The new york sales tax rate is currently %. The december 2020 total local sales tax rate was also 8.000%.

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

The aurora, ohio, general sales tax rate is 5.75%.the sales tax rate is always 7.25% every 2021 combined rates mentioned above are the results of ohio state rate (5.75%), the county rate (1.5%).

Aurora sales tax calculator. Create your own online store and start selling today. How 2021 sales taxes are calculated for zip code 60505. The minimum combined 2021 sales tax rate for aurora, colorado is.

You can find more tax rates and allowances for aurora and colorado in the 2022 colorado tax tables. The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%. Take the price of a taxable product or service and multiply it by the sales tax rate.

This sales tax will be remitted as part of your regular city of aurora sales and use tax filing. What is the sales tax rate in east aurora, new york? Retailers are required to collect the aurora sales tax rate of 3.75% on cigarettes beginning dec.

How 2021 sales taxes are calculated in aurora. Business licensing and tax class aurora offers a free workshop designed to help new and existing businesses understand business licensing and taxes. The east aurora sales tax rate is %.

See reviews, photos, directions, phone numbers and more for sales tax calculator locations in aurora, co. There is no county sale tax for aurora, illinois. The aurora, missouri, general sales tax rate is 4.225%.the sales tax rate is always 8.85% every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (2.125%), the missouri cities rate (2.5%).

The aurora, colorado, general sales tax rate is 2.9%.depending on the zipcode, the sales tax rate of aurora may vary from 6.75% to 8.5% every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (0.25% to 0.75%), the aurora tax rate (2.5% to 3.75%), and in some case, special rate (0.1%. The december 2020 total local sales tax rate was also 5.500%. The average sales tax rate in colorado is 6.078%.

The sales tax rate for aurora was updated for the 2020 tax year, this is the current sales tax rate we are using in the aurora, south dakota sales tax comparison calculator for 2022/23. The current total local sales tax rate in aurora, ne is 5.500%. Create your own online store and start selling today.

In no event shall the amount of tax to be held be less than 3.75% (4.00% in arapahoe county) of 50% of the permit fee determination assessment. The 60505, aurora, illinois, general sales tax rate is 8.25%. The county sales tax rate is %.

This is the total of state, county and city sales tax rates. The december 2020 total local sales tax rate was also 8.250%. The colorado sales tax rate is currently %.

How 2021 sales taxes are calculated in aurora. There is no special rate for aurora. The minimum combined 2021 sales tax rate for east aurora, new york is.

Method to calculate aurora sales tax in 2021. Our sales tax calculator will calculate the amount of tax due on a transaction. Try it now & grow your business!

If this rate has been updated locally, please contact us and we. The combined rate used in this calculator (8.25%) is the result of the illinois state rate (6.25%), the aurora tax rate (1.25%), and. Aurora in illinois has a tax rate of 8.25% for 2022, this includes the illinois sales tax rate of 6.25% and local sales tax rates in aurora totaling 2%.

Revenues from sales taxes such as the hst and rst are expected to total $28.1 billion, or 26.5% of all of ontario’s taxation revenue, during the 2019 fiscal year. Federal revenues from sales taxes. Sales taxes also contribute to.

How 2021 sales taxes are calculated in aurora. You can find more tax rates and allowances for aurora and illinois in the 2022 illinois tax tables. The aurora's tax rate may change.

This is greater than revenue from ontario’s corporation tax, health premium, and education property tax combined. There is no city sale tax for aurora. , ne sales tax rate.

With sales tax, though, it’s almost never that easy. Aurora in colorado has a tax rate of 8% for 2022, this includes the colorado sales tax rate of 2.9% and local sales tax rates in aurora totaling 5.1%. 101 rows how 2021 sales taxes are calculated for zip code 80014.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. The calculator can also find the amount of tax included in a gross purchase amount. At a glance, calculating sales tax seems simple:

The sales tax vendor collection allowance is eliminated with the january filing period due february 20, 2018. The current total local sales tax rate in aurora, il is 8.250%. The real trick is figuring out what needs to be taxed and then calculating the correct tax rate — which, depending on how your business operates, could.

How 2021 sales taxes are calculated in aurora. Find 1466 listings related to sales tax calculator in aurora on yp.com. This is the total of state, county and city sales tax rates.

The current total local sales tax rate in aurora, co is 8.000%. The aurora, illinois, general sales tax rate is 6.25%.the sales tax rate is always 8.25% every 2021 combined rates mentioned above are the results of illinois state rate (6.25%), the illinois cities rate (1.25%), and in some case, special rate (0.75%). The aurora sales tax rate is %.

The county sales tax rate is %. Try it now & grow your business!

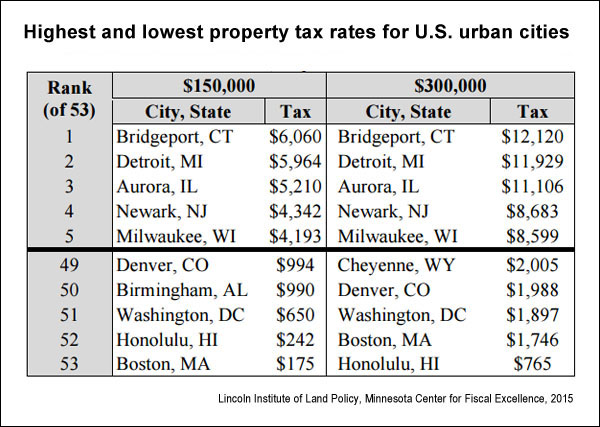

Us Property Taxes Comparing Residential And Commercial Rates Across States – The Journalists Resource

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

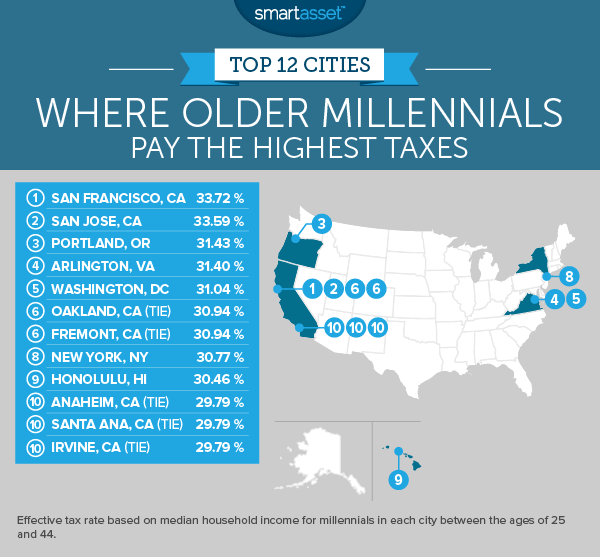

Where Millennials Pay The Highest Taxes – 2017 Edition – Smartasset

Set Up Automated Sales Tax Center

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator – Clevelandcom

22 Best Aurora Accountants Expertisecom

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

2

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 635

Illinois Car Sales Tax Countryside Autobarn Volkswagen

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Property Tax Village Of Carol Stream Il

Aurora Colorado Sales Tax Rate – Sales Taxes By City

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How Colorado Taxes Work – Auto Dealers – Dealrtax

Sales Tax Forms City Of Wasilla Ak

Nebraska Sales Tax Rates By City County 2021

Goods Imports Enjoy Most Sales Tax Exemptions – Newspaper – Dawncom