This sales tax will be remitted as part of your regular city of aurora sales and use tax filing. The minimum combined 2021 sales tax rate for aurora, colorado is.

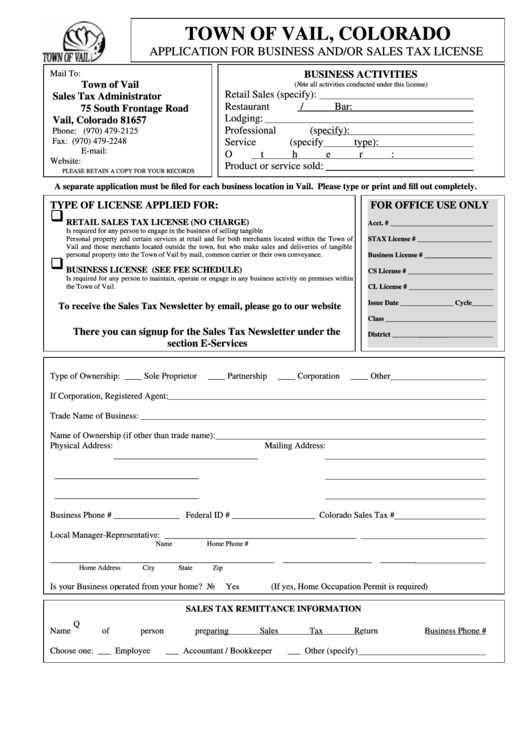

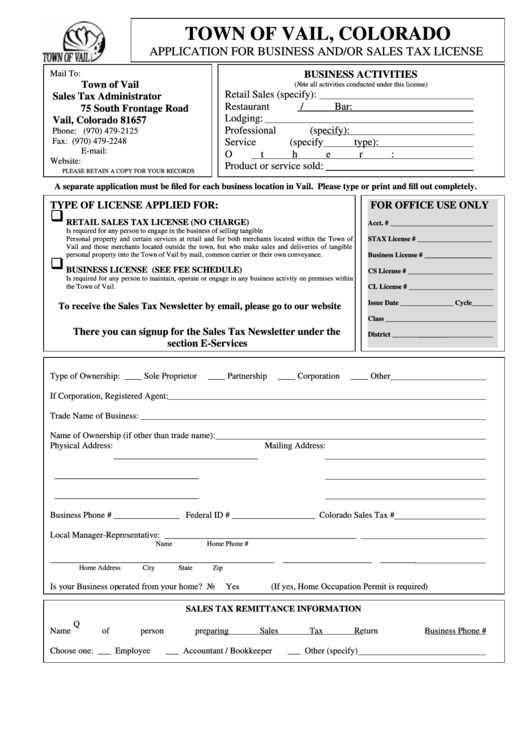

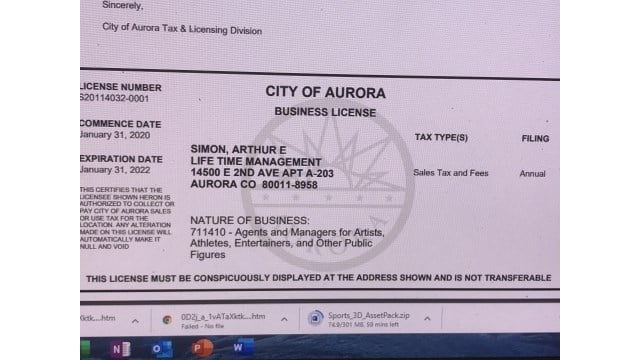

Colorado Business License

Arapahoe county does not directly administrate, enforce or collect sales tax, or license businesses within county boundaries.

Aurora co sales tax license. If you email your completed application a follow up email with instructions to make payment online through xpress bill pay will be sent. Other than liquor licenses, adams county does not have a separate sales tax license. Sometimes taxpayers refer to this as a business registration, but it is an application for a colorado sales tax account or sales tax license.

Code sections the city of aurora code of ordinances Understand the process of obtaining a business license in aurora, taxpayer rights and responsibilities, taxes you may have to pay, including sales tax, use tax and occupational privilege tax, and the reason that audits are conducted. Taxes collected for the city of aurora are monies held in trust by you.

Gross sales and service (total receipts from city activity must be reported and accounted for. It is the responsibility of the aurora business making a purchase from a company outside of aurora to verify that the vendor is licensed to collect aurora tax, if in fact the company does charge a local sales tax on its invoice. The resulting business license is the company’s authorization to conduct business in aurora.

Since all collection and administration of the sales tax is the responsibility of the colorado department of revenue, having a state sales tax license is sufficient for. Businesslic@auroragov.org © copyright 2021 city of aurora | version: Questions about remitting sales tax and business licensing should be directed to:

A sales and use tax license assigns you the right and obligation to collect sales tax for the city of aurora. City of aurora tax & licensing division staff will help answer questions. The tax filing roles and frequencies for the business can be seen in the bwer right of the license.

Aurora business licensing & sales tax. An aurora, colorado sales tax permit can only be obtained through an authorized government agency. All businesses are required to file a sales and use tax return even if there are no retail sales as almost all businesses owe some amount of use.

Your aurora cafe or restaurant may require a general license for all types of alcoholic beverages, or a license just for beer and wine. Building use tax when acquiring a building permit within arapahoe county, the 0.25 percent open space use tax is collected by the public works department based off of. Correspondence with tax and licensing staff can be sent through the aurora tax portal or by email at or website for more information on tax, or licensing.

Businesses attending more than five events need to apply for a city of aurora business license. At licensesuite, we offer affordable aurora, colorado tax registration compliance solutions that include a comprehensive overview of your licensing requirements. The cost of an aurora, colorado tax registration depends on a company's industry, geographic service regions and possibly other factors.

The retailer must apply for and obtain a sales tax license and begin collecting colorado sales tax by the first day of the first month commencing at least 90 days after the retailer’s aggregate colorado sales in the current year exceed $100,000. You have an obligation to account for and remit these funds to the city of aurora by the date due. To submit your completed business and tax license application either send it via email or mail to the following address along with the $20.00 application fee:

Aurora sales tax applies to the retail sale or rental of all tangible personal property. The county sales tax rate is %. Decide what drinks your business plans to sell, and learn the licenses you need to maintain compliance.

Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get an aurora, colorado sales tax permit. The information can be provided by email to tax@auroragov.org or c all us at 303.739.7800. It also applies to the retail sale of certain services that are listed below:

Licensing a company to conduct business in aurora begins with the business license application. Let us know if the special event you are attending is not listed so we can add it to our system. Retailers are required to collect the aurora sales tax rate of 3.75% on cigarettes beginning dec.

It is based on the jurisdiction (city/town) where the vehicle owner or lessee resides. The aurora sales tax rate is %. A sales tax license is used for collecting and remitting sales tax that is collected by the colorado department of revenue.

Telecommunication and cable television services. This is the total of state, county and city sales tax rates. If your cafe or restaurant in aurora serves any kind of beer, wine, cider, or spirits, you’re likely going to need some type of beverage alcohol license.

Sales tax paid to an unlicensed vendor does not result in payment to the city. If, you want to buy/sell/lease wholesale or sell retail as an license (in small amounts) items or materials, you will need a seller's permit / wholesale resale state id, (you can obtain and use this sales tax id license if you will sell/lease retail or wholesale or buy wholesale any aurora materials, items, merchandise, food etc.) Building permit is considered a sale of tangible personal property, and sales tax should be collected on such transactions, as required by the city of aurora tax code.

The colorado sales tax rate is currently %. Each physical location must have its own license and pay a $16 renewal fee. Sales tax is required to be paid (if applicable) when applying for a new certificate of title or a new temporary registration for all new vehicle purchases.

It also establishes the required sales, use, occupational privilege (opt) and/or lodger's tax filing roles and allows the business access to a variety of city services including online filing options.

Colorado Business License

Colorado Business License

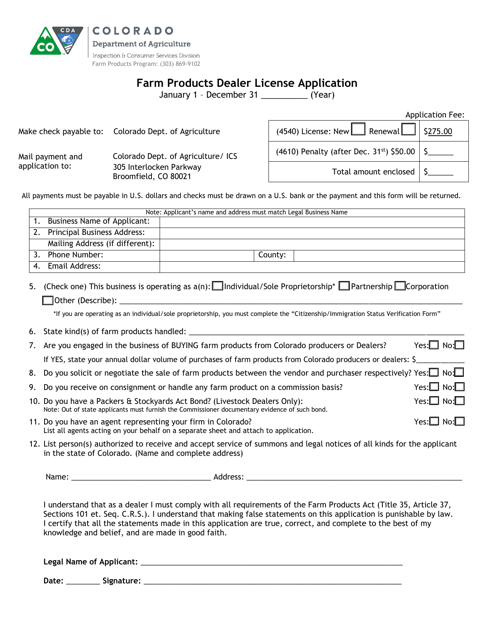

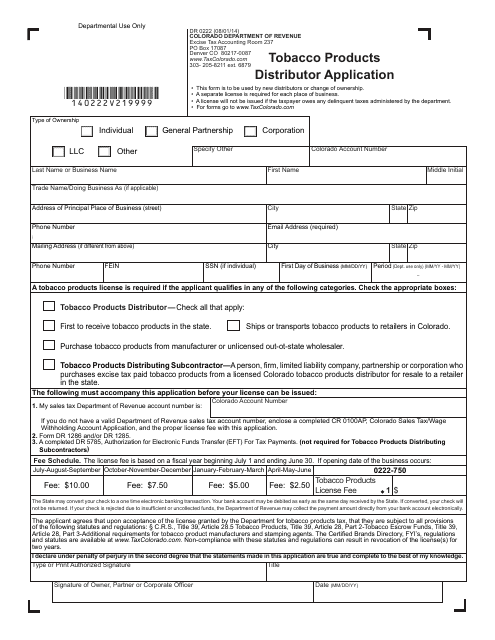

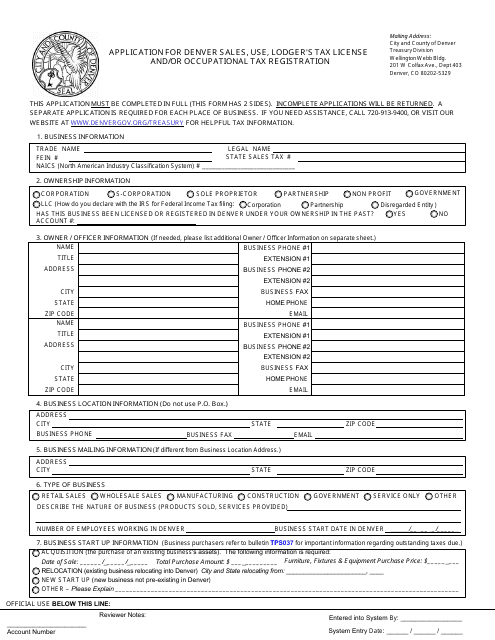

Sales And Use Tax Return Form

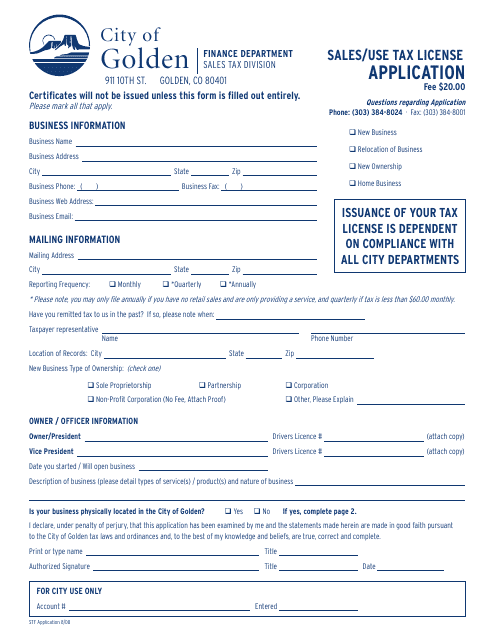

Resalesales Tax License Agron Llc

Resalesales Tax License Agron Llc

Resalesales Tax License Agron Llc

Aurora Co Music Artist Management Expert Promotion Marketing Ser – Wboc Tv

Colorado Business License

Colorado Business License

Resalesales Tax License Agron Llc

Resalesales Tax License Agron Llc

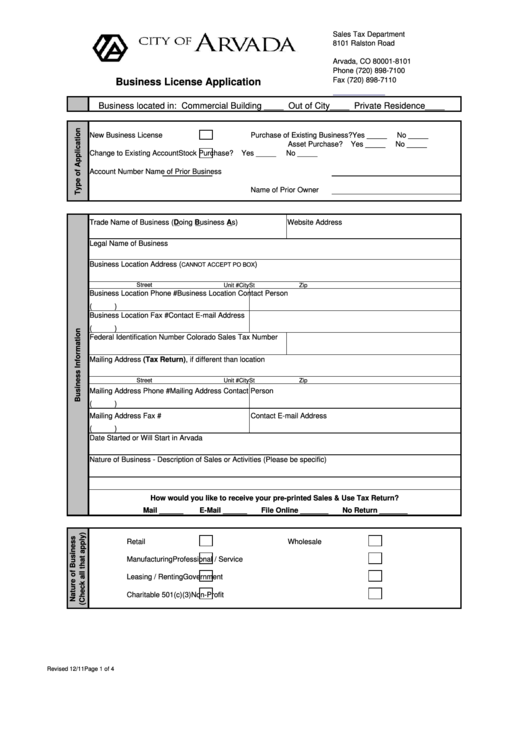

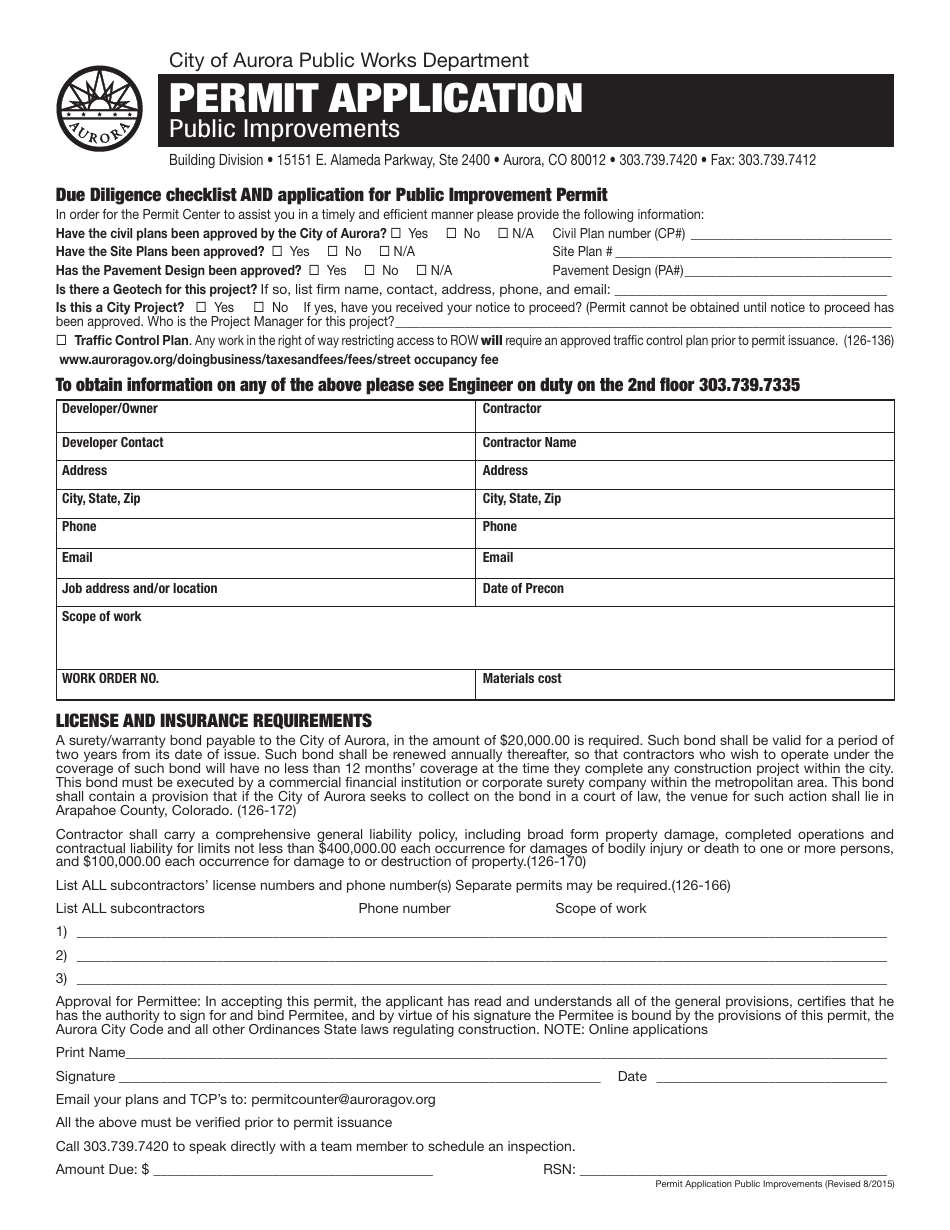

City Of Aurora Colorado Permit Application Form Download Fillable Pdf Templateroller

Resalesales Tax License Agron Llc

Colorado Business License

Colorado Business License

Sales And Use Tax Return Form

Colorado Business License

Colorado Business License

Colorado Business License