Real property consists of land, buildings and attachments to the land and/or buildings. Ahead of the fiscal year with starts oct.

Toronto Property Tax 2021 Calculator Rates – Wowaca

The city council voted monday to maintain the real estate tax rate of $1.20 per $100 of assessed value following a debate over whether to lower it to $1.135 to partially offset the tax increase.

Richmond property tax rate. The tax year 2019 is payable in year 2020. Including data such as valuation, municipal, county rate, state and local education tax dollar amounts. Residential property tax rate for richmond from 2018 to 2021;

$0.7297 municipal (includes conservation reserve fund) $1.6435 homestead education rate. What is the real estate tax rate for 2021? The new assessments will be used to calculate tax bills mailed to city property owners next year.

The tax assessor’s office is located on the second floor of the town hall building. A simple percentage used to estimate total property taxes for a home. $2 / $1,000 of assm't value between $3m to $4m 0.002 tier 2:

Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged. > home > city hall > finance, taxes & budgets > property taxes > tax rates. * tax as a percentage of market for owner occupied properties only.

Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. The budget calls for lowering the property tax rate from $0.687772 to $0.68. What is the due date of real estate taxes in the city of richmond?

See city of richmond, va tax rates, tax exemptions for any property, the tax assessment history for the past years, and more. See what the tax bill is for any city of richmond, va property by simply typing its address into a search bar! For a more detailed explanation of county property tax.

1, the richmond city commission has adopted a $41.5 million budget. 8/15/2020, 11/15/2020, 2/15/2021, and 5/15/2021. Real estate taxes are due on january 14th and june 14th each year.

Richmond’s real estate tax rate is $1.20 per $100 of assessed value. The tangible personal property tax is a tax based on the value of the property, commonly referred to as an ad valorem tax. Personal property taxes are billed once a year with a december 5 th due date.

All rates are per $100 in assessed value. What are the property taxes in richmond, nh? Boats, trailers and airplanes are not prorated.

Personal property taxes on automobiles, trucks, motorcycles, low speed vehicles and motor homes are prorated monthly. Property tax rates of richmond, nh Property tax bills are mailed in july of each year.

Richmond is the capital of virginia and the place where virginia’s property tax laws were established. City of richmond (debt service) $0.1745/$100 value total property tax rate $0.6999/$100 value. Over $4m $4 / $1,000 of assessment value over $4m 0.004 city of richmond 2021 tax rates new additional school tax for qualifying residential properties:

Tangible personal property is the property of individuals and businesses in the city of richmond. What is considered real property? City of richmond, va property tax information.

The town of richmond’s property tax due dates are as follows: Real property (residential and commercial) and personal property: Richmond’s average effective property tax rate is 1.01%.

Year municipal rate educational rate final tax rate; The real estate tax rate is $1.20 per $100 of the properties assessed value. The mission is to produce and certify an accurate and timely tax roll on an annual.

There is a $1.50 transaction fee for each payment made online. City of richmond (maintenance & operations) $0.5254/$100 value. The fiscal year 2021 tax rates are:

Residential Property Tax Calculator

Heres How Mississaugas Property Taxes Compare To Other Ontario Cities

Ontario Property Tax Rates Lowest And Highest Cities

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

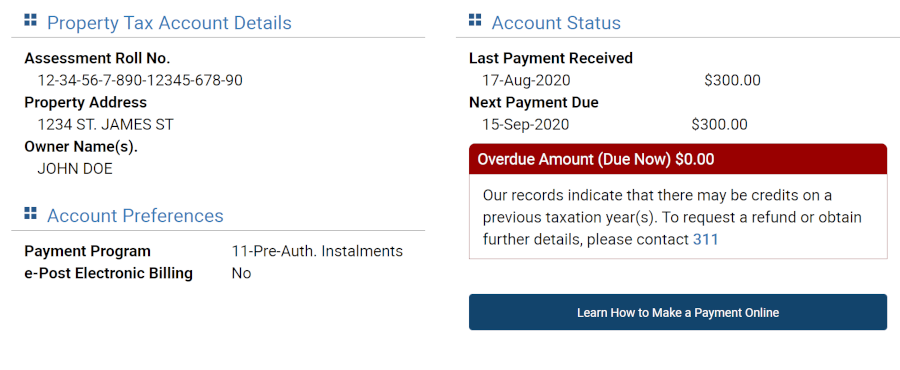

About Your Tax Bill – City Of Richmond Hill

Richmond Property Tax 2021 Calculator Rates – Wowaca

2

About Your Tax Bill – City Of Richmond Hill

Virginia Property Tax Calculator – Smartasset

Taxing Property Instead Of Income In Bc

Property Tax – North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

About Your Tax Bill – City Of Richmond Hill

Virginia Property Tax Calculator – Smartasset

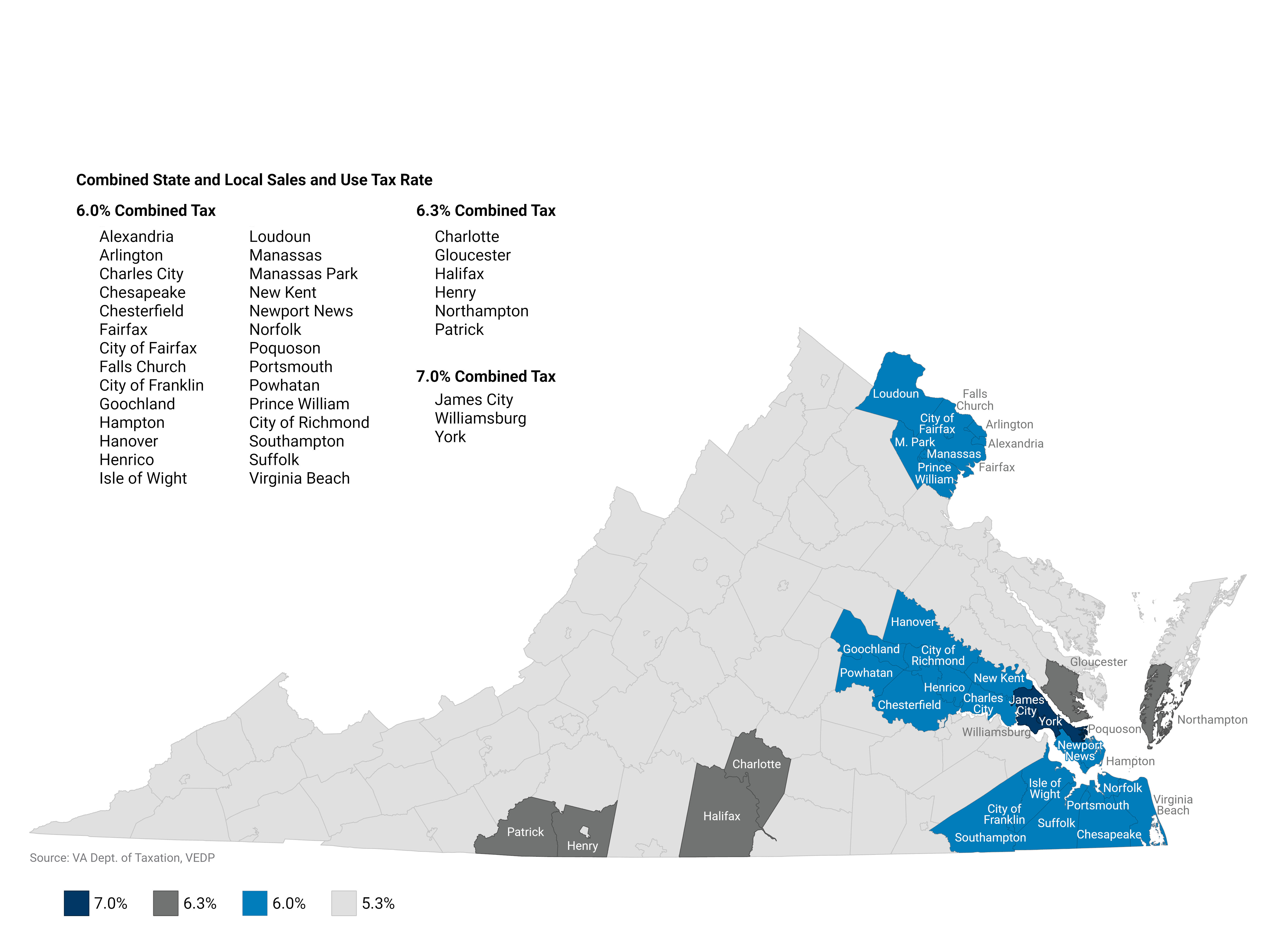

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Ontario Property Tax Rates Lowest And Highest Cities

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

4uagmek1d-lwjm

Toronto Property Taxes Explained Canadian Real Estate Wealth

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom