If you have direct deposit set up, make sure all the information is accurate. I have received every stimulus check, do not have an amended return and fit all eligibility requirements yet i'm still pending eligibility.

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021.

Child tax portal still says pending. I have already received my 2020 taxes months ago. I have a 2020 amended return still processing but per irs website (see below) that should not effect my payments. In some cases, taxpayers who believe they're eligible for the payments may find their eligibility listed as pending on the child tax credit update portal.

The irs won't send you any monthly payments until it can confirm your status. This means that the irs is still. I am qualified and received the first letter.

Eastern time on november 29, 2021. Eligible families who make this choice will still receive the rest of their child tax credit as a lump sum when they file their 2021 federal income tax return next year. I have no proof that the amended return is holding up our child tax credit eligibility, but that is my guess.

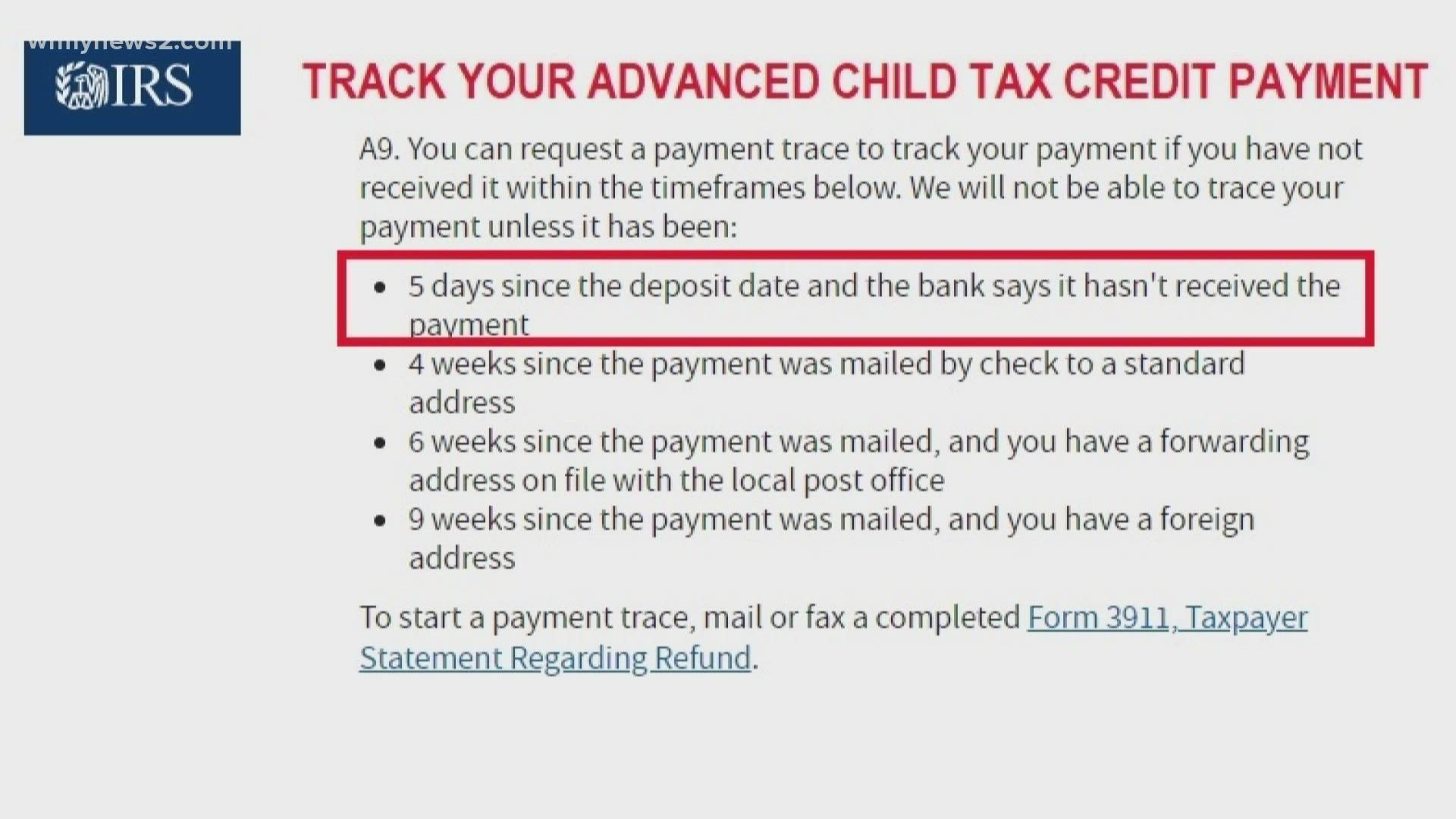

Check the child tax credit update portal check the irs’ child tax credit update portal to find the status of your payments— whether they are pending or processed. If the portal says a payment is pending, it means the irs is still reviewing your account to. Someone please explain to me why my ctc status still says pending eligibility you will not receive payments at this time.

My advanced child tax credit status shows pending. We filed an amended return on 4/29 (prompted by turbotax) and our eligibility for the child tax credit is currently pending. Went to irs portal says my child tax credit is pending i meet all the requirements so i sure hope they process and send my payments.

But at least 2.3 million children could be left out of the advance child tax credit payments, per a treasury department estimate. Parents of children under age 6 would be eligible for an even larger $3,600 total credit. The vast majority don't have to do anything to receive them.

That could cause the pending eligibility you are seeing. A check should be coming your way soon via direct deposit or mail. If you're waiting on your payment and the portal says it's pending, keep holding on.

In some instances, taxpayers who think they qualify for the payments may check the child tax credit update portal and find their eligibility listing as “pending.” that means the irs is still. We receive the child tax credit on our taxes every year. The irs online tool will be available until november 15, according to the.

Do you have a return that has not yet been processed in the system? See who is eligible for advance child tax credit payments? According to the irs, you can visit the child tax credit update portal, which should show which payments are pending (this involves registering for an irs username or id.me account, which requires.

My status on irs portal says my ctc is pending. If all else fails, you can plan to claim the child tax credit when you file your 2021 taxes next year. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m.

I know i meet the requirements so trying to figure out why we have not gotten it yet. Nearly 90% of families with children ages 17 and under qualify for the six monthly payments that will be distributed between july and december. Recipients can check the status of the monthly payment at the irs’ child tax credit update portal.

She even tried to call the irs several times and was disconnected before reaching anyone. Not eligible at this time. For families who do not typically file taxes, there is still time to sign up to receive advance child tax credit payments.

A cross the united states, citizens are still awaiting their child tax credit payment despite the fact that the checks should've been distributed. If the portal says your payment is coming by mail, give it several business days to arrive. Could it be because we filed and amended return for the unemployment tax thing false

If the child tax credit update portal returns a pending eligibility status, it means the irs is still trying to determine whether you qualify. Went to irs portal says my child tax credit is pending i meet all the requirements so i sure hope they process and send my payments. If the child tax credit update portal returns a pending eligibility status, it means the irs is still trying to determine whether you qualify.

If you do not receive the monthly payments you will be able to reconcile the child tax credit on your 2021 tax return. In some instances, taxpayers who think they qualify for the payments may check the child tax credit update portal and find their eligibility listing as “pending.” that means the irs is still. It said the portal would reflect the same status until august 2nd, then update.

If the portal says a payment is pending, it means the. Went to irs portal says my child tax credit is pending i meet all the requirements so i sure hope they process and send my payments.

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More – Cnet

A Month Since Launch Glitches Continue To Mar I-t Portal Functioning

I Got My Refund – Posts Facebook

Where Is My September Child Tax Credit 13newsnowcom

How To Use Offline Utility For Statutory Forms On New Income Tax Portal

Hr Block – Families Can Now Use The Irs Child Tax Credit Update Portal To Make Updates On Where The Irs Should Send Advance Payments Instead Of Automatically Receiving Payments To The

E-campaign For High Value Transactions In Compliance Portal

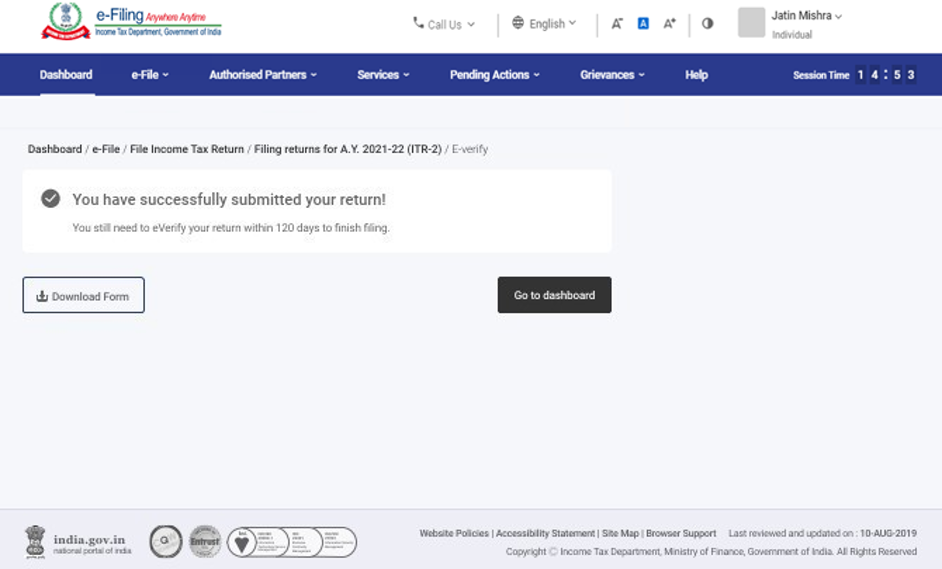

File Itr-2 Online User Manual Income Tax Department

Child Tax Credit Delayed How To Track Your November Payment Marca

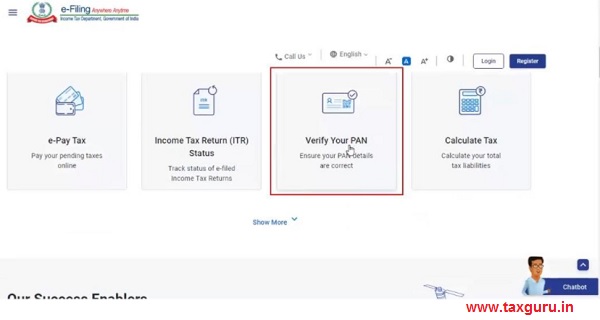

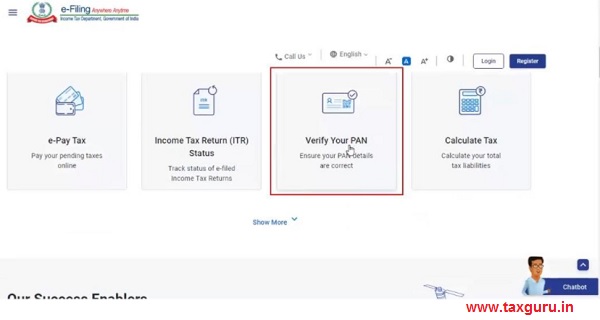

How To Verify Your Pan On New Income Tax Portal

Child Tax Credit 2021 How To Track September Next Payment Marca

Hra Rent Receipt Generator Generate Rent Receipt Income Tax Tax Return Income Tax Return

Over 24k Responses Filed Under E-proceedings 40k Itrs Filed Daily On New Portal Cbdt – The Hindu

Over 24k Responses Filed Under E-proceedings 40k Itrs Filed Daily On New Portal Cbdt – The Hindu

How To Verify Your Pan On New Income Tax Portal

How To Change Your Address For Monthly Child Tax Credit Payments Kiplinger

Having Trouble Accessing The Child Tax Credit Portal Heres How To Sign Into Idme Gobankingrates

Child Tax Credit How To Track Your October Payment Marca