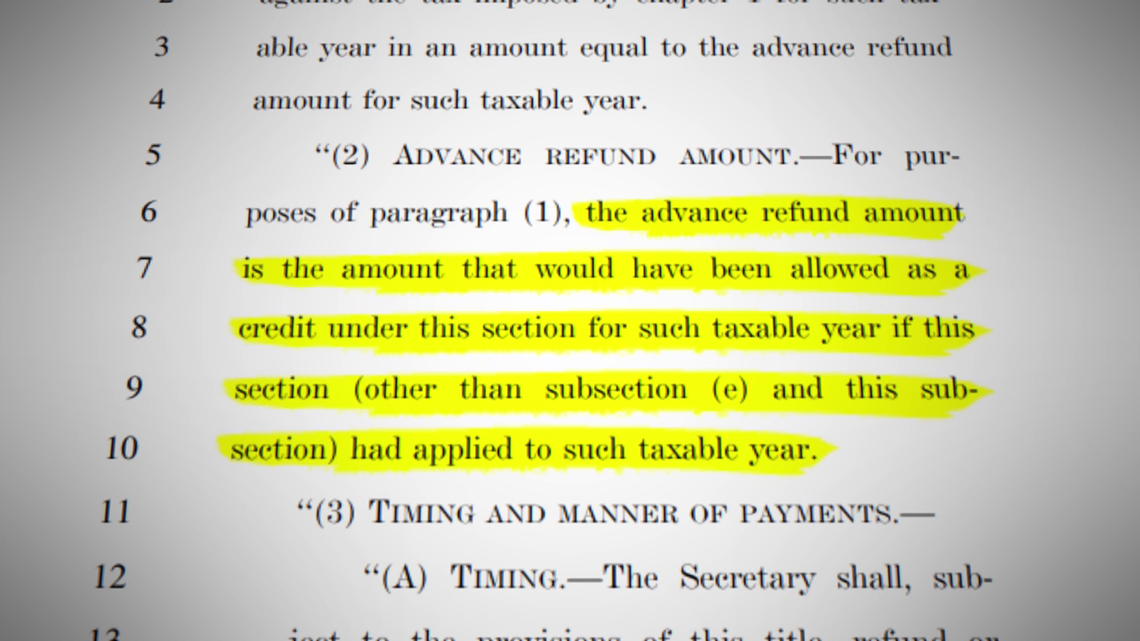

In addition, the check is not an advance on their 2020 tax refund, since they are mutually exclusive. They could have received more if they’re married or have children.

D6vt9okf0-fzrm

But what are the tax implications for stimulus checks and unemployment benefits?

Cares act stimulus check tax implications. Eligible taxpayers who filed tax returns for either 2020 or 2019 will automatically receive an economic impact payment of up to $1,400 for individuals or $2,800 for married couples. Several of the cares act provisions were tax related. Yes, as indicated in our prior alert about the stimulus package, individuals will be eligible for “recovery rebates.” more particularly, the cares act provides for a $1,200 refundable tax credit for individuals ($2,400 for joint taxpayers).

Although the cares act was drafted to predominantly assist small businesses, specific industries, and health care professionals; Check your final payment status in get my payment. The cares act protects stimulus payments from being reduced to pay certain debts owed to federal and state governments for all other reasons.

Individual taxpayers will be receiving a $1,200 payment. The tax cuts and jobs act allowed them to take the credits against regular tax liability through 2021. For nols arising in tax years beginning before 2021, the cares act allows taxpayers to carryback 100% of nols to the prior five tax years, effectively delaying for carrybacks the 80% taxable income limitation and.

Stimulus checks are also not a loan, so taxpayers do not need to pay the money back to the federal government. The treasury department and the internal revenue service. Child support can be taken from your stimulus check.

The new cares act has provided a new charitable deduction of up to $300 if you do not itemize your tax deductions on schedule a for tax year 2020. The stimulus check details are as follows: But, it does not provide clear protection from debt collectors garnishing the money from your bank account.

The cares act expanded deduction for charitable deductions for 25% of taxable income (up from 10% before cares act.) for donations to public charities. Thanks to the cares act, over 80 million americans got a stimulus check. If you didn’t get any payments or got less than the full amounts, you may qualify for the recovery rebate credit and must file a 2020 tax return to claim the credit even if you don’t normally file.

The cares act contains an unprecedented economic stimulus and the tax provisions are designed to facilitate getting cash to individuals and businesses as soon as possible. If taxable income is zero in 2020, the. Corporate alternative minimum tax was repealed with the tax cuts and jobs act, though some corporate taxpayers still had minimum tax credits carrying forward under the alternative minimum tax regime.

Tax implications of the 2020 stimulus check and cares act. If someone’s 2019 income was low enough, they qualified for up to $600 as an individual. Senate on march 25 passed the cares act—h.r.

Households also receive $1400 for each qualifying dependent. The cares act accelerated the credits to be taken. Updated april 24, 2020 for mailing dates of checks.

The stimulus checks aren’t taxable, so don’t report the money when filing taxes. One of the features of the caa that most people know about is the stimulus check. Economic security act” (cares act), includes a significant number of tax items applicable to individuals and businesses.

If you were in the 12 percent tax bracket, you'd reduce your taxes owed by $600 (12 percent of $5,000). (updated april 10, 2020) on march 27, 2020, the coronavirus aid, relief, and economic security act (the cares act) was signed into law by president trump. All first and second economic impact payments have been sent.

It reduces your income, which reduces the amount of tax you owe. Does the cares act provide any other financial relief for employees and individuals? The due date for 2019 tax returns has been extended to july 15th, 2020.

The 2017 tax cuts and jobs act limited nols arising after 2017 to 80% of taxable income and eliminated the ability the ability to carry nols back to prior years. As part of the coronavirus aid, relief, and economic security act (cares act), congress provided financial relief for many taxpayers with the introduction of a 2020 tax credit to be advanced to eligible taxpayers as “recovery rebates” (also referred to as economic impact payments). The coronavirus aid, relief and economic security (cares) act was signed into law by president trump on 3/27/20.

The money that taxpayers received via their stimulus check is not taxable, meaning it does not count towards their 2020 taxable income. The 2.2 trillion stimulus package includes measures to help businesses hurt by the pandemic, as well as direct payments to citizens who have been hurt by the pandemic. If you had $50,000 in income and had a $5,000 tax deduction, your deduction would reduce your taxable income by $5,000.

If i owe debt to someone can they take my stimulus check?

The Advance Child Tax Credit What Lies Ahead

Irs Offers Further Guidance On Employee Retention Credit Even As Congress May End It Soon Accounting Today

Havent Received Your Tax Refund Yet It Could Still Be Awhile – Fox School Of Business

Who Cares Assessing The Impact Of The Cares Act Frank Hawkins Kenan Institute Of Private Enterprise

Second Round Of 1200 Stimulus Checks Announced With Heals Act Reports Bambridge Accountants New York

How Does The Cares Act Impact Massachusetts State Tax Opendor

How Does The Cares Act Impact Massachusetts State Tax Opendor

2

Best Tax Software For 2021 Turbotax Hr Block Jackson Hewitt And More Compared – Cnet

Stimulus Checks And Care Act Changes – Everything You Need To Know – Terry Savage

Will The Stimulus Money Be Deducted From Your Refund Next Year Kgwcom

Second Round Of 1200 Stimulus Checks Announced With Heals Act Reports Bambridge Accountants New York

Forget 1400 Stimulus Checks Heres Whats Missing From Bidens 19 Trillion Stimulus Package

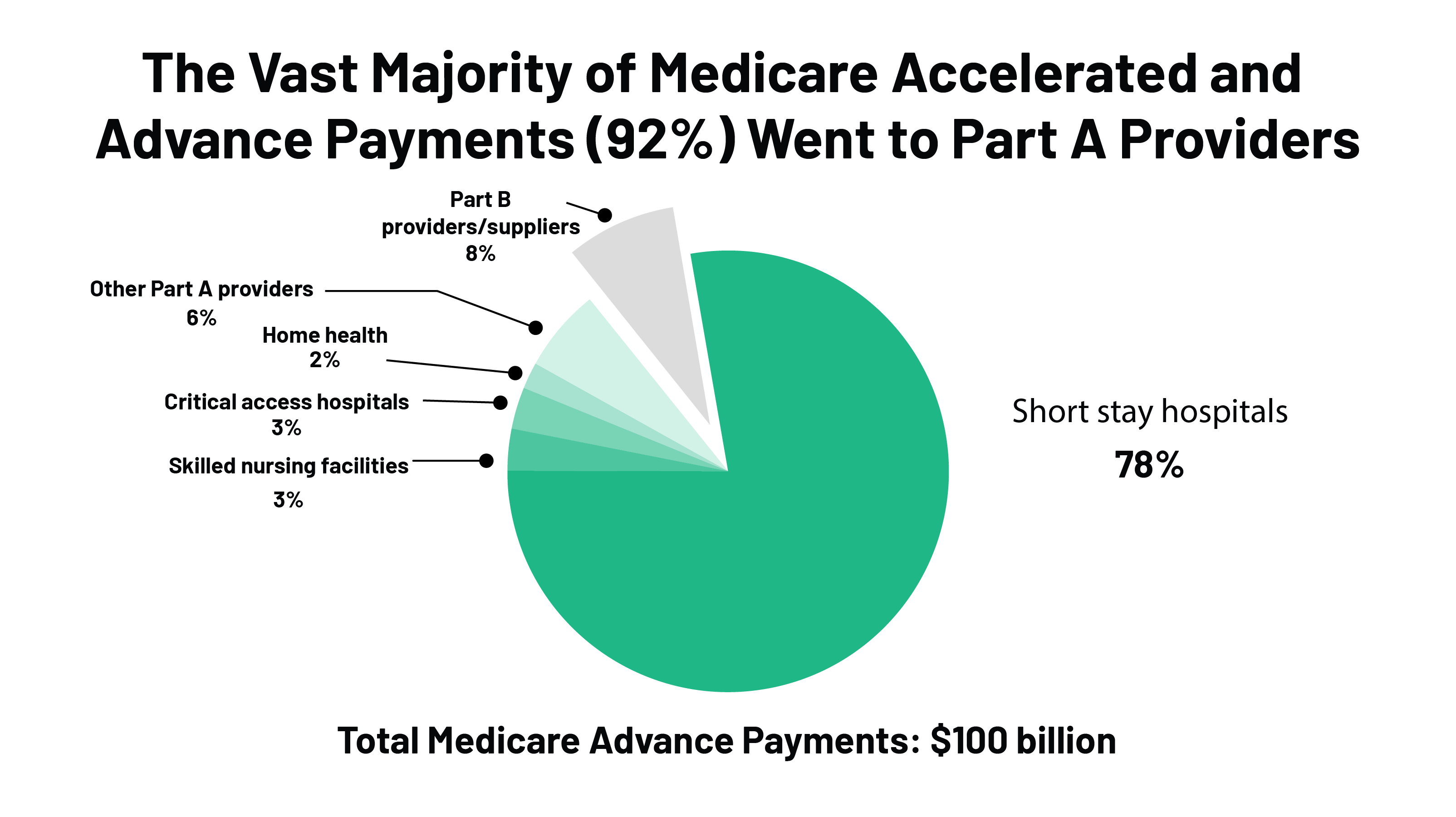

Medicare Accelerated And Advance Payments For Covid-19 Revenue Loss More Time To Repay Kff

Will The Stimulus Money Be Deducted From Your Refund Next Year Kgwcom

New Us Tax Deadline In 2021 For Citizens Living Abroad

Were Separated Who Gets The Stimulus Check

Cares Act And Tax Implications Student Services – Montclair State University

Cares Act Relief Payments To For-profit Medical Care Providers May Be Taxable On Receipt Publications Morgan Lewis