The estate even after the deceased’s death, the estate may still be receiving income from various sources (e.g. Polls, fees and parking associated with receiving medical treatment.

Which Expenses Are Tax-deductible In Australia Rask Education

These expenses may also include a reasonable amount to cover the cost of:

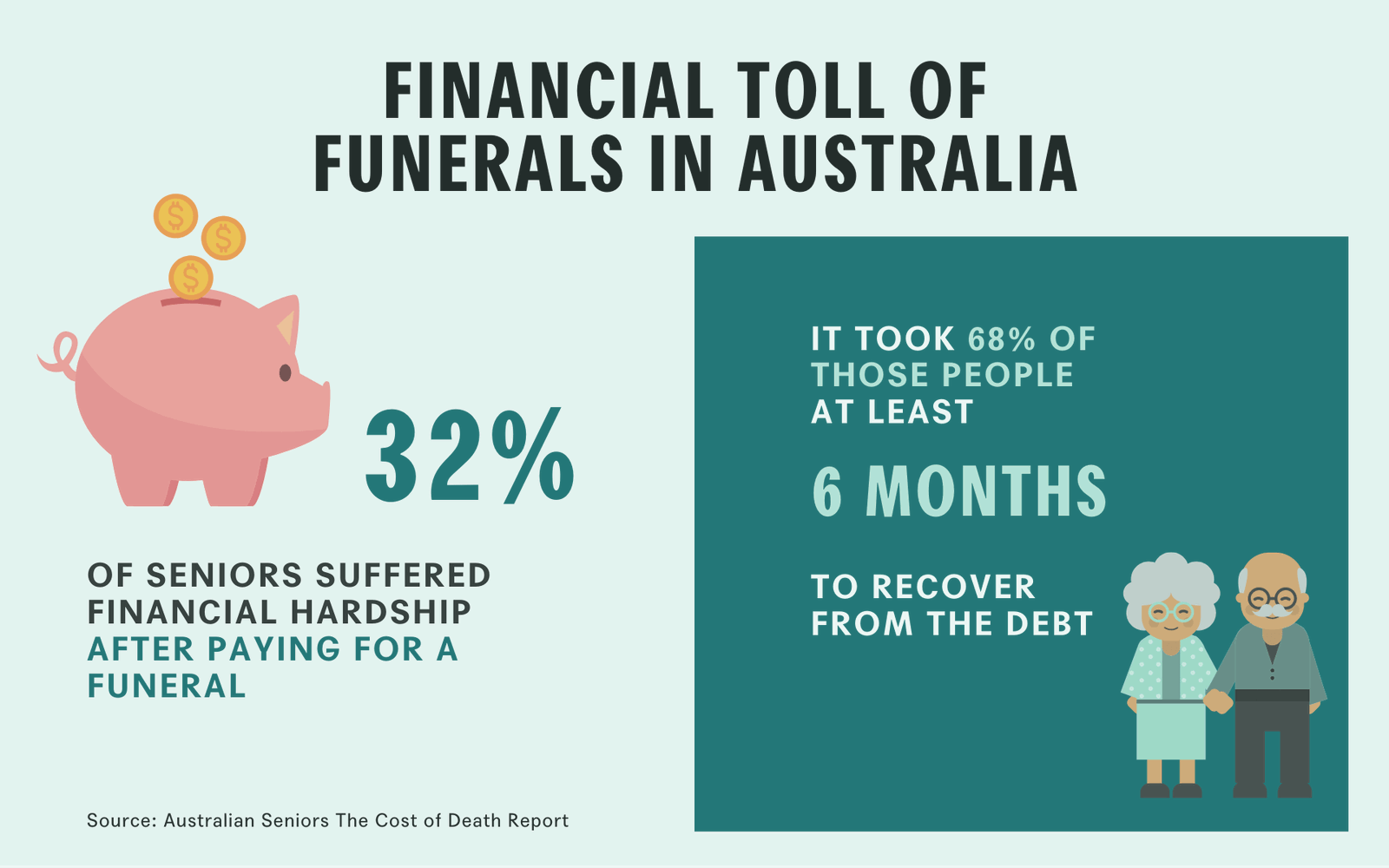

Are funeral expenses tax deductible in australia. A detailed tax invoice is usually sent out within 10 days of the funeral, with up to 30 days to settle the balance of the account. The department of social services review this limit on 1 july each year. Benefits received by the deceased estate under a friendly society funeral policy that was taken out before 1 january 2003 are exempt from tax.

Entitlements can change without notice and we recommend you contact your nearest centrelink office for further information. Any deductible expenses incurred after the date of death. However, it’s always possible that tax laws may change in future.

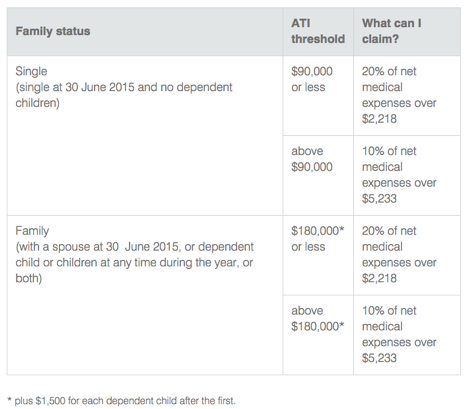

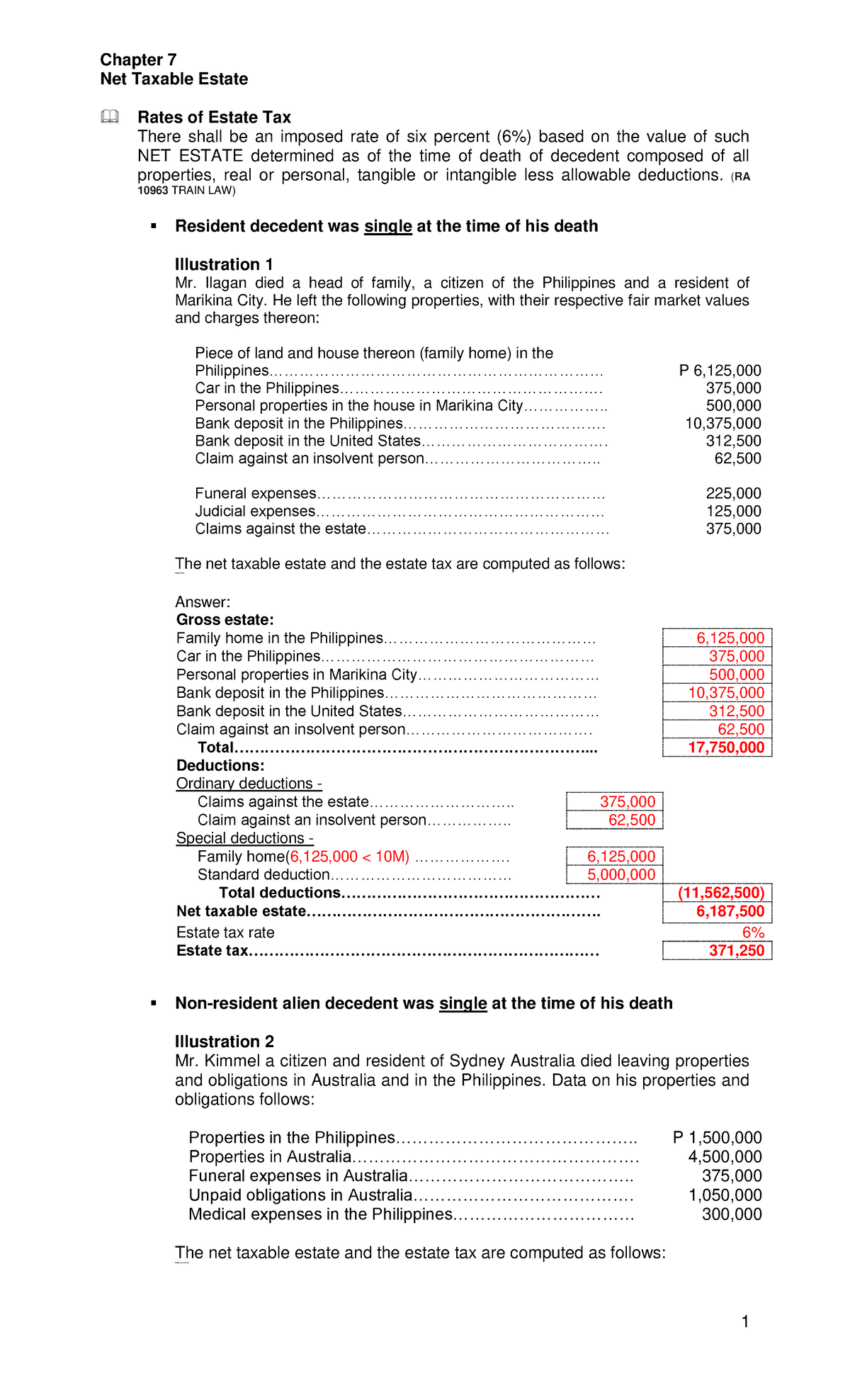

The amount of funeral expenses within the 200,000 threshold, which are still payable shall be allowed as a deduction from the gross estate. A single person with a taxable income of less than $88,000 can claim 20% of net medical expenses over $2,162. The 1040 tax form is the individual income tax form, and funeral costs do not qualify as an individual deduction.

You may also deduct the cost of a headstone or tombstone marking the site of the deceased’s grave. They may legitimately include the cost of funeral expenses as a deduction. Funeral insurance covers you for a limited benefit (usually up to $15,000) to help your loved ones with the cost of your funeral if you pass away.

But there’s generally no tax on the benefits that you or your beneficiaries will receive. Asic’s money smart has looked into how much funerals cost in australia, and it has been revealed that funerals cost between $4000 and $15,000. The amount you’ve invested in the bonds is under the funeral bond allowable limit.

Funeral expenses are not tax deductible and are not eligible for the medical expenses tax offset. We only require a deposit when you arrange the funeral. Assessable income earned or derived by the deceased person;

• flowers • refreshments provided for the mourners after the service Prepaying funeral expenses or investing in a funeral bond can result in significant tax savings in the future. Capital gain from the sale of estate assets.

You don’t also have prepaid funeral expenses; One of the most immediate expenses you are likely to pay after death is funeral costs. If you jointly own a funeral bond, we count it as a single bond that you own.

There are a few tax returns each year. In short, these expenses are not eligible to be claimed on a 1040 tax form. A single person with a taxable income over $88,000 can claim 10% of net medical expenses over $5,100.

Bonds of up to $12,000 are classified as ‘exempt assets’ for the age pension under the centrelink and department of veterans’ affairs means test. You can include tax agent fees and similar expenses incurred by the taxpayer’s executor, as well as all: Deductible medical expenses may include, but are not limited to the following:

Funeral expenses you may deduct funeral costs and reasonable mourning expenses. For example, although jane rawlings lives in edinburgh, when she was having trouble finishing one of the harry potter novels, she moved into a local edinburgh hotel for a month. The payment of the funeral account is not contingent on probate being granted or estates being settled.

To claim medical expenses on your tax return you must itemize your tax. As at 1 july 2021 the allowable limit is $13,500. Bank interest or dividends from shares) and/or incurring capital gains tax liability (e.g.

Funeral expenses of an employee: Permits (for example, for a burial at sea or private land) burial or cremation; Is funeral insurance tax deductible?

The occasion of death removes 'employee' status, and therefore a fringe benefit does not arise. Funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. The general principle with tax deductions is that the item is allowable as long as the expense is incurred in earning assessable income, says corias.

If you want to pay in advance, there are different options to consider. In most cases, funeral insurance premiums are not tax deductible. Other expenses such as a celebrant or clergy, flowers, newspaper notices and the wake;

It should also be known that if expenses are incurred for the funeral of a dependent, a certain amount of the cost can become a tax deduction. In the deceased estate's trust return, include: A family with an adjustable a income of $176,000.

In the vast majority of cases, however, funeral expenses are a nondeductible expense, which means that they cannot be deducted on a tax return. If the deceased person was insured under a friendly society funeral policy taken out after 31 december 2002, the investment income from the funeral policy is included in the assessable income of the estate, if the estate’s trustee: A typical funeral will have these costs:

A number of costs are included in this price including the coffin, transport, funeral director fees. What’s more, this may not apply to your specific situation. Premiums paid for this type of cover are not generally tax deductible.

The unpaid portion of the actual funeral expenses incurred which is in excess of the 200,000 threshold shall be allowed as deduction under “claims against the estate” The deductible travel expenses will include airfares. Section 136(1) definition of fringe benefit:

Funeral expenses are not tax deductible because they are not qualified medical expenses.

What Tax Deductions Can I Claim Go To Court Lawyers

Taxpack 2011 Supplement – Australian Taxation Office

Medical Expenses Tax Offset Online Tax Australia

Funeral Expenses Tax Deductible Ato Best Reviews

Funeral Expenses Tax Deductible Ato Best Reviews

2

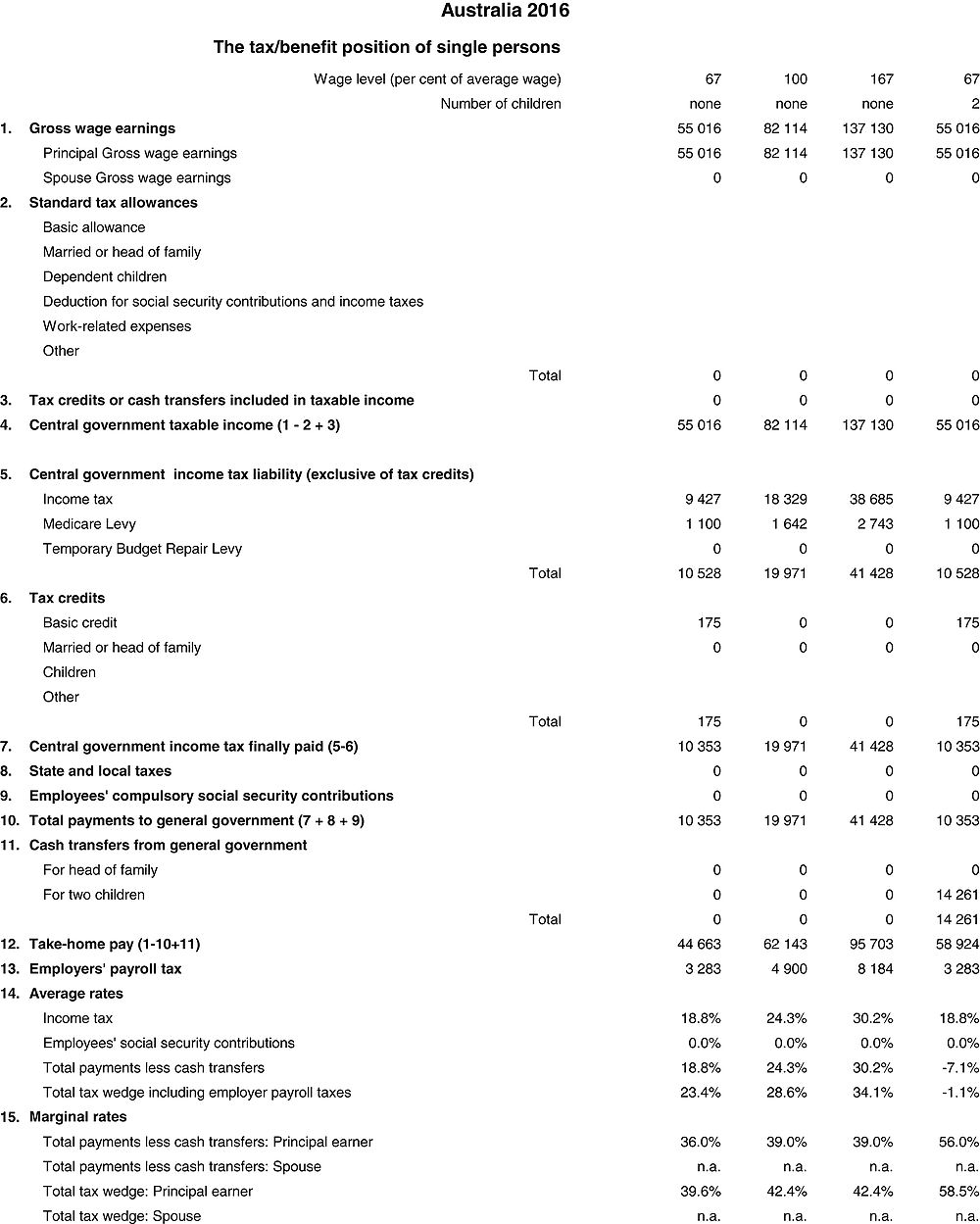

Deductible Expenses Under The Proposed Council Directive And Deviation Download Table

Pdf Taxing Popularity The Story Of Taxation In Australia

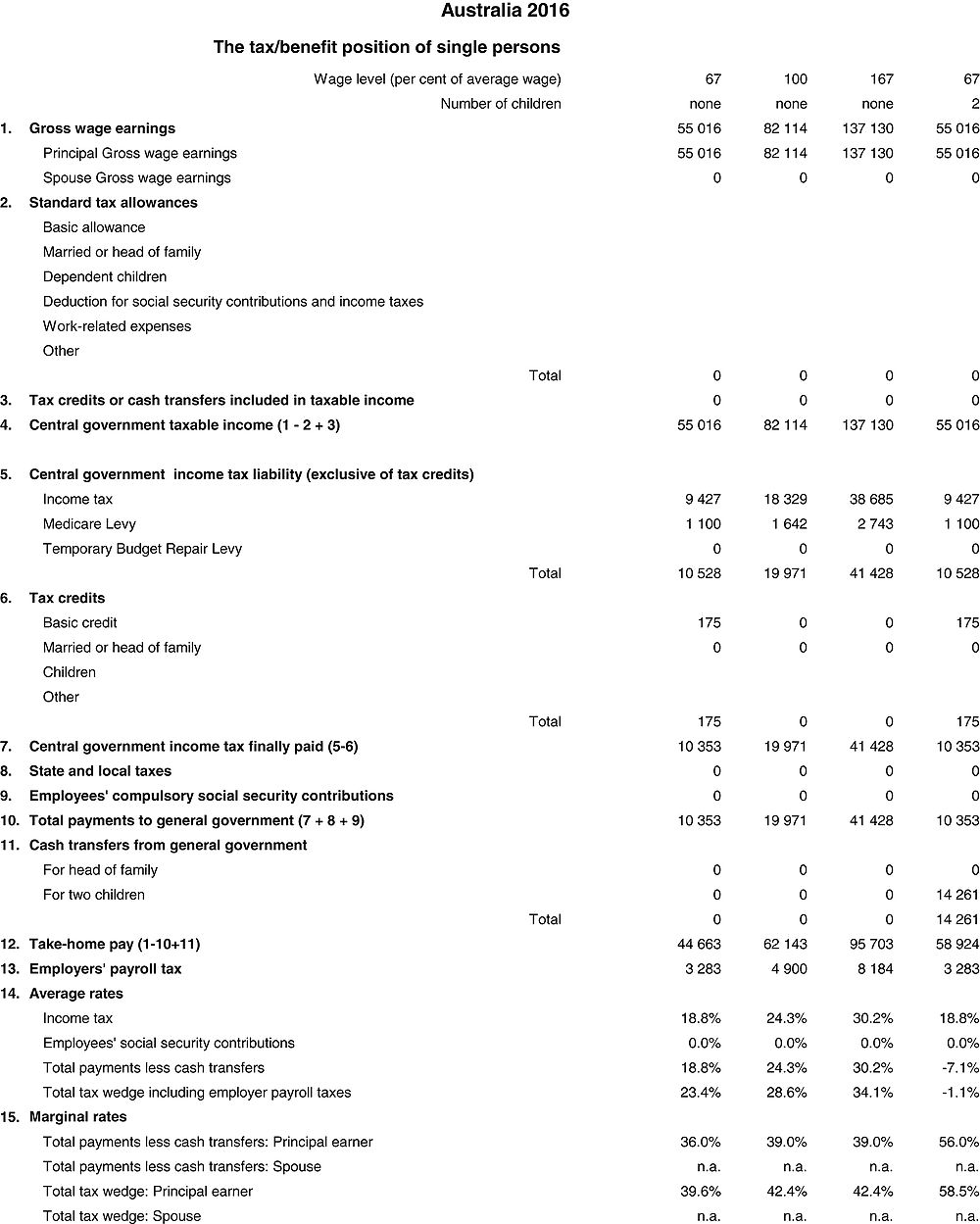

Italy Taxing Wages 2020 Oecd Ilibrary

Are Funeral Expenses Tax Deductible Claims Write-offs Etc

Medical Expenses Tax Offset Online Tax Australia

Ppt – Calculating Tax Deductions Powerpoint Presentation Free Download – Id1716749

Home Oecd Ilibrary

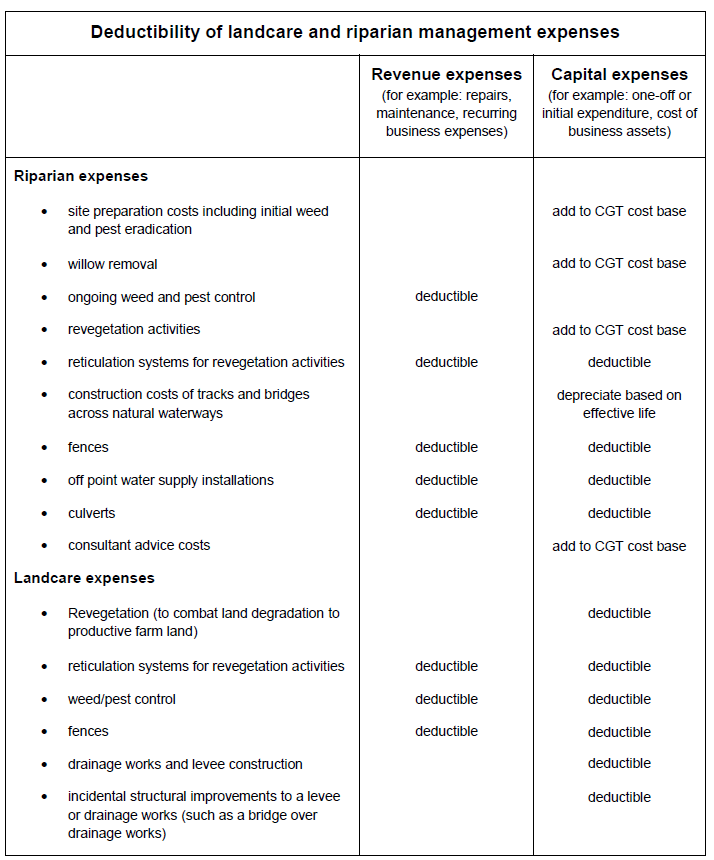

Tax Deduction Landcare And Similar Expenses Farm Table

Gofundme For Funeral Expenses How To Set Up A Fundraising Campaign

Chapter 7 Net Taxable Estate – Taxation Ii – Jd-tax2 – Feu – Studocu

Gofundme For Funeral Expenses How To Set Up A Fundraising Campaign

Are Funeral And Cremation Expenses Tax Deductible National Cremation

Australias Weirdest Tax Deductions