The florida (fl) state sales tax rate is currently 6%. So, $10,000 x.0975 (or 9.75%) = $975.00 in sales tax.

Used Cars For Sale In Tampa Fl Carvana

Multiply the sales price of the vehicle by the current sales tax rate.

Car sales tax in tampa florida. The tampa sales tax rate is %. 11:33 pm est february 25, 2021. According to autolist.com , buyers are required to register.

However, if you buy from a dealer and get a manufacturer's rebate, florida does not deduct the rebate amount from the purchase price. Florida sales tax is due at the rate of six percent on the $20,000 sales price of the vehicle. The full purchase price generally is the amount you actually pay for the vehicle.

Once you have the percentage rate for sales tax in your city, multiple the purchase price of the vehicle times the sales tax percentage rate to obtain the amount of sales tax to be paid. Cities with the highest tax rate include tampa, jacksonville, pensacola, and kissimmee. It should be noted that the local tax is only applied to the first 5,000 dollars of the cost of the vehicle.

Every 2021 combined rates mentioned above are the results of florida state rate (6%), the county rate (1% to 2.5%). Shop used vehicles in tampa, fl for sale at cars.com. Florida sales tax on cars.

The minimum combined 2021 sales tax rate for tampa, florida is. Generally, when a car is rented or leased in florida, the payment is subject to florida’s six percent (6%) state sales tax rate and any county sales tax on each lease payment. There is no special rate for tampa.

In florida, the state sales tax rate is 6% as of 2021, so the state of florida assesses a 6% sales tax on purchases of new and used vehicles. The florida sales tax rate is currently %. It is important for dealers to understand the florida sales tax treatment of leased vehicles.

Research, compare, and save listings, or contact sellers directly from 10,000+ vehicles in tampa, fl. No discretionary sales surtax is due. The tampa, florida, general sales tax rate is 6%.

However, the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 1.5%. Sales tax is set at 9.75%. If you are not in florida, check your state’s department of revenue for rates.

The december 2020 total local sales tax rate was 8.500%. The failure to do so could result in a devastating assessment down the line. You do not have to pay sales tax on a gifted car when given to a family member.

Depending on local municipalities, the total tax rate can be as high as 7.5%. Generally, when you buy a vehicle in florida, the state assesses a tax on the full purchase price. Depending on the zipcode, the sales tax rate of tampa may vary from 6% to 8.5%.

, fl sales tax rate. Cost of the car is $10,000. What is the clearwater fl sales tax?

This is the total of state, county and city sales tax rates. There is no city sale tax for tampa. Florida collects a six percent sales tax on the purchase of all new or used vehicles.

Florida sales and use tax in the amount of 6% is collected on the purchase price, less trade in, on all vehicle transfers of ownership. The florida department of revenue will always have the current sales tax rate listed. Skip to content welcome to your hillsborough county tax collector's office!

Hillsborough ave, , tampa, florida, 33610 The current total local sales tax rate in tampa, fl is 7.500%. Florida assesses a state sales tax of 6 percent on the full purchase price of the vehicle, at the time of publication.

It was lowered 1% from 8.5% to 7.5% in may 2021, lowered 1% from 8.5% to 7.5% in may 2021, lowered 1% from 8.5% to 7.5% in may 2021 and lowered 1% from 8.5% to 7.5% in may 2021. For example, if you’re a florida resident buying a vehicle with a total sale price of $18,252,. Florida collects a 6% state sales tax rate on the purchase of all vehicles.

By autolist editorial | june 21, 2021. The sales tax rate in the state of florida is 6%. Do i have to pay sales tax on a gifted car in florida?

The county sales tax rate is %. Hillsborough ave, , tampa, florida, 33610: Sale of $20,000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is seven percent.

The tampa sales tax has been changed within the last year.

Florida Sales Tax On Cars

What Are Dealer Fees In Florida

Tampa Tax Frauds Chrome Camaro Finds A Home In Motor City

New Cars Trucks For Sale Tampa Florida Auto Dealerships Dealers

How To Calculate Florida Sales Tax On A Car Squeeze

Florida Vehicle Sales Tax Fees Calculator

Giant Motor Cars Car Dealer In Tampa Fl

Car Lease Tampa Toyota Of Tampa Bay

Florida Sales Tax Leased Cars

Florida Car Sales Tax Everything You Need To Know

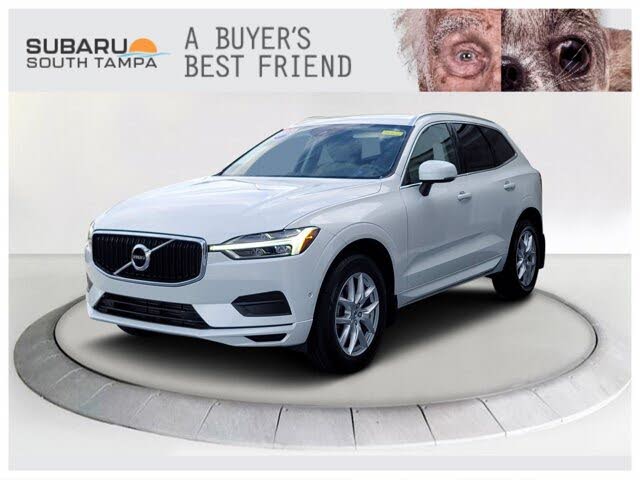

Used Volvo For Sale In Sarasota Fl – Cargurus

Sales Tax On Cars And Vehicles In Florida

Florida Sales Tax For Nonresident Car Purchases 2020

Used Bmw For Sale In Fort Lauderdale Fl – Cargurus

Used Infiniti For Sale In Fort Myers Fl – Cargurus

Hillsboroughs All For Transportation Tax Ruled Unconstitutional

Hillsborough Could Have Floridas Highest Sales Tax After The Nov 6 Election Will It Matter

Used Car Dealer In Tampa Fl 33612 Drivetime

Fl Car Dealer When Is A Sale Tax Exempt James Sutton Cpa Esq