Child tax credit payment schedule september 2021. What is the 2021 child tax credit payment schedule?

Child Tax Credit 2021 How To Track September Next Payment Marca

This means that another one will be coming on september 15.

Child tax credit september 2021 date. For 2021 only, the child tax. Even though child tax credit payments are scheduled to arrive. 15 (opt out by nov.

For those trying to opt out, unfortunately, the deadline passed on august 30. September child tax credit deposit date. The irs began sending out the fourt h of six monthly child tax credit payments on friday 15.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. 21 october 2021 11:47 edt. 13 (opt out by aug.

Tax benefits of the child tax credit (september 2021) individual taxes: You will claim the other half when you file your 2021 income tax return. The third payment date is wednesday, september 15, with the irs sending most of the checks via direct deposit.

When does the child tax credit arrive in september? Let's condense all that information. The biden administration expanded the child tax credit for 2021 to $3,600 for kids up to age six, and $3,000 for children aged between six and 17.

The 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows: 15 (opt out by aug. Tax benefits of the child tax credit (september 2021) individual taxes:

The energy tax credit for 2020 2021 tax credits what is energy energy. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. September child tax credit date 2021 shows that those who have complicated tax situations might opt out of the monthly checks and might be able to get a larger payout.

It is possible to opt out for the october payment, which. 13 (opt out by aug. See the payment date schedule.

15 or be mailed as a paper check. For families who are signed up, each payment is up to $300 per month for each child under age. N the 15th day of each month, families across the united states are supposed to receive.

If your child turns 18 this year, then they are not eligible for the monthly child tax credit, explained congressman steve cohen. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. The payments are supposed to go out on the 15th of the month until the end of the year.

Irs looking into delayed child tax credit payments; Washington — the internal revenue service and the treasury department announced today that millions of american families are now receiving their advance child tax credit (ctc) payment for the month of september. The second payment was sent out to families on august 13.

While the irs did extend the 2020 and 2021 tax filing dates due to the pandemic, you typically have from the end of january to april 15 to file. Eastern time on november 29, 2021. The 2021 advance monthly child tax credit payments started automatically in july.

The 'stimulus check', part of president joe biden's child tax credit plan, will see those who meet the final november 15 deadline potentially receive up to $1,800 per child come december. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. 2021 child tax credit payment schedule the first child tax credit payment went out on july 15 and the second on aug.

The irs bases your child's eligibility on their age on dec. The couple would then receive the $3,300 balance — $1,800 ($300 x 6) for the younger child and $1,500 ($250 x 6) for the older child — as part of their 2021 tax refund. This third batch of advance monthly payments, totaling about $15 billion, is reaching about 35.

I t's time for the third batch of monthly child tax credit payments. This is the only month where parents get the advance child tax creditsearly, with the rest to be paid on september 15, october 15, november 15 and december 15. The remaining money will come in one lump with tax refunds in 2021.

These are all the important child tax credit dates you need to know published mon, aug 23 2021 1:06 pm edt updated mon, aug 23 2021 5:11 pm edt carmen reinicke @csreinicke Child tax credit payment dates september 2021. The second payment was sent out to families on august 13.

However, given that august 15 falls on a sunday in 2021, eligible families will get the cash two days early on august 13 instead. (the deadline for the september payment has passed.) you can use the irs child tax credit update portal online anytime. 15 (opt out by nov.

For both age groups, the rest of the payment. For 2021 only, the child tax credit amount is increased from $2,000 for each child. For 2021 only, the child tax credit amount is increased from $2,000 for each child.

The deadline is already around, but the users can contact the irs update portal and make changes to the banking details or the mailing address. 15 (opt out by oct. 15 (opt out by nov.

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs – Fingerlakes1com

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt-out Of September Payments As Parents Flock To Irs Portal

What To Know About The First Advance Child Tax Credit Payment

/cdn.vox-cdn.com/uploads/chorus_asset/file/22852471/AP18331738555340__1_.jpeg)

Child Tax Credit Where Is My September Payment When Do September Payments Come – Deseret News

2

November Child Tax Credit Deadline To Opt Out Near Irs Reveals Updated Payment Dates – Fingerlakes1com

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

Where Is My September Child Tax Credit 13newsnowcom

Decembers Payment Could Be The Final Child Tax Credit Check What To Know – Cnet

September Child Tax Credit Payments Are Here What Happens If Irs Misses You – Fingerlakes1com

Child Tax Credit 2021 Payments How Much Dates And Opting Out – Cbs News

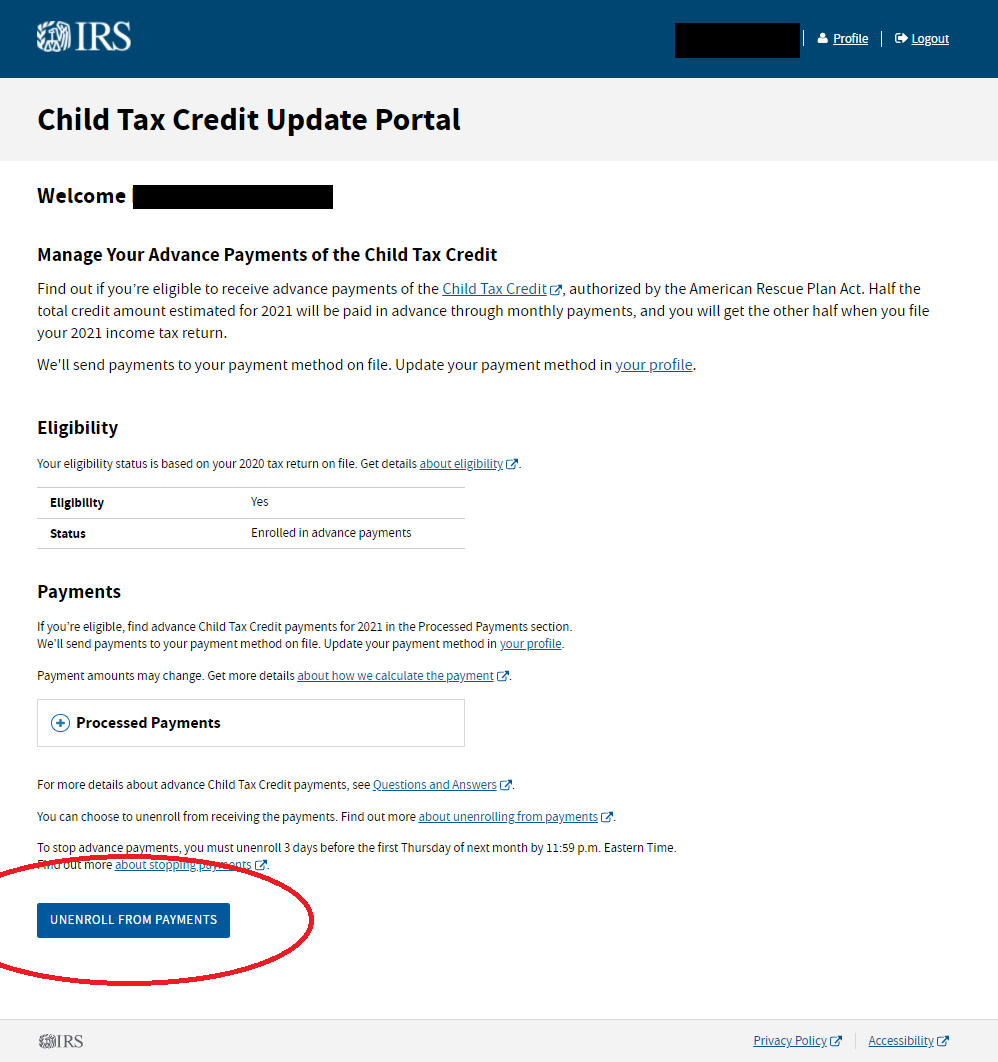

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor