Any capital losses resulting from the sale can only be offset against capital gains; You would pay capital gains tax on 50% of that profit.

Cryptocurrency Taxes In Canada The 2021 Guide Koinly

Canada divides crypto profits into either capital gains or business income, each with a slightly different tax rate.

Capital gains tax canada crypto. This is called the taxable capital gain. Cryptocurrency is taxed like any other commodity in canada. If you bought bitcoin at $50,000 and sold it at $42,000, that loss would be treated as a business loss or a capital loss and can be offset against your total business income or capital gains for that year.

How is cryptocurrency taxed in canada? You cannot use them to reduce income from other sources, such as employment income. Remember, 50% of your (realized) capital gains will be taxed at your tax bracket in canada.

The cra says “capital gains from the sale of cryptocurrency are generally included in income for the year,. Capital losses are tax deductible and can be used to reduce the income tax you owe the cra. In toronto, said several factors must be considered when deciding if the gains are income or not.

The canadian revenue agency has not provided specific guidance for how cryptocurrency received from hard forks should be treated for tax purposes. David rotfleisch, a tax lawyer with rotfleisch & samulovitch p.c. Depending on the conditions, any revenue earned from bitcoin transactions is generally categorized as either business income or capital gain.

Can you avoid crypto taxes in canada? For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto. If your crypto investments are seen as capital gains, you’ll only pay tax on 50% of your total gains.

Canadian citizens have to report their capital gains from cryptocurrencies. Profits are classified as either business income or capital. In canada, crypto is taxed as either capital gains or as income tax, depending on whether your activity with cryptocurrency is considered to be as a business or not.

There is no legal way to avoid paying taxes on cryptocurrency in canada. In canada, you’re only taxed on 50% of realized capital gains. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your invididual circumstances.

Cryptocurrency is taxed in canada as either capital gains or as income tax, depending on whether your activity with cryptocurrency is considered to be as a business or not. Taxpayers are subject to pay capital gains or business income tax after selling or mining cryptocurrency. Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax.

We worked with professional tax advisers to ensure that the calculation logic is consistent with available guidance and laws for filing crypto taxes in canada. It also conducts crypto audits for tax purposes. When filing your taxes in canada, you will treat your cryptocurrency like any other commodity or barter transaction.

Cryptocurrency is taxed as capital gains if you are using cryptocurrency to invest you will be taxed on the capital gains when you sell it. 50% of the gains are taxable and added to your income for that year. If you bought crypto from netcoins and then transferred to a crypto wallet or another discount brokerage, this is not considered to be a taxable event and therefore you do not have to file taxes for this.

Taxable cryptocurrency transactions need to be reported on your canadian personal income tax return (t1 general). While crypto transactions are conducted anonymously, the cra does have the right to demand customer data from crypto exchanges. In that case, i have to declare 50% of my capital gains, which is $2500, and the marginal rate is about 38% so in other words, i can get taxed up to 38% of the $2500 right?

The cra established a cryptocurrency section in 2017 to guarantee that canadians who invest in cryptocurrencies pay their fair share of taxes. Again, a safe approach is to pay capital gains tax when you later decide to sell the coins and assume a cost basis equal to zero similar to airdrops explained above. Cryptocurrency is considered a digital asset in the cra’s eyes.

Should you report crypto on your taxes as business income or capital gains in canada? How is crypto tax calculated in canada? If the client bought the cryptocurrency five years ago and disposed of it for profit today, the cra would probably view the gain as a capital gain, of which 50% is taxable.

Canadians do not have to pay taxes for buying or holding cryptocurrency. Say i put in $5000 in crypto and at market value now is $10,000, then my net capital gains is $5000 if i sell it all. The deadline to file your return and pay your taxes is april 30, 2021.

To qualify as business income, it typically requires repetitive processes. That means it is subject to capital gains tax, which has a much better tax treatment than income. (capital gains are “realized” when you dispose of an asset and “unrealized” when you hold onto it.) a capital loss occurs when you lose money from selling or exchanging crypto that has gone down in value.

The canada revenue agency (cra) taxes most cryptocurrency transactions. 100% of business income is taxable, whereas only 50% of capital gains are taxable. Let’s say you bought a cryptocurrency for $1,000 and sold it later for $3,000.

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

Cryptocurrency Tax In Canada

Pin On Coin4coin

The Investors Guide To Canada Cryptocurrency Taxes Cryptotradertax

All The Cryptocurrency Pattern Di 2021

2019 May Not Go Down As A Year Of Breathtaking Highs For Cryptocurrency Markets But Major Blockchain Technology Securities And Exchange Commission Blockchain

Pin On Buy Bitcoin In Canada

Httpsmixmio Investment Advice Ways To Earn Money Cryptocurrency Trading

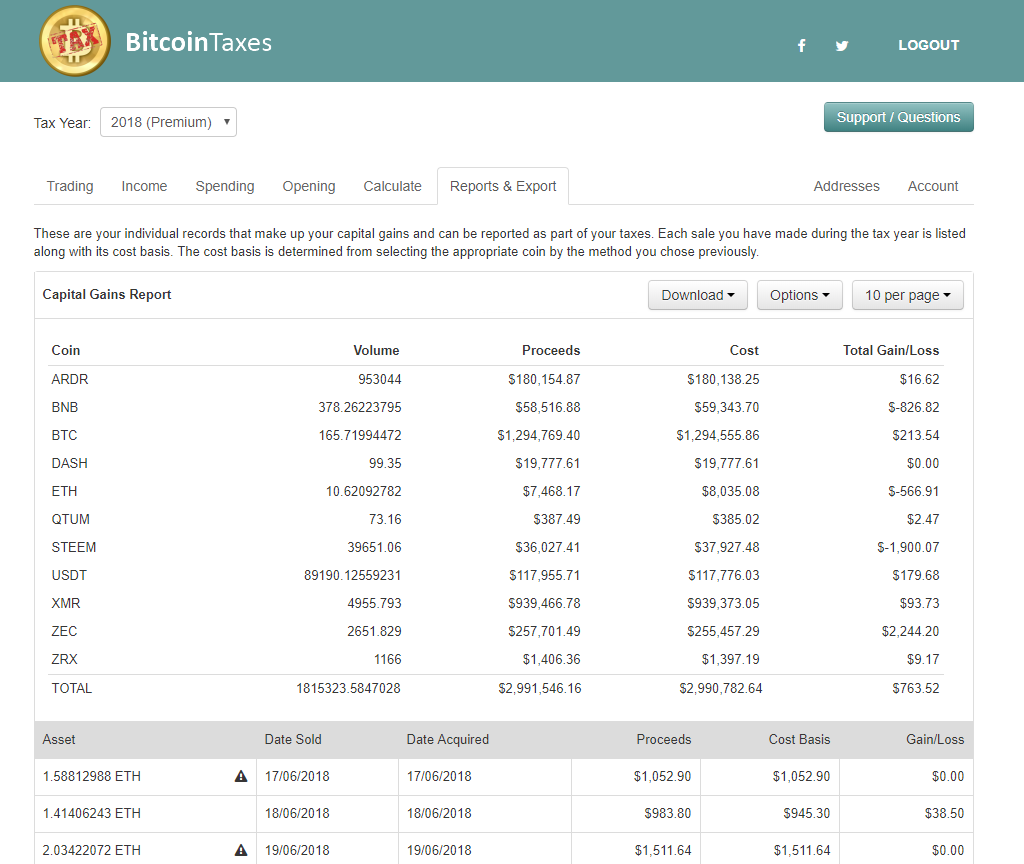

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Income

Pin On Hd Bitcoin Flag Design Wallpapers

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Crypto Tax Canada Superificial Loss Rule Koinly

Pin By Wilmer Lugo Villarroel On N F N F In 2021 Bitcoin Price Bitcoin Cryptocurrency

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Guide To Bitcoin Crypto Taxes In Canada – Updated 2020

.png)

The Investors Guide To Canada Cryptocurrency Taxes Cryptotradertax

Best Ethereum Ira Companies – Bitcoin Investing – Ideas Of Bitcoin Investing Bitcoin Investing Bitcoininvesting In 2020 Investing Investment Quotes Investing Money

Fiat Crypto Nebeus Crypto Bank Prepaid Card Savings Account Get A Loan

Ruzacl4_vx6cxm