Property tax in north carolina is a locally assessed tax, collected by the counties. The number of homes for sale in wake county, nc decreased by 20.3% between october 2021 and november 2021.

Wake County North Carolina Property Tax Rates 2020 Tax Year

Fuquay varina town of, police department.

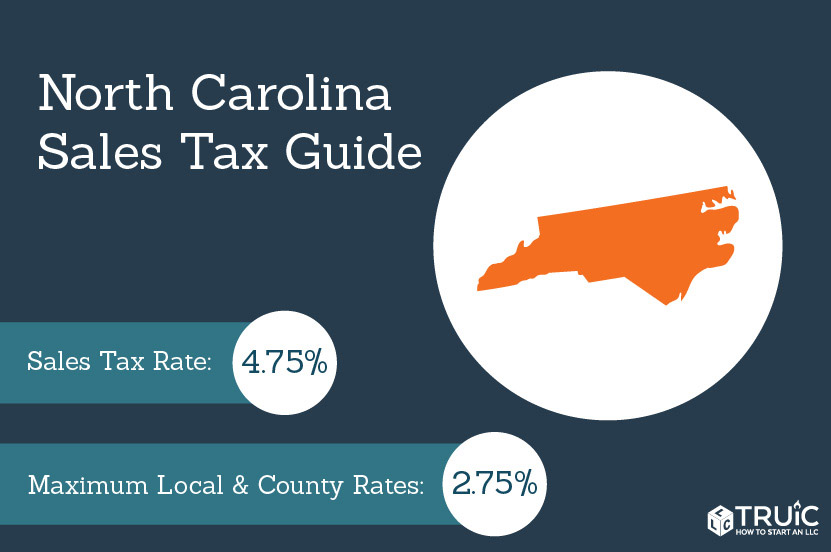

Wake county nc sales tax breakdown. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Wake county, nc wake county, nc has 3,870 homes for sale to choose from. Proof of plate surrender to ncdmv (dmv form fs20) copy of the bill of sale or the new state’s registration.

State legislation requires each county to reappraise real. Why are these records available? Most services are not subject to the tax.

Wake county, nc sales tax rate. Please contact the individual firms (shown below) for more information concerning the sale. 35 rows listed below by county are the total (4.75% state rate plus applicable local.

How does a tax lien sale work? The average home currently for sale in 27529 is around 17 years old and 2,444 ft². Listings spent 9 days on the market in november 2021, and had a median list price of $386,982 during the same period.

The certificate is then auctioned off in wake county, nc. North carolina assesses a 3 percent sales tax on all vehicle purchases, according to carsdirect. The median list price is $368,995 or $155 / ft².

The 2018 united states supreme court decision in south dakota v. (7 days ago) north carolina’s sales tax is imposed on the retail sale of most tangible personal property in the state. The buyer of the tax lien has the right to collect the lien, plus interest based on the official specified interest rate, from the property.

Some items like prescription drugs and groceries (except prepared foods, candy, soft drinks and the like) are exempt from the tax. This sales tax is known as the highway use tax, and it funds the improvement and maintenance of. Fuquay varina town of, police department.

These listings range from $343,240 in the lower quartile to $415,863 in the upper quartile. Typically, this tax is charged on restaurant. In august 2009, the nc general assembly ratified the congestion relief and intermodal transport fund act, allowing orange, durham and wake counties to generate new revenue for public transportation.

Wake county, north carolina sales tax rate 2021 up to 7.25%. The wake county, north carolina sales tax is 7.25%, consisting of 4.75% north carolina state sales tax and 2.50% wake county local sales taxes.the local sales tax consists of a 2.00% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). The wake county sales tax rate is %.

See detailed property tax report for 305 e hillside dr, wake county, nc. 27529 currently has 44 residential homes for sale on the market. Between 2018 and 2019 the median property value increased from $301,900 to $316,800, a 4.94% increase.

All about deepening the connection with information wake transit plan 2020 update sales tax wake county nc 2020 wake transit plan 2020 update north carolina attorneys law firm bell davis pitt wake transit plan 2020 update the latest sales tax rate for wake county nc this rate includes any state county city and local sales taxes 2019 rates included for use while preparing your in e tax. Has impacted many state nexus laws and sales tax collection requirements. Within one year of surrendering the license plates, the owner must present the following to the county tax office:

The median property value in wake county, nc was $316,800 in 2019, which is 1.32 times larger than the national average of $240,500. The december 2020 total local sales tax rate was also 7.250%. Some cities and local governments in wake county collect additional local sales taxes, which can be as high as 0.5%.

The homeownership rate in wake county, nc is 63.8%, which is lower than the national average of 64.1%. Sign up today because the best tax deals might disappear as soon. Local occupancy tax charged by the nc hotels and motels (this is a tax in addition to the regular sales tax) local prepared food and beverage taxes levied in certain areas of the state (wake and mecklenburg county are two examples where a 1% tax is charged in addition to the regular sales tax rate);

Enjoy the pride of homeownership for less than it costs to rent before it's too late. The current total local sales tax rate in wake county, nc is 7.250%. The state department of revenue is responsible for listing, appraising and assessing all real estate estate within the counties.

The wake county sales tax is 2%. All tax foreclosure sales are scheduled by individual firms.

Wake County North Carolina Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Taxes – Wake County Economic Development

Wake County North Carolina Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

How To Find Out If Your Wake County Property Tax Is Going Up – Abc11 Raleigh-durham

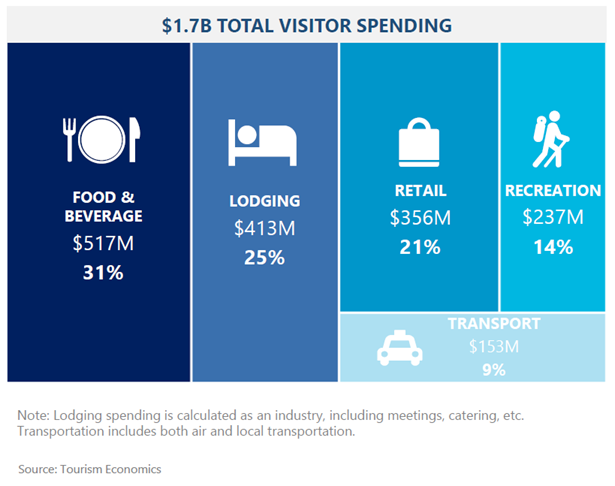

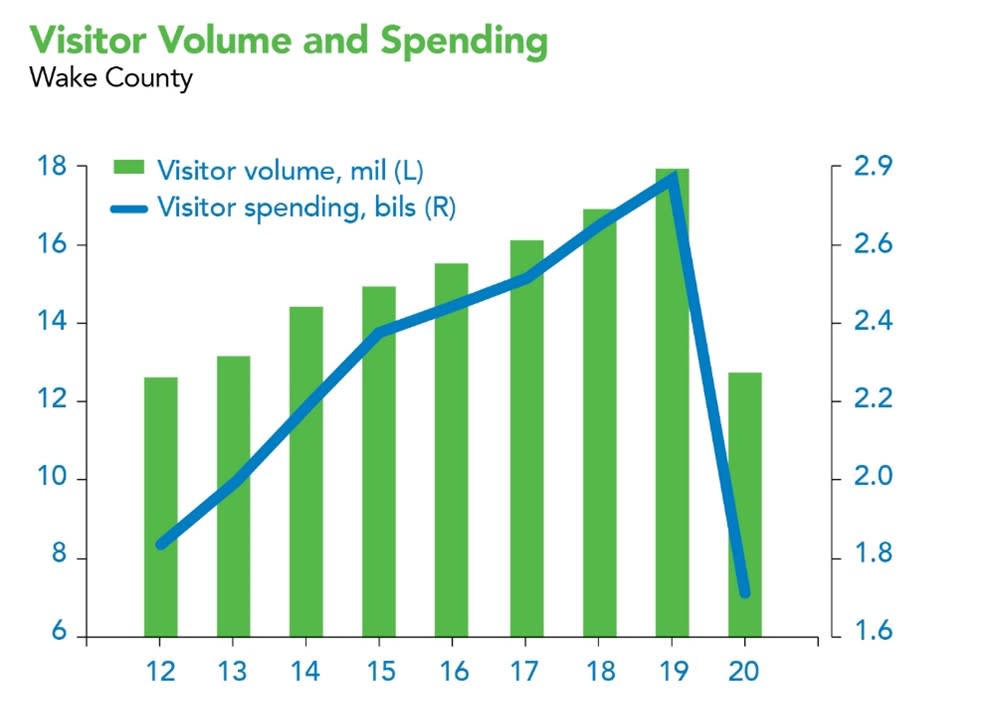

2020 Wake County Visitation Figures Released

Wake County Nc Approves 10 Percent Tax Increase – Ke Andrews

Wake County North Carolina Property Tax Rates 2020 Tax Year

Pin On My Saves

North Carolina Sales Tax – Small Business Guide Truic

Precinct Map Shows Wake Voting Patterns Wralcom

2021 Best Zip Codes To Buy A House In Wake County Nc – Niche

2020 Wake County Visitation Figures Released

Wake County North Carolina Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Organizational Chart Town Of Wake Forest Nc

Buy Your Dream House Or Get Refinancing For Your Private Property At The Lowest Home Loan Interest Rates Consu Dream House Exterior Dream Home Design Mansions

Sales And Use Tax In Nc Roper Accounting Group

Wake County North Carolina Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Pin On Survival