Where the business installs, new and unused, charging points for electric vehicles up to 31st march 2023, it can claim a 100% fya for those costs. Because of the tax benefits of electric and hybrid cars this means tom and the company can potentially save tax and national insurance of £10,103 overall.

Road Tax Company Tax Benefits On Electric Cars Edf

There is an exception to this rule though.

Are electric cars tax deductible uk. The tax rules for ultra low emission company cars are set to change from 6 april 2020 making the purchase of an. 100% first year allowance (fya) first year allowance is claimable for up to 100% of the cost of qualifying low emission and electric cars. Are electric cars tax deductible?

Road tax for zero emissions car is free too. Any vehicle (excluding bevs) with a list price of £40,000 or above will incur an additional premium rate for 5 years (starting from the second time the vehicle is taxed). Electric and ultra low emission vehicles (ulevs) are great for more than just the environment, as road tax and company car tax on electric cars is much lower.

That is because with every £2 that you earn over £100,000 you lose £1 of your personal allowance. A change being driven by the rapid rise in electric and hybrid vehicles. Road tax, insurance, breakdown cover

Summary of electric car tax benefits. Pure battery electric vehicles (bevs) are exempt from ved. From 1 april 2021 the enhanced ecas only apply to fully electric vehicles (evs).

However, for an electric car, the entire £30k can be used as a tax deductible cost, thereby reducing your corporation tax bill by £5,700 in year 1. It all depends on how much business use your vehicle gets. The rates for all 100% electric vehicles are now £0 and this will apply until at least 2025.

Business owners who buy and use a car for work purposes can take advantage of. Charge for battery electric cars. If their employer does not reimburse them, they are entitled to a deduction under s337/s338 itepa 2003 for the.

Ten easy ways to cut your tax bill. This means the full cost would be an allowable deduction against your business’ profits, so it reduces your company’s tax bill. There are reduced ved rates for.

Opt for a low emission vehicle. Car leases can be attractive Cars with lower emissions benefit from reduced benefit in kind , at 0% for the 2020 tax year, increasing to just 1% for 2021/22, then 2% for 2022/23.

You may think that the main savings made by buying a company car are the fuel savings. For the example above, purchasing the bmw i3 at £33,340, would save corporation tax of £6,335. By choosing a tesla car, your business can claim a 100% year one deduction for the cost of the vehicle.

Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. From 6th april 2018, where the company allows employees to charge their own electric vehicles at the workplace, there is no taxable benefit for the provision of that free electricity. It brings your income tax rate to effectively 60%.

Therefore cars with any co2 emissions will go back to only getting the tax relief at 8% per year. As with car tax and company car tax, the rate at which a company can 'write down' the value of company vehicles is based on its co2 emissions. Add up all your costs, then deduct the costs of private use.

From april 2021, this will no longer be the case as only zero.

Government Electric Car Grants – Save On Your Ev Leasing Options

Road Tax Company Tax Benefits On Electric Cars Edf

How To Get More Electric Vehicles On The Road

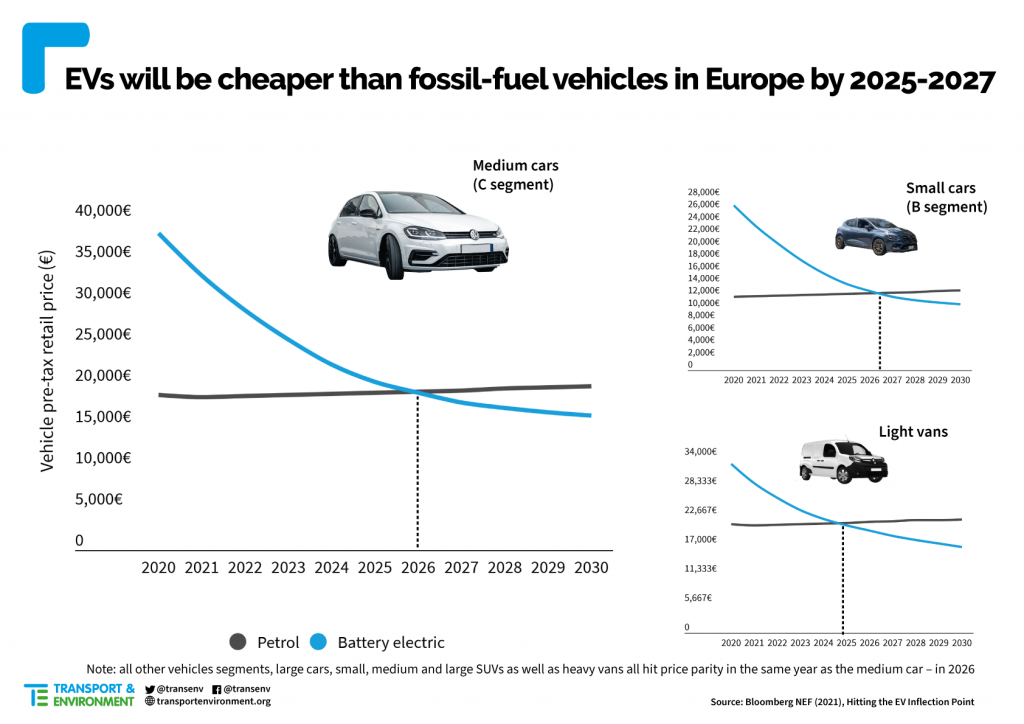

Evs Will Be Cheaper Than Petrol Cars In All Segments By 2027

The Ev Wedge How Electric Vehicle Fuel Savings Vary By Country And Car Shrinkthatfootprintcom

Leqbkq_x_vbk4m

Electric Car Tax Benefits – Green Car Guide

Electric Cars Rise To Record 54 Market Share In Norway Electric Hybrid And Low-emission Cars The Guardian

Government Grants For Electric Cars Uk Edf

The Tax Benefits Of Electric Vehicles Taxassist Accountants

How To Spread Norways Success With Electric Cars

Uk Chancellor Announces 390 Million In New Funding To Support Ev Industry Adoption Electric Vehicle Charging Electric Vehicle Charging Station Electric Cars

Electric Car Incentives In Norway Uk France Germany Netherlands Belgium Cleantechnica Electricity Electric Car Incentive

Corporate Strategy To Optimize The Development Of Battery Electric Vehicle In Indonesia Sbm Itb

Electric Vehicles Face Lingering Challenges How Are Startups Helping Early Metrics

Corporate Strategy To Optimize The Development Of Battery Electric Vehicle In Indonesia Sbm Itb

Road Tax Company Tax Benefits On Electric Cars Edf

Carpartscom Launches First Electric Vehicle Hybrid Focused Shopping Hub Business Wire

The Ev Tax Credit Can Save You Thousands — If Youre Rich Enough Grist