Tax relief programs are available in city of richmond, which may lower the property's tax bill. $3.50 per $100.00 assessed value first half due june 5th, second half due december 5th

3455 Fleetwood Drive Richmond – Contra Costa County Ca – Compass Fleetwood In Ground Pools Richmond

Interactively search the city's property database here, using criteria e.g.

City of richmond property tax bill. The city of richmond is authorized by state law to levy taxes on real property in the city of richmond. Parcel id, address, land value, and consideration amount. The 10% late payment penalty is applied december 6 th.

Property tax payments may be paid by cheque, bank draft, debit card, or credit card (a service fee of 1.75% applies). Province of bc's tax deferment program. (5 days ago) with the city ’s real estate tax rate of $1.20 per $100 of assessed value, the tax bill would be $2,964.

Allow 6 to 8 weeks for processing. Property values are determined by the city assessor and the department of finance issues the tax bills based on the valuation information provided by the assessor's office. If you do not receive a bill, it is your responsibility to investigate whether you have a liability to the town.

Tax bills are mailed in the month of july. You can also safely and securely view your bill online, consolidate your tax bills into one online account, set up notifications and reminders to be sent to your email or mobile phone, schedule payments, create an online wallet, and pay with one click using credit/debit or your checking account. The city of richmond assessor is responsible for appraising real estate and assessing a property tax on properties located in city of richmond, virginia.

All expenditures are disbursed through this department. Appealing your property tax appraisal; Richmond hill issues two tax bills per year.

Welcome to the tax online payment service. Richmond city collects, on average, 1.05% of a property's assessed fair market value as property tax. $1.20 8 hours ago real estate details:

(8 days ago) the median property tax in richmond city, virginia is $2,126 per year for a home worth the median value of $201,800. These are deducted from the property's assessed value to give the property's taxable value. Finance conducts continuous analysis of the city’s revenues and expenditures and prepares related financial and.

Broad st, rm 802 | richmond, va 23219 | phone: Richmond city council expands tax relief program, approves. (8 days ago) city of richmond real estate tax bills.

3 road, richmond, bc v6y 2c1. Personal property delinquent taxes real estate delinquent taxes; All property owners in richmond hill must pay their property taxes.

Change the name on land titles: City of richmond real estate tax bills. There is a $1.50 transaction fee for each payment made online.

If you are disputing the. City of richmond, macomb county. Your final tax bill is sent to you in june with instalments due in august and october.

Interest is assessed as of january 1 st at a rate of 10% per year. Disabled veterans, or their surviving spouses, who believe they may be. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year.

The interim bill is based on 50% of the previous year's annualized taxes and is shown as a reduction on the final bill. Property owners are responsible for making sure that they receive their tax bills and for making the required payments on time. Frequently asked questions (faqs) regarding delinquent taxes why am i in delinquent collections?

To begin, please enter the appropriate information in one of the searches below. All late payments accrue interest. Residential and commercial property owners will receive a tax bill including their property tax rates, property assessment and class and payment dates and deadlines.

May 1st real estate tax rate: The interim tax bills are mailed in january of each year with instalments due in march and may. City of richmond tax department 6911 no.

This service allows you to make a tax bill payment for a specific property within your municipality. $3.70 7 hours ago city of richmond personal property tax rate: The search could take a couple minutes depending on the search criteria.

Due dates and penalties for property tax. $2,126 7 hours ago details: Personal property taxes are billed annually with a due date of december 5 th.

$3.70 per $100.00 assessed value due: These agencies provide their required tax rates. We have no information about whether any exemptions currently apply to this property.

$1.38 per $100.00 assessed value total amount due by june 1st (penalty is 10% of tax bill) henrico county. Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged. Please note that failure to receive a tax bill does not negate the requirement to pay the tax.

Personal property taxes are billed once a year with a december 5 th due date. Collection of taxes for other taxing authorities your annual property taxes collected by the city of richmond funds municipal services and other taxing agencies such as the province of bc (school tax), translink, bc assessment authority, metro vancouver and the municipal finance authority. See bill example to know how to read your property tax bill.

Henrico county now offers paperless personal property and real estate tax bills! This department is responsible for maintaining general accounting records for the city, billing and collection of property taxes, and fees and permits. You can contact the city of richmond assessor for:

For additional information including delinquent bpol taxes please contact us at: Please correct the errors and try again. The city of richmond is not accepting property tax payments in cash until march 31, 2021, due to pandemic safety measures.

Richmond city assessor’s office | 900 e.

Bill Goodwins Riverstone Properties Is The New Owner Of The Three-building Office Complex Encompassing Nearly 1 Million Square F Property Building Home Buying

Doubling Down Richmond Free Press Serving The African American Community In Richmond Va

Richmond Property Tax 2021 Calculator Rates – Wowaca

1254 Greenway Drive Hilltop Green Ca – Compass House Prices Richmond House Styles

70 El Toro Court Fairfield Ca – Compass In Ground Spa House Prices Fairfield

Access Denied Ridgewood Street View Property Records

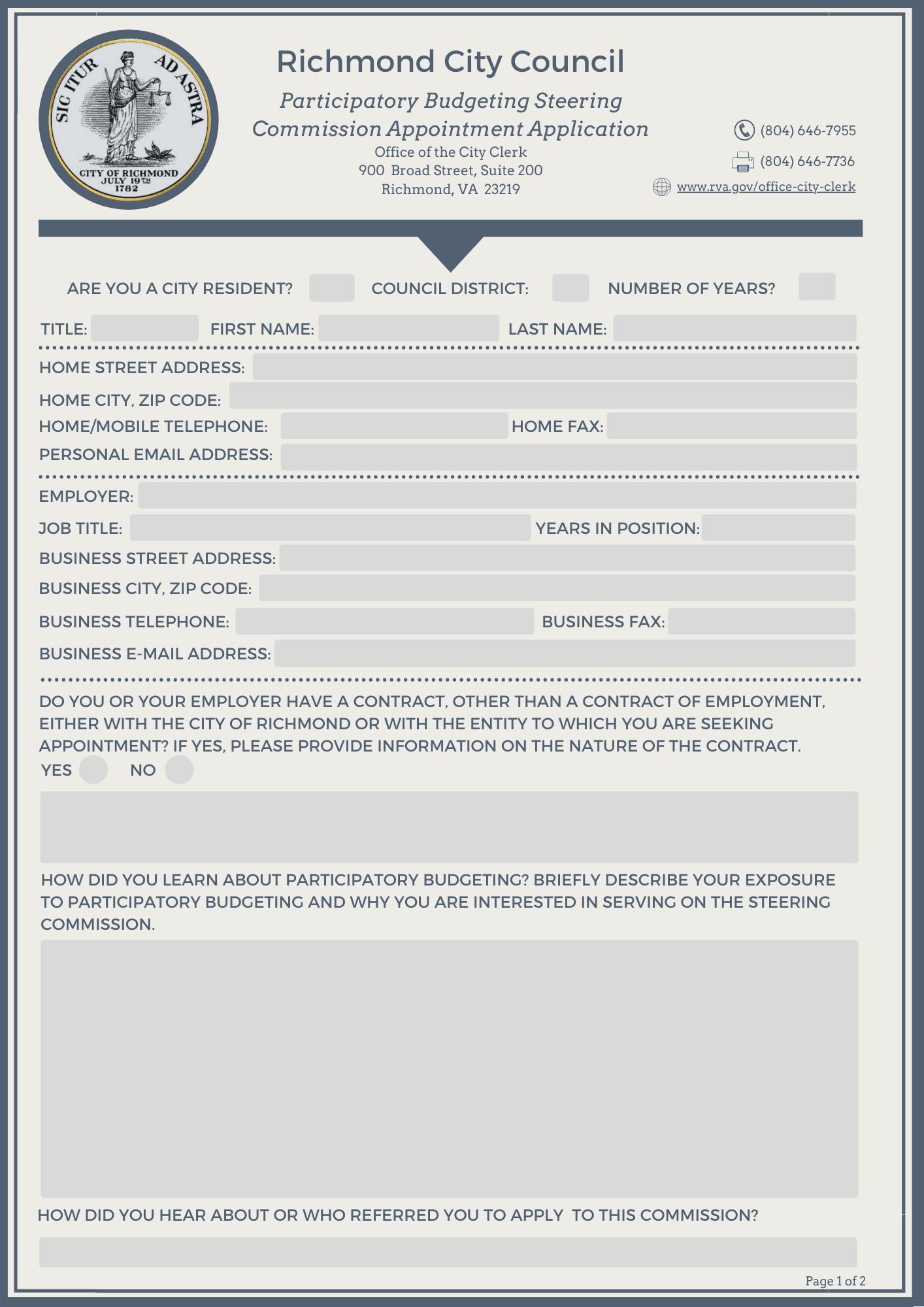

Boards And Commissions Richmond

How To Read Your Water Bill

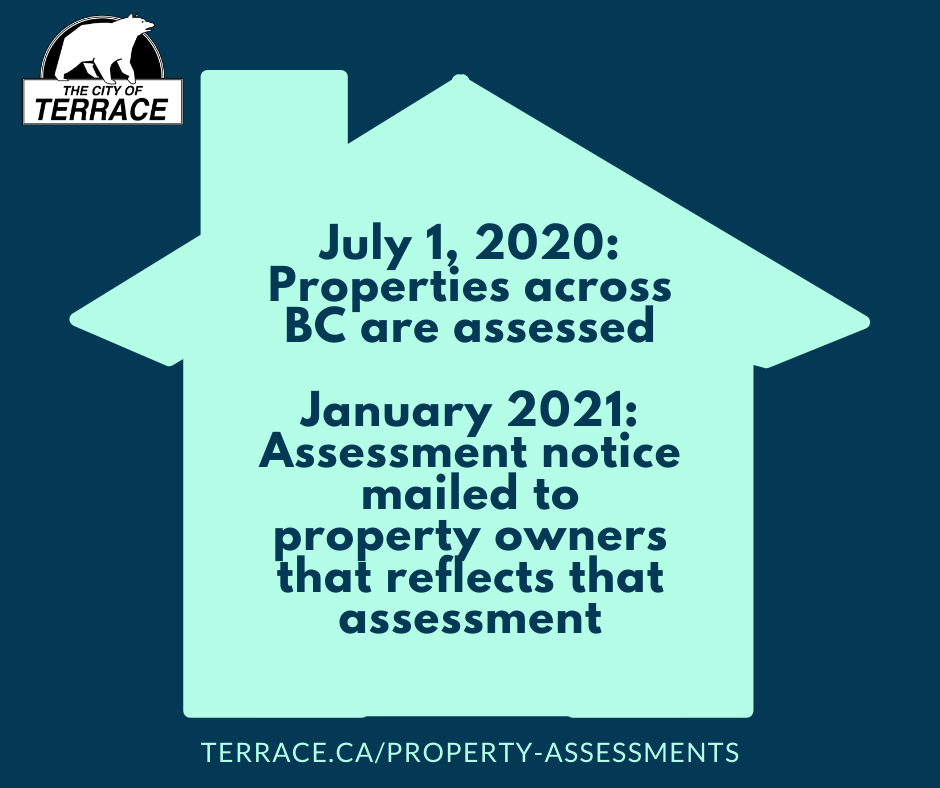

Property Assessments City Of Terrace

About Your Tax Bill – City Of Richmond Hill

Most In Demand Areas In The Uk To Rent A Property Being A Landlord Uk City Richmond Upon Thames

About Your Tax Bill – City Of Richmond Hill

About Your Tax Bill – City Of Richmond Hill

Collegeville Listing Just Went Under Contract Still Interested In Moving To The Collegeville Ar Real Estate Real Estate Marketing Real Estate Marketing Tools

Blank Commercial Invoice Invoice Template Word Invoice Template Certificate Of Achievement Template

Municipal Court City Of Richmond

Pin On Important Topics

Skyscraper Wallpapers Skyscraper Civil Engineering Real Estate Marketing

How Much Will Your House Be Worth In 2030 Uk House Price Map London Property House Prices Home Buying