Sales and use taxes have replaced the decades old gross receipts tax. The county sales tax rate is %.

Maintenance Districts Montgomery County Al

Automotive vehicle dealers are required to collect sales tax on the sale of all vehicles in the city.

City of montgomery al sales tax application. A certificate of occupancy will not be issued until the city has inspected the property for code compliance. In addition to the rental tax rates currently displayed on our website for the categories of automotive, general and linen, the city of montgomery levies a tax rate that applies to the short term rental of a motor vehicle used primary for the transportation of 15 or fewer passengers, for a period of sixty (60) or fewer consecutive days, and the vendor has five or more. The general sales tax rate in the city of alabaster is 9% (state of alabama= 4%, shelby county= 1%, and city of alabaster= 4%).

Food & beverage tax form #7 (pdf file) joint petition for refund (pdf file) leasing tax form #3 (pdf file) petition for release of penalty (pdf file) sales tax form #12 (pdf file) seller use tax tax form #13 (pdf file) city of mobile alcoholic beverage application (pdf file) city of mobile business application external link Minimum of $50 or 10% of tax due any correspondence should be mailed to: (central standard time) on or before the due date, to be considered timely paid.

411 rows any business that sells goods or taxable services within the state of alabama to customers. If your business sells products on the internet, such as ebay, or through a storefront, and the item is shipped within the state of alabama, sales tax must be collected from the buyer, and the sales tax must be paid on the collected tax to the state of alabama. Online filing available for sales tax reporting.

For more information about sales tax, click here. If the account will be a sales tax or seller’s use tax account, please include your state of alabama sales tax number not the federal tax id number. Combined application for sales/use tax form.

The city of madison collects the following types of taxes: The minimum combined 2021 sales tax rate for montgomery, alabama is. We recommend that you obtain a.

Downloadable application (email, or submit manually) and links to forms and resources for business license and sales tax. The alabama sales tax rate is currently %. Income tax withholding (see instructions) all applicants must.

Mail completed application and any initial tax due to: Hoover public safety center, revenue department 2020 valleydale road, suite 207 hoover, al 35244. Virtually every type of business must obtain a state sales tax number.

Montgomery, al application for sales/use tax registration. Of revenue’s my alabama taxes website (mat), or by mailing the return and payment to: The application should be delivered to the traffic division commander at the police headquarters at 3721 26th avenue, northport, al 35473 at least 3 weeks in advance of the date of the parade.

If paying via eft, the eft payment information must be transmitted by 4:00 p.m. An account can be registered with the tuscaloosa county special tax board by completing the new business application form and returning to our office. General information on alabama state sales tax.

Businesses register with the city and are assigned an account number and reporting forms for this purpose. A mail fee of $2.50 will apply for customers receiving new metal plates. In all likelihood, the application for sales/use tax registration is not the only document you should review as you seek business license compliance in montgomery, al.

Parade permits are subject to approval and at the discretion of the chief of police. Contractors (builders, plumbers, landscapers) etc. Sales tax is also due on the gross receipts from places of amusement or entertainment.

Motor fuel/gasoline/other fuel tax form. The montgomery sales tax rate is %. In completing the city/county return to file/pay montgomery county, you must enter in the jurisdiction account number field of the return your local taxpayer id number assigned to you by these jurisdictions.

All returns with zero tax payment should be filed with myalabamataxes.alabama.gov 2. Complete the application for the city of madison tax accounts for the type of tax return needed. City of montgomery, al inspections department.

Combined application for sales/use tax form. This is the total of state, county and city sales tax rates. Alabama department of revenue, central registration unit, p.o.

With local taxes, the total sales tax rate is between 5.000% and 11.500%. If applicable, businesses may check with each agency to obtain their automotive, farm equipment and manufacturing rates. Sales tax returns may be reported online through the alabama dept.

This does not apply to vehicles delivered outside huntsville, “delivery” being defined by alabama law. Alabama (al) sales tax rates by city (a) the state sales tax rate in alabama is 4.000%. Sales/seller's use/consumers use tax form.

The sales tax discount consists of 5% on the first $100 of tax due, and 2% of all tax over $100 not to exceed $400.00. Please note quarterly interest rates are assessed to late payments according to the state of alabama interest rate table. Box 5070 montgomery, al 36101

City of montgomery revenue division p.o.

Court Square Fish Pond Gardens Garden Fountains Water Fountain

Chicago Now Home To The Nations Highest Sales Tax Sales Tax Chicago National

Montgomery County Courthouse Price-phelps Justice Center A County Office Montgomery County Al

Fast Facts About Montgomery County Montgomery County Al

Alabama Birth Certificate Signed By Catherine Molchan Donald Birth Certificate Alabama Digital

Mgm Film Works City Of Montgomery Al

2

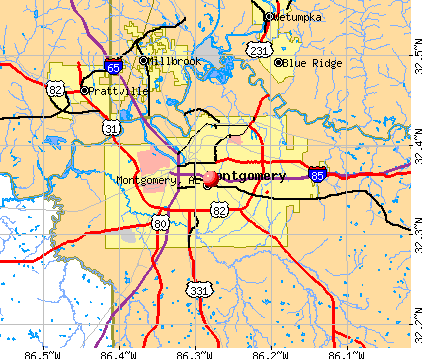

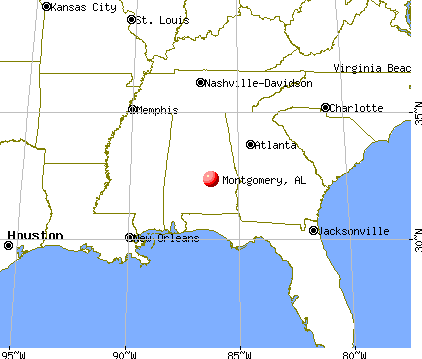

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mgm Film Works City Of Montgomery Al

Montgomeryal Lagoon Park Tennis Center Nice Mixed Experiences In Town Alabama Travel Montgomery Civil Rights

Mgm Film Works City Of Montgomery Al

Sales Tax Audit Montgomery County Al

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Appraisal Montgomery County Al

Montgomery City Missouri Mo 63361 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arab Alabama Jefferson City Poplar Bluff Atlanta