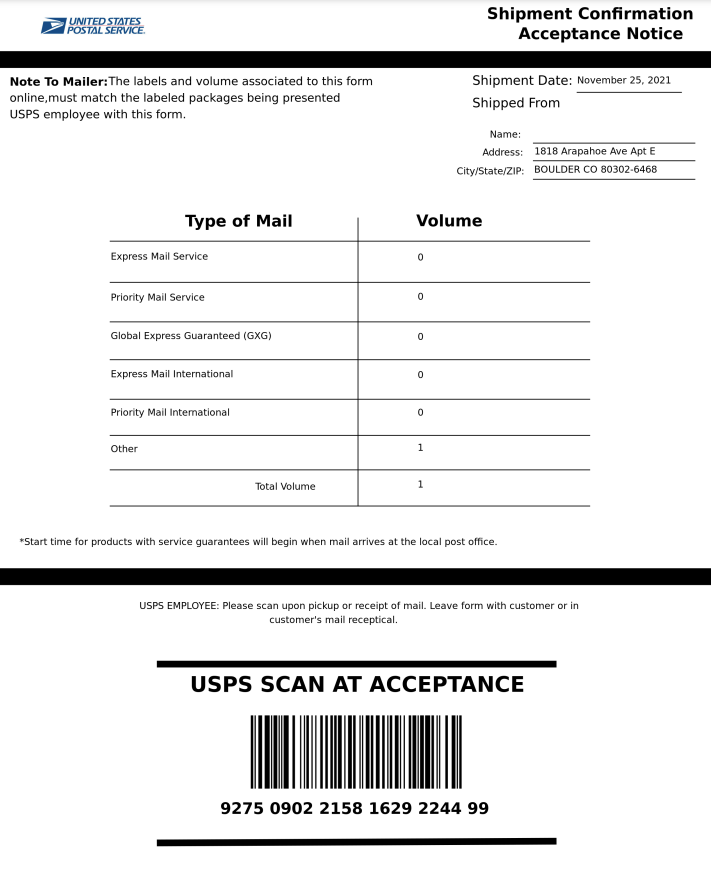

All payments of boulder county sales tax should be reported through cdor’s revenue online or through cdor’s printable forms found at cdor’s website: Building materials use tax reconciliation form (pdf,.

2

The boulder, colorado sales tax is 8.85% , consisting of 2.90% colorado state sales tax and 5.95% boulder local sales taxes.the local sales tax consists of a 0.99% county sales tax, a 3.86% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc).

Boulder co sales tax return form. The city of boulder requires all organizations and businesses coming into boulder for special events to obtain a city of boulder business license and file a sales & use tax return. 2020 boulder county sales & use tax the 2020 boulder county sales and use tax rate is 0.985%. Create an account using your email or sign in via google or facebook.

Purchase of business assets sales tax return form (pdf, 583kb) use tax. Enter you r business ’ gross sales. Businesses register with cdor to determine what taxes to pay.

The city of boulder does not mail return forms. As you can see, to obtain an alcohol tax in boulder, colorado alcohol tax, you have to reach out to multiple agencies at various levels of government, including federal, state, county and local level offices. This page serves as a guide to navigating the special event tax.

The rate is comprised of individual, voter‐approved county sales and use tax ballot measures adopted to support county programs in conservaon, transportaon, offe nder management, nonprofit capital Towntax@crgov.com po box 17906 phone: 2a enter any bad debts that had been written off, but recently collected.

As a home rule city, the city of lafayette charges sales tax on some items that the state of colorado does not. Longmont sales tax division, 350 kimbark st., longmont, co 80501. Sales tax returns are due the 20th of.

Publication #32 titled gifts, premiums and prizes states, “purchases of tangible personal property for use as gifts, premiums or prizes, for which no valuable. Use boulder online tax system to file a return and pay any tax due visit the boulder online tax system help center for additional resources and guidance. Vendors that do not have an active account with the city of lafayette must register for an account using the sales tax application link below.

Below are details on the required paperwork and processes you are legally mandated to go through to obtain a boulder, colorado alcohol tax. For instance, the city taxes food for domestic consumption, the state does not. To sign a sales tax boulder form right from your iphone or ipad, just follow these brief guidelines:

View sales tax and business licensing forms sorted by category. You also can visit the sales tax office in the longmont. Cdor collects the sales tax from business on behalf of boulder county.

Install the signnow application on your ios device. Sales tax return you must file this return even if line 15 is zero $ note: Upload the pdf you need to esign.

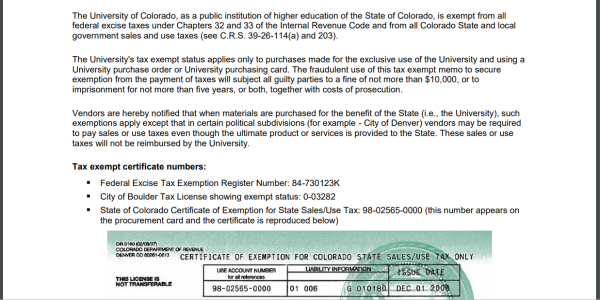

No, the university is not subject to sales tax on giveaway items. Sales tax you must file this return even if line 12 town of castle rock sales tax return division email: Once you have completed your request, you will

A tax return must be filed, even if taxes are not due. (fid) (taxable sales) times.01% (.0001) Tax district weld county areas incorporated prior to 1994 weld county areas incorporated since 1994 boulder county;

Www.crgov.com/tax period covered due date license # The boulder sales tax is collected by the. Do that by pulling it from your internal storage or the cloud.

Taxpayer name and address mail to: If you can’t find what you’re looking for online, contact sales tax staff at salestax@bouldercolorado.gov. For organizations not based permanently in the city of boulder we have a special event license available.

Paper Tax Forms Vanishing Leaving Some In A Bind The Denver Post

Rustic Wedding Invitation Suite With Romantic Lace And Woodgrain Background Minted Wedding Invitations Wedding Invitations Rustic Wedding Invitation Suite

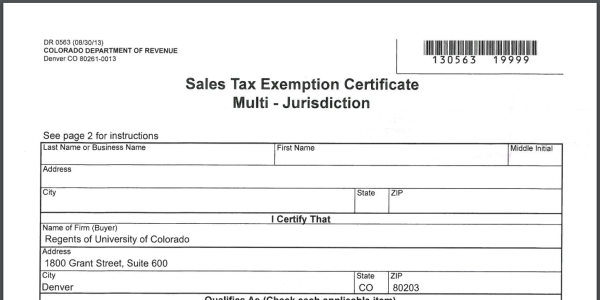

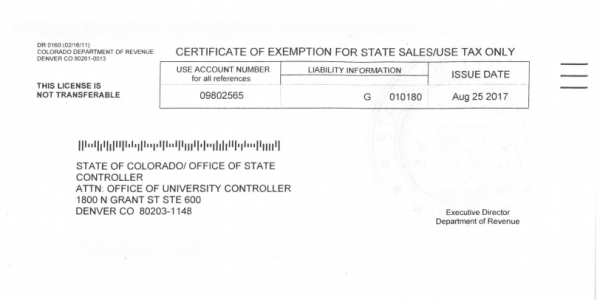

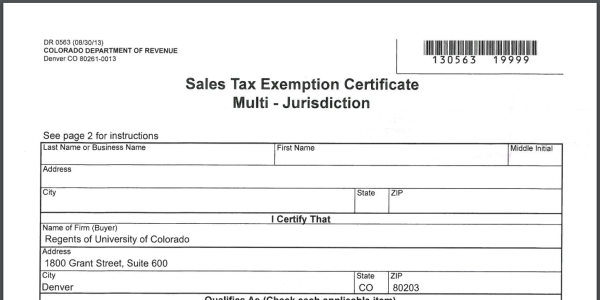

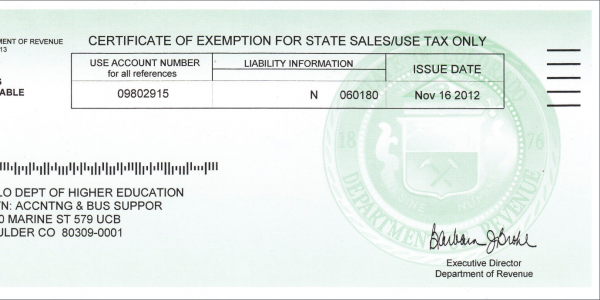

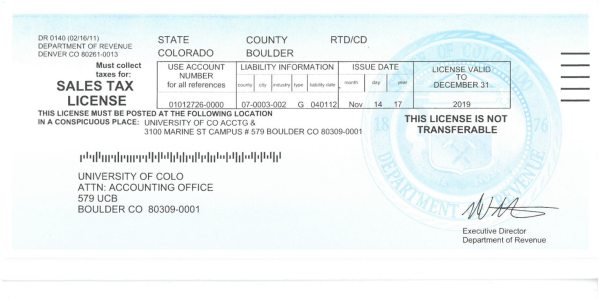

Sales Tax Campus Controllers Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

Use Tax City Of Boulder

Sales Tax Campus Controllers Office University Of Colorado Boulder

Sales Tax Campus Controllers Office University Of Colorado Boulder

City Of Boulder Sales Tax – Fill Out And Sign Printable Pdf Template Signnow

Construction Use Tax City Of Boulder

V_zfutk0np7n7m

Step 7 – California Residential Rental Agreement Wizard Ez Landlord Forms Being A Landlord Rental Agreement Templates Lease Agreement

Sales Tax Campus Controllers Office University Of Colorado Boulder

Use Tax City Of Boulder

Banner Lease Agreement Termination Of Tenancy Rental Agreement Templates

City Of Boulder Colorado Salesuse Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controllers Office University Of Colorado Boulder

Tenant Receipt Of Keys Ez Landlord Forms Lettering Being A Landlord Reference Letter

2

Sales Tax Campus Controllers Office University Of Colorado Boulder