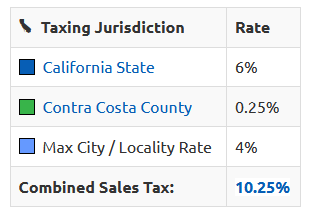

If it passes, sales tax would increase by half a percent on most goods, but not on necessities like food and medicine. Martinez — the contra costa county board of supervisors on tuesday unanimously signaled its support for a proposed sales tax measure and a plan for how to spend the $3.6 billion it’s expected to generate over the next three and a half decades on transportation improvements.

Wfdc1hqxployqm

*this story may be updated if new information becomes available.

Contra costa sales tax measure. The contra costa coutny transportation authority is the driving force behind the sales tax measure, which has drawn the support of the board of supervisors and. Measure x, intended to increase contra costa county sales taxes by another half percent, is regressive: We’ve tracked several of the key races and measures across the populous county.

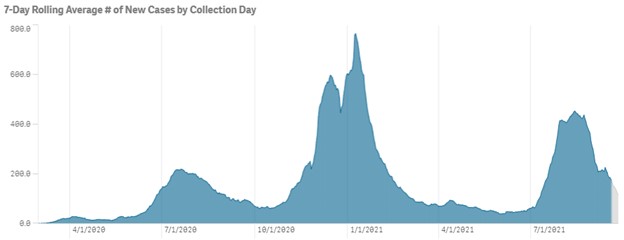

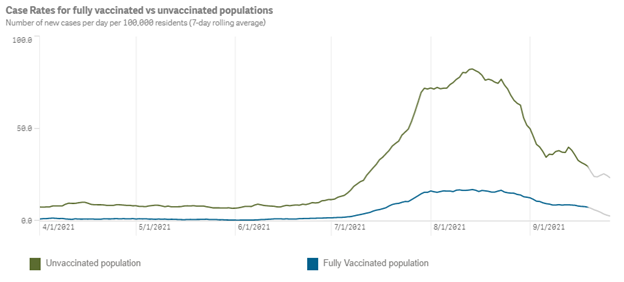

41 rows contra costa county, california, measure x, sales tax (november 2020) contra costa county measure x was on the ballot as a referral in contra costa county on november 3, 2020. Measure x is a sales tax measure that’s expected to generate $81 million dollars a year for the next 20 years. Sales taxes disproportionately burden our poorest and most vulnerable residents, those least able to afford that extra burden —especially in the very expensive bay area, and especially during a time of pandemic impact.

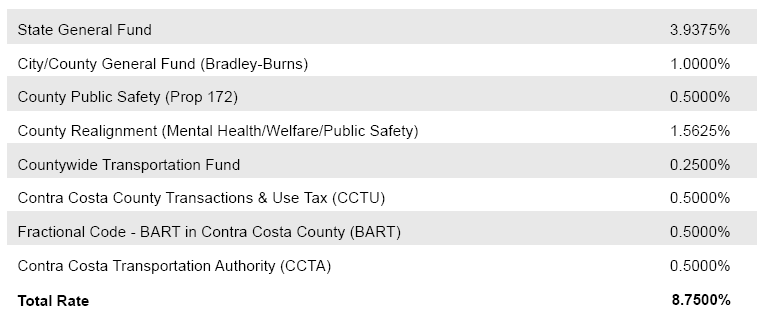

Concord's overall sales and use tax rate will rise from 8.75 percent to 9.25 percent. Concord voters will say yes or no on nov. City officials anticipate that, if approved.

That doesn’t mean that sustainable transportation advocates all support it, however. When voters in contra costa county approved a new sales tax last year, they were promised a host of essential services such as community. Measure x, a 1/2 cent sales tax, is failing to meet the 2/3 vote requirement.

That would bring contra costa’s sales. The contra costa county sales tax measure, measure x, depends on the passage of sb 1349, drafted by sen. The original bill has been amended to include language providing relief to the county and several cities — including danville, lafayette, pittsburg and san ramon — for future similar tax measures.

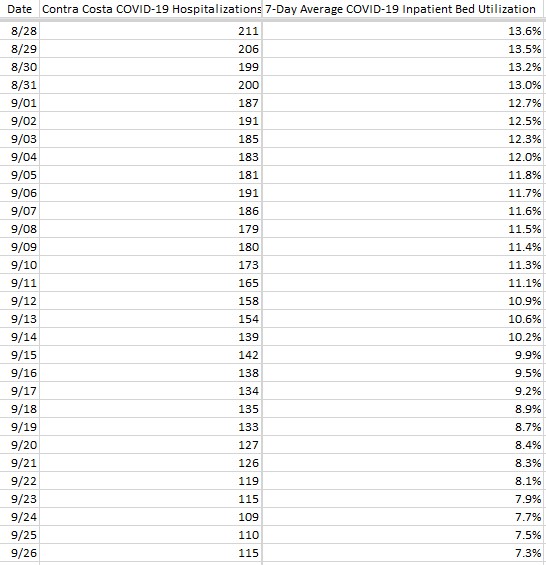

A simple majority is required for each, and all proceeds will be deposited into the respective. The measure adopts a 0.5% sales tax for 20 years beginning april 2021. The contra costa county congressional district races landed pretty much where expected with incumbents retaining seats handily.

Contra costa county sales taxes vary by local jurisdiction, presently collecting 8.25% to 9.75% already. Sb 1349 enables more such circumvention of the statutory limit. A “yes” vote supported authorizing an additional sales tax of 0.5% for 20 years generating an estimated $81 million per year for essential services.

The money began accruing in april, when the county's measure x advisory board began meeting. The c ontra costa county sales tax measure, measure x, depends on the passage of sb 1349, drafted by sen.

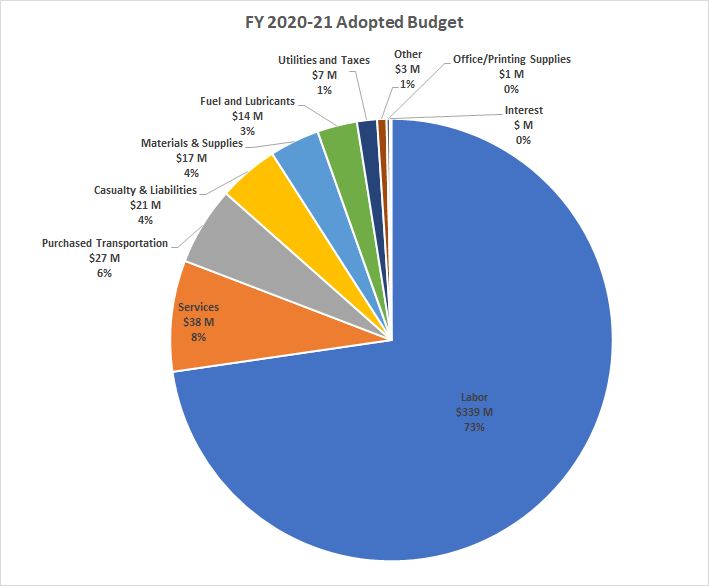

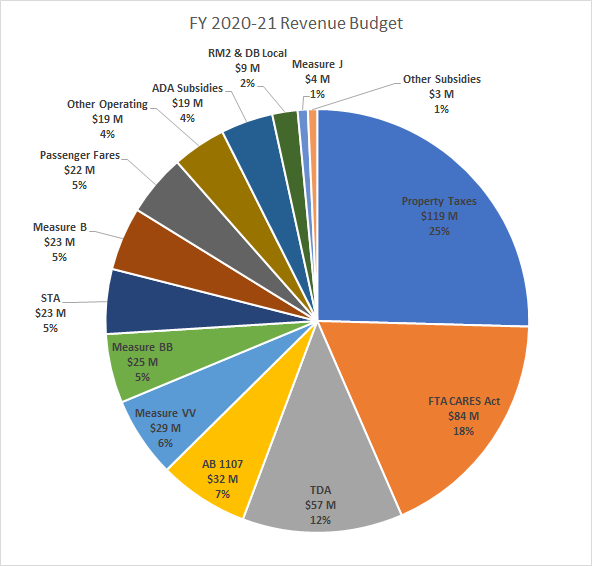

Budget Alameda-contra Costa Transit District

Fate Of Alameda Countys Measure C Remains Uncertain

Stanton California Repeal Transactions And Sales Tax For General Services Measure Qq November 2016 – Ballotpedia

Business Contra Costa Herald

City Of Sacramento Library Parcel Tax Measure B June 2014 – Ballotpedia

![]()

Martinez Unified School District California Bond Issue Measure R November 2016 – Ballotpedia

Pleasant Hill Who Will Get Carmax Sales Tax

Business Contra Costa Herald

Bay Area Streets May Be Steep But Pavement Quality Is Flat Metropolitan Transportation Commission

Business Contra Costa Herald

Budget Alameda-contra Costa Transit District

Business Contra Costa Herald

Santa Cruz County California Ballot Measures – Ballotpedia

Pleasant Hill Who Will Get Carmax Sales Tax

Business Contra Costa Herald

California Primary Election 2020 Live Results From Statewide Bay Area Races – Abc7 San Francisco

Business Contra Costa Herald

2

Reimagine Richmond