Johnston county tax administration office. Box 368 smithfield, nc 27577

North Carolina Nc Car Sales Tax Everything You Need To Know

Has impacted many state nexus laws and sales tax collection requirements.

Car sales tax wake county nc. (vehicles are also subject to property taxes , which the n.c. Good credit and bad credit welcome. Wake county's 2006 property tax rate is $0.634, which must be added to the local tax rate in the city in which you are considering.

Although the process of assessing annual vehicle property taxes may seem somewhat complex, the nc vehicle sales tax is relatively straightforward. Proof of plate surrender to ncdmv (dmv form fs20) copy of the bill of sale or the new state’s registration. Wake auto sales is an automobile dealer with used preowned vehicles and internet inventory in raleigh, nc.

The december 2020 total local sales tax rate was also 7.250%. In addition to taxes, car purchases in north carolina may be subject to other fees like registration, title, and plate fees. State of north carolina taxes the corporate income tax rate for north carolina is 3.0%.

The 2018 united states supreme court decision in south dakota v. Property is appraised every eight years. The state government currently assesses a 3 percent sales tax rate, calculated from the purchase price, on all vehicles purchased from a dealer.

This calculator is designed to estimate the county vehicle property tax for your vehicle. The county property tax rate is $0.615. Approximately three months after registration takes place, a tax bill will be issued by the wake county revenue department for each vehicle registered.

The calculator should not be used to determine your actual tax bill. Johnston street smithfield, nc 27577 collections mailing address: There is no applicable city tax.

Contact your county tax department for more information. While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking. North carolina collects a 3% state sales tax rate on the purchase of all vehicles.

Cash, car loan, warranties, and financing available. The median property tax in wake county, north carolina is $1,793 per year for a home worth the median value of $222,300. 35 rows listed below by county are the total (4.75% state rate plus applicable local.

Two other counties are authorized to levy the 0.5% transit local rate but have not levied the tax as of october 1, 2020. Wake county collects, on average, 0.81% of a property's assessed fair market value as property tax. Call your local dmv so they can help you determine your car's actual value.

North carolina assesses a 3 percent sales tax on all vehicle purchases, according to. Sales tax is charged on car purchases in most states in the u.s. Division of motor vehicles collects, as defined by law, on behalf of counties.)

The current total local sales tax rate in wake county, nc is 7.250%. Used cars are for sale and for great prices. The refund will be calculated on any full calendar months remaining in the registration period after the license plate is surrendered to the n.c.

Sales taxes will also apply to any car purchase you make. The assessed valuation is 100% of the appraised value. The property records and tax bill data provided herein represent information as it currently exists in the wake county collection system.

, nc sales tax rate. Yearly median tax in wake county. You can find these fees further down on the page.

Autotrader.com, cars.com, craigslist, ebay, google, vast, msn, yahoo, auctions, manhiem, all list our inventory. Within one year of surrendering the license plates, the owner must present the following to the county tax office: Your county vehicle property tax due may be higher or lower, depending on other factors.

You can print a 7.25% sales tax table here. Motor vehicle bills are due on the first day of the fourth month following registration and become delinquent on the first day of the fifth month following registration. Box 451 smithfield, nc 27577 administration mailing address:

For tax rates in other cities, see north carolina sales taxes by city and county. The wake county sales tax rate is %. The 7.25% sales tax rate in cary consists of 4.75% north carolina state sales tax, 2% wake county sales tax and 0.5% special tax.

Wake county has one of the highest median property taxes in the united states, and is ranked. Items subject to the general rate (line 4) are also subject to the 0.5% transit county sales and use tax rate if the item is sourced to or purchased for storage, use, or consumption in durham, mecklenburg, orange, or wake counties. Within one year of surrendering the license plates, the owner must present the following to the county tax office:

30 Million Mansion In Lake Saint Louis Us Fidelis Car Warranty Ceo Mansions Luxury Homes Dream Houses Dream Mansion

Used Lincoln Town Car For Sale Near Raleigh Nc With Photos – Cargurus

Pin On Adidas

Pin On Bmw

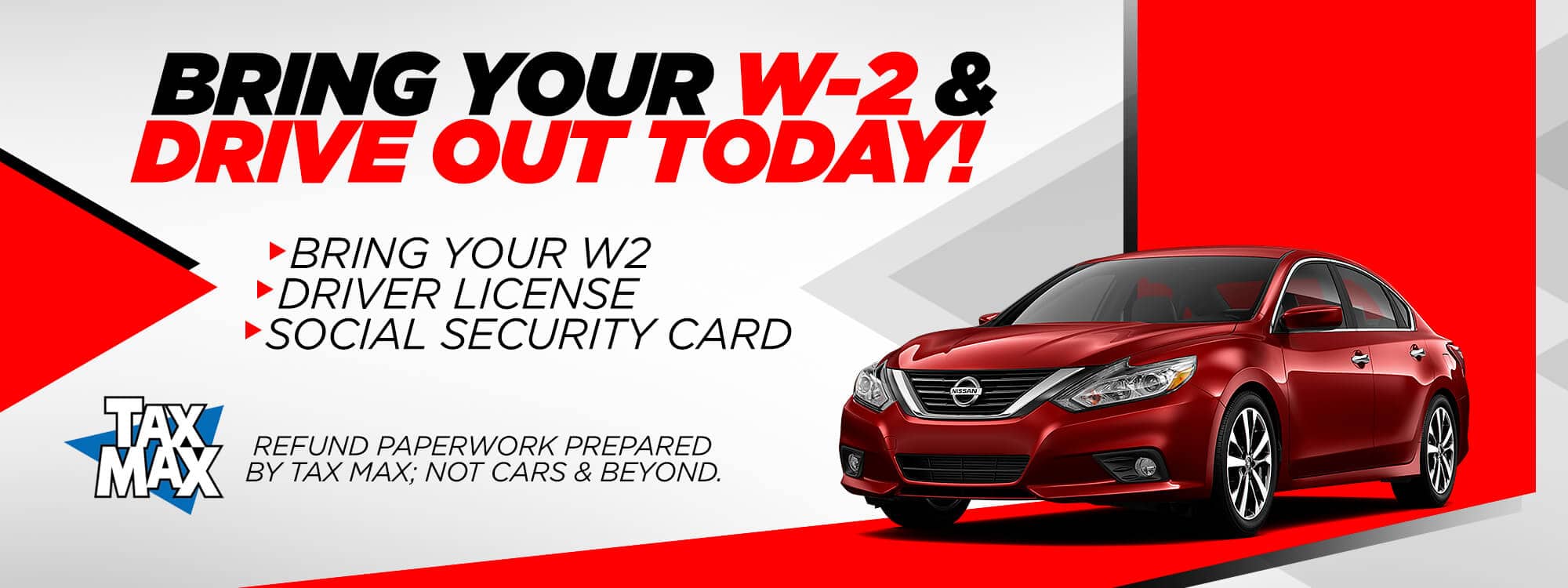

Used Car Dealership In Greenville Nc Cars And Beyond Llc

Pin On Dream Homes

Pin By Dee On Lifted Trucks Chevy Trucks Chevrolet Silverado Duramax

With Demand Skyrocketing Its A Great Time To Sell Your Car Wralcom

Used 2018 Kia Optima Sx Texas Direct Auto 2018 Sx Used Turbo 2l I4 16v Automatic Fwd Sedan 2020 Is In Stock And For Sale – 24carshopcom Kia Optima Kia Sedan

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

Used Bmw In Raleigh Nc For Sale

Credit Repair Stock Photos Images Pictures Positive Cash Flow Credit Repair Cash Flow

Used Jeep Compass In Raleigh Nc For Sale

Used Cars For Sale In Raleigh Nc Carvana

C_zjmyxvmnj0wm

Used Cars For Sale In Raleigh Nc Carvana

Jaguar Lease Raleigh Nc Jaguar Raleigh Auto Leasing

7345 Waterlook Way Wake Forest Nc – 35 Baths Dream House Exterior House Exterior Dream House Plans

Used Car Dealership In Greenville Nc Cars And Beyond Llc