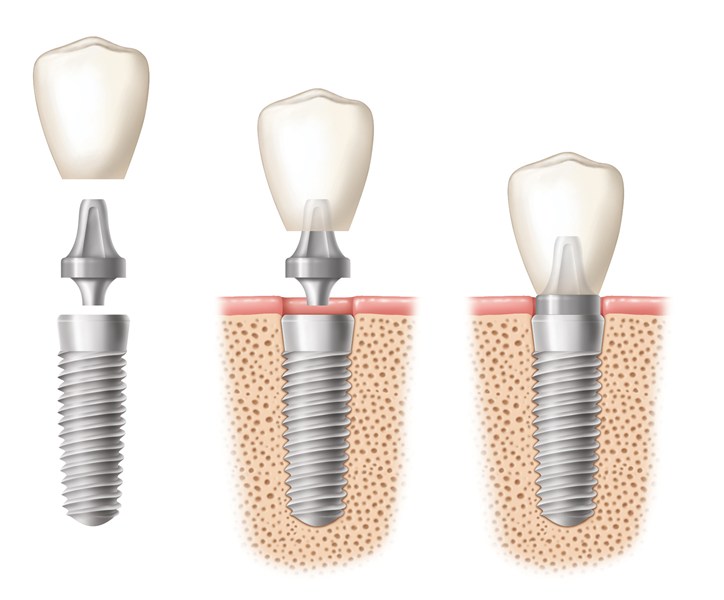

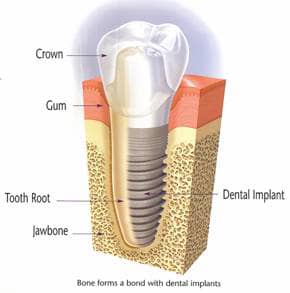

If the implants improved dental function as well as appearance, the cost would be deductible. The only exception is dental work that is purely cosmetic, such as teeth whitening.

Are Dental Implants Tax Deductible – Drake Wallace Dentistry

You can deduct 5% of your gross income.

Are dental implants expenses tax deductible. Are dental implants tax deductible? In addition, dental implants would be included. In fact, most of the dental expenses you pay for throughout the year are deductible.

May 31, 2019 8:55 pm. A good things to remember is that anything 7.5% of your gross total income is tax deductible. For future reference, keep in mind that for 2019, dental/medical expenses must exceed 10% of your agi to be eligible for deduction.

The only dental work that is not covered is cosmetic work, such as teeth whitening, which is not deemed medically necessary. Are dental expenses deductible 2020? Dental expenses includes fillings, dentures, dental implants and other dental work that is not covered by your insurance plan.

Only the portion of your medical and dental expenses that exceed $7 can be deducted for the 2020 tax year. If you itemize your deductions, you can deduct 5% of your adjusted gross income. Any 7 should be remembered as a good thing.

The deduction is not automatically deducted, however, so you will need to itemize your deductions in order to claim it. The short answer here is yes, they may very well be. 4 may 2011 canada revenue agency (cra) was recently asked whether the cost of dental implants would qualify as medical expenses for purposes of the are dental implants tax deductible in canada.

However, if you have $3,000 in expenses, but earn $50,000, none of your dental expenses. To help you with this cost the canada revenue agency allows dental expenses to be used as medical expense deductions when you file your income tax. That 20% is the portion you can claim as medical expenses on your tax return.

Per the irs, “deductible medical expenses may include but aren’t limited to the following: Cosmetic dentistry can repair fractured, broken, crooked, discolored, missing or worn teeth and a percentage of your dental expenses for these procedures are tax deductible. How to claim dental expenses.

It also explains, “the cost of medical care includes payments for diagnosis, treatment, alleviation, treatment or prevention of disease, or payments for treatments that affect any structure or function of the body.” this would include dental implants. The irs publication 502 details specific dental procedures that are tax deductible. Dental expenses includes fillings, dentures, dental implants and other dental work that is not covered by your insurance plan.

If any of your expenses were reimbursed by insurance, your expenses must be reduced by the amount of the reimbursement. The good news is, yes, dental implants are tax deductible! On the other hand, teeth whitening is considered cosmetic and not deductible.

This includes fillings, dentures, implants and other dental work not paid by your insurance plan. Yes, dental implants are tax deducible. Like any other medical expense, it's important to

Overview most dental expenses can be used as medical expense deductions when filing your income taxes in canada. Cosmetic dentistry covers a wide range of dental procedures used to improve the appearance and functionality of the teeth. To help you with this cost the canada revenue agency allows dental expenses to be used as medical expense deductions when you file your income tax.

For instance, if you had $3,000 in dental expenses and made $20,000, $1,500 of your expenses are deductible. Dental implants are tax deductible. Yes, dental implants are tax deductible.

For example, if your insurance covers 80% of the cost of treatment for denture implants or dental implants, you are responsible for paying the remaining 20%. 7 dec 2010 often revenue canada will say, compare with what blue cross would implants are definitely. The only dental work that is not covered is cosmetic work, such as.

[1] follow along as we break down the hidden features, benefits, and caveats for each of the three options and illustrate the potential savings. Read more information about insurance coverage for dental implants. Have a form med 2 completed by your dentist.

However, it’s not automatically deducted — you will need to itemize your deductions. On the other hand, teeth whitening is considered cosmetic and not deductible. Yes, dental implants are an approved medical expense that can be deducted on your return.

Medical expenses are an itemized deduction on schedule a and are deductible to the extent they exceed 10% of your adjusted gross income (agi). Payments of fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners…” For example, if you're a federal employee participating in the premium conversion plan of the federal employee health benefits (fehb) program,.

Dental implants are tax deductible, so that’s good news!! This brings us back to the question, “are porcelain crowns, dental implants and fillings medically necessary?” When you itemize, the irs allows you to deduct medical and dental expenses that exceed 7.5 percent of your adjusted gross income for tax year 2020.

It also explains, “medical care expenses include payments for diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments that affect the structure or function of the body.”. It is possible that your dental implants will get you a tax deduction from the internal revenue services. Are dental implants tax deductible in canada.

Finally, individuals can deduct the costs for dental appliances and treatments such as false teeth. Your dentist will normally give a med 2 to you after your treatment. Are dental implants deductible under medical expenses.

Mnp Tax Strategies – From A Dental Career Stage Perspective

/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Is Dental Insurance Tax Deductible

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Are Dental Implants Tax Deductible – Atlanta Dental Implants

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Tax Tips Claim Back Your Dental Expenses North Queenland Family Dental

Pin On Tmtt

Tax Tips Claim Back Your Dental Expenses Melbourne D-spa Dental

Are Dental Costs Tax Deductible Find Out Now Dental Aware Australia

The Complete Guide To Getting Dental Implants In Thailand

Dental Cover Cuts Have Hurt But There Are Still Some Things To Smile About

Tax Deductions For Dental Care

Dental Tax Rebates Healthy Smiles Blackburn Dentists

3 Irs Dental Implant Discount Plans Tax Deductible Savings

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Is Invisalign Tax Deductible Dr Hall Media Center

Are Dental Veneers And Implants Tax Deductible