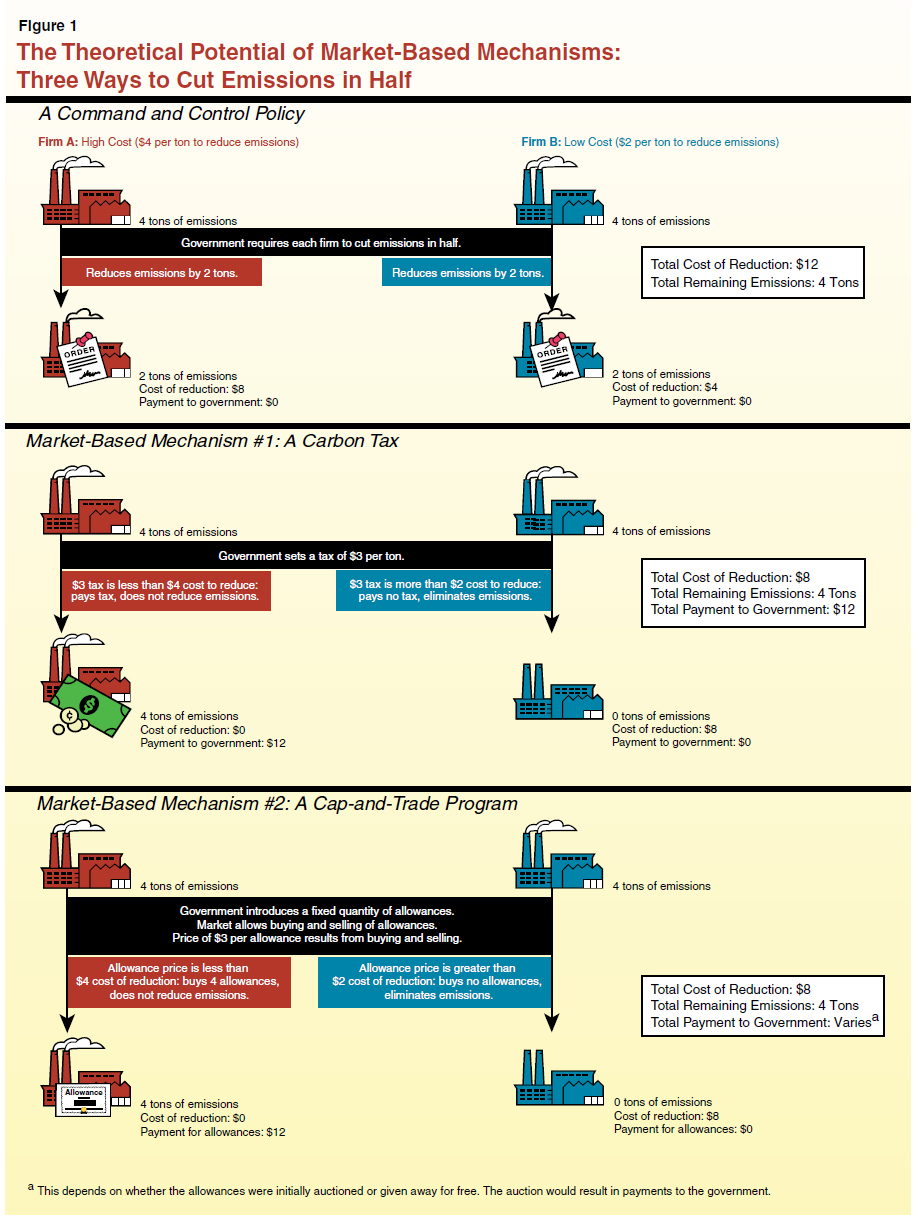

Each approach has its vocal supporters. With a tax you get certainty about prices but uncertainty about emission reductions;

The Pros And Cons Of Carbon Taxes And Cap-and-trade Systems Semantic Scholar

The point of cap and trade is to increase the price of energy.

Cap and trade vs carbon tax upsc. Both can be weakened with loopholes and favors for special interests. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved, has been shown to effectively work to. Read more on carbon tax in the linked article.

The regulatory authority stipulates the Cap and trade allows the market to determine a price on carbon, and that price drives investment decisions and spurs market innovation. Carbon tax approaches, however, can be designed such that tax revenues are returned.

The best climate policy — environmentally and economically — limits emissions and puts a price on them. Emissions trading/cap and trade approach: With a cap you get the inverse.

The cap gets stricter over time. The cap on greenhouse gas emissions that drive global warming is a firm limit on pollution. However, in reality they differ in many ways.

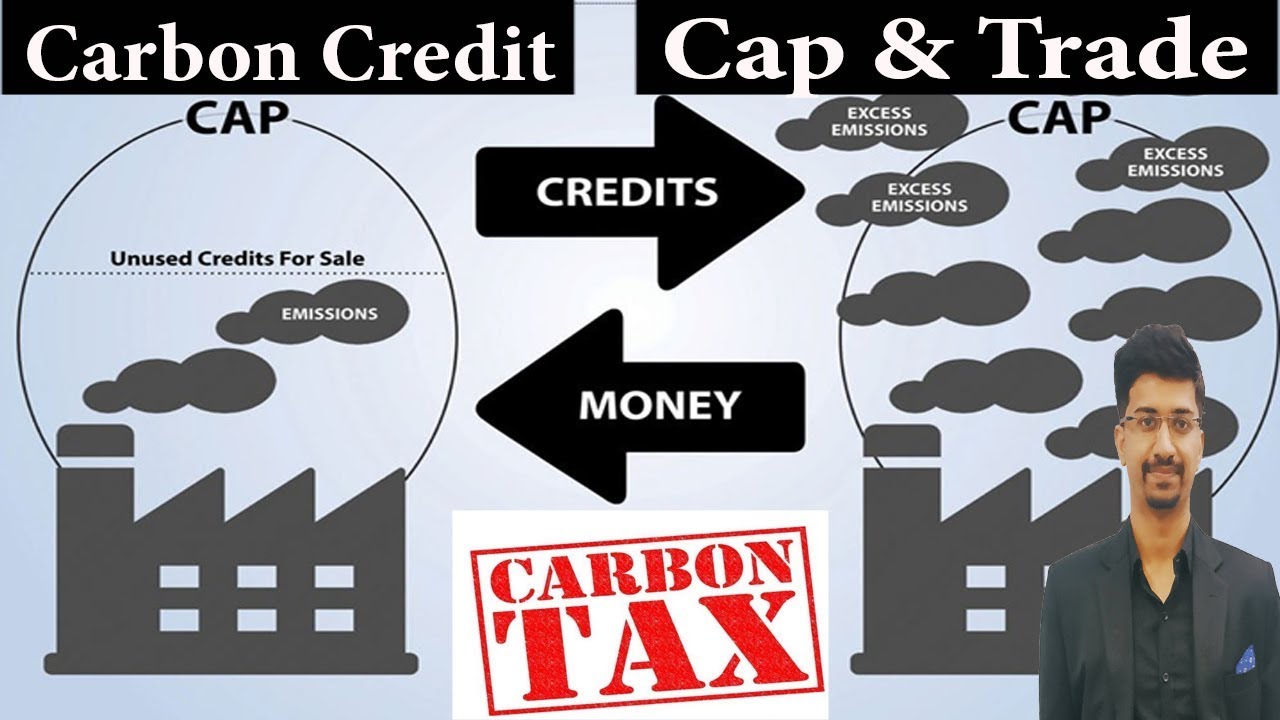

The carbon trade also refers to the ability of individual companies to trade polluting rights through a regulatory system known as cap and trade. With a tax you get certainty about prices but uncertainty about emission reductions; Proponents of cap and trade argue that it is a palatable alternative to a carbon tax.

However, in reality they differ in many ways. All opinions in this column reflect the views of the author(s), not of euractiv media network. It’s a system designed to reduce pollution in our atmosphere.

One difference is the way the two policies distribute the cost of reducing pollution. In addition, we bring out important dimensions along which the. You can tweak a tax to shift the balance;

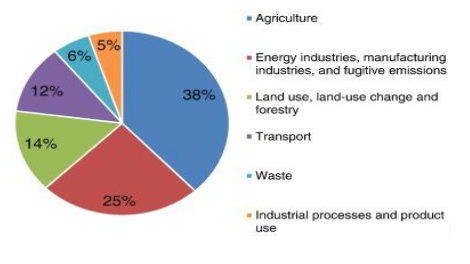

You can tweak a tax to. Cap and trade is designed to increase the price of 85 percent of the energy we use in the united states. Under this approach, the total permissible emissions of a country or region are set in advance or ‘capped’.

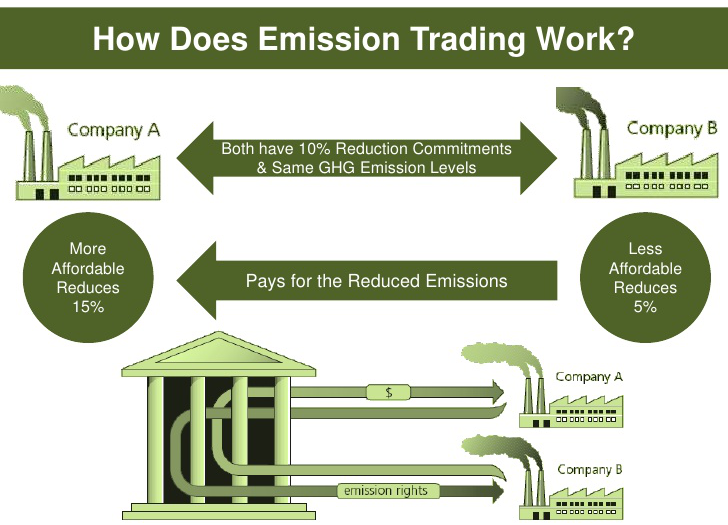

Within a region also, companies’ total emissions can be capped. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. Countries or companies as the case may be, can trade emissions permits with one another.

Cap and trade differs from a tax in that it provides a high level of certainty about future emissions, but not about the price of those emissions (carbon taxes do the inverse). For it to “work,” cap and trade needs to increase the price of oil, coal, and natural gas to force consumers to. Cap and trade is one way to do both.

But the key difference is that political pressures on a carbon tax system will most likely lead to exemptions of sectors and firms, which reduces. We show that the various options are equivalent along more dimensions than often are recognized. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas (ghg) emissions.

April 9, 2007 4:13 pm et. Both measures are attempts to reduce environmental damage without causing undue economic hardship to the. A cap may be the preferable policy when a jurisdiction has a specified.

With a cap you get the inverse. Cap and trade versus carbon tax disclaimer: Reasons why cap and trade is a bad idea:

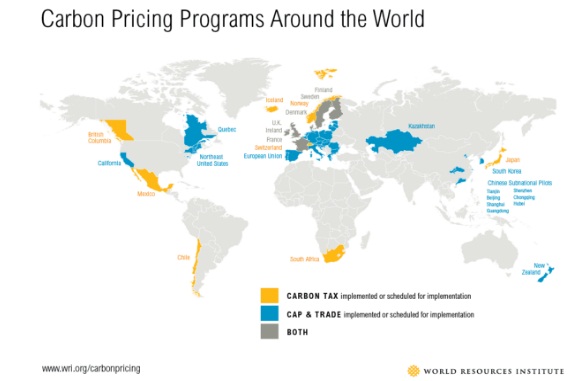

With a cap and trade scenario, emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own. Carbon emissions trading then allows countries that have higher carbon emissions to purchase the right to release more carbon dioxide into the atmosphere from countries that have lower carbon emissions. Theory and practice robert n.

Carbon Tax Vs Cap And Trade Vs Carbon Credit Vs Carbon Pricing Difference12 – Youtube

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal – Indias Largest Community For Upsc Exam Aspirants

Insights Into Editorial A Case For A Differential Global Carbon Tax – Insightsias

Carbon Trading Climate Change – Ias Gatewayy

Pricing And Taxing Carbon

Carbon Emissions Trading – Need Working Pros Cons Alternatives Upsc – Ias Express

Difference Between Carbon Tax And Cap And Trade Difference Between

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

What Is Cap And Trade Uplift

Comparison Between Carbon Tax Cap-and-trade And Cac Policies Download Scientific Diagram

Nova Scotias Cap-and-trade Program Climate Change Nova Scotia

Carbon Tax – Pros And Cons – Economics Help

Pdf Carbon Tax Vs Cap-and-trade Implications On Developing Countries Emissions Semantic Scholar

Difference Between Carbon Tax And Cap And Trade Difference Between

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal – Indias Largest Community For Upsc Exam Aspirants

Pdf Carbon Tax Vs Cap-and-trade Implications On Developing Countries Emissions Semantic Scholar

Carbon Tax Vs Cap-and-trade A Comparative Analysis

Carbon Fee And Dividend – Wikipedia

Comparison Of Carbon Tax And Cap Trade Eme 803 Applied Energy Policy