Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. Retroactive to september 13, 2021 (date proposal was released)* capital gains:

Biden Tax Plan And 2020 Year-end Planning Opportunities

The green book indicated the capital gain hike would be “effective for gains required to be recognized after the date of announcement.” secretary yellen intimated that date would be april 28, the date.

Capital gains tax proposal effective date. Proposed effective date proposed effective date for increase to income tax is december 31, 2021. Proposed effective date for increase to capital gains tax is april 28, 2021. 1, 2022, except for the proposed increase in capital gains tax rates, which would likely be effective retroactive to april 28, 2021.

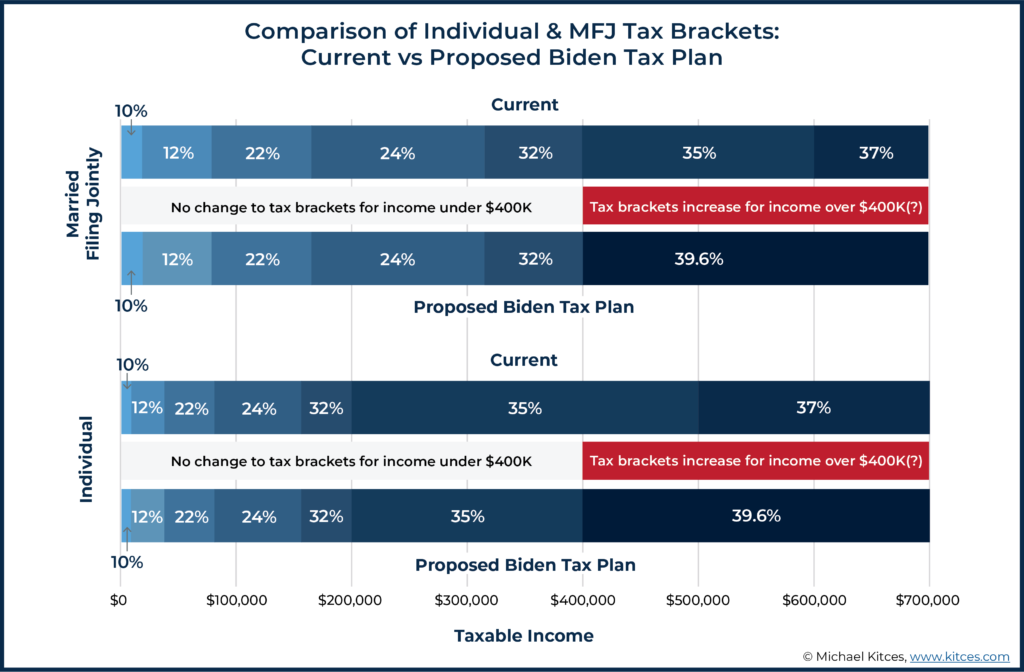

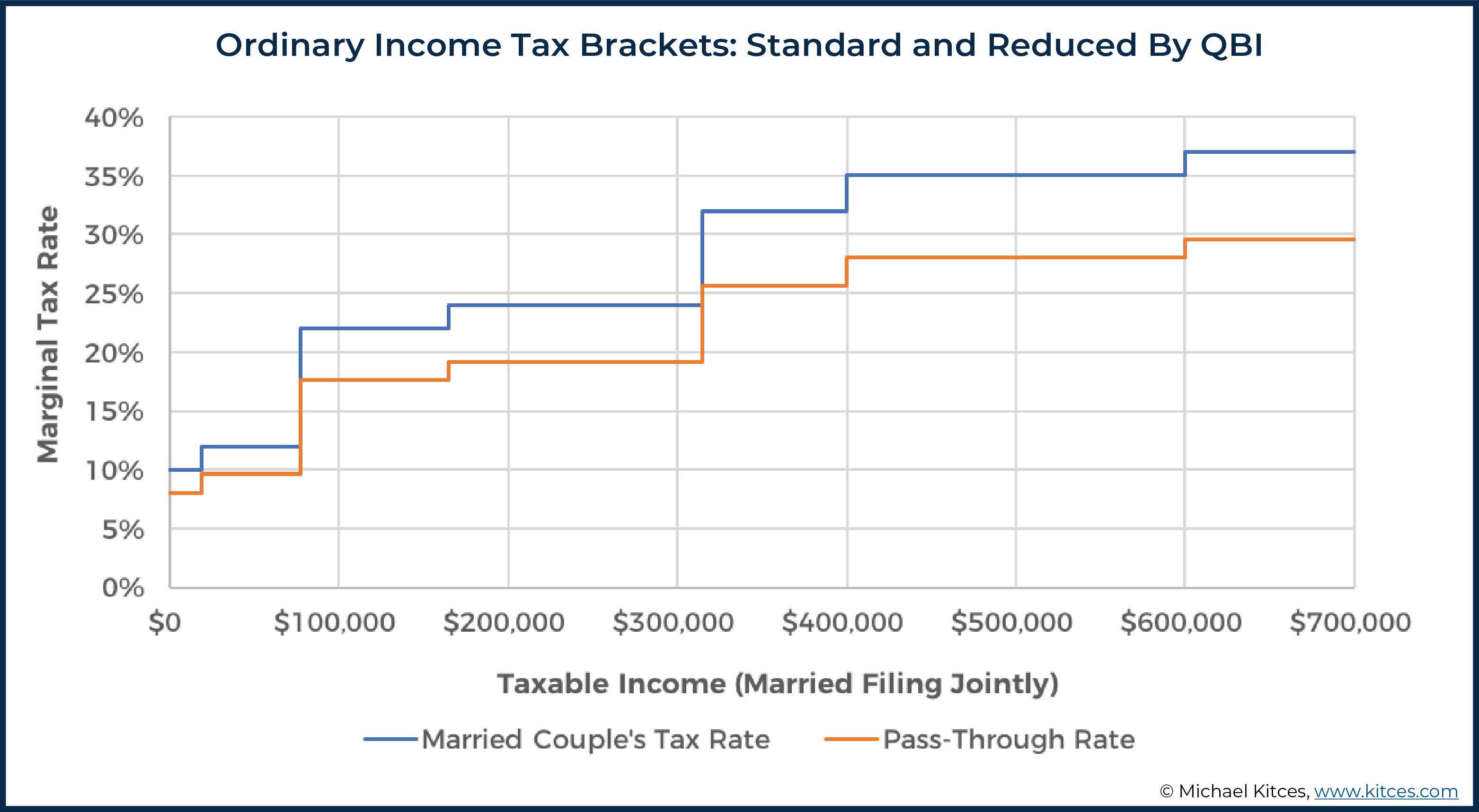

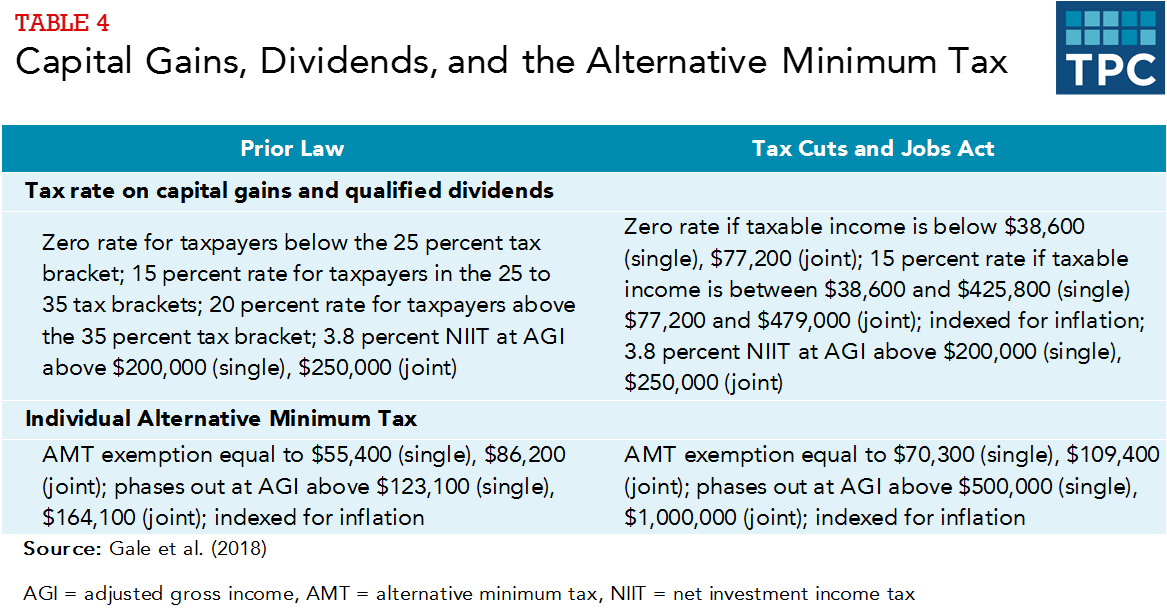

If this were to happen, it may not only seem unfair, but it is also bad tax policy. The proposed legislation would increase the top marginal tax rate from 37% to 39.6%, the level it was in 2017. The current statutory rate of 20% co ntinues to apply to capital gains and qualified dividend income for the portion of.

The proposal would be effective for gains recognized after the undefined date of announcement, which could be interpreted as the april 28, 2021 date of the release of the american families plan or the may 28, 2021 date of the release of the greenbook itself. The proposed legislative text currently provides that any transactions completed on or before september 13, 2021, or subject to a binding written contract on or before september 13, 2021 (even if the transaction closes after september 13), are subject to the current 20 percent. Retroactive effective date for capital gains tax increase is a bad idea.

The effective date for most of the proposals is jan. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase. Carries over the language from the september version, including the september 13, 2021 effective date, by amending section 1202(a) to provide that the special 75% and 100% exclusion rates for gains realized from certain qualified small business stock will not apply to taxpayers with adjusted gross income equal to or exceeding $400,000 for sales and exchanges.

The proposed effective date for the implementation of capital gains tax (cgt) is 1 october 2001. The proposal would be effective for gains recognized after the undefined date of announcement, which could be interpreted as the april 28, 2021 date of the release of the american families plan or the may 28, 2021 date of the release of the greenbook itself. This is a total of $1,124,000 additional tax!

The market value of r550 000 at valuation date exceeds both the time apportionment base cost and 20 of the proceeds and thus should be chosen for the base cost. There are exceptions, however, and some are notable. The proposed tax legislation includes a variety of changes.

In general, the biden administration would make its tax proposals effective january 1, 2022 (which is how budget recommendations are ordinarily submitted). If this were to happen, it may not only. This may be why the white house is seeking an april 2021 effective date for the retroactive capital gains tax increase, as president biden announced the proposal on april 28, 2021, although it was not widely publicized at the time and investors are still becoming aware of it.

By contrast, the other proposals in the greenbook generally state that they will be. Proposed to be effective for decedents dying and gifts made on or after december 31, 2021. As you review this alert, it is critical to keep in mind that the green book is a wish list, not legislation.

• the capital gains rate increase is proposed to be effective for tax years ending after the date of introduction (september 13, 2021). The effective date for the capital gains tax hike would be april 28, 2021, when the american families plan was introduced, according to the treasury department’s greenbook, a compendium of. By contrast, the other proposals in the greenbook generally state that they will be.

Biden's proposed tax law changes. The proposed effective date for a 25 percent capital gain rate is september 13, 2021. House democrats propose raising capital gains tax to 28.8% published mon, sep 13 2021 3:33 pm edt updated mon, sep 13 2021 4:06 pm edt greg iacurci @gregiacurci

The proposed retroactive effective date is for transfers after december 31, 2020. We’ve grouped them here by some key dates: Should the proposals become law, your client will now pay federal capital gains tax of $740,000 in 2021 and $792,000 in 2022 and 2023.

Pin On Buy Ready Made Company

Expansion Of Existing Relief On Increase Of Total Relief For Lifestyle For Up To A Maximum Of Effective Datelifestyle Relief R In 2021 The Expanse Competition Relief

Pin On Financial

Hoan Thue Thu Nhap Ca Nhan Nhu The Nao Income Tax Return Filing Taxes Income Tax

Biden Tax Plan And 2020 Year-end Planning Opportunities

Npv Net Present Value In 60 Seconds Go Ahead And Repin Accounting Basics Business Valuation Investing

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

434 Capital Gain Tax 10 Things To Know

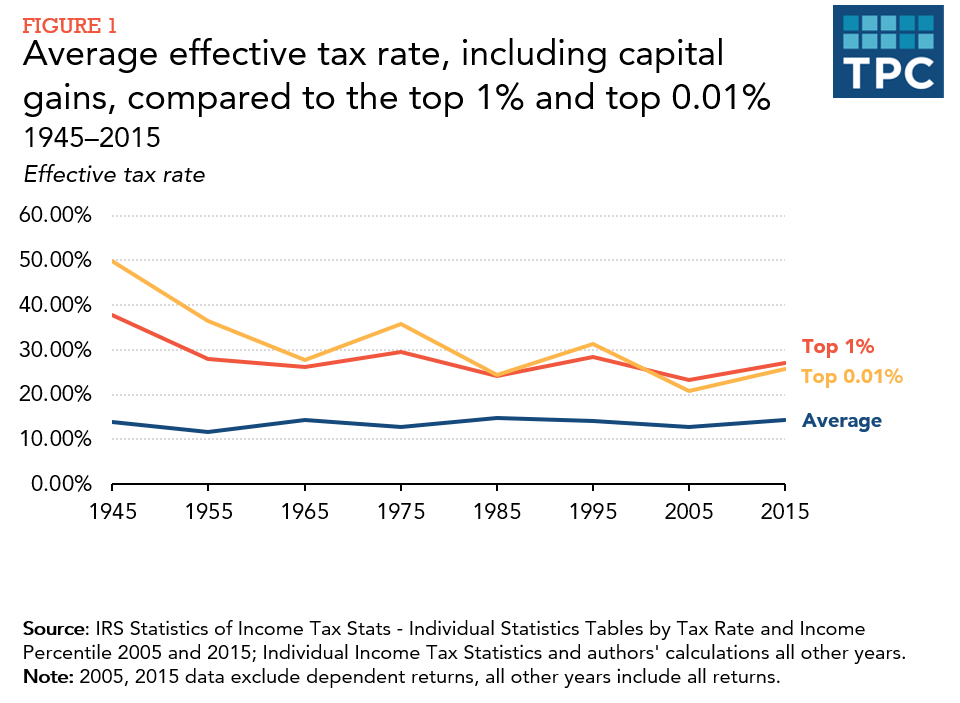

Effective Income Tax Rates Have Fallen For The Top One Percent Since World War Ii Tax Policy Center

Attitude Check How To Manage Intangible Problems Attitude Hr Management Psychology

Flowchart – Start Own Business Or Buy A Franchise Franchising Start Own Business Flow Chart

Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others

Complete Tax Due Dates For All Return Forms For The Year 2019 Due Date Informative Years

Gst Return Due Date List Jan 2020 Billing Software Accounting Software Dating

Capital Gains And Capital Pains In The House Tax Proposal – Wsj

Attitude Check How To Manage Intangible Problems Attitude Hr Management Psychology

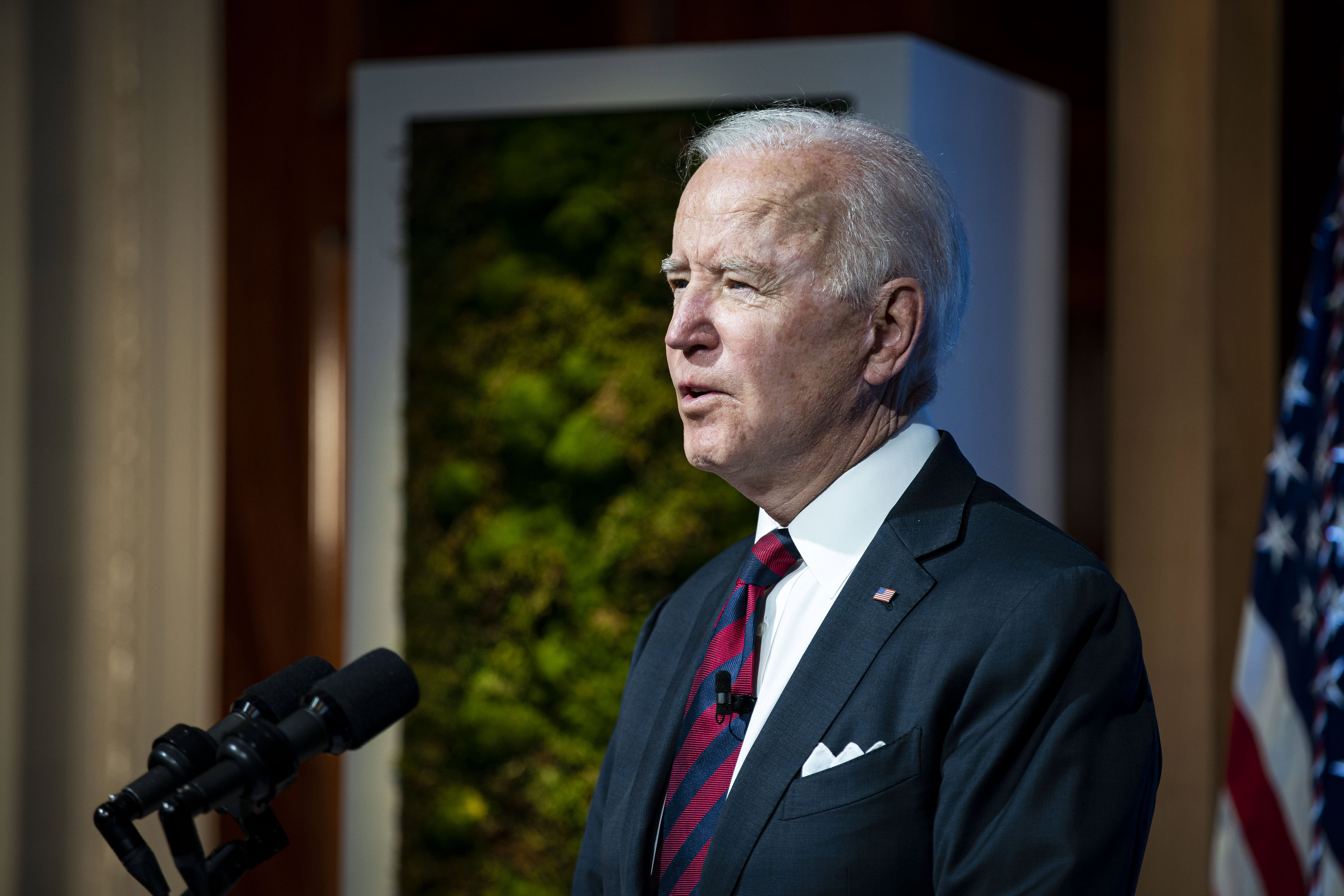

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Capital Gain Taxability – Joint Development Agreements Jda Whether All Issues Are Addressed In Budget 2017 – Httpta Capital Gain Budgeting Indirect Tax

Sales And Service Tax 2018 Sst In Malaysia Taxact Tax Service