File, pay and print a copy of your sales tax return; This calculator is for new registrations only.

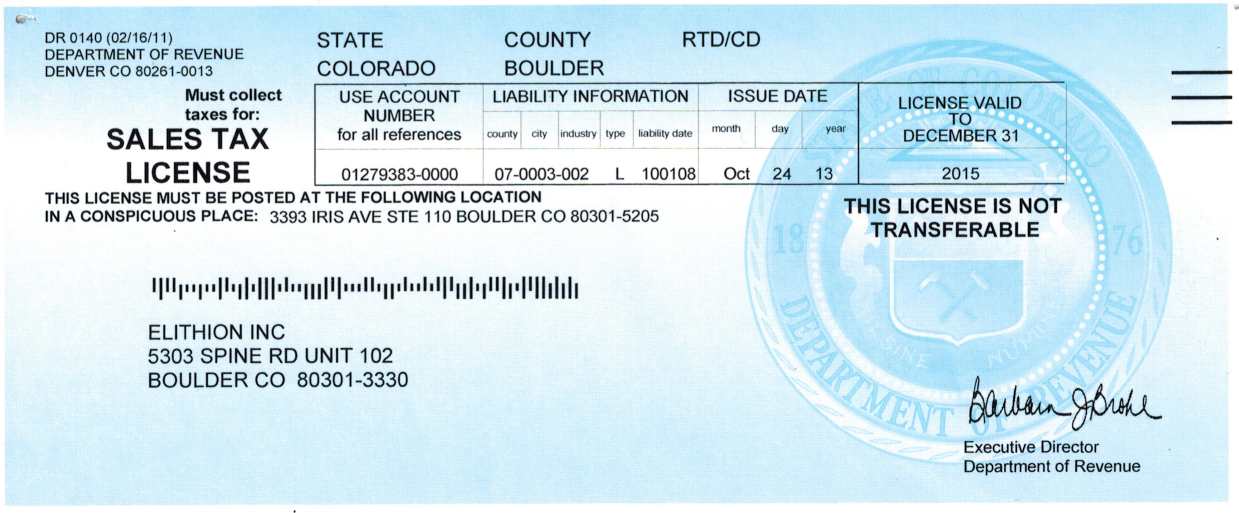

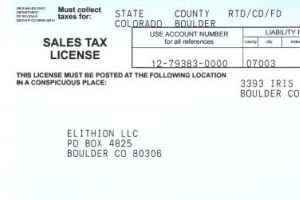

Company – Elithion

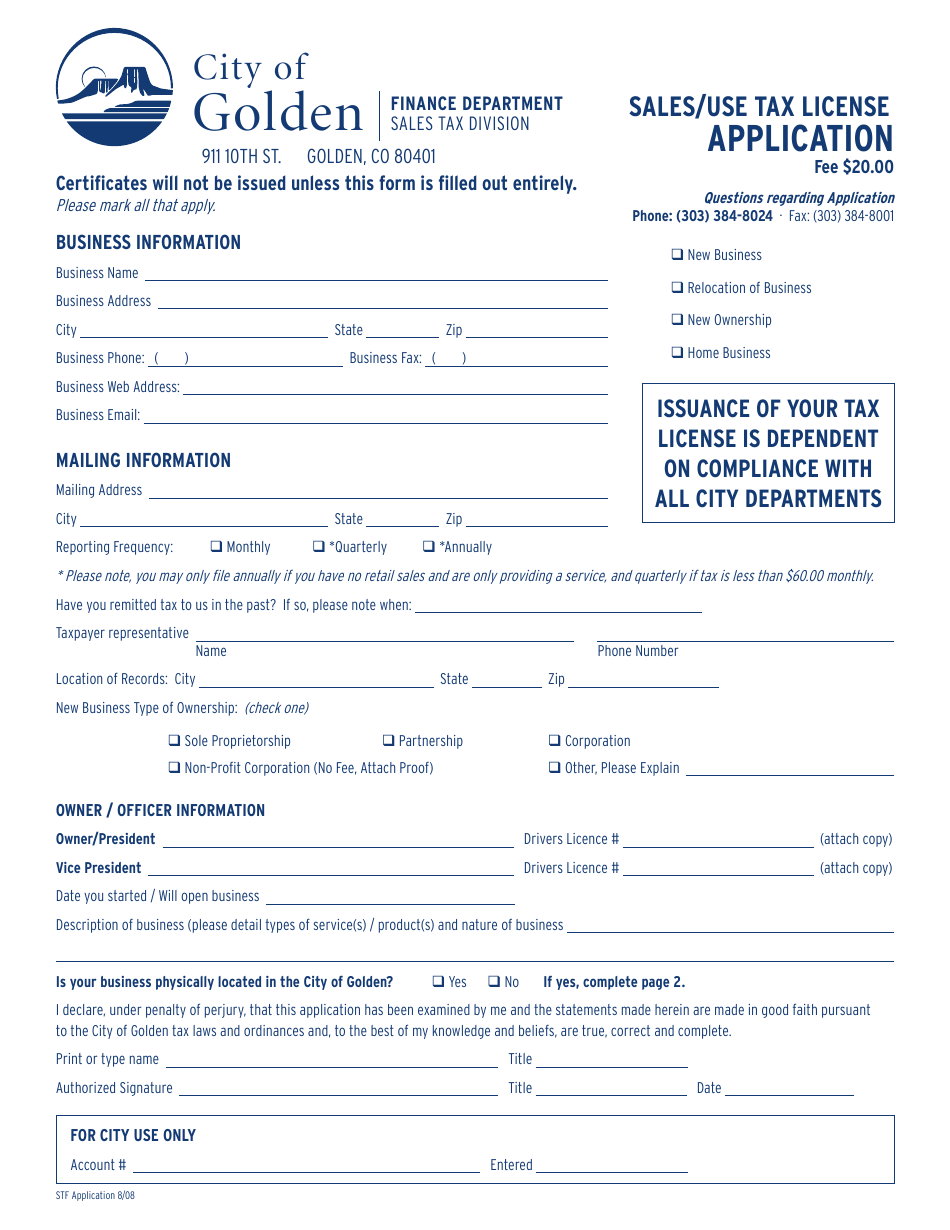

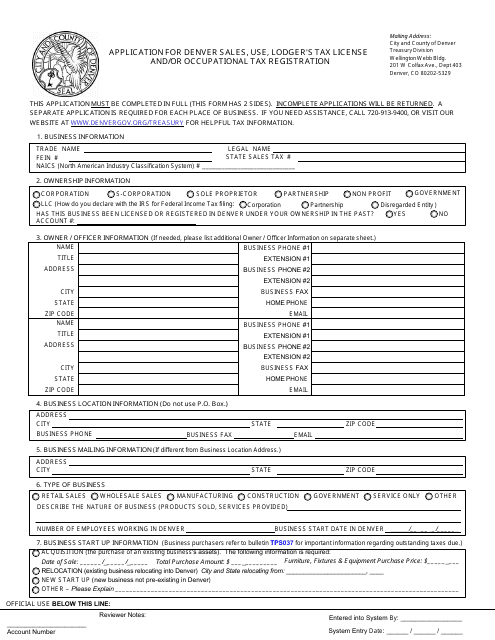

A sales and use tax license assigns you the right and obligation to collect sales tax for the city of aurora.

Aurora co sales tax license renewal. New businesses must obtain a business license prior to engaging in business in the city; Apply or renew a business license; Be sure to review the instruction and faqs or contact munirevs directly if additional assistance is needed.

The business license fee is $25.00; Sales tax licenses may also be renewed through electronic funds transfer (eft). It will not include sales tax.

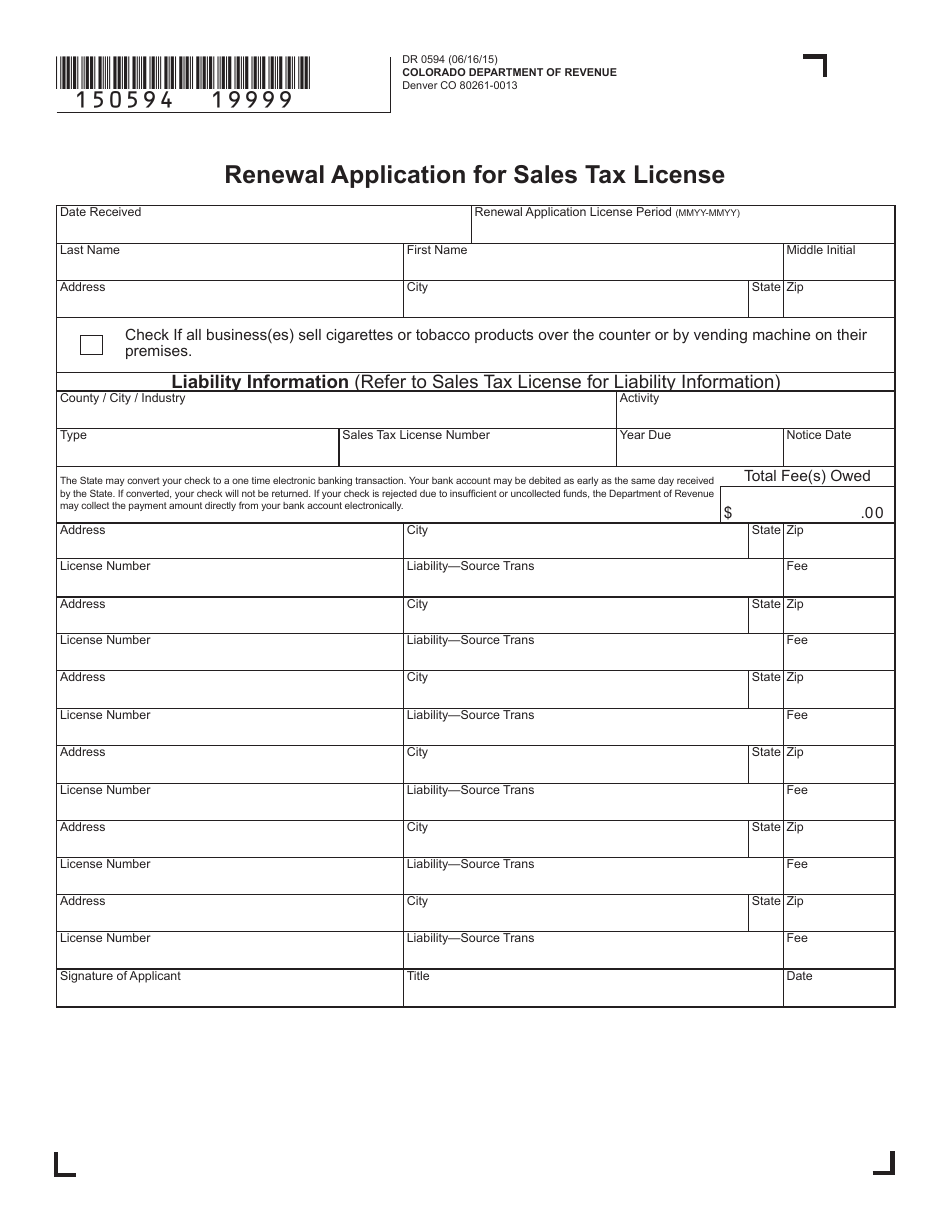

Alameda parkway, suite 5700 aurora, co 80012 303.739.7057 businesslic@auroragov.org In lieu of recording a adams county trade company name (our filing service fee includes trade name registration and newspaper legal publication for 4 weeks) you can also form a license in co or form an co license (starts @ $49 plus state fee for most states & includes bylaws for the license and limited liability operating agreement for the license that is required to open a business bank account). Complete and mail or take the renewal application for sales tax license to any taxpayer service center.

Business license renewal applications are due each calendar year on march 31st. Aurora offers a free workshop designed to help new and existing businesses understand business licensing and taxes. The annual sales and use tax license fee is $10.00 and must accompany a completed sales and use tax license application.

Sales tax vendor collection allowance. The sales tax vendor collection allowance is eliminated with the january filing period due february 20, 2018. Businesslic@auroragov.org © copyright 2021 city of aurora | version:

4 th of july activity / novelty, food vendor and event fee forms. It cannot be used to estimate renewal fees. The city’s communications department coordinates this event and other fees and.

Taxes collected for the city of aurora are monies held in trust by you. Sales tax administration email mailing / payment address p.o. Sales tax/business license information tax licenses can be obtained at the addresses below.

You have an obligation to account for and remit these funds to the city of aurora by the date due. The city of rifle uses munirevs, an online sales and use tax licensing and reporting system, to provide a secure, online tool for businesses to apply for sales tax licenses, file tax returns, and submit payments. Manage my business/tax account (password required) online payment options!

You must obtain a sales and use tax license in order to conduct business in the city of delta. Pay past due balances on your account. When renewing by eft, you do not need to send us the dr 0594 form because that can cause a duplicate filing.

Understand the process of obtaining a business license in aurora, taxpayer rights and responsibilities, taxes you may have to pay, including sales tax, use tax and occupational privilege tax, and the reason that audits are conducted. All licenses are for a calendar year and expire on the 31st of. All businesses are required to file a sales and use tax return even if there are no retail sales as almost all businesses owe some amount of use.

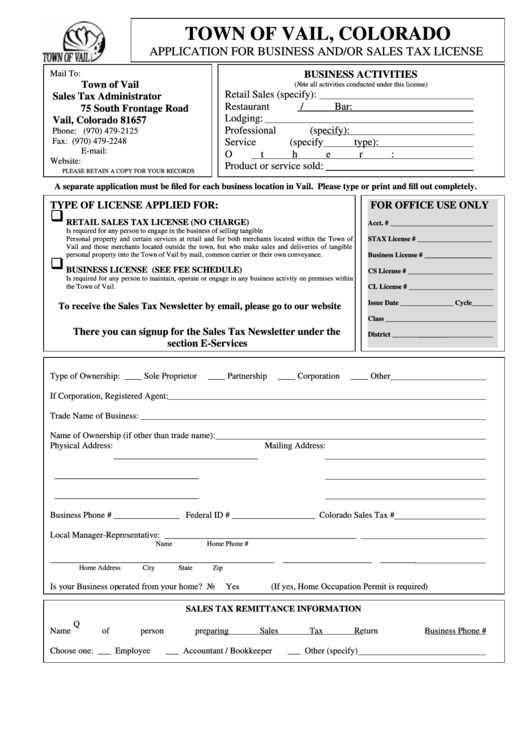

Copies of both state and city tax licenses must be provided. To apply for any of the below mentioned licenses or a sales, use or lodgers tax license, please access the munirevs system with the following link: This estimate will include license fees and ownership tax only, based on the weight, age and taxable value of the vehicle.

City of aurora tax & licensing division staff will help answer questions specific to your industry or business. See tax rates and fees in arapahoe county. For business license fees please refer to ordinance 6.16 or click the appropriate form on this page.

Initial license fee/renewal license fee: Please note, with zero sales tax returns you will need to complete the payment process all the way to the end where you will receive a payment confirmation page, failure to complete all steps may result in penalties and interest. Applies to all businesses participating in the 4 th of july special event.

Business licensing and tax class. If you are a new business an initial business license application must be submitted to the clerk’s office. Adams county government center • 4430 south adams county parkway • brighton, colorado 80601 • ph:

Two years from date of issuance : Visit the munirevs website to register and begin remitting. The city of delta is a home rule city that collects and administers its own sales and use tax, which is currently 3%.

Company – Elithion

Sales Tax – City Of Aurora

Colorado Business License

Business Licensing – City Of Aurora

Colorado Business License

Colorado Business License

Taxes – City Of Aurora

2

How To Apply For A Colorado Sales Tax License Department Of Revenue – Taxation

Sales Tax – City Of Aurora

City Of Golden Colorado Salesuse Tax License Application Form Download Printable Pdf Templateroller

Taxes – City Of Aurora

Sales Tax License Grand County Co – Official Website

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Colorado Business License

Business Licensing – City Of Aurora

Form 0594 Download Printable Pdf Or Fill Online Renewal Application For Sales Tax License Colorado Templateroller

Colorado Business License

2