Only property tax and parking tickets may be paid online. Richmond real estate prices have not changed significantly from november 2019 to november 2020 and the average price of a house in richmond is $972k.

Ontario Property Tax – Rates Calculator Wowaca

The current millage rate is 4.132.

City of richmond property tax calculator. Broad st., room 802 richmond, va 23219 usa. The city of richmond tax assessor is the local official who is responsible for assessing the taxable value of all properties within city of richmond, and may establish the amount of tax due on that property based on the fair market value appraisal. Late payment penalties will apply to 2021 tax instalments.

City of richmond 2019 and newer property taxes (real estate and personal property) are billed and collected by the ray county collector. In city of richmond the reassessment process takes place every two years. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year.

Beginning january 31, 2021, interest on unpaid taxes will be applied monthly. Broad st, rm 802 | richmond, va 23219 | phone: When contacting city of richmond about your property taxes, make sure that you are contacting the correct office.

134 rows annual property taxes are likewise quite high, as the median annual property tax paid by. Examples are shown below with and without seniors discount. To pay your 2019 or newer property taxes online, visit the ray county collector’s website.all city of richmond delinquent taxes (2018 and prior) must be paid to the city of richmond collector prior to paying 2019 or newer property taxes to the ray county.

The city of richmond is located south of vancouver in the metro vancouver regional district and is home to over 198k residents. This property tax calculator is intended for. Richmond city collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections.

Tax relief programs are available in city of richmond, which may lower the property's tax bill. Richmond property tax calculator 2021. Personal property taxes are billed once a year with a december 5 th due date.

It is used to pay for city services such as police, the fire department, and public transit as. Richmond city assessor’s office | 900 e. Address richmond city hall 900 e.

Calculating your richmond hill property tax due. California city documentary and property transfer tax rates governance: City millage rate based on the house value of $250,000 for select years.

All taxpayers with an outstanding balance of $10 or more will receive a reminder notice early in december 2020. City of richmond (maintenance & operations) $0.5254/$100 value. Virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value.

We accept cash, personal check, cashier’s check, and money order. Your annual property taxes collected by the city of richmond funds municipal services and other taxing agencies such as the province of bc (school tax), translink, bc assessment authority, metro vancouver and the municipal finance authority. Richmond property tax 2021 calculator & rates.

City of richmond (debt service) $0.1745/$100 value total property tax rate $0.6999/$100 value. Residents of richmond pay a flat city income tax of 2.00% on earned income, in addition to the kentucky income tax and the federal income tax. Tax rate for nonresidents who work in richmond.

If you own a property, you will have to pay property tax. City of richmond assessor's office services. These agencies provide their required tax rates and the city collects the taxes on their behalf.

It is based on the assessed value of a property. City of richmond and extraterritorial jurisdiction 7%. Property tax is a tax on land and property.

The median property tax (also known as real estate tax) in richmond city is $2,126.00 per year, based on a median home value of $201,800.00 and a median effective property tax rate of 1.05% of property value. Nonresidents who work in richmond also pay a local income tax of 2.00%, the same as the local income tax paid by residents. Property tax in british columbia.

Abbotsford Property Tax 2021 Calculator Rates – Wowaca

Ontario Property Tax Rates Lowest And Highest Cities

Following A Recent Council Approval Canadian City Of Richmond Hill Will Be Exploring Providing Crypto Asset Pr Property Investor Property Tax Mortgage Payment

The Aliana City Of Richmond County Of Fort Bend Tx Zip Code 77407 Benhuynhrealtor The Neighbourhood Richmond Cool Websites

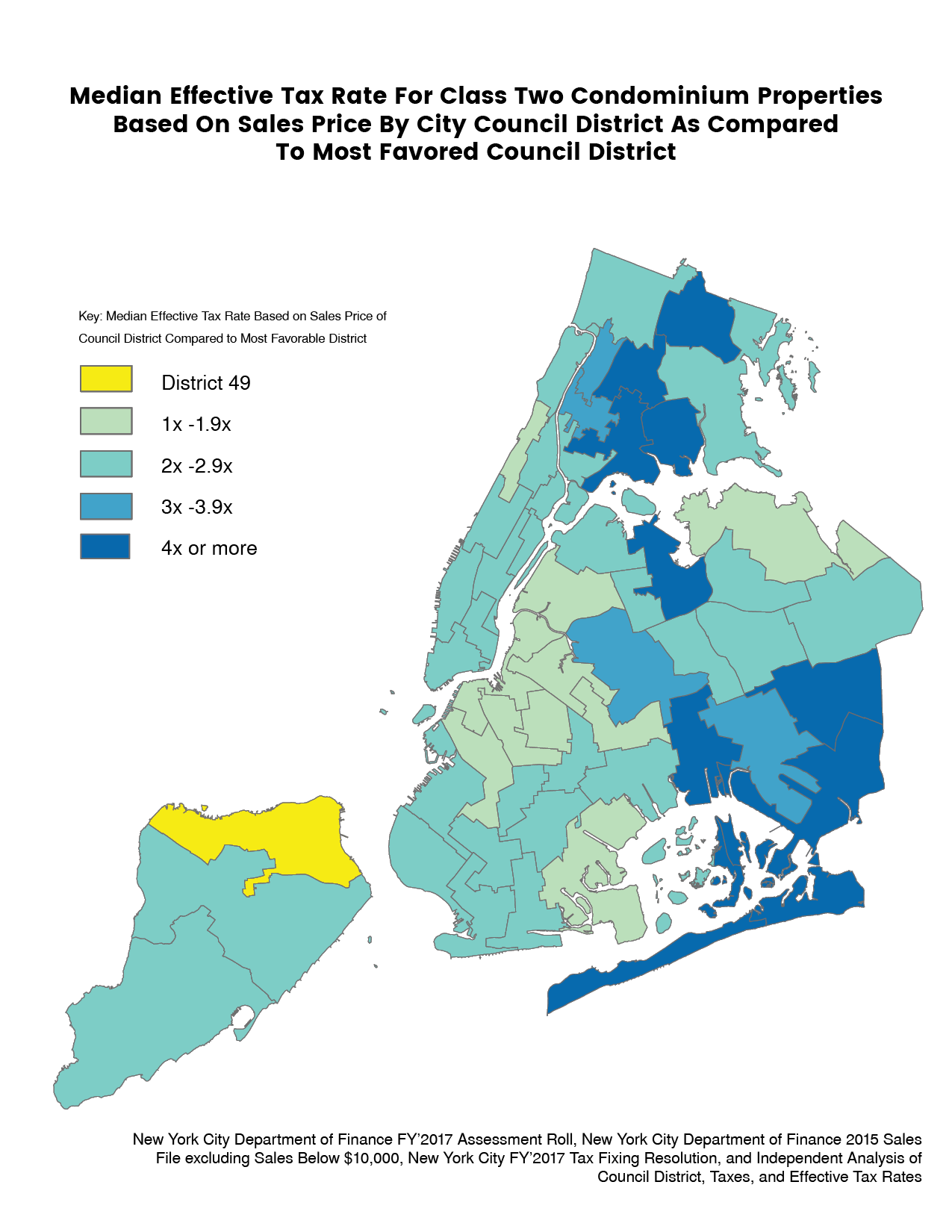

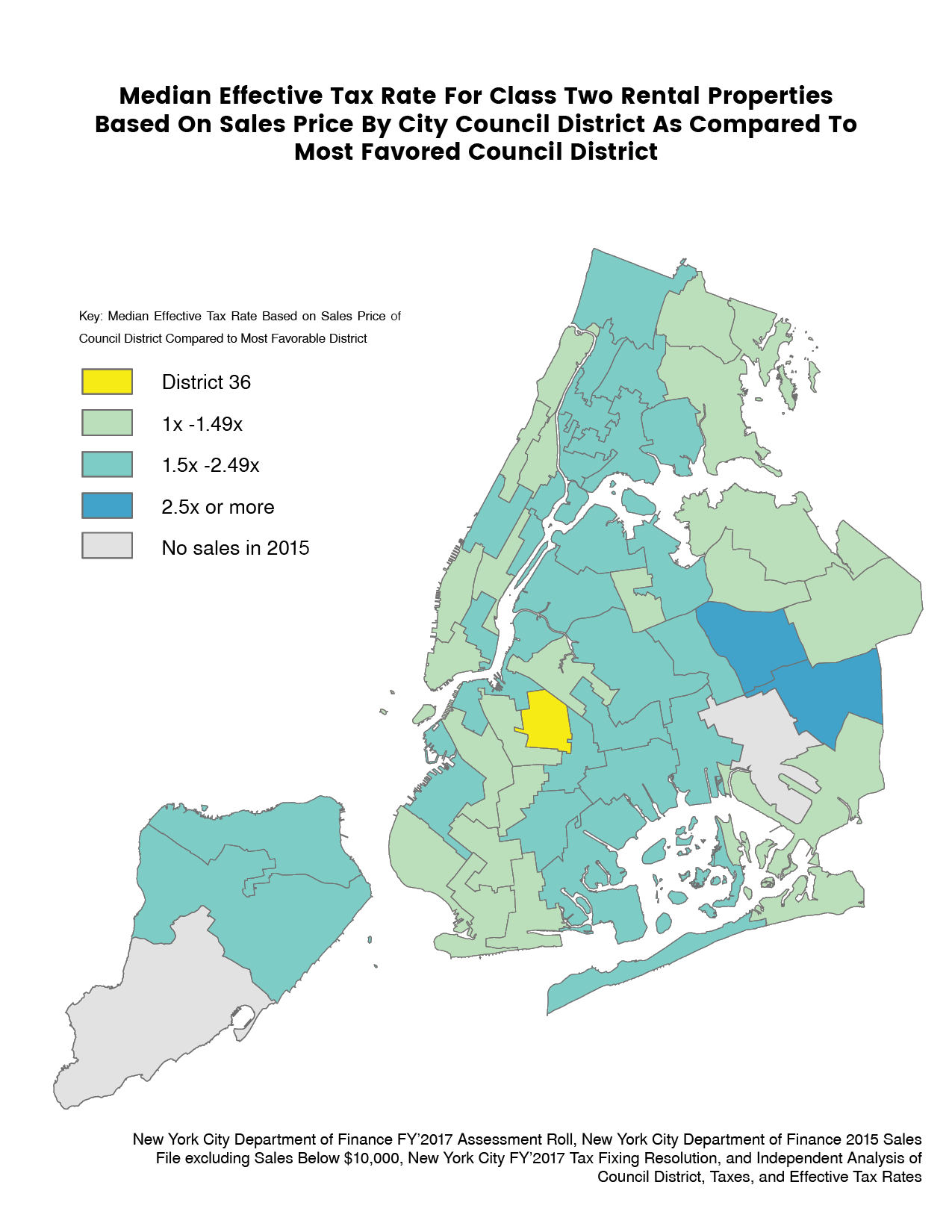

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods – Tax Equity Now

4uagmek1d-lwjm

Houston City Council Adopts Tiny Tax Rate Increase The Rate Will Shift From About 584 Cents Per 100 Ferry Building San Francisco Houston City Property Tax

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods – Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods – Tax Equity Now

Heres How Mississaugas Property Taxes Compare To Other Ontario Cities

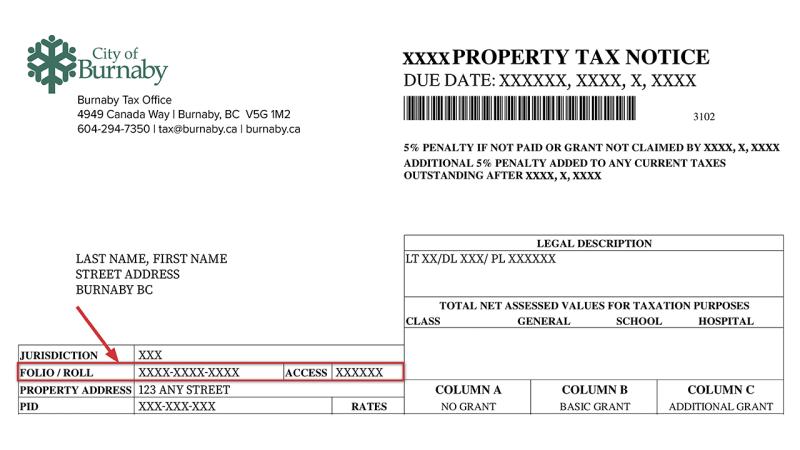

How To Pay City Of Burnaby

Tax Preparation Services 4 Mistakes In Wealth Planning — Hit The Like Repin Button If You Dont Mind Income Tax Return Income Tax Income Tax Preparation

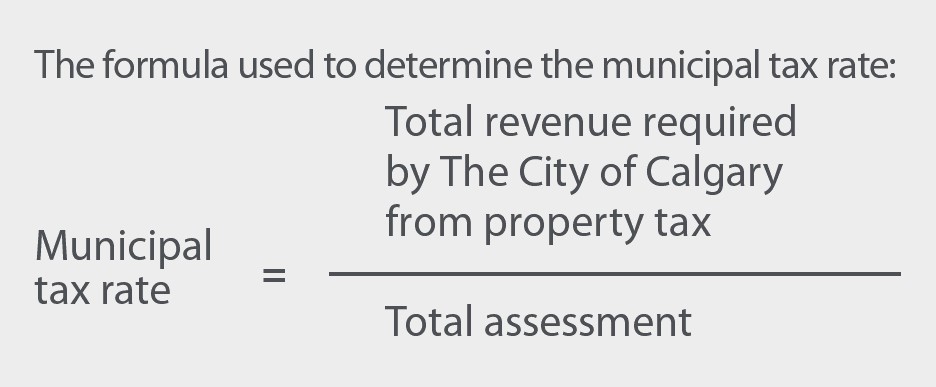

Property Tax Tax Rate And Bill Calculation

Hey I Would Like To Send You A Personalized Comparative Market Analysis Cma On Your Home Configur In 2021 Whats My Home Worth Nashville Real Estate Real Estate

The Best And Worst Cities To Own Investment Property Investment Property Investing Real Estate Marketing Strategy

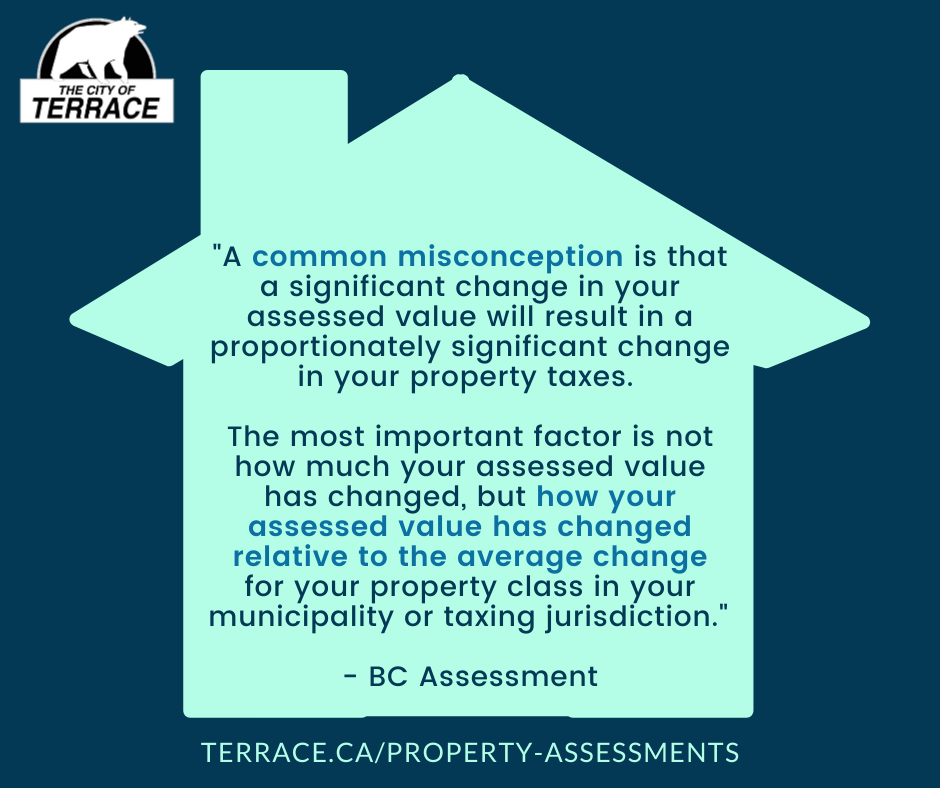

Property Assessments City Of Terrace

How Much Will Your House Be Worth In 2030 Uk House Price Map London Property House Prices Home Buying

Property Tax Tax Rate And Bill Calculation

Richmond Property Tax 2021 Calculator Rates – Wowaca