Finally, individuals can deduct the costs for. For instance, if you had $3,000 in dental expenses and made $20,000, $1,500 of your expenses are deductible.

How Much Do Dental Implants Cost In Canada Explained

In addition to fillings, dentures, dental implants, and other dental work that is not covered by your insurance plan, dental expenses also include other dental work.

Are dental implants tax deductible in canada. You should speak with your accountant or financial advisor for further details. This is only a partial list. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning, the application of sealants, and fluoride treatments to prevent tooth decay.

Have a form med 2 completed by your dentist. Ad get unlimited tax deduction questions answered online & save time. If you receive treatment over more than one year, they must complete a separate med 2 for.

Phototherapy equipment for treating psoriasis or other skin disorders. The only dental work that is not covered is cosmetic work, such as teeth whitening, which is not. All costs must have been incurred by the taxpayer, a spouse or dependent.

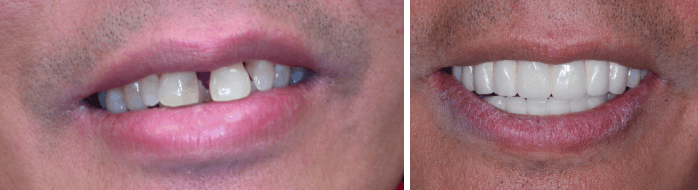

Denture implants and dental implants are eligible medical expenses that you can claim on your tax return. In fact, most of the dental expenses you pay for throughout the year are deductible including basic. In order to help you with this cost, the canada revenue agency allows you to deduct dental expenses from your income tax when filing.

Qualified costs are limited to expenses paid for cure, diagnosis, mitigation, prevention, or treatment of disease, including dental and vision costs. Ad get unlimited tax deduction questions answered online & save time. And dental crowns to treat a damaged tooth or support a bridge.

Are dental implants tax deductible in canada. You can claim the amount paid to buy, use, and maintain this equipment. Claiming dental expenses is an allowable deduction on your tax return.

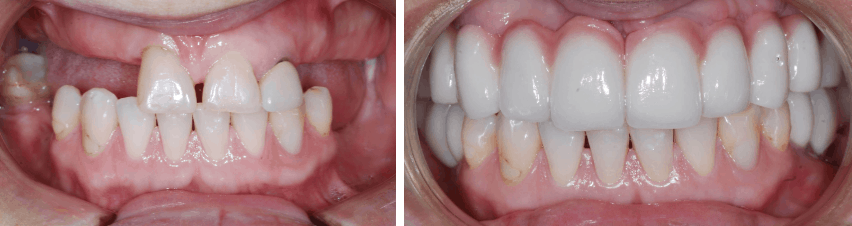

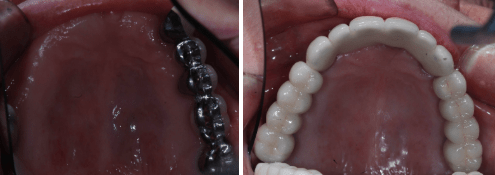

All costs must have been incurred by the taxpayer, a spouse or dependent. Application of sealants and fluoride treatments to prevent tooth decay. Vancouver dentists british columbia bc canada a dental implant is an artificial tooth root that is anchored in your jaw to hold a replacement tooth, bridge or

Have a form med 2 completed by your dentist. Are dental implants tax deductible in canada. Essentially, any procedure that is performed to improve your overall oral health qualifies for tax deduction.

They can be claimed as a medical expense, as long. This is good news for people who are considering implants and do not have insurance coverage or whose insurance plan does not include implants. Medical expenses are an itemized deduction on schedule a and are deductible to the extent they exceed 10% of your adjusted gross income (agi).

On the other hand, teeth whitening is considered cosmetic and not deductible. To help you with this cost the canada revenue agency allows dental expenses to be used as medical expense deductions when you file your income tax. Your dental and medical expenses must amount to at least 7.5 percent of your agi for the tax year.

Your dentist will normally give a med 2 to you after your treatment. Have a form med 2 completed by your dentist. What dental expenses are tax deductible in canada?

Are dental implants deductible under medical expenses yes, dental implants are an approved medical expense that can be deducted on your return. Most dental expenses can be used as medical expense deductions when filing your income taxes in canada, including: In addition to fillings, dentures, dental implants, and other dental work that is not covered by your insurance plan,.

Other dental work not paid by your insurance plan; Services of a dental hygienist or dentist for teeth cleaning. Dental expenses includes fillings, dentures, dental implants and other dental work that is not covered by your insurance plan.

Are dental implants tax deductible in canada. For more information about the dtc, see disability tax credit. Other qualifying dental procedures include implants to replace missing teeth and prevent further health issues;

115 first commerce dr.,unit 1. In order to help you with this cost, the canada revenue agency allows you to deduct dental expenses from your income tax when filing. The only exception is dental work that is purely cosmetic, such as teeth whitening.

Premiums paid to private health services plans including medical, dental, and hospitalization plans. Are dental implants tax deductible in canada. For instance, if you had $3,000 in dental expenses and made $20,000, $1,500 of your expenses are deductible.

In fact, most of the dental expenses you pay for throughout the year are deductible including basic. You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease. This list of eligible benefits is exhaustive.

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

How To Avoid Common Dental Implants Problems

Dental Implants

How Much Do Dental Implants Cost In Canada Explained

Dental Implants Faq – Vancouver Centre For Cosmetic And Implant Dentistry

Are Full Dental Implants Tax Deductible – Coloringforkids

Are Dental Veneers And Implants Tax Deductible

Are Full Dental Implants Tax Deductible – Coloringforkids

How Much Do Dental Implants Cost In Canada Explained

Are Dental Implants Tax Deductible – Drake Wallace Dentistry

Are Full Dental Implants Tax Deductible – Coloringforkids

Dental Implants Faq – Vancouver Centre For Cosmetic And Implant Dentistry

Dental Implants Faq – Vancouver Centre For Cosmetic And Implant Dentistry

Are Full Dental Implants Tax Deductible – Coloringforkids

What Is The Cost Of Dental Implants In Canada

High-quality Dental Implant Surgical Instruments Kit With Wholesale Price Treedental

Are Full Dental Implants Tax Deductible – Coloringforkids

Four Lesser-known Tax Incentives Not To Be Missed In 2021 Jioforme

Are Full Dental Implants Tax Deductible – Coloringforkids