![Download Hazbin Hotel Windows Theme - [Year] 1 download hazbin hotel windows theme year](https://superagc.com/wp-content/uploads/2025/10/download-hazbin-hotel-windows-theme-year-1024x576.jpg)

This customization option allows users to personalize their desktop environment with elements inspired by the adult animated musical comedy. It typically includes a collection of wallpapers, icons, sound schemes, and cursors designed to reflect the show’s aesthetic and characters. For example, individuals can change their desktop background to an image of the Hazbin Hotel or use character-themed icons for their folders.

The popularity of this specific type of personalization stems from the show’s significant online following and distinctive visual style. Benefits include expressing fandom, creating a visually appealing desktop, and enhancing user engagement with their computer. Historically, such customizations have offered a creative outlet for individuals to showcase their interests and personalize technology to reflect their unique preferences.

The following sections will delve into the specific components often included in this type of modification, explore resources for obtaining and installing it, and address common questions regarding compatibility and safety.

1. Visual Aesthetics

Visual aesthetics form a critical component of the popularity and appeal of any Windows theme, particularly when based on pre-existing media properties. In the context of this customization option, the visual elements are paramount in capturing the essence of the source material and translating it into a cohesive and engaging user interface.

-

Color Palette & Style Replication

Suggested read: Read Provia Windows Reviews: Are They Worth It?

The reproduction of the show’s distinctive color palette and animation style is crucial. This involves accurate representation of key character colors, background hues, and overall stylistic choices. Failure to accurately reflect the source material can lead to a disjointed or inauthentic experience, detracting from the theme’s intended appeal. For example, using washed-out or inaccurate color tones for character portraits would diminish the visual impact.

-

Character Integration

Character representations within the theme, such as wallpapers and icons, serve as primary visual anchors. The selection of characters, their poses, and the artistic rendering employed directly impact the theme’s perceived quality. High-resolution, professionally created assets are essential for avoiding a pixelated or amateurish appearance. This includes the proper incorporation of key characters, such as Charlie Morningstar or Alastor, within the theme’s visual landscape.

-

Thematic Consistency

A cohesive aesthetic requires consistency across all visual elements, from wallpapers to icons and cursors. Disparate styles or resolutions can create a visually jarring experience. A well-designed theme ensures that each element complements the others, contributing to a unified and immersive environment. For instance, using sleek, modern icons alongside a hand-drawn wallpaper would create a visual dissonance.

-

Originality and Interpretation

While faithful replication is important, a successful theme may also incorporate original interpretations or stylistic variations that remain true to the source material. This could involve creating unique artwork based on the established aesthetic, rather than simply using existing images. Such creative interpretations can enhance the theme’s appeal and offer a fresh perspective on the source material. An example of this could be stylized cursors or folder icons, incorporating subtle nods to the show’s key motifs.

These facets collectively determine the overall visual impact and user experience. Effective visual aesthetics not only reflect the source material but also enhance the usability and enjoyment of the customized desktop environment. Therefore, the aesthetic quality dictates the success of implementing this personalization option.

2. Customization Options

Customization options are integral to the implementation and appeal of a “Hazbin Hotel” Windows theme. The degree of personalization available directly impacts the user’s ability to create a desktop environment reflective of their specific preferences within the broader context of the source material. Limited choices may result in a generic or unsatisfying outcome, whereas extensive options allow for a highly tailored and immersive experience. For example, a theme offering only a single wallpaper and a basic icon set provides significantly less personalization than one including multiple wallpapers, custom sound schemes, animated cursors, and application-specific icons.

Furthermore, the quality and depth of customization options influence the perceived value and longevity of the theme. Users are more likely to invest time and effort into installing and maintaining a theme that offers meaningful and diverse ways to personalize their desktop. This includes options such as selecting specific character wallpapers, assigning unique sounds to system events, or modifying the appearance of commonly used applications to align with the theme’s aesthetic. The absence of such nuanced options can lead to user dissatisfaction and abandonment of the theme in favor of alternatives.

In conclusion, the range and quality of customization options directly determine the user’s ability to fully realize the potential of a “Hazbin Hotel” Windows theme. A comprehensive and well-designed set of options enhances user engagement, provides a more personalized experience, and ultimately contributes to the long-term adoption and appreciation of the theme. The depth of customization is a key differentiating factor between a superficial modification and a genuinely immersive and personalized desktop environment.

3. Compatibility Concerns

Compatibility presents a significant consideration when implementing any Windows theme, and this is especially true for user-created or media-derived themes, such as those inspired by “Hazbin Hotel”. The successful integration of such a theme depends heavily on the underlying operating system architecture and the specific elements included in the theme package. Addressing these concerns proactively is crucial for ensuring a stable and functional desktop environment.

-

Operating System Version

The intended operating system version forms the primary compatibility factor. Themes designed for older Windows versions may not function correctly, or at all, on newer systems, and vice-versa. Changes in system architecture, resource handling, and theming engines across different Windows versions can render older themes incompatible. For example, a theme designed for Windows 7 may lack the necessary code or assets to integrate seamlessly with Windows 10 or 11, leading to visual glitches, system instability, or even system crashes in extreme cases.

-

System Resource Requirements

Themes utilizing high-resolution wallpapers, animated cursors, or custom sound schemes can place significant demands on system resources. Computers with limited processing power or memory may experience performance degradation when running resource-intensive themes. This can manifest as slower application loading times, reduced responsiveness, or even system freezes. Therefore, assessing the resource footprint of the theme is essential prior to installation, particularly on older or less powerful hardware. For instance, applying a theme with multiple 4K wallpapers on a computer with only 4GB of RAM may severely impact system performance.

-

Software Conflicts

Certain theme elements, such as custom icon packs or shell extensions, may conflict with other software installed on the system. These conflicts can lead to application crashes, system errors, or unexpected behavior. It is crucial to ensure that the theme is compatible with the existing software environment to avoid such issues. As an example, a custom icon pack that replaces system icons may interfere with the functionality of certain applications that rely on those icons, causing display errors or program malfunctions.

-

Driver Compatibility

Although less common, conflicts can also arise between theme components and system drivers, particularly graphics drivers. Incompatible drivers can lead to display issues, such as distorted images, flickering screens, or even system crashes. Ensuring that the graphics drivers are up-to-date and compatible with the theme’s visual elements is crucial for maintaining system stability. For instance, a theme that utilizes advanced visual effects may require specific driver versions to function correctly, and older drivers may not provide the necessary support.

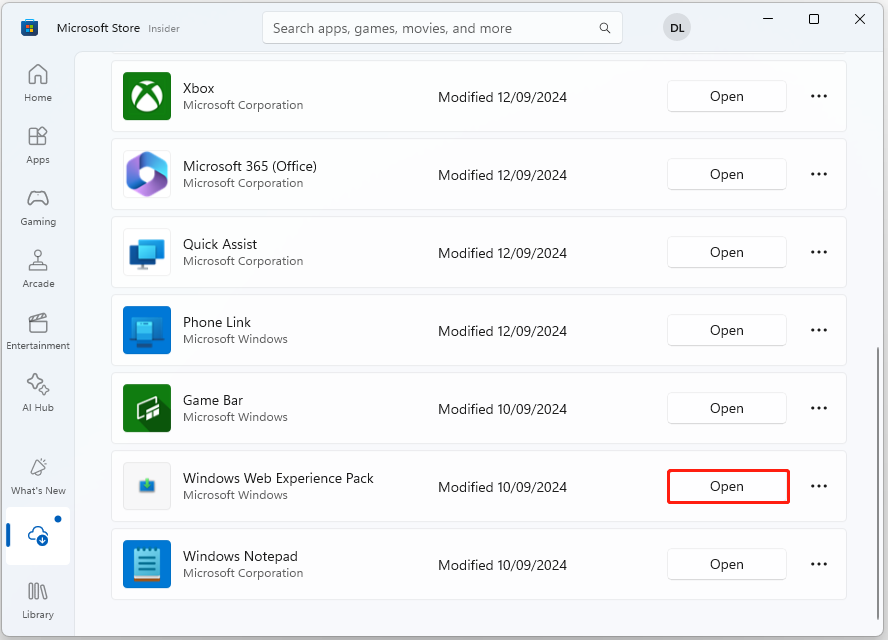

Suggested read: Boost Windows with the Web Experience Pack Download

Addressing compatibility concerns is essential for mitigating potential issues and ensuring a positive user experience. Thoroughly researching the theme’s requirements, verifying compatibility with the target operating system, and monitoring system performance after installation are vital steps in preventing compatibility-related problems. These precautions contribute to a stable and aesthetically pleasing “Hazbin Hotel” Windows theme implementation.

4. Source Reliability

The availability of modifications, such as a “Hazbin Hotel” Windows theme, from untrusted sources poses a significant risk to system security and stability. The absence of rigorous vetting processes on unofficial platforms means that these themes may contain malicious code, including viruses, spyware, or other forms of malware. Downloading and installing such a theme can lead to data breaches, system corruption, or unauthorized access to sensitive information. This causal relationship underscores the importance of source reliability as a critical component of any Windows theme installation. For example, a theme obtained from a file-sharing website could contain a keylogger that records keystrokes, compromising passwords and personal data.

Reputable sources, such as official theme stores or well-established customization websites, typically implement security checks and verification processes to mitigate these risks. These processes often involve scanning files for malware, verifying the developer’s identity, and providing user feedback mechanisms for reporting issues. Selecting a theme from such a source significantly reduces the likelihood of encountering malicious content and ensures a safer user experience. A practical application of this understanding is to prioritize downloading themes from the Microsoft Store or DeviantArt, where content is subject to moderation and scrutiny, rather than from less reputable file-sharing sites or forums.

In summary, the reliability of the source from which a “Hazbin Hotel” Windows theme is obtained directly impacts the security and integrity of the user’s system. While the allure of free or exclusive content may be tempting, the potential consequences of downloading a malicious theme far outweigh the benefits. Prioritizing reputable sources and exercising caution when installing any third-party software or theme are essential practices for maintaining a secure and stable computing environment. The challenge lies in educating users about the potential risks and promoting the adoption of safer practices when personalizing their systems.

5. System Performance

The integration of a “Hazbin Hotel” Windows theme can directly influence system performance, acting as both a potential benefit and a potential detriment. System performance is primarily affected by resource consumption related to elements within the customization. High-resolution wallpapers consume memory, custom sound schemes increase CPU load during event triggers, and animated cursors demand continuous processing. If a theme employs excessively large or unoptimized assets, the cumulative effect can degrade overall system responsiveness, particularly on computers with limited resources. An older machine with a slower processor and less RAM, for instance, may exhibit noticeable lag when running a theme with multiple high-resolution wallpapers and custom sound effects.

Conversely, a well-optimized theme can minimize the impact on system performance. Themes designed with efficient coding practices, employing compressed image formats, and utilizing lightweight sound files can provide aesthetic customization without significant resource overhead. Furthermore, selective application of theme elements allows users to balance visual appeal with performance considerations. For example, opting for a static wallpaper instead of a slideshow or disabling custom sound schemes can mitigate potential performance issues. Therefore, the key to minimizing negative impacts lies in selecting themes designed for efficiency and adapting usage patterns to system capabilities.

Understanding the relationship between resource consumption and system performance is crucial for users seeking to personalize their desktop environment. Choosing a theme thoughtfully and managing its settings effectively allows for balancing aesthetics with functionality, ensuring a visually appealing desktop experience without compromising system responsiveness. Addressing performance implications beforehand allows users with a diverse range of hardware configurations to implement such themes.

Frequently Asked Questions About Applying Hazbin Hotel Windows Themes

This section addresses common inquiries regarding the acquisition, installation, and usage of Windows themes based on the Hazbin Hotel animated series.

Question 1: What are the primary components typically included in a Hazbin Hotel Windows theme?

A typical theme encompasses a collection of customized wallpapers, icon sets, sound schemes, and, in some instances, animated cursors. The aim is to provide a cohesive visual and auditory experience reflective of the source material.

Question 2: Where can a user reliably obtain such themes without compromising system security?

Reliable sources include official theme stores, reputable customization websites such as DeviantArt, and established online communities. Avoid downloading themes from unofficial file-sharing sites or untrusted sources, as these may contain malicious software.

Question 3: How does the resolution of wallpapers affect system performance when using a Hazbin Hotel theme?

High-resolution wallpapers, particularly those exceeding the monitor’s native resolution, can significantly impact system performance. Lowering the wallpaper resolution or opting for static images instead of slideshows can mitigate performance issues.

Question 4: Are themes designed for older versions of Windows compatible with newer operating systems?

Themes designed for older Windows versions may not be fully compatible with newer operating systems due to changes in system architecture and theming engines. Compatibility should be verified before installation to prevent potential issues.

Question 5: Can the installation of a Hazbin Hotel theme conflict with other installed software?

Conflicts may arise if the theme includes custom icon packs or shell extensions that interfere with other software. It is advisable to test the theme’s functionality after installation and monitor for any unusual behavior.

Question 6: How can a user remove a Hazbin Hotel theme if it causes system instability or performance issues?

To remove a theme, navigate to the Windows personalization settings, select a default theme, and uninstall any associated theme packs or components through the Control Panel’s Programs and Features section.

In conclusion, careful consideration of source reliability, compatibility, and system resource usage is essential when implementing these customizations. Implementing these recommendations promotes a safe and optimal user experience.

The following section will address the legal and ethical considerations.

Navigating “Hazbin Hotel Windows Theme” Implementation

Effective utilization requires an understanding of the potential challenges and opportunities presented by such a customization. The following tips provide guidance on optimizing the experience while minimizing potential risks.

Tip 1: Prioritize Reputable Sources: Always obtain themes from verified and trusted sources. This minimizes the risk of downloading malicious software or unstable theme components. Example: favor official theme stores over unofficial file-sharing websites.

Tip 2: Verify Operating System Compatibility: Confirm that the theme is designed for the specific Windows version in use. Incompatible themes can cause system errors or instability. Example: check the theme’s description for compatibility information before installation.

Tip 3: Manage Resource Consumption: Be mindful of the theme’s resource demands, particularly regarding wallpaper resolution and sound scheme complexity. Excessive resource usage can degrade system performance. Example: opt for static wallpapers over slideshows or animated backgrounds on less powerful hardware.

Tip 4: Preview Before Applying: Utilize preview options, if available, to assess the theme’s visual impact and potential compatibility issues before fully implementing it. Example: use theme preview features to identify any display anomalies or compatibility conflicts.

Tip 5: Create a System Restore Point: Before installing any third-party theme, create a system restore point. This allows for a swift return to a previous stable configuration if issues arise during or after installation. Example: use Windows System Restore to create a backup of the system state before installing the theme.

Suggested read: RV Windows: Replacement, Repair & More!

Tip 6: Regularly Scan for Malware: Periodically scan the system with a reputable antivirus program to detect and remove any malicious software that may have been bundled with the theme. Example: schedule regular scans with Windows Defender or a third-party antivirus solution.

Tip 7: Remove Unused Themes: Uninstall themes that are no longer in use to free up system resources and prevent potential conflicts with other software. Example: remove old or unwanted themes through the Windows personalization settings.

These tips promote a secure and optimized experience, ensuring that personalization enhances rather than detracts from overall system functionality.

The subsequent discussion will delve into legal and ethical Considerations.

Hazbin Hotel Windows Theme

This exploration of “Hazbin Hotel Windows Theme” has outlined its components, acquisition methods, and potential ramifications. Key considerations include source reliability, system compatibility, and resource consumption. Theme elements encompass wallpapers, icons, and sound schemes, with availability contingent upon reputable platforms. Compatibility depends on the operating system version and installed software, while performance hinges on resource utilization. The investigation emphasizes informed decision-making when customizing a computing environment.

Ultimately, the decision to implement such a theme resides with the individual user. Prudence dictates a thorough evaluation of potential risks and benefits before proceeding. Continued vigilance regarding security and system performance remains paramount for a secure and efficient user experience, where future trends in desktop customization emphasize streamlined integration and resource efficiency.

![Download Toki Pona Language Pack for Windows - [Updated] 19 download toki pona language pack for windows updated](https://superagc.com/wp-content/uploads/2025/10/download-toki-pona-language-pack-for-windows-updated.webp)