There is no applicable special tax. Some of the florida tax type are:

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The duval county, florida sales tax is 7.00% , consisting of 6.00% florida state sales tax and 1.00% duval county local sales taxes.the local sales tax consists of a 1.00% county sales tax.

Jacksonville fl sales tax rate 2019. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The homeownership rate in jacksonville, fl is 56.7%, which is lower than the national average of 64.1%. The 8% sales tax rate in jacksonville consists of 6.25% illinois state sales tax, 1% morgan county sales tax and 0.75% jacksonville tax.

The jacksonville sales tax rate is 8.25%. You can print a 7.5% sales tax table here. Please refer to the florida website for more sales taxes information.

Sales and use tax and discretionary sales surtax rates. Limited to amount allowed as a credit. However, there are some counties that do not impose surtax.

What is the sales tax rate in jacksonville, florida? 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity. The median property value in jacksonville, fl was $200,200 in 2019, which is 0.832 times smaller than the national average of $240,500.

The minimum combined 2021 sales tax rate for jacksonville, florida is. Florida's general sales and use tax rate is 6% with the following exceptions: Instead of the rates shown for the jacksonville tax region above, the following tax rates apply to these specific areas:

The jacksonville sales tax rate is. 31 rows with local taxes, the total sales tax rate is between 6.000% and 7.500%. Specifically, florida levies a sales tax at the rate of 5.7% for commercial rent and allows counties to levy an additional surtax that ranges from 0% to.

, fl sales tax rate. There is no applicable special tax. The 7.5% sales tax rate in jacksonville consists of 6% florida state sales tax and 1.5% duval county sales tax.

This is the total of state, county and city sales tax rates. Capped at 10% increase annually: Florida state rate(s) for 2021.

The december 2020 total local sales tax rate was 7.000%. The duval county sales tax is collected by the merchant on all qualifying sales made within duval county. The current total local sales tax rate in jacksonville beach, fl is 7.500%.

The 7.5% sales tax rate in jacksonville beach consists of 6% florida state sales tax and 1.5% duval county sales tax. The florida sales tax rate is currently %. There is 0 additional tax districts that applies to some areas geographically within jacksonville.

Between 2018 and 2019 the median property value increased from $183,700 to $200,200, a 8.98% increase. There is no applicable city tax or special tax. Sales tax and discretionary sales surtax are calculated on each taxable transaction.

The current total local sales tax rate in jacksonville, fl is 7.500%. State sales and use tax: The jacksonville sales tax rate is 8%.

1.5% (capped at the first $5,000) estate tax: 6% (numerous exemptions available) local sales and use tax: The current total local sales tax rate in middleburg, fl is 7.500%.

There is no applicable city tax or special tax. Get all of the tools that you need to manage your business efficiently with wix. 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity.

There is no applicable city tax or special tax. 6% is the smallest possible tax rate (, florida) 6.5%, 7%, 7.5% are all the other possible sales tax rates of florida cities. Instead of the rates shown for the jacksonville tax region above, the following tax rates apply to these specific areas:

There is 0 additional tax districts that applies to some areas geographically within jacksonville. , fl sales tax rate. The discretionary sales surtax rate depends on the county, where rates currently range from.5% to 2.5%;

For tax rates in other cities, see florida sales taxes by city and county. Florida's general state sales tax rate is 6% with the following exceptions: The florida's tax rate may change depending of the type of purchase.

Consumers use, rental tax, sales tax, sellers use, lodgings tax and more. The county sales tax rate is %. Get all of the tools that you need to manage your business efficiently with wix.

Ad Valorem Tax – Overview And Guide Types Of Value-based Taxes

Illinois Sales Tax Rates By City County 2021

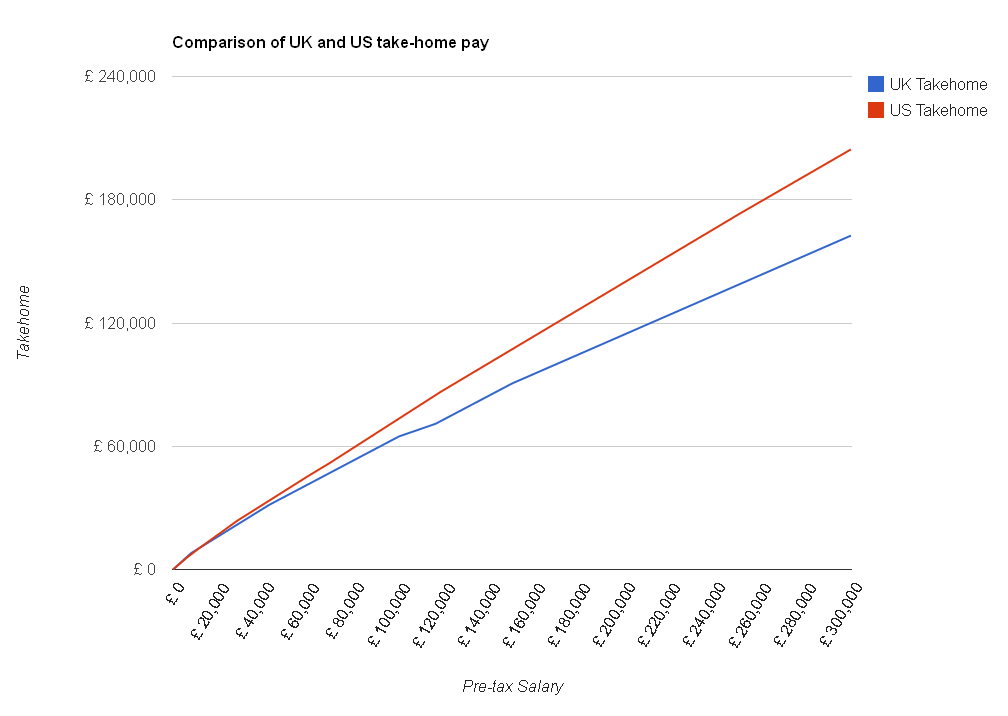

Comparison Of Uk And Usa Take Home The Salary Calculator

Georgia Sales Tax Rates By City County 2021

Florida Sales Tax J David Tax Law

2021 Florida Sales Tax Rates For Commercial Tenants – Winderweedle Haines Ward Woodman Pa

Ohio Sales Tax Rates By City County 2021

Us States With Highest Gas Tax 2021 Statista

2

What Is Cap Rate And How To Calculate It Infographic Investment Property For Sale Real Estate Infographic Real Estate Investing

2

Florida Sales Tax Rates By City County 2021

2nd Tax On Receipts Confuses Customers At New Walmart

2

New York Sales Tax Rates By City County 2021

Alabama Sales Tax Rates By City County 2021

Florida Sales Use Tax Guide – Avalara

Florida Sales Tax Information Sales Tax Rates And Deadlines

2021 Guide To Tax-free Weekend In Your State Direct Auto