Property taxes are due each year on the first working day after july 1 st. The results of a successful search will provide the user with information including assessment details, land data, service.

Property Tax

On this page you will find tax assistance programs for the city of richmond's department of finance.

City of richmond property tax inquiry. In 2021, property taxes were due july 2, 2021 at 4:30 pm. Richmond real estate prices have not changed significantly from november 2019 to november 2020 and the average price of a house in richmond is $972k. The current year's tax notice mailing is.

City of richmond real estate search program. You can also purchase tax certificates in person by visiting the property tax department on the main floor of city hall. The report will display property assessment and tax levy information as well as the legal description.

Welcome to the district of north vancouver's property information inquiry. Richmond property tax calculator 2021. 8:15 am to 5:00 pm, monday to friday.

You can also safely and securely view your bill online, consolidate your tax bills into one online account, set up notifications and reminders to be sent to your email or mobile phone, schedule payments, create an online wallet, and pay with one click using credit/debit or your checking account. The city of richmond is located south of vancouver in the metro vancouver regional district and is home to over 198k residents. We accept cash, personal check, cashier’s check, and money order.

Henrico county now offers paperless personal property and real estate tax bills! A 1% penalty has been added to outstanding current balances. If you prefer to pay for the tax certificate by credit card, please visit www.apicanada.com to open an account and order your tax certificate.

Below are categories of assistance which can potentially limit tax payments for real estate and personal property for those who qualify. Personal property taxes are billed once a year with a december 5 th due date. Only property tax and parking tickets may be paid online.

City of richmond 2019 and newer property taxes (real estate and personal property) are billed and collected by the ray county collector. I was sent a bill for personal taxes in richmond and chesterfield i moved to chesterfield in 2018. These records may be accessed using one or more search criteria such as premise (address), transfer price or date ranges.

Use the selection list tab review and modify the selected properties. Team papergov • 11 months ago. In city of richmond the reassessment process takes place every two years.

This utility allows a person to interactively search the city of richmond real property database on criteria such as parcel id, address, land value, consideration amount etc. Instructions for using the property information inquiry service. Virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value.

City of richmond 6911 no. Property information search portal choose a search option from the first drop down box below and follow search instructions as noted. Personal property taxes are billed annually with a due date of december 5 th.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Individual (vehicle) personal property tax frequently asked questions City of richmond real estate transfer search program this interactive search utility allows a person to view real estate transfers from the city of richmond property transfer database.

You may search for a property using the civic address, folio number or pid. To pay your 2019 or newer property taxes online, visit the ray county collector’s website.all city of richmond delinquent taxes (2018 and prior) must be paid to the city of richmond collector prior to paying 2019 or newer property taxes to the ray county. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year.

3 road, richmond, british columbia, v6y 2c1 hours: 2021 property taxes were mailed the third week of may and are due on july 2, 2021. Property taxes 2021 property taxes.

The property information portal allows users to view and print a property information report for properties located in surrey. Tax relief programs are available in city of richmond, which may lower the property's tax bill. Use the search tab to add properties to your selection list.

Tangible personal property is the property of individuals and businesses in the city of richmond. The tangible personal property tax is a tax based on the value of the property, commonly referred to as an ad valorem tax. 3 road richmond bc v6y 2c1 manage your property.

Welcome to the my property account online access for the city of richmond. Basic property information is available using the above tabs at no charge.

Digital Tax Map Main Menu – New York City Department Of Finance

Tax Collector Beverly City

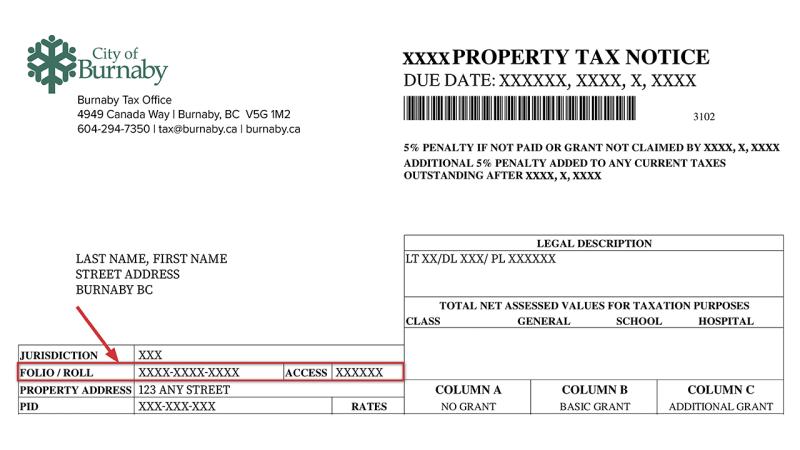

Property Taxes City Of Burnaby

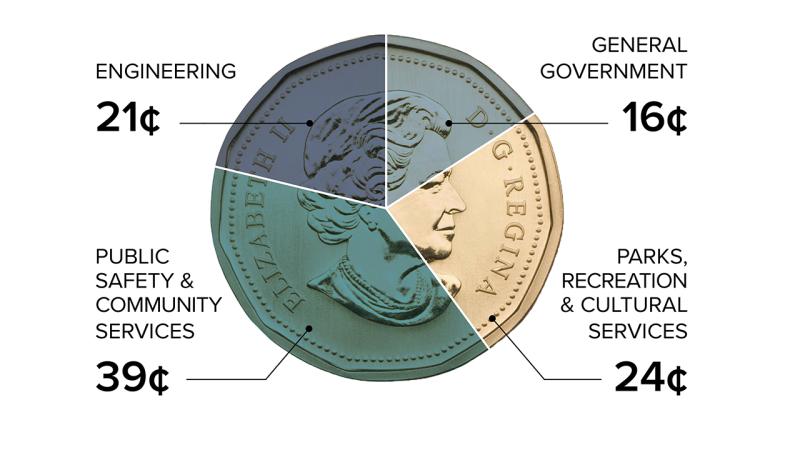

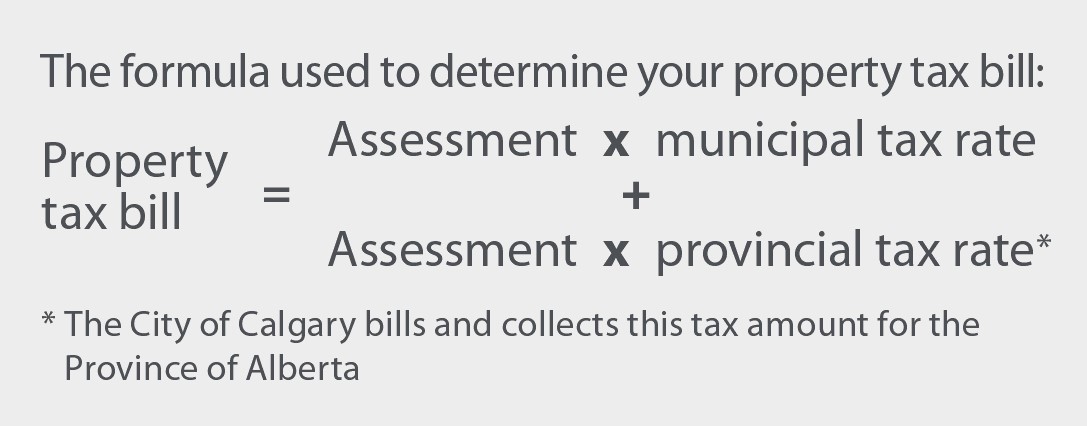

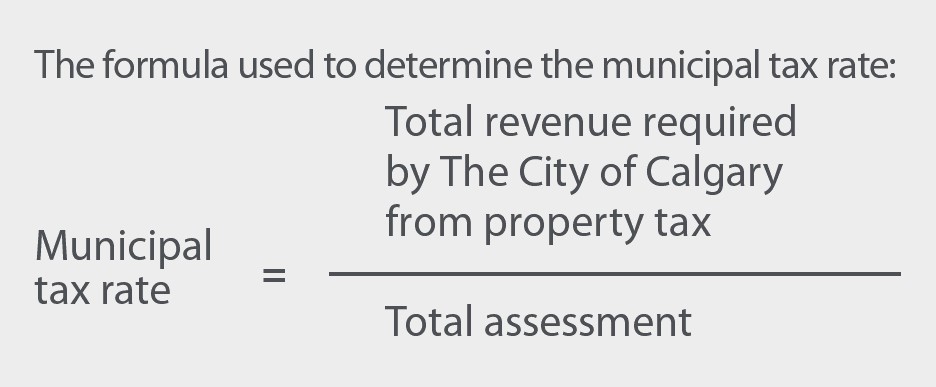

Property Tax Tax Rate And Bill Calculation

Surrey Property Tax 2021 Calculator Rates – Wowaca

Real Estate Property Tax – Jackson County Mo

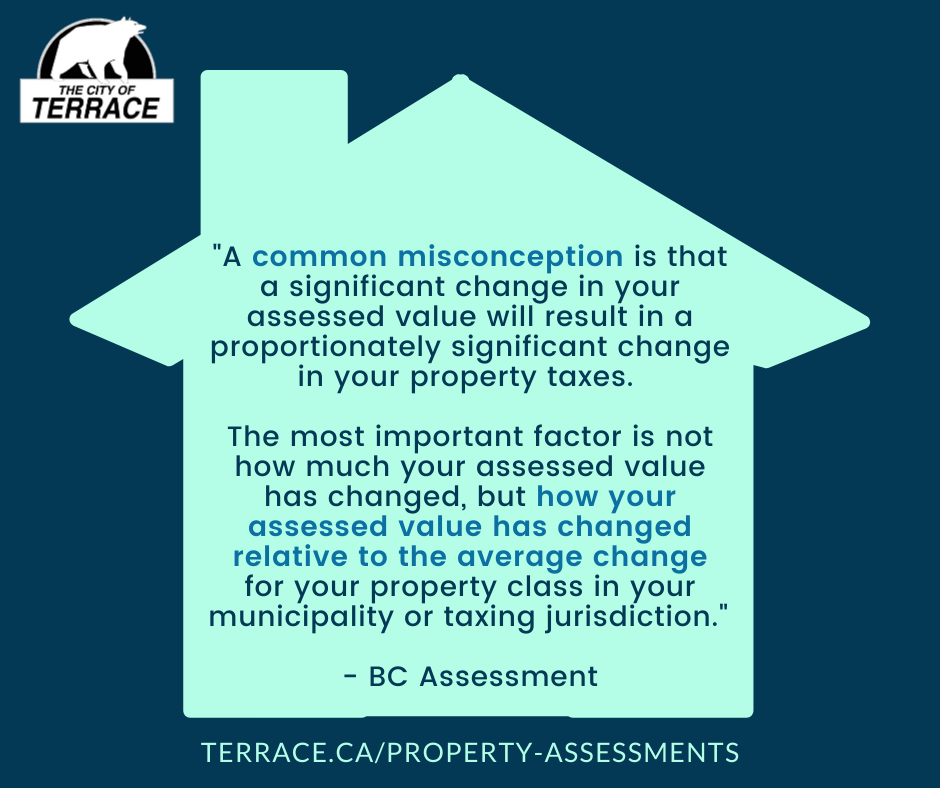

Property Assessments City Of Terrace

Penticton Property Tax 2021 Calculator Rates – Wowaca

Propertytax

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Momentum Logistics Launches Operations In Us State Of Delaware – Construction Business News Middle East Logistics Construction Business Business Development

The Property Tax Equation

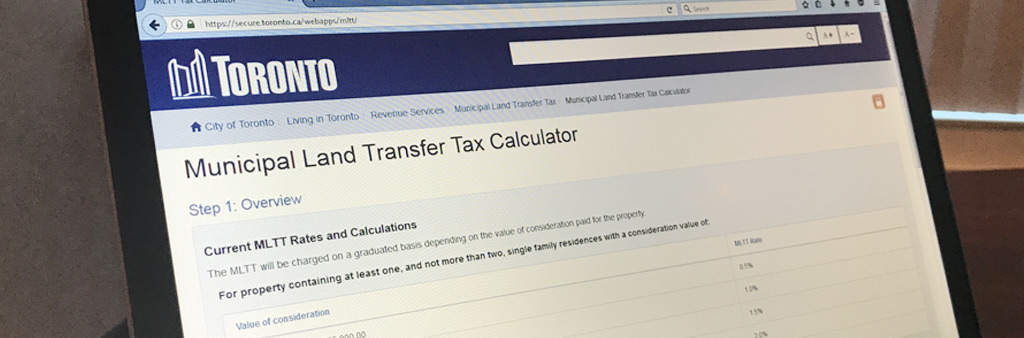

Municipal Land Transfer Tax Mltt City Of Toronto

City Tax Collection

The Property Tax Equation

Tax Information City Of Katy Tx

Richmond Property Tax 2021 Calculator Rates – Wowaca

How To Pay City Of Burnaby