The advance payments of the child tax credit are well underway with the third payment to be deposited sept. The 'stimulus check', part of president joe biden's child tax credit plan, will see those who meet the final november 15 deadline potentially receive up to $1,800 per child come december.

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2com

Eastern time on november 29, 2021.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

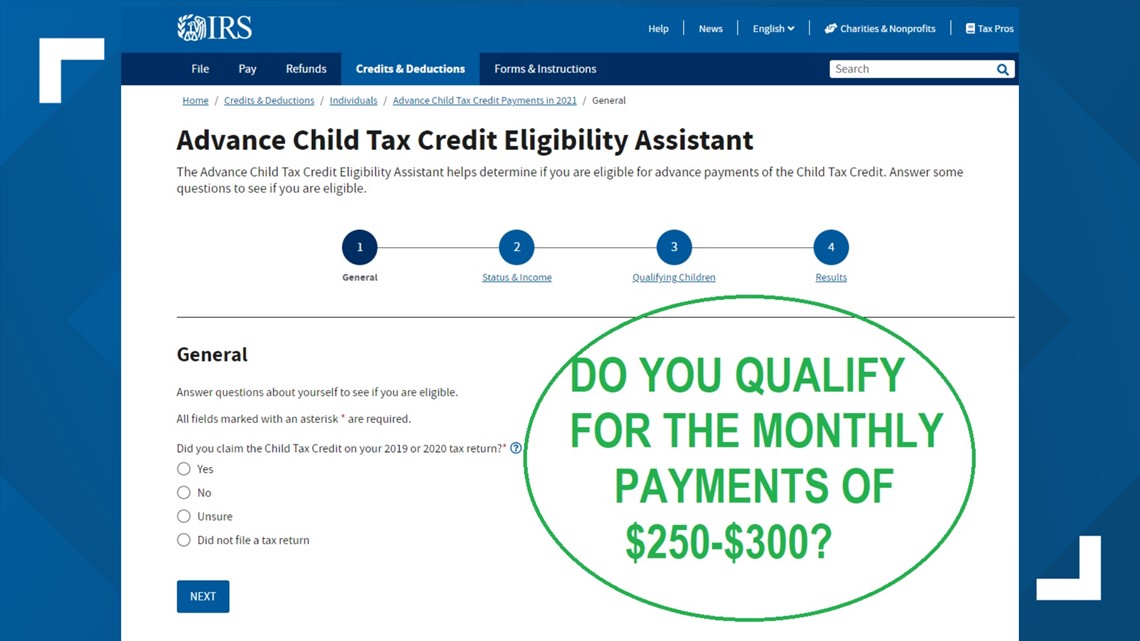

Child tax credit portal phone number. Advance child tax credit payments are early payments from the irs of 50 percent of the estimated amount of the child tax credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. Parents worried about their child tax credit can use an irs portal to check on the whereabouts of their $300 and opt out of payments. Your personal tax account or business tax account using hmrc online services best time to call:

If the irs has processed your 2020 tax return or 2019 tax return, these monthly payments will be made starting in july and through. Child tax credit update portal. 15, but the millions of payments the irs has sent out have not been without trouble.

Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. Phone lines are usually less busy tuesday to thursday from 2pm to 4pm. There have been important changes to the child tax credit that will help many families receive advance payments.

You will receive this text message to your phone. Our help lines are open monday through friday. Watch out for scams using email, phone calls or texts related to the payments, the.

How to contact the irs about the 2021 child tax credit even though families are automatically signed up they may want to change the payment type or. The third child tax credit payment is coming in just two weeks and will arrive in your bank account on sept. Social security social security numbers for your children and social security numbers (or itin) for you and your spouse;

If your family situation has changed you will soon be able to use the irs ctc update portal to update the number of eligible dependents in your household (for example if. Click on the link at the end of the text message to upload photos of your driver’s. Telephone service wait times are generally higher on monday and tuesday.

Half the total credit amount is being paid in advance monthly payments. Important changes to the child tax credit are helping many families get advance payments of the credit: To provide the advance child tax credit payments, the irs needs to know current information about you and your children.

Some telephone service lines may have longer wait times. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Enter in your phone number and press the blue “continue” button.

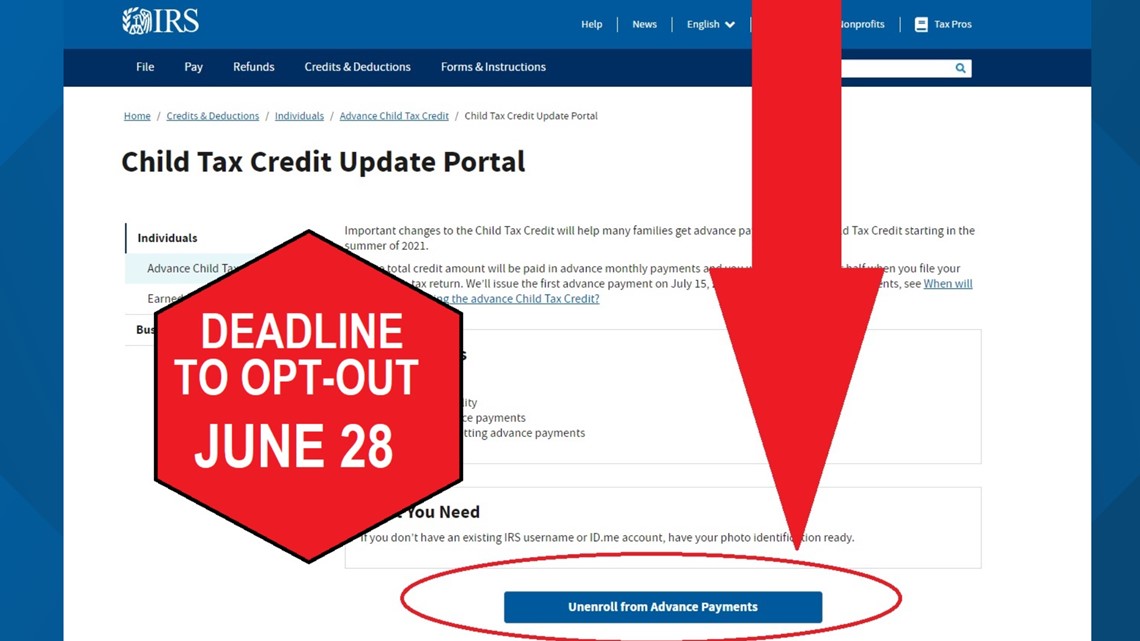

The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. Advance payments are sent automatically to eligible people. You will be taken to this computer page where you will need to enter your phone number.

The american rescue plan act (arpa) of 2021 expands the child tax credit (ctc) for tax year 2021. What else can i use for help? See the payment date schedule.

Upload your photos using your phone. We’ll issue the first advance payment on july 15, 2021. You claim the other half when you file your 2021 income tax return.

Phone lines in puerto rico are open from 8 a.m. Before calling, just a warning — the irs has already advised citizens it is dealing with extraordinary backlogs, overwhelming phone calls and not enough staff to deal with the procedural demands of. At time of publication, the irs is not accepting phone calls for information regarding the child tax credit.

Make sure you have the following information on. Residents of alaska and hawaii should follow pacific time. The child tax credit update portal lets you opt out of receiving this year's monthly child tax credit payments.

Make sure you have the following details on hand to validate your. You will see the following screen on your computer:

How To Opt-out Or Unenroll From The Child Tax Credit Payments Wfmynews2com

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information – The Georgia Virtue

Child Tax Credit New Online Portal And Irs Tools Help Families Before July Payment

How To Opt-out Or Unenroll From The Child Tax Credit Payments Wfmynews2com

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Get Your Child Tax Credit Getctc

Irs Number For Child Tax Credit How To Get Your Questions Answered – Cnet

I Got My Refund – Ctc Portal Updated With Payments Facebook

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Wheres My Refund – Tax News Information

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit 2021 Unenroll Cahunitcom

Taxpayers Now Can Go Online To Opt Out Of Advance Child Tax Credit Payments Verify Eligibility – Dont Mess With Taxes

Irs Child Tax Credit 2021 Portal Access Cahunitcom

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Opens Non-filer Portal For Child Tax Credit Registration

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More – Cnet

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service