How real estate is taxed varies greatly from state to state. The assessment rate for most other types of property, including personal property, is 29% of actual value.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Estate income tax estate income tax is a tax on income, like interest and dividends.

Colorado estate tax rate. For property that is classified residential, the current assessment rate is 7.15% of market value. Thus 98.42 mills = 9.842 percent or.09842 as the decimal equivalent. Green ’s assessed value is $43,500, her taxes will be:

4 hours ago the colorado sales tax rate is 2.9% as of 2021, with some cities and counties adding a local sales tax on top of the co state sales tax. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: The median property tax in colorado is $1,437.00 per year for a home worth the median value of $237,800.00.

Colorado is ranked number thirty out of the fifty states, in order of the average amount of property taxes collected. Colorado has a flat income tax rate of 4.63%. Colorado estate (fiduciary) income tax.

$1.00 per pack state of colorado sales tax 2.9% 2020 colorado tax tables with 2021 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Estate income tax is tax on the income after a person has died. 2020 colorado state sales tax rates the list below details the localities in colorado with differing sales tax rates, click on the location to access a supporting sales tax calculator.

Estate (death) taxes and estate income taxes are two different types of tax! Does colorado have an inheritance tax or estate tax? Property taxes due are calculated by multiplying the actual value of the property by the assessment rate by the mill levy.

No estate tax or inheritance tax connecticut: When considering these local taxes, the average colorado sales tax rate is 7.65%. The colorado income tax rate for tax years 2018 and prior was 4.63%, for tax year 2019 was 4.5%, and for tax year 2020 is 4.55%.

Counties in colorado collect an average of 0.6% of a property's assesed fair market value as property tax per year. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: There is no inheritance tax or estate tax in colorado.

That match will grow to 20 percent for tax year 2022 and to 25 percent in the following year. A tax rate is the mill levy expressed as a percentage. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

The state’s property tax rates are among the nation’s lowest, with an average effective rate of just 0.49%. The terminology is confusing, but the federal gift/estate tax is a wholly. The estate should pay this tax.

Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. On the other hand, homeowners in colorado get a break on real estate taxes. 2018 (manual rate chart) 2018 (food for home consumption only) 201 7 (manual rate chart) 2017 (food for home consumption only) use tax rates.

As a matter of fact, you may have to file one or more of these returns: According to usa today, colorado has the 7th lowest property tax rates in the country, although that is a statewide average. A tax of 10 mills on a property with an assessed value of $10,000 is equal to $100 ($10,000 x 0.1).

Colorado sales tax rate 2021. Click the tabs below to explore! But that there are still complicated tax matters you must handle once an individual passes away.

Below, we have highlighted a number of tax rates, ranks, and measures detailing colorado’s income tax, business tax, sales tax, and property tax systems. Here in colorado, we are blessed with very low property taxes compared to many other states. Assessed value x mill levy = taxes $ 43,500 assessed value x.

The assessment rate is 7.15%. Colorado form 105, colorado fiduciary income tax. The benefit could range from a.

Colorado has no estate tax for decedents whose date of death is on or after january 1, 2005. The first step towards understanding colorado’s tax code is knowing the basics. Ordinances and resolutions are adopted 90 to 120 days prior to an election.

Currently the estate tax has an exemption amount of over $5 million and a tax rate of 35%. Property taxes in the centennial state are currently at 7.96 percent, whereas the rate for nonresidential properties is at 29 percent. A mill is equal to 1/1000 of a dollar.

The colorado income tax rate for tax years beginning in 2018 and prior was 4.63%, for tax years beginning in 2019 was 4.5%, and for tax years beginning in 2020 is 4.55%. The assessed value is then multiplied by the mill levy to get the tax amount. Tax rate changes administered by the state of colorado, department of revenue become effective either january 1 or july 1.

Special event vendor rate charts. It is very easy and normal to confuse estate tax with estate income tax. Under certain circumstances involving fiscal year state revenues in excess of limitations established in the state constitution, the income tax rate for future tax years may be temporarily reduced to 4.5%.

Tax amount varies by county. An effective tax rate is the amount you actually pay annually divided by the value of your property.so if you pay $1,500 in taxes annually and your home’s market value is $100,000, your effective tax rate is 1.5%. Unlike the federal income tax, colorado's state income tax does not provide couples filing jointly with expanded income tax brackets.

Map Of Erie Colorado Neighborhoods Erie Colorado Erie Colorado

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Nationally Renowned Shopping Low Sales Tax Rates And Diverse Recreational Opportunities Make The City Of Lone Tree A Very Desirable Plac Lone Tree Tree Lonely

Taxation In Castle Pines – City Of Castle Pines

Ohio Sales Tax – Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Pin On Lugares Que Visitar

Updated State And Local Option Sales Tax Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Nar Data Shows Now Is A Great Time To Sell Things To Sell Real Estate Infographic Real Estate Advice

25 Percent Corporate Income Tax Rate Details Analysis

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Wyoming Tax Benefits – Jackson Hole Real Estate – Ken Gangwer

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

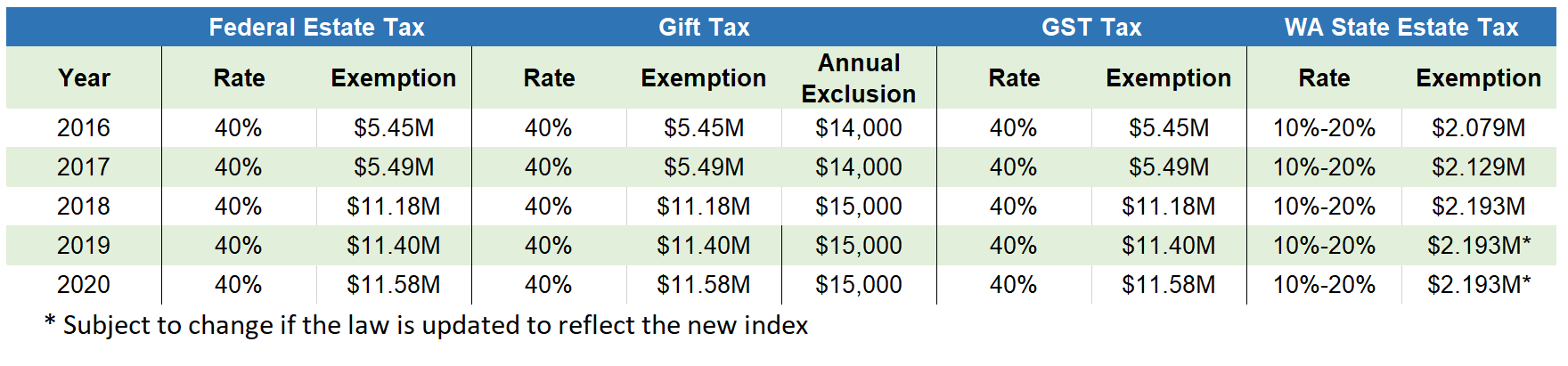

2020 Estate Planning Update

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax