You can find these fees further down on the page. In addition to taxes, car purchases in texas may be subject to other fees like registration, title, and plate fees.

800 Brazos St 704 Austin Tx – 1 Bed1 Bath In 2021 Home Photo Redfin Royal Blue Grocery

The sum of all taxable sales multiplied by the tax rate equals the sales tax amount.

Car sales tax in austin texas. According to the texas department of motor vehicles, any person that buys a car in texas owes the government a motor vehicle sales tax. Motor vehicle sales tax is. This is what the vehicle would sell for, based on similar sales in the texas region.

The state of texas imposes a motor vehicle sales and use tax of 6.25% of the purchase price on new vehicles and 80% of the standard presumptive value (non dealer sales) of used vehicles. Depending on the zipcode, the sales tax rate of austin may vary from 6.3% to 8.25%. A used car in texas will cost $90 to $95 for title and license, plus 6.25% sales tax of the purchase price.

According to the texas department of motor vehicles, car owners must pay a motor vehicle tax of 6.25 percent. If you are legally able to avoid paying sales tax for a car, it will save you some money. If you purchase a used honda civic for $10,000, you will have to pay an.

Find your vehicle’s standard presumptive value. If buying from an individual, a motor vehicle sales tax (6.25 percent) on either the purchase price or standard presumptive value (whichever is the highest value), must be paid when the vehicle is titled. The austin, texas, general sales tax rate is 6.25%.

Motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. Texas collects a 6.25% state sales tax rate on the purchase of all vehicles. Sales tax varies by state, but overall it will add several hundred, or even a thousand, dollars onto the price of buying a car.

The title, registration and local fees are also due. Every 2021 combined rates mentioned above are the results of texas state rate (6.25%), the county rate (0% to 0.5%), the austin tax rate (0% to. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625).

A motor vehicle sale includes installment and credit sales and exchanges for property, services or money. 1568 rows combined with the state sales tax, the highest sales tax rate in texas is 8.25% in the cities. Texas residents are required to pay 6.25% sales tax to the state of texas when purchasing a vehicle.

New texas residents pay a flat $90.00 tax on each vehicle, whether leased or. A transfer of a motor vehicle without payment of consideration, that does not qualify as a gift, is a retail sale and is subject to the 6.25 percent motor vehicle tax. The current total local sales tax rate in austin, tx is 8.250%.

Some dealerships may charge a documentary fee of 125 dollars. Austin, tx sales tax rate. Taxable sales ($150.00) x tax rate (8.25 percent) = sales tax amount ($12.38)

The value is updated weekly by the texas department of motor vehicles and that means what you owe can change. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. If sales tax was paid in another state, the vehicle owner will get credit for the sales tax

The minimum combined 2021 sales tax rate for austin, texas is. Sales tax on a car purchase in texas is 6.25%, regardless of where you buy it. , tx sales tax rate.

And you can’t escape this tax by buying your car in a neighboring state: Texas residents still have to pay the 6.25 percent, minus any sales or use taxes paid to other states, when they bring a vehicle into texas that they bought in another state. This is the total of state, county and city sales tax rates.

For example, sales tax in california is 7.25%. State sales tax is 6.25 percent and based on the standard presumptive value (spv). The texas sales tax rate is currently %.

Cities, counties, and transit authorities may add to the sales tax rate up to a maximum combined state and local rate of 8.25%. The sales tax rate of 9.35% applies to rental or lease of a passenger motor vehicle for a period of 30 or more days. Sales tax is charged on car purchases in most states in the u.s.

Luckily, some states are more relaxed on their minimum sales tax requirements, and a handful. The state levies a sales and use tax of 6.25% on sales of tangible personal property and certain services. While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking.

City/county/other sales tax authorities do not apply. The december 2020 total local sales tax rate was also 8.250%. If you purchased the car in a private sale, you may be taxed on the purchase price or the “standard presumptive value” (spv) of the car, whichever is higher.

715 E 43rd St Austin Tx – 3 Beds3 Baths Sale House Outdoor Mothers Cafe

Pin On Good Lookin

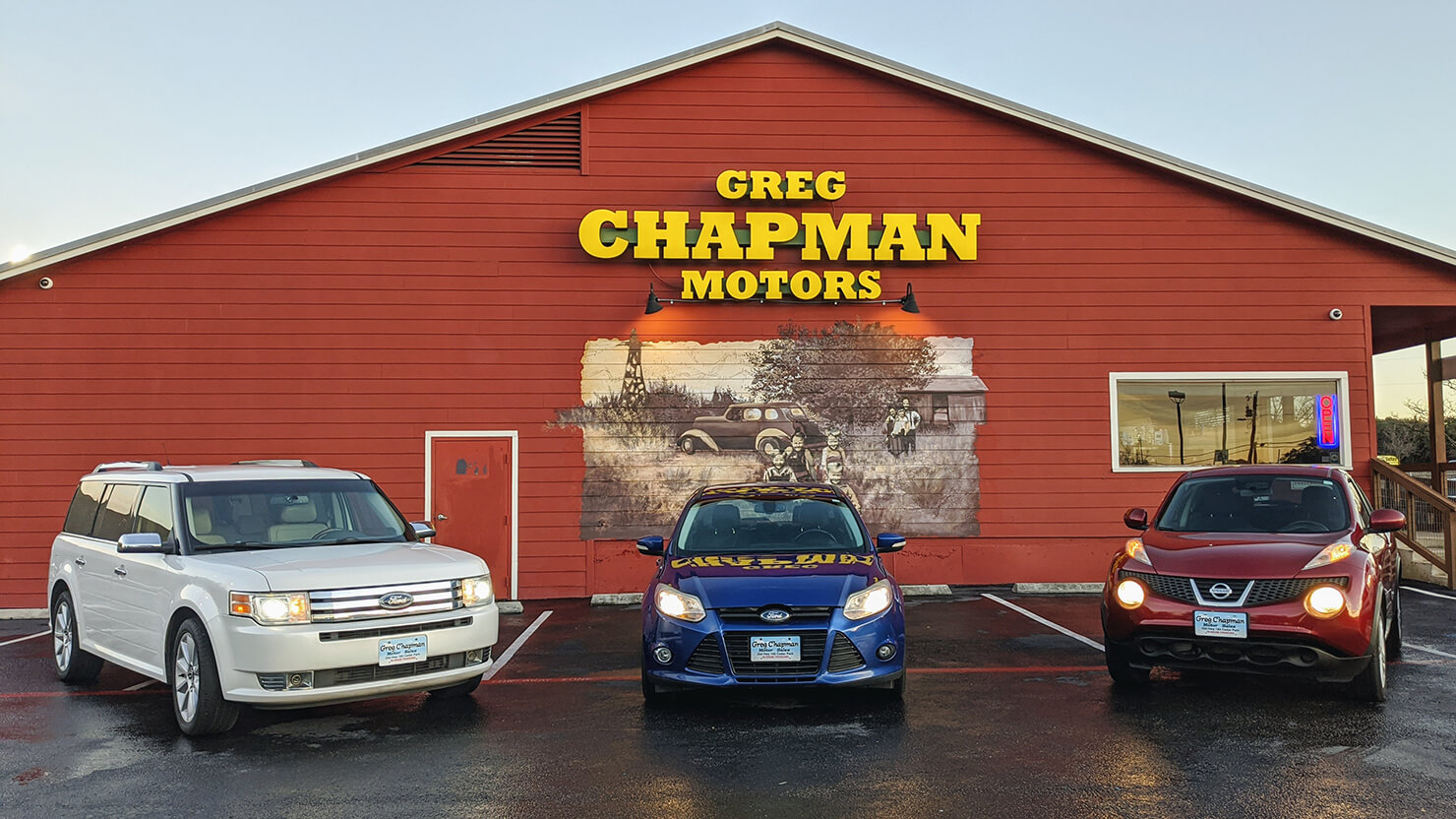

Austin Cedar Park Used Car Sales – Greg Chapman Motor Sales

5009 Spanish Oaks Club Blvd Austin Tx 78738 – Zillow Mansions Mansions Homes Mansions Luxury

Texas Car Sales Tax Everything You Need To Know

Ebay Mini 1275 Gt Classic Car Barn Find Car Barn Classic Cars Mini Cars For Sale

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Texas Used Car Sales Tax And Fees

Down Under Auto Sales – Homepage – Used Car Dealership – Austin Tx – Homepage

1301 W 42nd St Austin Tx 78756 In 2020 Contemporary Design Bath Design

Pass Through Garage House Design House Designs Exterior Houses In Austin

Pin On Austin

Pin By Tessa Burns On For The Home Outdoor Decor Home Decor

79 Elegant Image Of Sample Resume For Bank Manager Position Check More At Httpswwwourpetscrawleycom79-elegant-image-of-sample-resume-for-bank-manager-posi

Mengapa Asuransi Dan Manfaat Asuransi Serta Istilah-istilah Asuransi Professional Indemnity Insurance Disability Insurance Life Insurance Agent

Pin On Games Room

Road Tax Online – Check Transport Tax Table Rates Road Tax Hunza Valley Online Checks

Pin On Churches

2211 Canterbury St Austin Tx – 4 Beds3 Baths Living Dining Combo Home Values Canterbury