The tax rate on accumulated earnings is 20%, the maximum rate at which they would be taxed if distributed. The accumulated earnings tax is computed by multiplying the accumulated taxable income (irc section 535) by 20%.

What Are Accumulated Earnings Profits Accounting Clarified

Accumulated earnings tax the aet is a 20 percent tax for each tax year on accumulated taxable income of corporations.1 while the aet hasn’t been widely imposed or litigated in recent years, it still applies to all corporations — with limited exceptions2.

Accumulated earnings tax calculation example. The tax is in addition to the regular corporate income tax and is assessed by the irs, typically during an irs audit. Accumulated e&p following reduction for the year 6 distribution will be $73,800, which will be the accumulated e&p balance at the beginning of year 7. The irs also allows certain exemptions based on the required.

Irc section 535(c)(1) provides that. The regular corporate income tax. Earnings,” a component of amt calc.

• muni bond interest • excluded life insurance proceeds • federal income tax refunds • dividends received deduction Calculating the accumulated earnings tax; The aet is a penalty tax imposed on corporations for unreasonably accumulating earnings.

Therefore, in computing its accrued tax, metro would include only the current year’s reported installment income. This earning is considered unreasonable and somewhat unnecessary. Example of retained earnings calculation.

It compensates for taxes which cannot be levied on dividends. Vestment for example, marketable securi. • termination of s if e&p exists and excess passive income (section 1362) • corporate level tax if c corp.

Corporation has a book net income of $20 million, $500,000 of book depreciation, $1 million of tax depreciation, $500,000 of earnings and profits depreciation, $2.5 million interest paid but not deducted for federal income tax purposes, $1.5 million of federal income taxes paid, and $3 million of meals and. Corporate federal income tax paid: The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted to avoid tax to.

Multiply each $4,000 distribution by the 0.625 figured in (1) to get the amount ($2,500) of each distribution treated as a distribution of current year earnings and profits. Determining a corporation’s e&p requires a detailed investigation into. This means that every dollar of accumulated earnings is essentially another dollar added to shareholders' equity.

Given that there has been little change, other than rates, in the taxation of accumulated earnings, the guidelines may still be useful in planning and in dealing with examining agents. E&p exists with excess passive income (section 1375). Accumulated e&p on january 1:

Exemption levels in the amounts of $250,000 and $150,000, depending on the company, exist. The accumulated earnings tax rate is 20%. Accumulated earnings tax can be reduced by reducing accumulated taxable income.

It is a form of tax imposed by the federal government on firms and cooperation with retained earnings. There is a certain level in which the number of earnings of c corporations can get. Gain from sale of stock in cfc may be a dividend to the extent of cfc’s e&p.

Examinations usually occur several years after the tax year in question has ended. Thus, the irs may know during an examination what actually happened after the tax year to justify accumulating earnings in the business. Breaking down accumulated earnings tax.

Divide the current year earnings and profits ($10,000) by the total amount of distributions made during the year ($16,000). The accumulated earnings tax, also called the accumulated profits tax, is a tax on abnormally high levels of earnings retained by a company. The accumulated earnings tax is basically a 15% tax on the corporation’s “accumulated taxable income” for the tax year.

When the revenues or profits are above this level, the firm will be. Generally, a corporation’s “accumulated taxable income” is calculated as follows: What is “accumulated taxable income”?

Accrued means tax actually payable based on reported income, not tax based on income a corporation would include if it reported all items of income and deductions under the accrual method. 1954, the income tax regulations. The worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax, and a sample taxpayer’s statement pursuant to §534(c) and regs.

Current expenses over an operating cy. The statement of accumulated earnings summarizes changes in accumulated earnings for a fiscal period, and total accumulated earnings appears in the shareholders' equity portion of the balance sheet. This is the amount of retained earnings to date, which is accumulated earnings of the company since its inception.

The accumulated earnings tax is more like a penalty since it is assessed by the irs often years after the income tax return was filed. The accumulated earnings tax is typically figured by an irs agent as part as an examination (“audit”). The accumulated earnings tax is governed by sections 531.

Determining The Taxability Of S Corporation Distributions Part I

Demystifying Irc Section 965 Math – The Cpa Journal

Solved A How Much Is The Income Tax Due For 2019 Assuming That It Is A Domestic Corporation B How Much Is The Income Tax Due For 2019 Assuming Course Hero

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Investing Preferred Stock

Determining The Taxability Of S Corporation Distributions Part Ii

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math – The Cpa Journal

Demystifying Irc Section 965 Math – The Cpa Journal

Earnings And Profits Computation Case Study

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession – Ppt Download

Cares Act Implications On Corporate Earnings And Profits Ep

What Are Accumulated Earnings – Definition Meaning Example

Earnings And Profits Computation Case Study

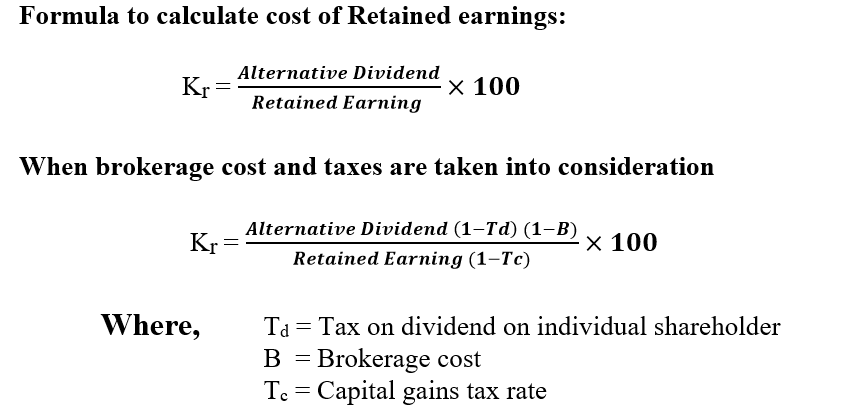

Cost Of Retained Earnings – Commercestudyguide

Prepared By Lilybeth A Ganer Revenue Officer – Ppt Download

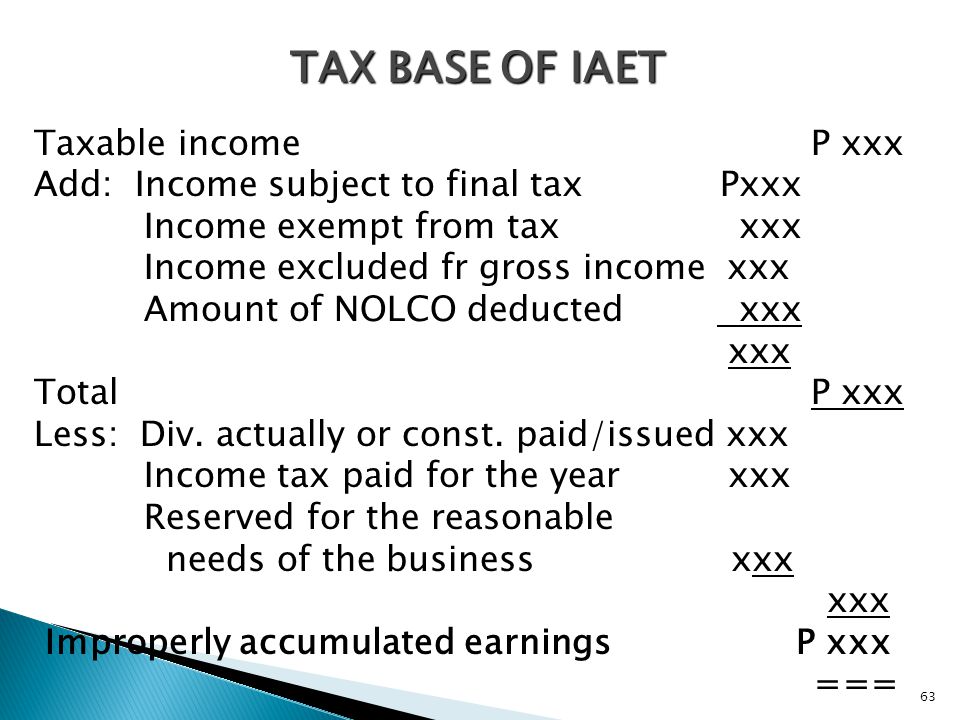

Overview Of Improperly Accumulated Earnings Tax In The Philippines – Tax And Accounting Center Inc – Tax And Accounting Center Inc

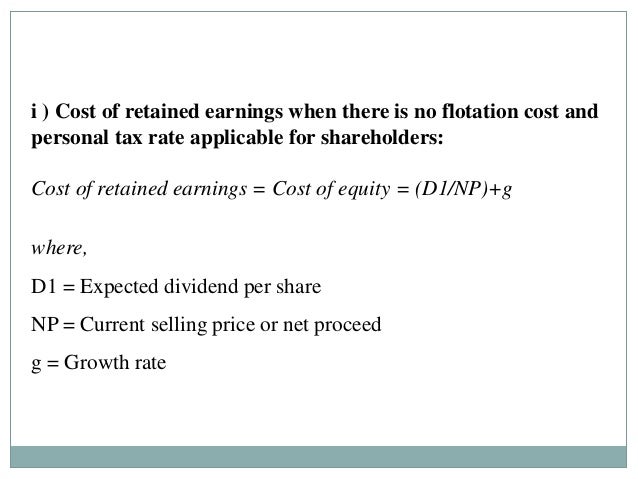

Cost Of Retained Earnings

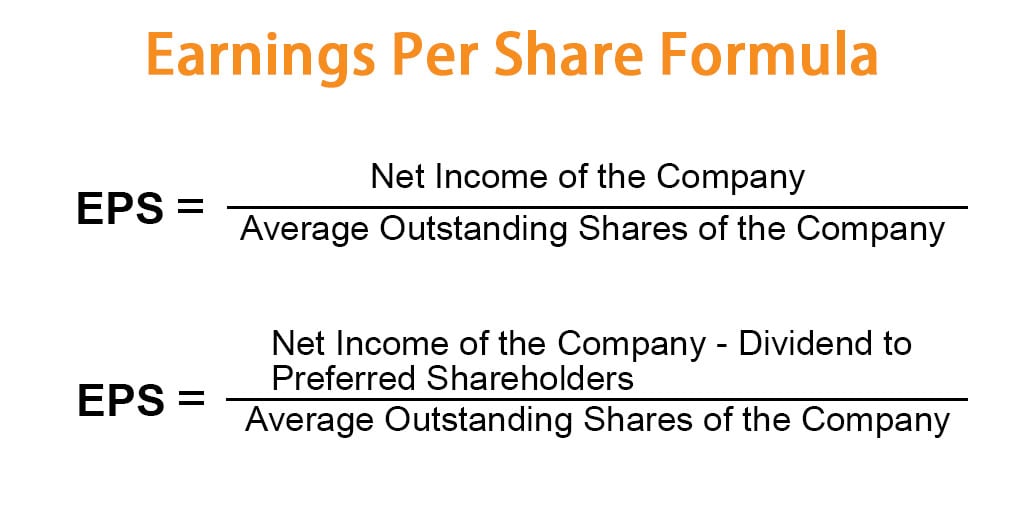

Earnings Per Share Formula Eps Calculator With Examples