions ccda may offer property tax savings for a negotiated period based on the company’s job creation, capital investment and average wage. When/how can homeowners apply for the homestead exemption?

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

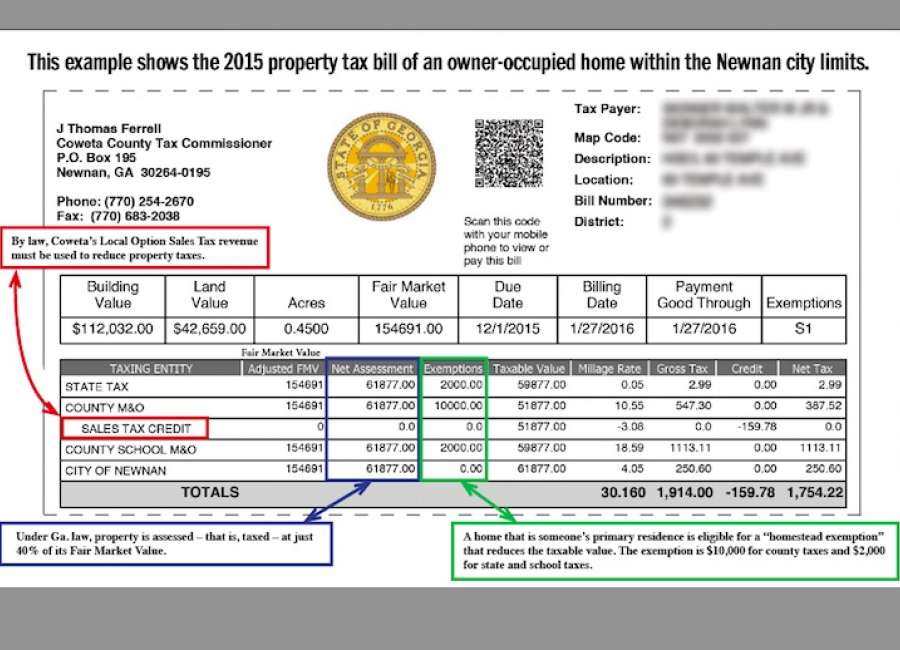

Coweta county collects, on average, 0.81% of a property's assessed fair market value as property tax.

Coweta county property tax exemptions. Application for freeport exemption should be made with the board of tax assessors within the same time period that returns are due in the county. Board of tax assessors & appraisal office. Property must be owned and occupied by the applicant on january 1

Georgia superior court clerks' cooperative authority. These exemptions apply to homestead property owned and occupied by the claimant as his or her legal residence. The county board of tax assessors, appointed for fixed terms by the county commissioners, is responsible for determining taxability, value and equalization of all assessments within the county.

The deadline for homestead exemptions is april 1. The basic exemption for this county is $2,000 on state and school and $5,000 on county and fire. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county.

Homestead exemptions the coweta county tax assessor can provide you with an application form for the coweta county homestead exemption, which can provide a modest property tax break for properties which are used as the primary residence of their owners. Basic exemption extended to $10,000. The median property tax in coweta county, georgia is $1,442 per year for a home worth the median value of $177,900.

To receive the benefit of the homestead exemption, the taxpayer must have occupied the property as of january 1st and file an initial application. Applications filed after that time can receive a. Basic exemption extended to $7,000.

The exemption covers 100% of inventory destined to be shipped outside georgia for the following inventory classes: Coweta county voters adopted a variation of the freeport inventory tax exemption which includes coweta county and any municipality in the county. Payments may be made to the county tax collector or treasurer instead of the assessor.

Be in the know the moment news happens. Georgia department of revenue, property tax division. The georgia department of revenue website has some good info on property taxes.

Sales & use tax exemptions. Pearl presley, pastor of new deliverance ministry, has been holding her small church services in the basement of her home in the springwater subdivision since 2003. Find coweta county residential property tax assessment records, tax assessment history, land & improvement values, district details, property maps, tax rates, exemptions, market valuations, ownership, past sales, deeds & more.

Exemptions offered by the state and counties. Free coweta county assessor office property records search. The state of georgia offers homestead exemptions to all qualifying homeowners.

Remember to have your property's tax id number or parcel number available when you call! In coweta county,the tax commissioner has transferred the Georgia is ranked 841st of the 3143 counties in the united states, in order of the median amount.

As of january 1, 2018, the tax commissioner delegated the responsibility of accepting tax returns and homestead exemption applications to the tax assessors office. Voters in the county may elect to exempt commercial and industrial inventory. Get property records from 1 treasurer & tax collector office in coweta county, ga.

Yearly median tax in coweta county. The county board of tax. Existing industry job tax credit bonus.

B386363e680359b5cc19-97ec1140354919029c7985d2568f0e82sslcf1rackcdncom

Chatthillsdistrict3com

2

Cowetataxcomcom

Cowetaliving2016 Lowres By The Times-herald – Issuu

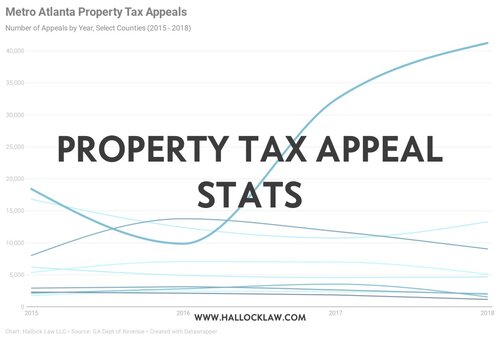

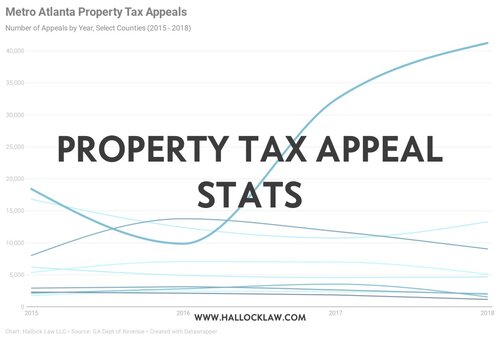

Coweta County Ga Hallock Law Llc Property Tax Appeals

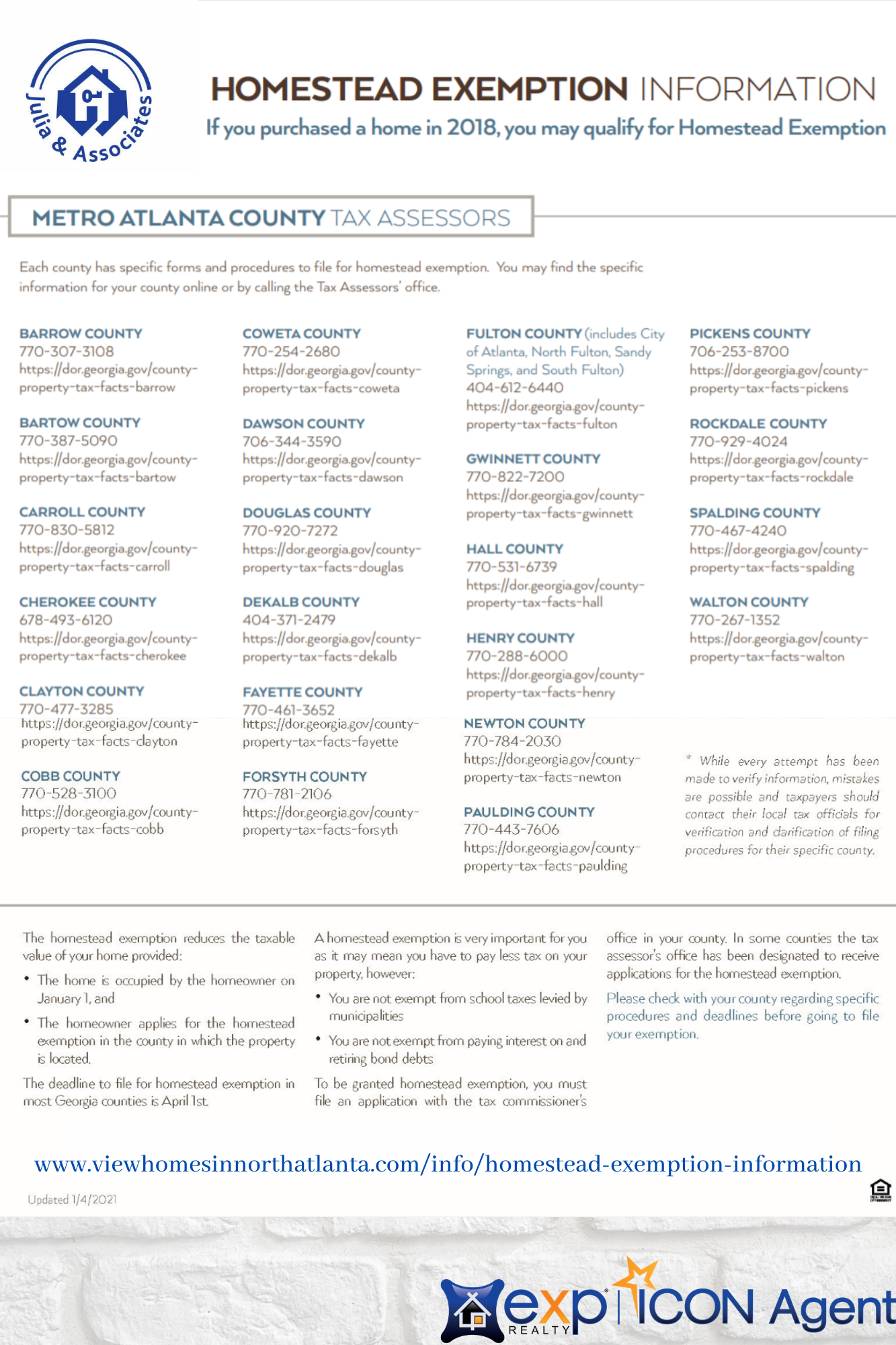

Homestead Exemption Information View Homes In North Atlanta

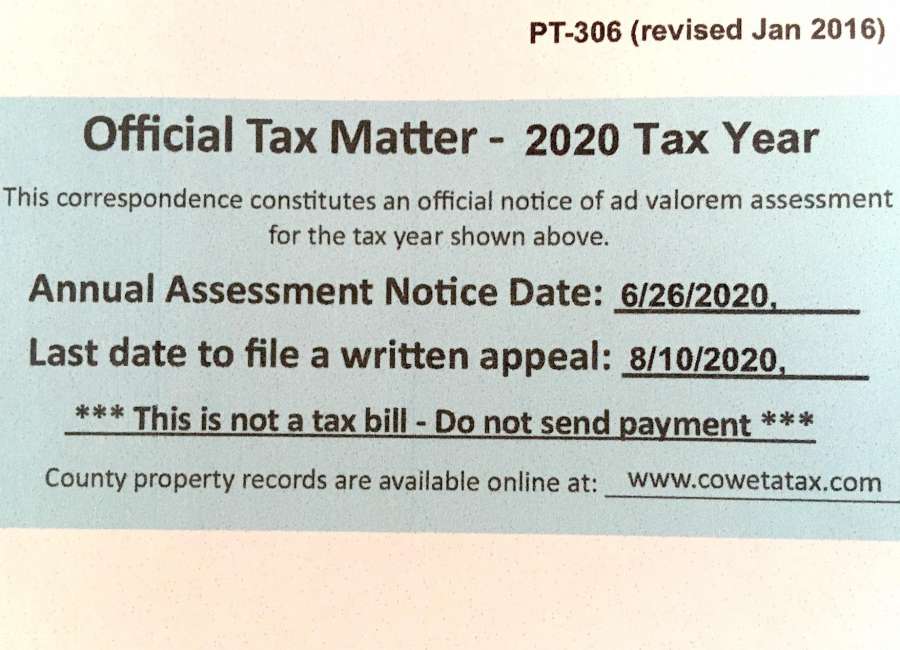

Coweta County Government – 2020 Notices Of Assessment 2020 Notices Of Assessment Were Mailed On Friday June 26 2020 The 2020 Noa Is The Culmination Of A Three-year Revaluation Project For All

Property Tax Rates To Be Set In Next Few Weeks – The Newnan Times-herald

Lgs Local Property Tax Facts For The County – Georgia Department

Coweta County Government – Homestead Exemption Property Valuation Tax Assessors Office Is By Appointment Only Make An Appointment By Calling 7702542680 Or Email Tassessorscowetagaus When You Arrive For Your Appointment Use Entrance

Coweta County Ga Hallock Law Llc Property Tax Appeals

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Nfmcjaxcom

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Property Tax Bills On Their Way – The Newnan Times-herald

Property Values Skyrocket But Taxes Havent Been Set – The Newnan Times-herald

Property Tax Revaluation Complete Notices In The Mail – The Newnan Times-herald