Quarterly if taxable sales are $4,801 to $95,999 per year (if the tax is less than $300 per month). Get all of the tools that you need to manage your business efficiently with wix.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Method to calculate aurora sales tax in 2021.

Aurora sales tax rate. The aurora colorado sales tax is 290 the same as the colorado state sales tax. The city of aurora’s tax rate is 8.850% and is broken down as follows: Aurora in illinois has a tax rate of 8.25% for 2022, this includes the illinois sales tax rate of 6.25% and local sales tax rates in aurora totaling 2%.

There is no applicable county tax or special tax. Monthly if taxable sales are $96,000 or more per year (if the tax is more than $300 per month). Sales tax and use tax rate of zip code 80016 is located in aurora city, douglas county, colorado state.

The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%. The minimum combined 2021 sales tax rate for arapahoe county , colorado is 3.25%. The county sales tax rate is %.

The colorado sales tax rate is currently %. The aurora sales tax rate is %. , in sales tax rate.

The current total local sales tax rate in aurora, in is 7.000%. The 5.5% sales tax rate in aurora consists of 4.5% south dakota state sales tax and 1% aurora tax. The december 2020 total local sales tax rate was also 7.000%.

You can find more tax rates and allowances for aurora and colorado in the 2022 colorado tax tables. Aurora in colorado has a tax rate of 8% for 2022, this includes the colorado sales tax rate of 2.9% and local sales tax rates in aurora totaling 5.1%. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

The 80011 aurora colorado general sales tax rate is 8. The aurora sales tax rate is 375. There is no applicable county tax or special tax.

What is the sales tax rate for arapahoe county colorado? Depending on the zipcode, the sales tax rate of aurora may vary from 6.75% to 8.5% depending on the zipcode, the sales tax rate of aurora may vary from 6.75% to 8.5% How 2021 sales taxes are calculated for zip code 60506.

You can print a 5.5% sales tax table here. 80016 zip code sales tax and use tax rate | aurora {douglas county} colorado. The sales tax jurisdiction name is aurora (arapahoe co) , which may refer to a local government division.

This sales tax will be remitted as part of your regular city of aurora sales and use tax filing. Annually if taxable sales are $4,800 or less per year (if. Aurora collects a 5.1% local sales tax, the maximum local sales tax allowed under colorado law aurora has a higher sales tax than 76.7% of colorado's other cities and counties aurora colorado sales tax exemptions

This is the total of state and county sales tax rates. Note that failure to collect the sales tax does not remove the retailer’s responsibility for payment. While many other states allow counties and other localities to collect a local option sales tax illinois does not permit local sales taxes to be collected.

Get all of the tools that you need to manage your business efficiently with wix. What city has the highest sales tax in colorado? The 8% sales tax rate in aurora consists of 2.9% colorado state sales tax, 0.25% adams county sales tax, 3.75% aurora tax and 1.1% special tax.

The 60506, aurora, illinois, general sales tax rate is 8.25%. The aurora, colorado, general sales tax rate is 2.9%. This is the total of state, county and city sales tax rates.

The average sales tax rate in colorado is 6.078% The minimum combined 2021 sales tax rate for aurora, colorado is. Retailers are required to collect the aurora sales tax rate of 3.75% on cigarettes beginning dec.

[ 5 ] state sales tax is 2.90%. The colorado state sales tax rate is currently 2.9%. The arapahoe county sales tax rate is 0.25%.

The combined rate used in this calculator (8.25%) is the result of the illinois state rate (6.25%), the aurora tax rate (1.25%), and in.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

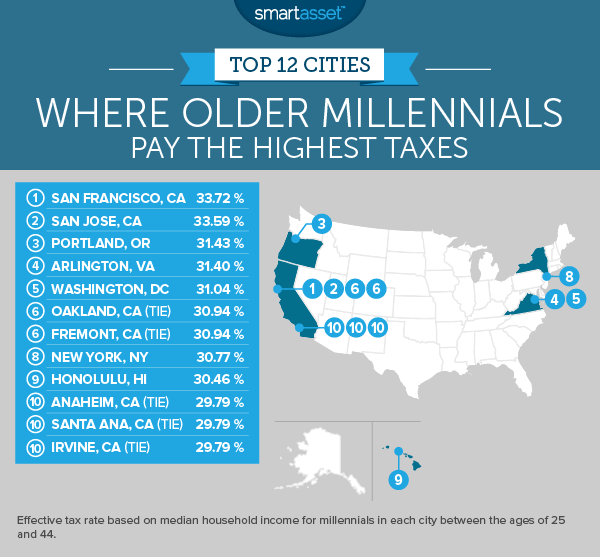

Where Millennials Pay The Highest Taxes – 2017 Edition – Smartasset

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates – Orem Ut The Best Guide To Orem Utah

Sales And Use Tax Return Form

How Colorado Taxes Work – Auto Dealers – Dealrtax

Sales And Use Tax Return Form

2

2

Aurora Colorado Sales Tax Rate – Sales Taxes By City

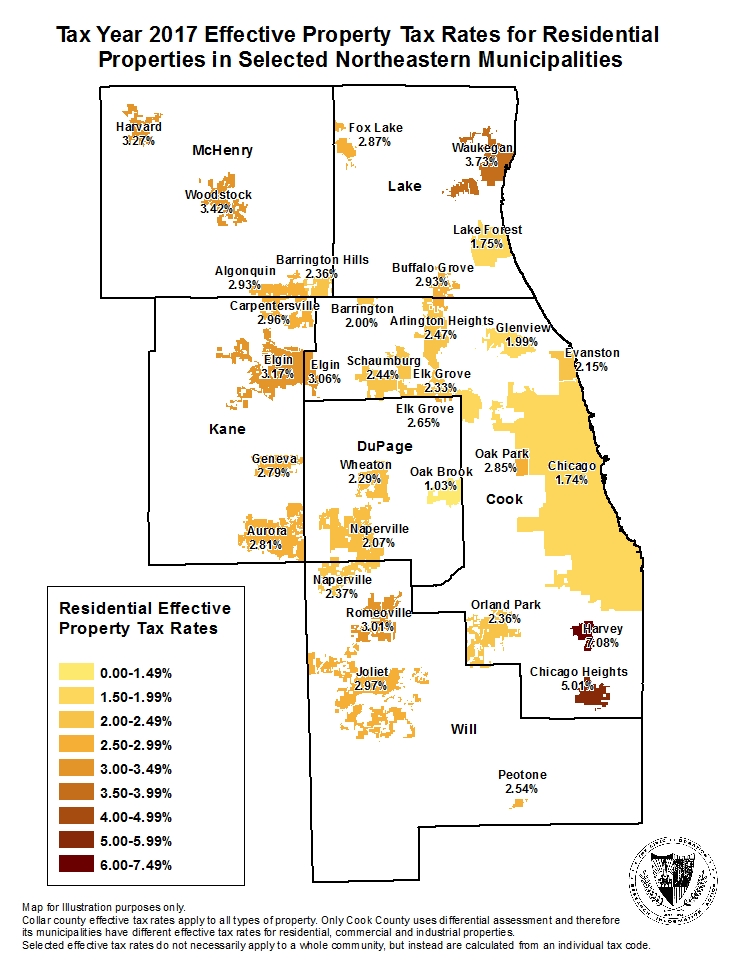

Estimated Effective Property Tax Rates 2008-2017 Selected Municipalities In Northeastern Illinois The Civic Federation

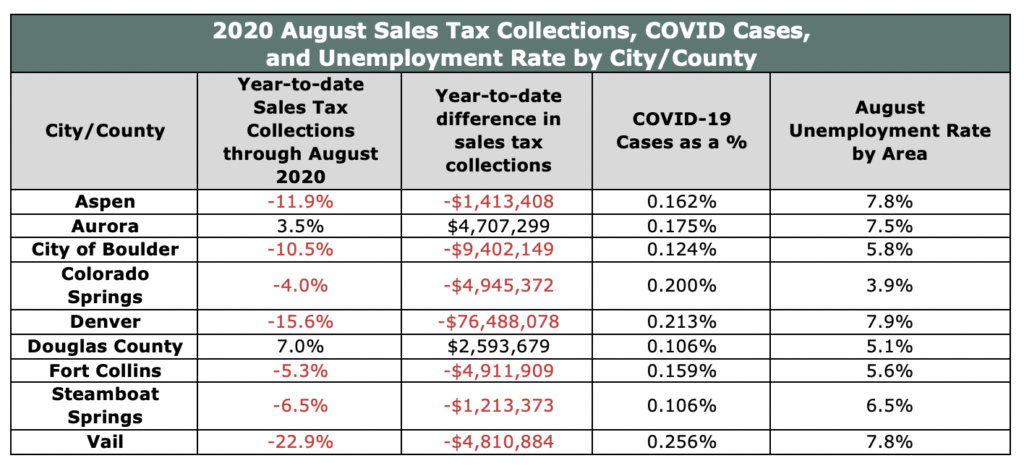

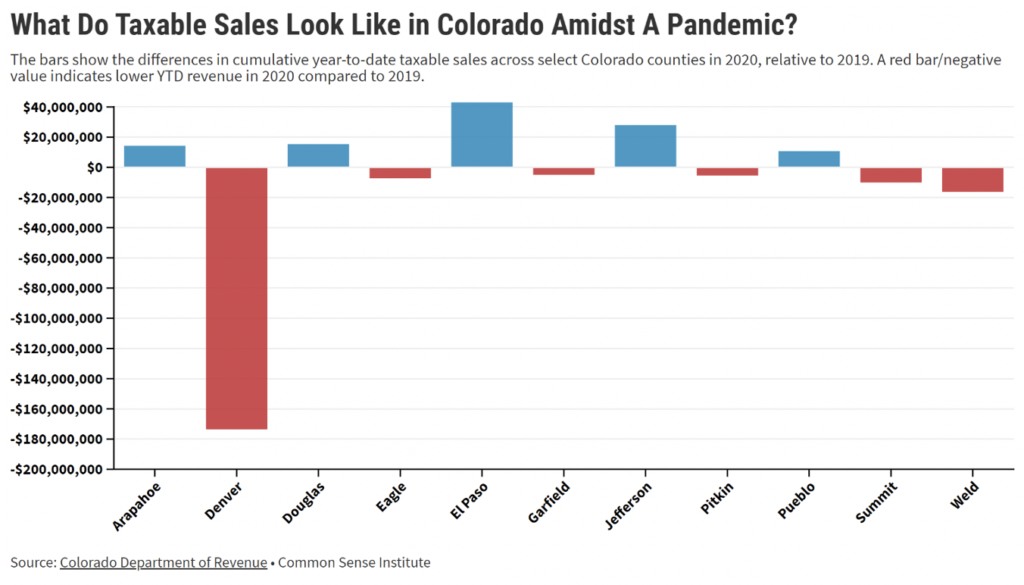

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Nebraska Sales Tax Rates By City County 2021

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Us Property Taxes Comparing Residential And Commercial Rates Across States – The Journalists Resource

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Property Tax Village Of Carol Stream Il