Oswego county, with the cooperation of sdg, provides access to rps data, tax maps, and photographic images of properties. Those sections are further broken down by block with each block containing lots.

Nys Gis – Parcels

Assessment records for cities, towns, and villages in oswego county are hosted online via sdg's image mate online service, also known as the real property database.

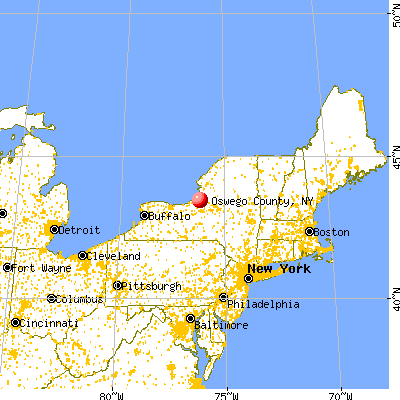

Oswego county ny property tax map. For other gis inquiries for oswego county, please see the contact below. In new york, oswego county is ranked 36th of 62 counties in assessor offices per capita, and 41st of 62 counties in assessor offices per square mile. The lots are the individual land parcels found on an assessment roll.

Contract or payment agreement payments cannot be made electronically. For other gis inquiries for oswego county, please see the contact below. Delinquent taxes are handled by the county treasurer, except for taxes in the city of fulton.for property taxes within the city of fulton please contact the fulton city chamberlain.

After the completion of the original tax mapping project, several mappers at the county working in the real property department routinely updated the tax maps Tax mapping, local assessment administration support, equalization and valuation trending analysis, administrative and school district boundary management. The county tax map is broken down into approximately 1,133 sections and subsections.

Town and city halls may make county maps available through their websites. Corey metz oswego county office of real property tax services 46 east bridge street oswego, ny 13126. You can access tax parcel infromation and much more.

The acrevalue oswego county, ny plat map, sourced from the oswego county, ny tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres. Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books. New york has 62 counties, with median property taxes ranging from a high of $9,003.00 in westchester county to a low of $1,674.00 in st.

Oswego county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. There are 4 assessor offices in oswego county, new york, serving a population of 119,833 people in an area of 952 square miles.there is 1 assessor office per 29,958 people, and 1 assessor office per 237 square miles. This website provides the public with easy access to real property information, tax maps, and photographic imagery derived from the local assessor's rps file.

Town and city halls have oswego county property tax maps which show parcels, buildings, and property ownership for tax assessment purposes, as well as municipal or zoning maps that contain jurisdictional boundaries, zoning divisions, and public property. The cities and villages were mapped at a scale of 1 inch = 100 feet or 1. Lawrence county.for more details about the property tax rates in any of new york's counties, choose the county from the interactive map or the list below.

To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). The county is working towards integrating all tax information to our system. Image mate online is oswego county’s commitment to provide the public with easy access to real property information.

See detailed property tax report for 836 n wart rd, oswego county, ny. In oswego county this update to the tax maps was completed in 1975 and was based on accurate land base information derived from a 1974 aerial flyover and orthophoto mapping project. For information specific to this tax parcel dataset, please contact:

In new york state, the real property tax is a tax based on the value of real property. Oswego county collects, on average, 2.68% of a property's assessed fair market value as property tax. While utilizing the online tax map explorer is the most convenient way to search for and view parcels on the.

Our oswego county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in new york and across the entire united states. Furthermore, the assessor is responsible to all the people in ensuring that no property escapes the assessment process or is underassessed and that no property owner receives unauthorized. In oswego county this update to the tax maps was completed in 1975 and was based on accurate land base information derived from a 1974 aerial flyover and orthophoto mapping project.

Propertyshark.com provides a large collection of online real estate maps of oswego county, ny so you can rapidly view parcel outlines, address numbers, neighborhood boundaries, zip codes, school districts and, where available, the fema flood zones and building classification. Counties, cities, towns, villages, school districts, and special districts each raise money through the real property tax. The median property tax in oswego county, new york is $2,354 per year for a home worth the median value of $88,000.

The assessor serves the individual property owner by insuring that all values are proper so that owners pay no more than their fair share of the property tax. Oswego county has one of the highest median property taxes in the united states, and is ranked 313th of the 3143 counties in order of median property taxes. Not all municipalities have tax records online or have the ability to pay taxes online.

The following list contains information on the online availability of local tax records. The median property tax (also known as real estate tax) in oswego county is $2,354.00 per year, based on a median home value of $88,000.00 and a median effective property tax rate of 2.68% of property value. In order to comply with the ail the tax maps had to conform to a uniform measurement scale.

The money funds schools, pays for police and fire protection.

Gadgets 2018 Oswego County Tax Map

Gadgets 2018 Oswego County Tax Map

Oswego County Ny

Two-dozen Tax Delinquent County Properties Could Be Transferred From The County To The Oswego County Land Bank Next Month Oswego County Landbank

Gadgets 2018 Oswego County Tax Map

Oswego County Releasing Baits Containing Rabies Vaccines For Wildlife Wsyr

2021 Best Places To Buy A House In Oswego County Ny – Niche

Oswego County Ny

Oswego County New York 1897 Map Rand Mcnally Fulton Mexico Pulaski Redfield Phoenix Sandy Creek Hastings Williamstown Oswego County Oswego Fulton

Antique Oswego County New York 1911 New Century Atlas Map Etsy

Oswego Tax Mapping Homepage

Oswego County New York Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Oswego County New York Genealogy Familysearch

Gadgets 2018 Oswego County Tax Map

Map Of Richland Oswego Co Ny From Actual Surveys Library Of Congress

Oswego County Ny

Oswego County Map – Nys Dept Of Environmental Conservation

Map Of Oswego County New York From Actual Surveys Library Of Congress

Oswego Tax Mapping Homepage