The boulder, colorado sales tax is 8.85% , consisting of 2.90% colorado state sales tax and 5.95% boulder local sales taxes.the local sales tax consists of a 0.99% county sales tax, a 3.86% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local. The boulder, colorado, general sales tax rate is 2.9%.

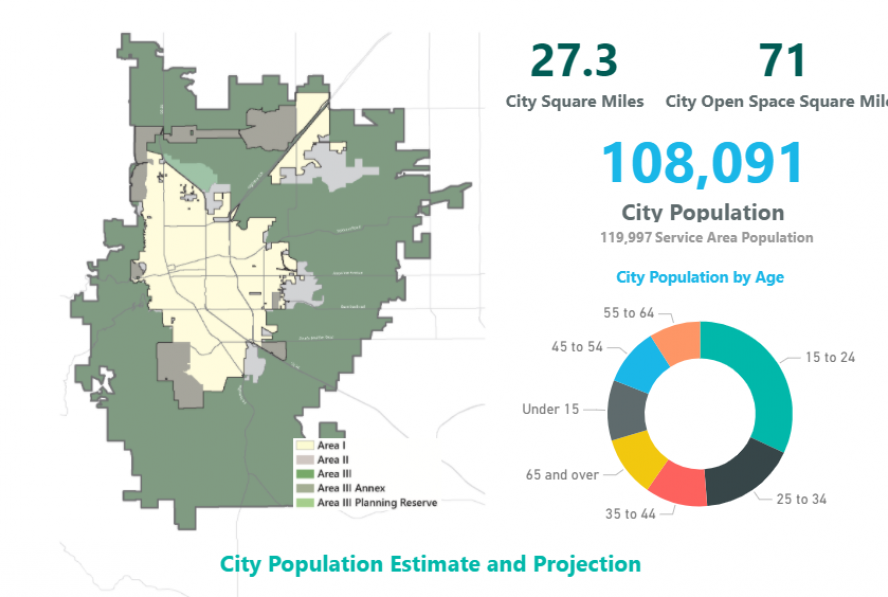

Use Tax City Of Boulder

7.65% [is this data incorrect?] the denver, colorado sales tax is 7.65% , consisting of 2.90% colorado state sales tax and 4.75% denver local sales taxes.the local sales tax consists of a 3.65% city sales tax and a 1.10% special district sales tax (used to.

Boulder co sales tax 2020. Depending on the zipcode, the sales tax rate of boulder may vary from 2.9% to 8.845% depending on the zipcode, the sales tax rate of boulder may vary from 2.9% to 8.845% It’s part of an effort to curb use among young. As of july 1, 2020, tobacco retailers must collect and remit the 40% sales tax on electronic smoking devices including any refill, cartridge or any other esd components.

This is the total of state, county and city sales tax rates. The 80303, boulder, colorado, general sales tax rate is 8.845%. Including audit revenue, total sales and use tax increased from 2020 by $1,657,565 or 18.29%.

2.055% lower than the maximum sales tax in co. The city of boulder will no longer mail returns after jan. Payments postmarked on or before the 20th of the month will be considered timely and will not be assessed penalties and interest.

Colorado property taxes have three main components: Boulder, co sales tax rate. Create your own online store and start selling today.

Create your own online store and start selling today. Lafayette 1376 miners dr., unit 105 map & directions please note: The combined rate used in this calculator (8.845%) is the result of the colorado state rate (2.9%), the 80303's county rate (0.985%), the boulder tax rate (3.86%), and in some case, special rate (1.1%).

University of colorado 0.2% all other boulder The current total local sales tax rate in boulder county, co is 4.985%. 2020 boulder county sales & use tax.

All customer accounts will be consolidated by federal tax id number (fein). The sales tax jurisdiction name is santa cruz county tourism marketing district, which may refer to a local government division. The boulder sales tax rate is %.

Some cities and local governments in weld county collect additional local sales taxes, which can be as high as 4.5%. All returns must be filed on boulder online tax or can be printed from your account on boulder online tax and mailed in. The current total local sales tax rate in boulder, co is 4.985%.

The county sales tax rate is %. The minimum combined 2021 sales tax rate for boulder, colorado is. The 2020 boulder county sales and use tax rate is 0.985%.

The 9% sales tax rate in boulder creek consists of 6% california state sales tax, 0.25% santa cruz county sales tax and 2.75% special tax. You can print a 9% sales tax table here. • details by industry, geographic zone and month are found on pages 3 through 7 of this report.

The rate is comprised of individual, voter‐approved county sales and use tax ballot measures adopted to support county programs in conservaon, transportaon, offe nder management, nonprofit capital investment and sustainability. The actual value of property, which is established by local assessors along with the property's classification (residential, commercial, or personal).; Weld county, colorado sales tax rate 2019 while many counties do levy a countywide sales tax, weld county does not.

The colorado sales tax rate is currently %. Try it now & grow your business! The esd tax is on top of the city of boulder sales tax rate of 3.86%.

The 8.845% sales tax rate in boulder consists of 2.9% colorado state sales tax, 0.985% boulder county sales tax, 3.86% boulder tax and 1.1% special tax. Try it now & grow your business! The december 2020 total local sales tax rate was also 4.985%.

The assessed value of property, which is based on the assessment rate, which is determined by the colorado legislature. Longmont 515 coffman street, suite 114 map & directions. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

Their 2020 salaries are $271,342.85, $229,406.93 and $174,193.03, respectively. Assessor boulder & longmont drop boxes. The colorado sales tax of 2.90% applies countywide.

The assessment rate for commercial and industrial property is set at 29. Boulder 1325 pearl st., 2nd floor boulder, co 80302 map & directions hours: The december 2020 total local sales tax rate was 8.845%.

There is no applicable city tax. Download all colorado sales tax rates by zip code. The lafayette office will be closed until october 26.

You can print a 8.845% sales tax table here.

10402 Manly Chapel Hill Nc 27517 – Photo 7 Of 29 Chapel Hill House Design Chapel

Sales And Use Tax City Of Boulder

La Sportiva Boulder X Approach Shoes – Mens Rei Co-op

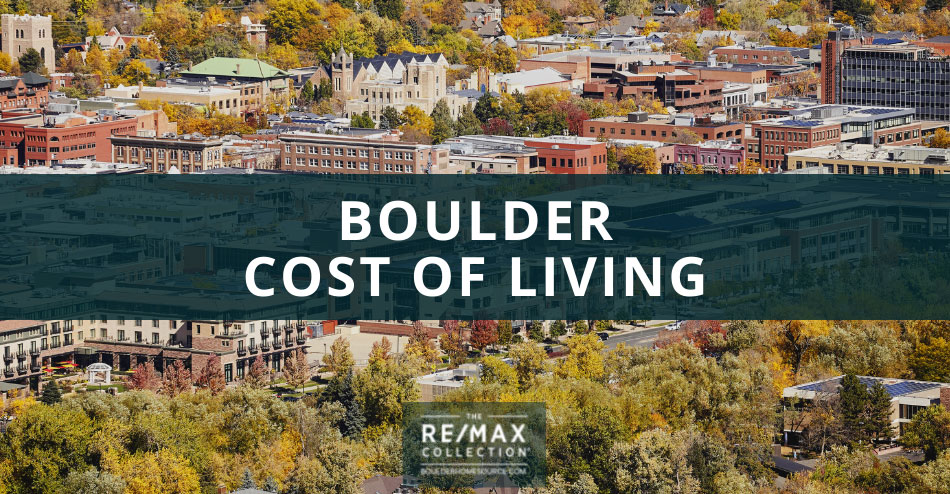

Boulder Cost Of Living Boulder Co Living Expenses Guide

Boulder Co Economy – 2022 Guide

Use Tax City Of Boulder

Pin On Dream Home

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Innovation Technology City Of Boulder

Geotax Spatial Boulder City Small Biz

Construction Use Tax City Of Boulder

Boulder Again Named Best Place To Live But Some Disagree Westword

Taxes In Boulder The State Of Colorado

1133 Timber Ln Boulder Co 80304 Mls 893342 Zillow Unique Houses Natural Interior Design Indoor Waterfall

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Insurance Ads Life Health Life Insurance Banner – Banner Ads Web Template Psd Download Here Graphicr Insurance Ads American Life Insurance Life Insurance

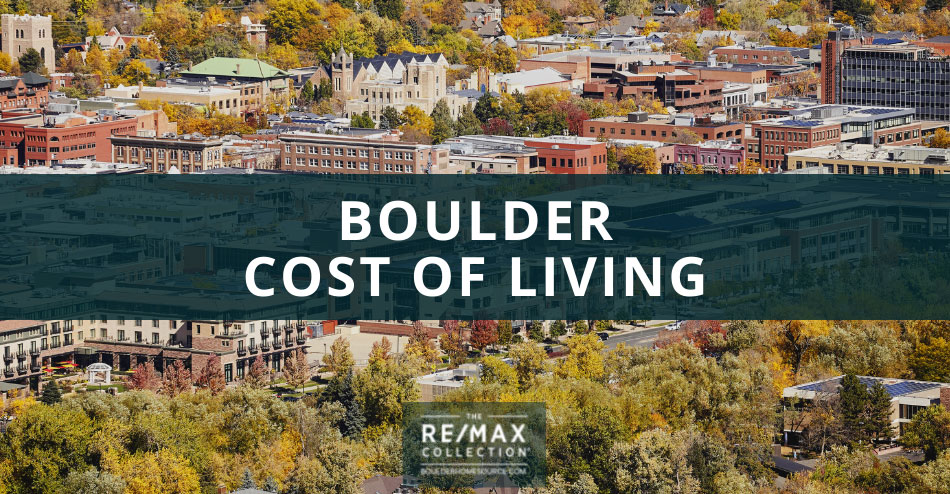

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Visia Whole Foods Investing For Retirement Bouldering Grant Writing