Search orange county property tax and assessment records by municipalities, tax ide, name or address. Please acknowledge receipt of this message.

Dustin Hahn Buy Tax Liens And Deeds The Method Of Grabbing Deeds House Deeds Mortgage Top Mortgage Lenders

Some county treasurers will refer to this list by different names, like:

Are delinquent property taxes public record. Tax records include property tax assessments, property appraisals, and income tax records. Verification of information on source documents is recommended. Certain tax records are considered public record, which means they are available to the public, while some tax records are only available with a freedom of information act (foia) request.

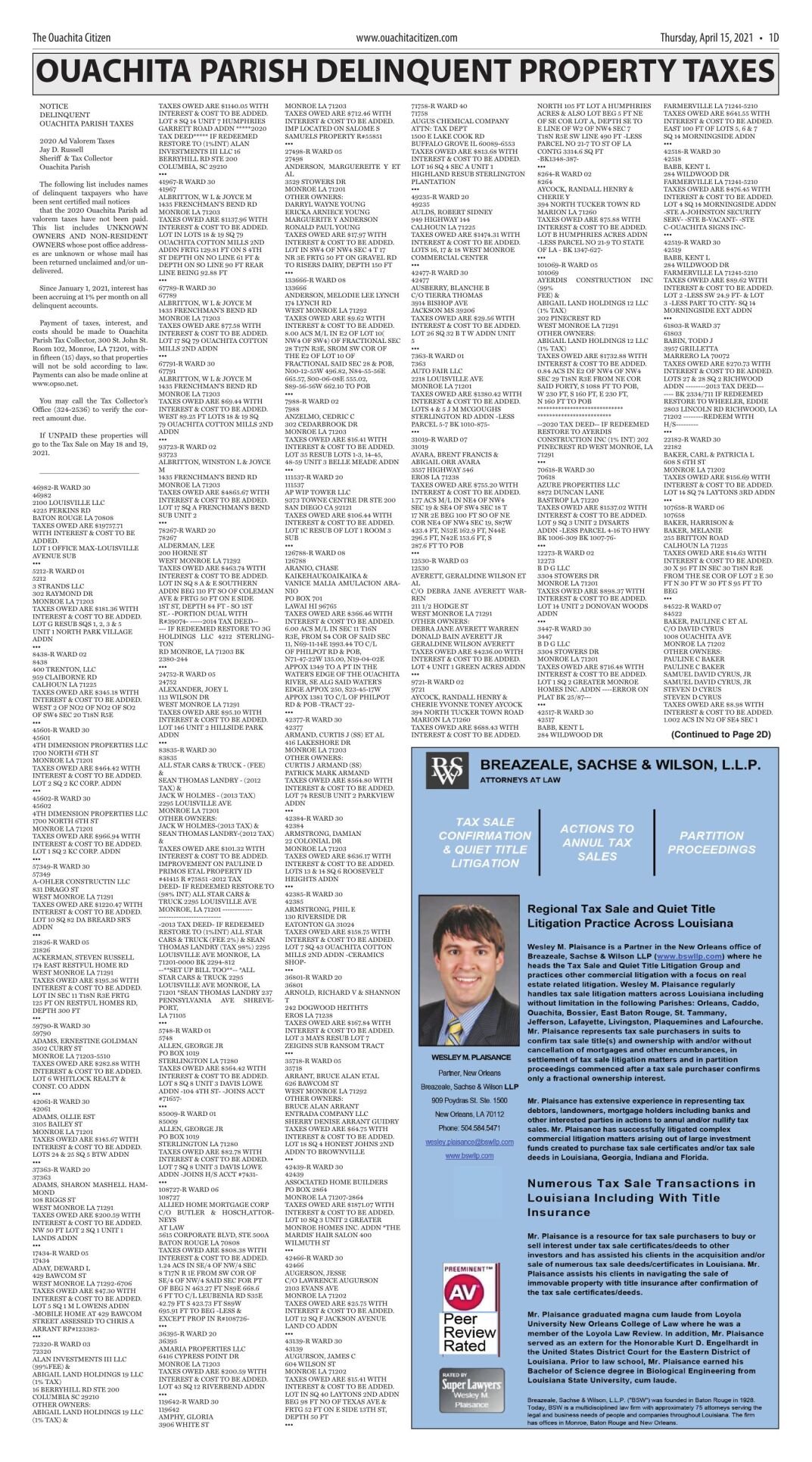

When property taxes go unpaid, or are delinquent for a period of time, this is recorded by the tax assessor or tax collector. “delinquent tax roll” “tax delinquent list” “tax forfeiture list” Certain tax records are considered public record, which means they are available to the public, while some tax records are only available with a freedom of information act (foia) request.

Every tax delinquent property is compiled together in a ledger that can be called by many names: Certain tax records are considered public record, which means they are available to the public, while some tax records are only available with a freedom of information act (foia) request. In each of the examples above, the county could initiate foreclosure against the real property in question after the taxes become delinquent on january 6.

Search vernon county property tax and assessment records by parcel number, owner name or property address. Certain tax records are considered public record, which means they are available to the public, while some tax records are only available with a freedom of information act (foia) request. Tax records include property tax assessments, property appraisals, and income tax records.

This is a request for public records made under opra and the common law right of access. New mexico property tax records However, access to these lists differs widely from one area to the other.

Tax records include property tax assessments, property appraisals, and income tax records. Please be advised that all electronic correspondence, including this contact form submission, is public record. The unpaid property taxes at the end of the fiscal tax year.

Please acknowledge receipt of this message. Original records may differ from the information on these pages. The county tax collector may offer the property for sale at public auction, a sealed bid sale, or a negotiated sale t.

Remember that regardless of record ownership, delinquent taxes on real property may always be collected through foreclosure on the real property itself. This is a request for public records made under opra and the common law right of access. You must first purchase a tax history search.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. When people don’t pay their taxes, the treasurer’s office will create a running list of who still owes them money (this is the same list they use to mail out their delinquent tax notices). The first step of the process is getting access to the tax delinquent property list in your county.

By using this application, you assume all risks arising out of or associated with access to these pages, including but not limited to risks of damage to your computer, peripherals, software and data from any virus. This lien is a public claim for the outstanding delinquent tax, meaning the property cannot be transferred or sold without the tax lien being paid or transferring as an outstanding debt to the buyer. Tax records include property tax assessments, property appraisals, and income tax records.

Town of duxbury delinquent taxes, tax titles and abandoned check notices town of duxbury treasurer and collector duxbury town hall 878 tremont, duxbury, ma. New york property tax records I am not required to fill out an official form.

Assessor, real property tax services and tax foreclosure auctions orange county real property tax service agency 1887 county building, first floor 124 main st., goshen, ny 10924 phone: Perform a free public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. Town of pomfret assesor town of pomfret assessor 5 haven road, pomfret center, ct 06259 assessor phone:

That’s the key to this real estate investment strategy. Delinquent property tax bills click here to view current and historical delinquent tax bills the legal records division is responsible for legal documents which are filed as public record. If you do not want this email request recorded as a public record, do not submit this contact form via email.

Search the town of pomfret property tax and assessment records by address, owner name or account number including sales search by sales date range or sales price range. Navigation property summary search resul tax history gis parcel sales history split history tax description logout refine search new search print property summary our records are updated may, august and january. List of all properties with delinquent taxes owed, over the amount of one dollar ($1.00) yours faithfully, community member

When people fail to pay taxes, the treasurer’s office generates a list of property owners who are back on their taxes and it is called the delinquent property tax list. These lists are compiled in every jurisdiction across the us housing market and are a matter of public record. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale.

They use this list to send delinquent tax notices by mail to the property owners who owe them money.

Everything You Need To Know About Getting Your Countys Delinquent Tax List – Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

How To Read A Tax Deed Sale List – Youtube Reading List Investing

Deducting Property Taxes Hr Block

Quit Claim Deed Terms Only Buyer To Assume All Back Taxesdelinquent Waterliensassessments Call County For Amounts And Detroit Houses House Renting A House

Wholesaling Tax Delinquent Properties Ultimate Guide For Investors

Montgomery County Tn

Delinquent Property Taxes April 15 2021 Click To Download Pages Public Notices Hannapubcom

Property Tax Payment Deadline

Look Uppay Property Taxes

Statement Of Prior Year Taxes Los Angeles County – Property Tax Portal

Everything You Need To Know About Getting Your Countys Delinquent Tax List – Retipster

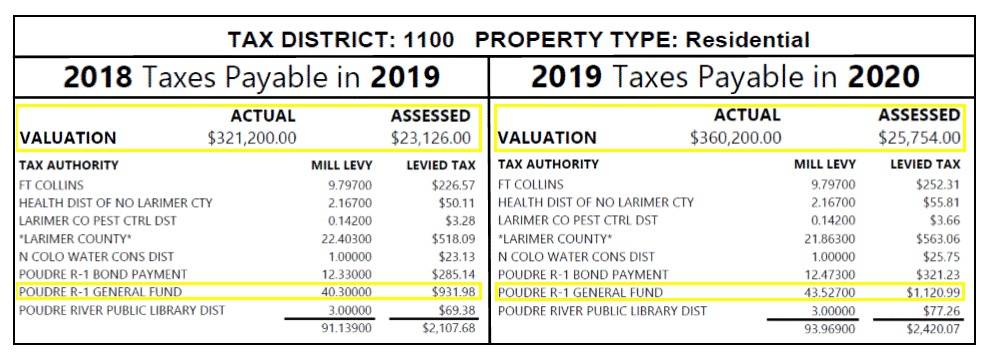

Property Tax Assessment Larimer County

Youve Ever Had To Deal With Delinquent Taxes And The Internal Revenue Service Then You Will Be A Bit Familiar Wit Tax Attorney Legal Services Tax Lawyer

Twin-style Home Near Cadwalader Park Amp Parkside Avenue Sold Strictly As-is Price Negotiable Bring All Offers Edgewood Horror Show Trenton

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Tax Listings – Personal Property Dare County Nc

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

Pin Di Berita Terbaru