Sales tax exemptions in arizona. The district’s estate tax exemption has dropped to $4 million for 2021.

State Corporate Income Tax Rates And Brackets Tax Foundation

For taxpayers subject to the highest rate schedule, starting in tax year 2021, arkansas’s top marginal rate has been reduced from 6.6 to 5.9 percent, which was accomplished by eliminating the top income tax bracket.

Arizona estate tax exemption 2021. The following retail sales are no longer taxable from and after june 30, 2021: The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. In 2020, the rates ranged from 12 to 16 percent, but they now range from 11.2 to 16 percent.

No estate tax or inheritance tax. Sale of propagative materials for use in commercial crop production. Some examples of exceptions to the sales tax are certain types of groceries, some medical devices, certain prescription medications, and any machinery and chemicals which are used in research and development.

This certificate is prescribed by the department of revenue pursuant to a.r.s. All estates in the united states that are worth more than $5.49 million as of 2017 are required to pay an estate tax. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions.

The current federal estate tax is currently around 40%. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: Alĭ ṣonak) is a state in the western united states, grouped in the southwestern and occasionally mountain subregions.

This exemption rate is subject to change due to inflation. Federal estate, gift, and gst tax. For tax year 2017, the estate tax exemption was $5.49 million for an individual, or twice that for a couple.

This rate reduction is the result of a 2019 tax reform law that also Its capital and largest city is phoenix. A person gives away $2,000,000 in their lifetime and dies in 2021 and is entitled to an individual federal estate tax exemption of $11,700,000.

As part of this legislation, the cities are required to come into compliance with the state's retail classification. Beginning in 2019, the cap on the connecticut state estate and gift tax is reduced from $20 million to $15 million (which represents the tax due on a connecticut estate of approximately $129 million). The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.)

On may 31, 2019, arizona governor doug ducey signed house bill 2757 into law. Final regulations, user fee for estate tax closing letter (td 9957 pdf), establishing a new user fee of $67 for persons requesting the issuance of irs letter 627, estate tax closing letter (etcl) will be effective october 28, 2021. But that doesn’t leave you exempt from a number of other necessary tax filings, like the following:

A democratic senator from arizona who has. However, the new tax plan increased that exemption to $11.18 million for tax year 2018, rising to $11.4 million for 2019, $11.58 million for 2020, and now $11.7 million for 2021. Starting in 2022, the exclusion amount will increase annually based on a cost of.

New process for obtaining an estate tax closing letter effective october 28, 2021 final regulations, user fee for estate tax closing letter ( td 9957 pdf ), establishing a new user fee of $67 for persons requesting the issuance of irs letter 627, estate tax closing letter (etcl) will. There are no inheritance taxes or estate taxes in arizona. Federal exemption for deaths on or after january 1, 2023.

Their federal estate tax exemption is no longer $11,700,000, but $9,700,000. It is the 6th largest and the 14th most populous of the 50 states. The district of columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to.

The plan omits changes in the estate tax exemption level, treatment of grantor trust assets, and valuation rules for transfers of nonbusiness assets. Residents and nonresidents owning property there can rejoice. Even though arizona does not have its own estate tax, the federal government still imposes its own tax.

It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale. For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020).

Newsletter Key Retirement And Tax Numbers For 2021 Key Retirement And Tax Numbers For 2021

Are There Any States With No Property Tax In 2021 Free Investor Guide

All You Need To Know About Thailand Pass List Of No Quarantine Countries Under The Test And Go Program

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Closer Look At 2021 Proposed Tax Changes – Charlotte Business Journal

All You Need To Know About Thailand Pass List Of No Quarantine Countries Under The Test And Go Program

Gst Ready Reckoner By Vs Datey Taxmann Virtual Bookebook

All You Need To Know About Thailand Pass List Of No Quarantine Countries Under The Test And Go Program

Tax Guide

Pajak 2022 Harus Utamakan Prinsip Justice Dan Fairness

Global Service Providers Guide 2021 By Chemical Watch – Issuu

What Is The New Estate Tax Exemption For 2021 – Phelps Laclair

Property Taxes

Pajak 2022 Harus Utamakan Prinsip Justice Dan Fairness

Pajak 2022 Harus Utamakan Prinsip Justice Dan Fairness

Pajak 2022 Harus Utamakan Prinsip Justice Dan Fairness

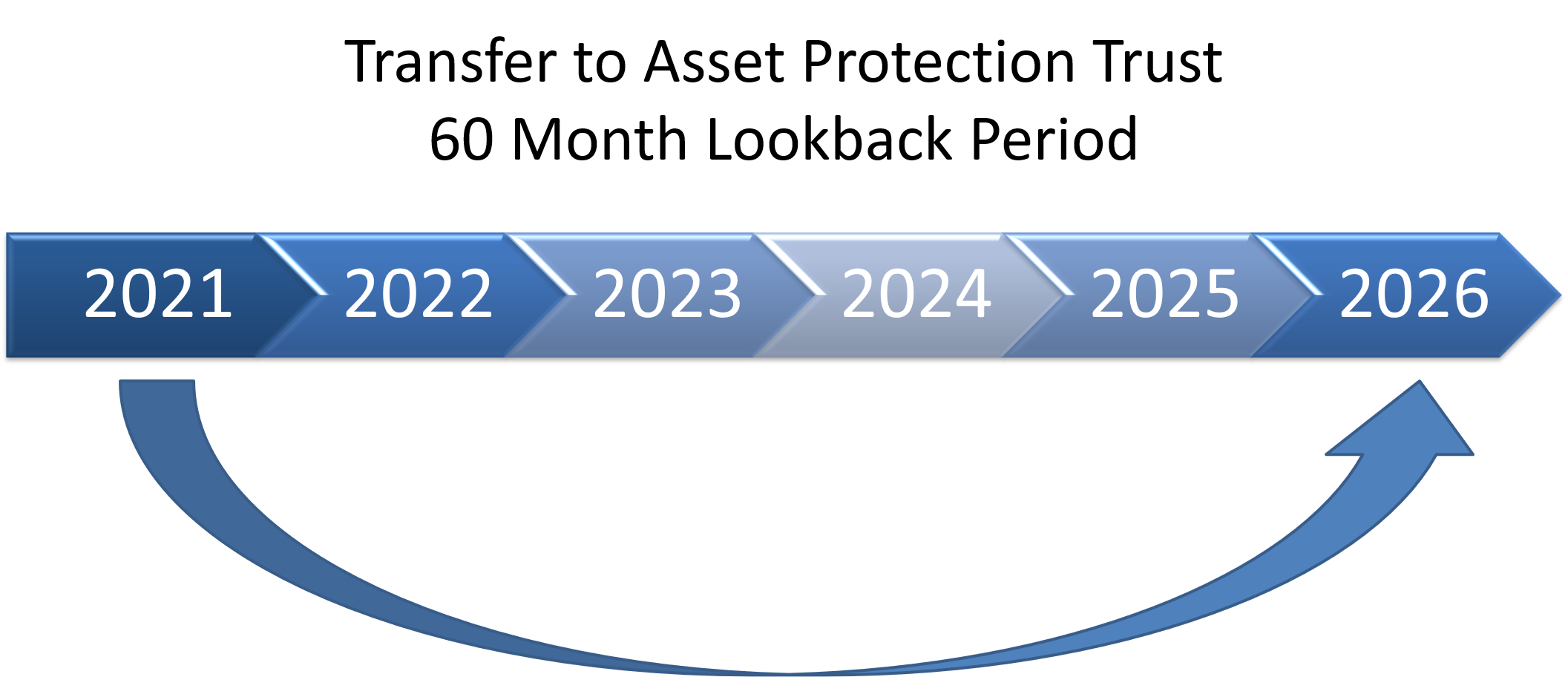

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Catalogue New Forthcoming Titles – Autumn Winter 2021-2022 By Brepols – Issuu

Data Protection 2021 Laws And Regulations Indonesia Iclg