The county sales tax rate is %. Please note that the tax law discussed on the city of boulder website applies to the city of boulder tax only.

Motor Vehicle – Boulder County

The city of boulder requires all businesses operating in boulder to have a license.

Boulder co sales tax license. Please keep in mind that a city of boulder business license comes with a tax filing requirement. The boulder online tax system offers enhanced user experiences and tax compliance functionality to city businesses, including the ability to: Sales tax licenses are required from both the city and state for businesses to operate in the city of boulder.

The city of loveland's sales tax rate is 3.0%, combined with larimer counties 0.80% sales tax rate and the state of colorado's 2.9% sales tax rate, the overall. City of boulder licensing division. The city of boulder requires all organizations and businesses coming into boulder for special events to obtain a city of boulder business license and file a sales & use tax return.

The boulder sales tax rate is %. You can apply for a business license here: 1777 broadway, 1st floor, boulder, co 80302.

Boulder county does not issue licenses for sales tax as the county sales tax is collected by the colorado department of revenue (cdor). The city of boulder requires that anyone operating a business in boulder be licensed. The license is called a sales and use tax license, and a tax return must be filed each year, even with no sales tax revenue.

For questions, contact sales tax at salestax@bouldercolorado.gov; The city of loveland's sales tax rate is 3.0%, combined with larimer counties 0.80% sales tax rate and the state of colorado's 2.9% sales tax rate, the overall. Business / sales & use tax licensing:

State of colorado, boulder county, and rtd taxes are remitted to the state of colorado via the colorado department of revenue. For organizations not based permanently in the city of boulder we have a special event license available. The boulder sales tax rate is %.

A late fee of $200.00 will be charged for all applications that are submitted after the deadline. The boulder sales tax rate is %. The license fee is $20 and covers a two year period ending on december 31 of each even numbered calendar year.

Complete city of boulder sales tax license application with fee copy of a valid boulder county health. In order to purchase at wholesale price, you must upload your sales tax license. Any petitions or remonstrances pertaining to the above may be filed via email at licensingonline@bouldercolorado.gov or by mail to the city of boulder finance department, sales tax and licensing division, brenton building, 1136 alpine avenue, boulder, colorado.

501(c)(3) tax exempt this certifies that the licensee shown hereon is authorized to collect or pay city of boulder sales or use tax for the location. This page serves as a guide to navigating the special event tax. The colorado sales tax rate is currently %.

Licenses for sales and use tax are called sales and use tax licenses, and tax returns must be filed each year even if there is no sales tax revenue generated. Licenses for businesses and sales and use taxes: Boulder county does not issue licenses for sales tax as the county sales tax is collected by the colorado department of revenue (cdor).

The city’s tax and licensing division manages business licensing, sales tax, use and other tax. There is always a tax filing requirement even if tax due is $0. A sales tax license is used for collecting and remitting sales tax that is collected by the colorado department of revenue.

This is the total of state, county and city sales tax rates. Box 791, boulder, co 80306 checklist of required documents: All payments of boulder county sales tax should be reported through cdor’s revenue online or.

Nd$2,000 operating fee for licensing 2 rmb licensed premise payable to “ city of boulder ”. Cdor collects the sales tax from business on behalf of boulder county. Businesses register with cdor to determine what taxes to pay.

501(c)(3) tax exempt this certifies that the licensee shown hereon is authorized to collect or pay city of boulder sales or use tax for the location. File online tax returns with electronic payment options; A sales tax deposit in the amount of $500 (business check only) must be submitted.

Complete a business license application or register for a special event license; Departments with a small volume of sales collect sales tax and let the campus controller's office file and pay the tax. Fee and a check for $25.00 made out to the city of boulder for the sales tax license fee.

Please fill out the form below to upload. An application must be received at least two weeks prior to beginning sales. Sent direct messages to sales tax staff

$25 sales and use tax business license fee payable to “city of boulder”. The minimum combined 2021 sales tax rate for boulder, colorado is. 1) license type (please select all licenses that apply and make check to city of boulder):

Sales and use tax license ($25) ‐ for reporting purposes, please check all. There are some cu boulder campus departments that have a large volume of sales (e.g., the book store) have their own sales tax license and file/pay their own taxes. The city of boulder presumes tax liability unless it receives a tax return indicating otherwise.

999 Cedar Ave Boulder Co 80304 – Realtorcom

Heres What Boulder Co Is Making Gun Owners Do – Rally For Our Rights

1901 Columbine Ave Boulder Co 80302 Mls 953660 Zillow

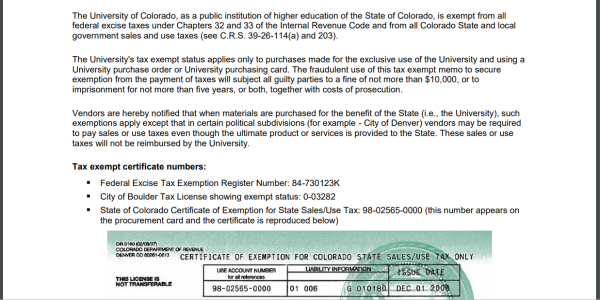

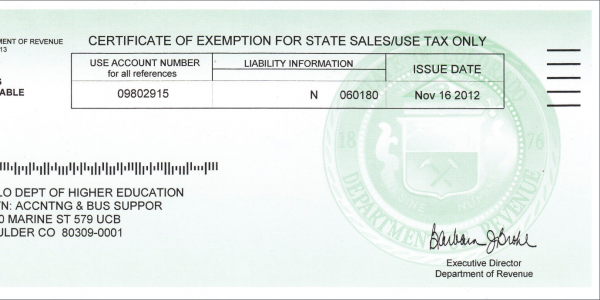

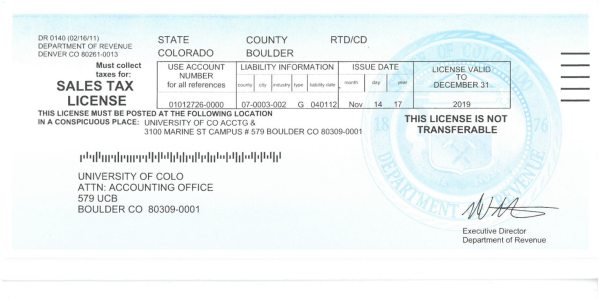

Sales Tax Campus Controllers Office University Of Colorado Boulder

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Famous Women Of Boulder Take A Walk Through Boulders History

Moving To Boulder Boulder Co Relocation Homebuyer Guide

1839 Arapahoe Ave Boulder Co 80302 Trulia

536 Apollo Dr Boulder Co 80303 Mls 954097 Zillow

The Weekender Boulder Colorado – Dujour Colorado Travel Bouldering Boulder Colorado

Boulder Again Named Best Place To Live But Some Disagree Westword

Sales Tax Campus Controllers Office University Of Colorado Boulder

Sales Tax Campus Controllers Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

2530 6th St Boulder Co 80304 – Realtorcom

927 10th St Boulder Co 80302 Zillow

Boulder Colorado Best Place To Live Us News 2021 Update Westword

4758 Franklin Dr Boulder Co 80301 Mls 954019 Zillow

Sales Tax Campus Controllers Office University Of Colorado Boulder