However, donations to actblue charities and other registered 501(c)(3) organizations are tax deductible. But can campaign donors write off any of these contributions on their federal income taxes?

Are Political Contributions Tax Deductible Anedot

Are political contributions tax deductible?

Are federal campaign contributions tax deductible. Unlike charitable donations, which are tax deductible, donations to a political party or pac are not tax deductible. According to the internal service review (irs), the irs publication 529 states: Contributions to political campaigns and candidates are not tax deductible.

You cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. You can’t deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. If you have made contributions, donations, or payments for any of these, that amount can't be deducted from your taxes:

If you gave to political candidates last year, you might be wondering if campaign contributions are tax deductible as you gear up for this year’s tax preparation. The irs is very clear about whether you can deduct political campaign contributions from your federal income taxes: Data on individual contributors includes the following:

Political donations aren’t deductible on federal income taxes — but lots of other expenses are. There are also limits to how much you can contribute to a campaign. The irs states, “you cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund.

Resources for charities, churches, and educational organizations. The same goes for campaign contributions. Thank you for contributing through the combined federal campaign (cfc).

Resources for social welfare organizations. But when it comes to individual states, that's not the whole story. This means that if you donate to a political candidate, a political party, a campaign committee or a political action committee (pac), these.

Make a year end federal club council monthly gift today your year end gift in support of the groundbreaking work of the hrc foundation is tax deductible to the full extent of the law and enables a wide variety of educational outreach and informational services in our pursuit of fairness & equality. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the cfc. Likewise, gifts and contributions to 501(c)(4) social welfare organizations are not deductible as charitable contributions.

Resources for labor and agricultural organizations. Your tax deductible donations support thousands of worthy causes. Andrew harrer—bloomberg via getty images.

The answer is a stone cold no. Political donations to federal candidates and committees are not deductible from federal income taxes, whether they are made online or in person. Donors should contact a tax advisor for more information.

Section 6113 of the internal revenue code requires political committees whose gross annual receipts normally exceed $100,000 to include a special notice on their solicitations to inform solicitees that contributions are. If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible. Can a deduction to a political campaign be deducted on the donor’s federal income tax return?

Contributions to political parties and campaigns, generally, must be disclosed to the federal election commission (fec) which publishes the information. Contributions to the organization under irc 162 dues or contributions to irc 501(c)(4), (c)(5), and (c)(6) organizations may be deductible as business expenses under irc 162. The commission maintains a database of individuals who have made contributions to federally registered political committees.

If you routinely deduct contributions made to charities on your tax returns, you may assume that the process works roughly the same when you make political donations. Amounts paid for intervention or participation in any political campaign may not be deducted as a business expense. Though giving money to your candidate of choice is a great way to get involved in civic discourse, political donations are not tax deductible.

With this, your business is not allowed to deduct political contributions on its tax return. Each of these zones has. Contributions or gifts to the human rights campaign foundation are tax deductible.

“you cannot deduct contributions made to a political candidate,. Even though charitable donations can be deductible from your tax, all donations made to politics cannot. And some states offer tax breaks for campaign contributions.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political. The cfc is comprised of 30+ zones throughout the united states and overseas. According to the internal service review (irs), the irs publication 529 states:

According to the irs, the answer is a very clear no. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible.”. “you cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund.

Generally, a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year.

Are Political Contributions Tax Deductible – Turbotax Tax Tips Videos

Do I Qualify For New 300 Tax Deduction Under The Cares Act

Are Political Contributions Tax Deductible Hr Block

Heres How To Get This Years Special Charitable Tax Deduction

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

Are Campaign Contributions Tax Deductible

Pin On Web Design Inspiration Ui Ux

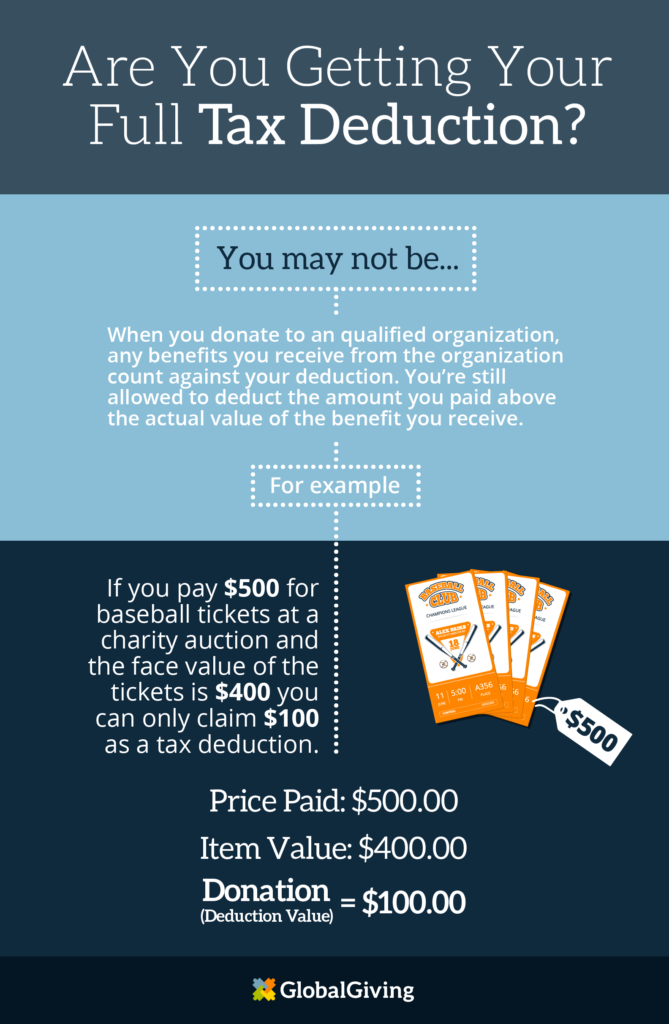

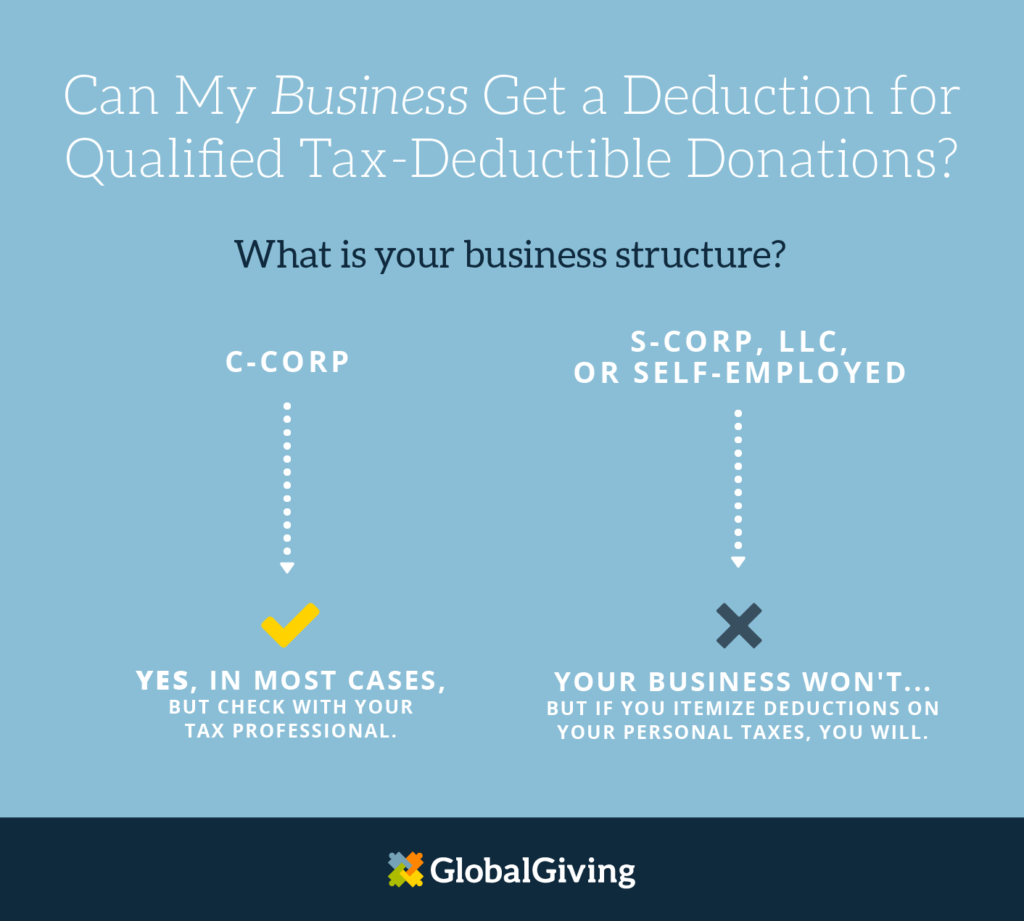

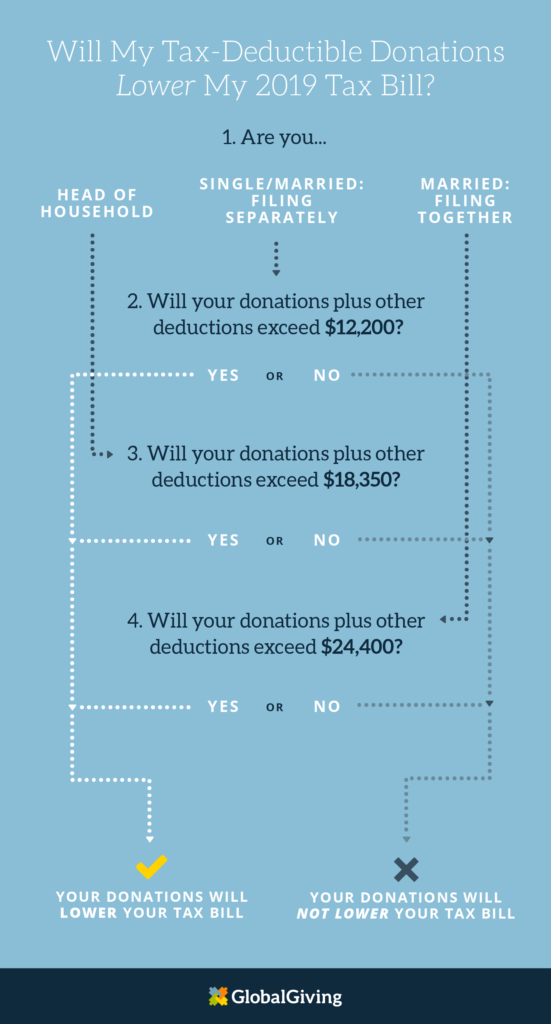

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Are Political Contributions Tax-deductible Personal Capital

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Are Your Political Contributions Tax Deductible Taxact Blog

Pin On Politicscurrent Affairs

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Are Political Contributions Tax Deductible Hr Block

Charity Organisation Charity Create Website Organisation

Tax-deductible Donations These Are The Conditions

Are Political Donations Tax Deductible Credit Karma Tax

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Susie Lee On Twitter Campaign Finance Susie