She attended silver lake elementary, eisenhower middle school, and is a graduate of cascade high school. The tax foreclosure sale is a voice auction, starting with a minimum bid provided by the county.

2

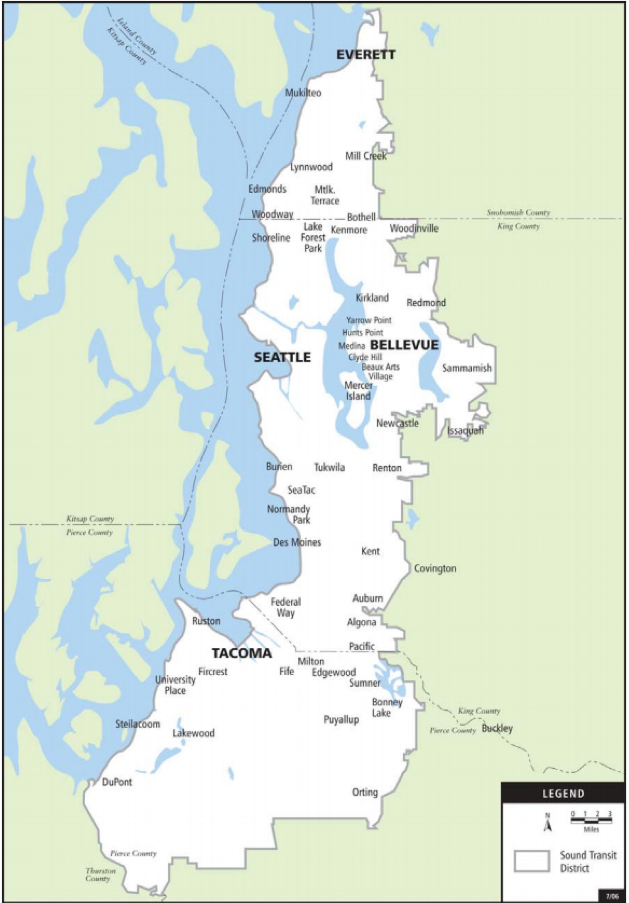

The city of everett collects a number of special local taxes on specific types of business activity, including the utility, gambling, and admission tax.

Washington state sales tax everett wa. Start yours with a template!. Utility taxes are imposed on businesses such as telephone, cellular, gas, electric, cable, and garbage. The combined rate used in.

Washington state & local government revenue sources, fiscal year 2019 ($ millions) source amount sales & gross receipts tax $28,326 property tax $12,965 individual & corporate income tax $0 other taxes $4,704 education charges $3,726 hospital charges $5,431 other charges $15,457 interest earnings $1,957 other general revenue $4,247 total $76,812 fiscal year 2019 washington is The county sales tax rate is %. Ad earn more money by creating a professional ecommerce website.

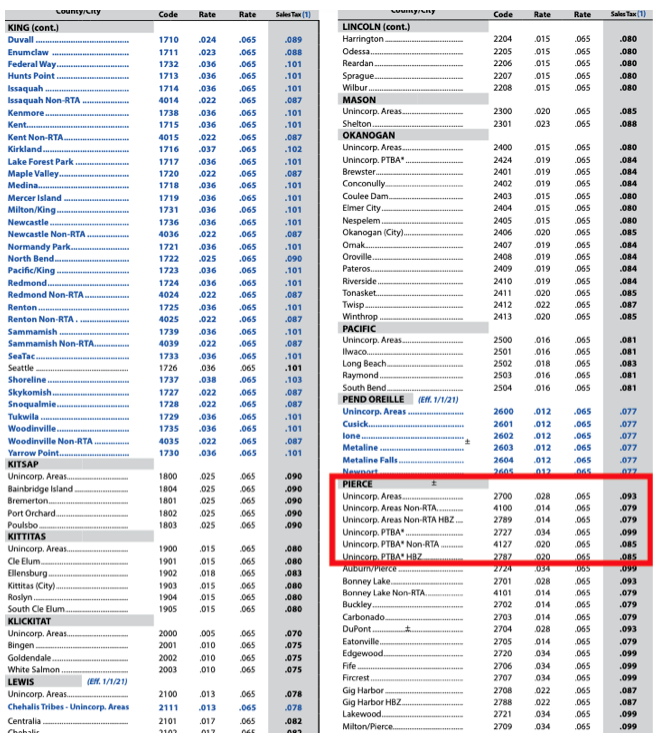

If our tax lawyers cannot offer a comprehensive strategy to deal with your tax matter, you will owe us nothing. The 9.8% sales tax rate in everett consists of 6.5% washington state sales tax and 3.3% everett tax. With the passage of the revenue act of 1935 washington began focusing on excise taxes such as the retail sales and use tax and the business and occupation tax.

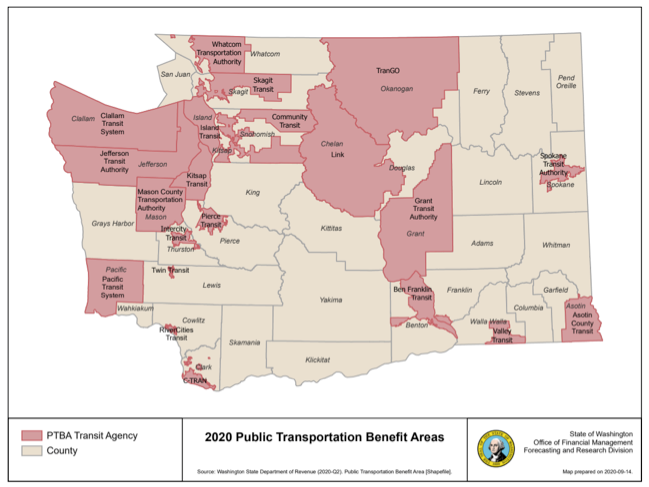

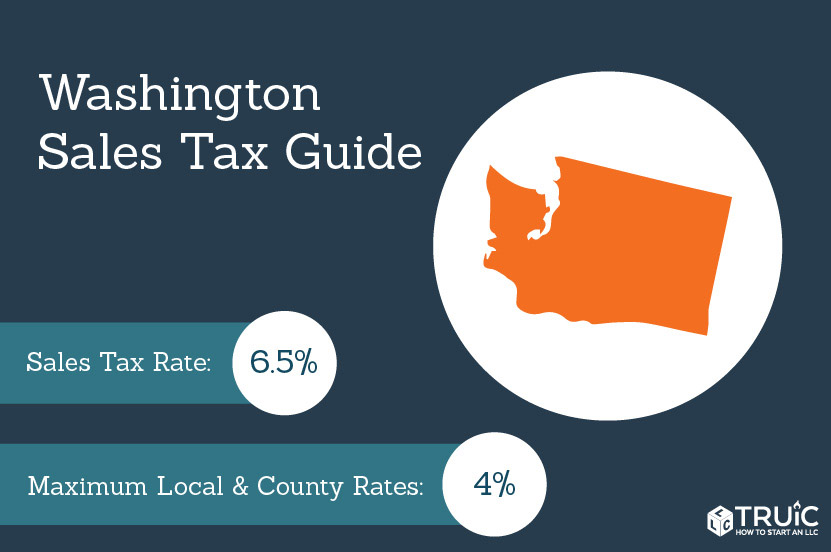

The sales and use tax is washington’s principal revenue source. The everett, washington, general sales tax rate is 6.5%. Washington has state sales tax of 6.5% , and allows local governments to collect a local option sales tax of up to 3.1%.

The current total local sales tax rate in everett, wa is 9.800%. Ad earn more money by creating a professional ecommerce website. The december 2020 total local sales tax rate was also 9.800%.

Cost for a copy of the paper list is $12.00 if picked up in person or $15.00 if mailed. Denise is a cpa and has been the firm's tax lead since 2019. There are a total of 218 local tax jurisdictions across the state, collecting an average local tax of 2.252%.

Use leading seo & marketing tools to promote your store. Depending on local municipalities, the total tax rate can be as high as 10.4%. Ago files felony sales tax theft charges against everett retailer.

Let more people find you online. Start yours with a template!. Search by address, zip plus four, or use the map to find the rate for a specific location.

To calculate sales and use tax only. From the establishment of washington as a territory in 1853 until the depression years of the 1930s, property tax was the principal revenue source for both state and local governments. According to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington state.

Decimal degrees (between 45.0° and 49.005°) longitude: This is the total of state, county and city sales tax rates. Just click on a city name to view the estate sales and auctions that are being held by companies in wa.if you are holding an estate sale or auction and would like to be a part of estatesales.net, join us!

So call today for a free consultation to find out your tax help options. , wa sales tax rate. The everett sales tax rate is %.

25, 2006 — the owner of a business that once operated 10 seen on screen kiosks in malls across washington has been charged with 48 felony counts of theft of sales tax and filing false state tax returns. On top of that is a 0.3 percent lease/vehicle sales tax. The minimum combined 2021 sales tax rate for everett, washington is.

This annual sale of property includes parcels with at least one year of property taxes that are 3 years old and delinquent (meaning if the full year 2018 or any prior years are unpaid as of june 2021). The washington sales tax rate is currently %. A retail sale is the sale of tangible personal property.

January february march april may june july august september october november december. You just need to know who to talk to. Look up a tax rate on the go.

Homeowners with property in tax lien foreclosure: Businesses making retail sales in washington collect sales tax from their customer. Washington estate sales (tag sale) listed below are the cities of washington that we serve.

There is no applicable county tax or special tax. You do not need to know everything. Use leading seo & marketing tools to promote your store.

You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. There is no applicable county tax or special tax. Let more people find you online.

Average sales tax (with local): Retail sales and use tax. We will notify hundreds or even thousands of people who have signed up to get notified about estate.

Originally from wichita kansas, denise and her family moved to washington during her childhood and settled in the silver lake area of everett. With local taxes, the total. Depending on the zipcode, the sales tax rate of everett may vary from 9.8% to 10.4% depending on the zipcode, the sales tax rate of everett may vary from 9.8% to 10.4%

Download our tax rate lookup app to find washington sales tax rates on the go, wherever your business takes you. 31 rows the state sales tax rate in washington is 6.500%. 101 rows the 98208, everett, washington, general sales tax rate is 10.4%.

The washington (wa) state sales tax rate is currently 6.5%. Washington sales tax may also be levied at the city/county/school/transportation.

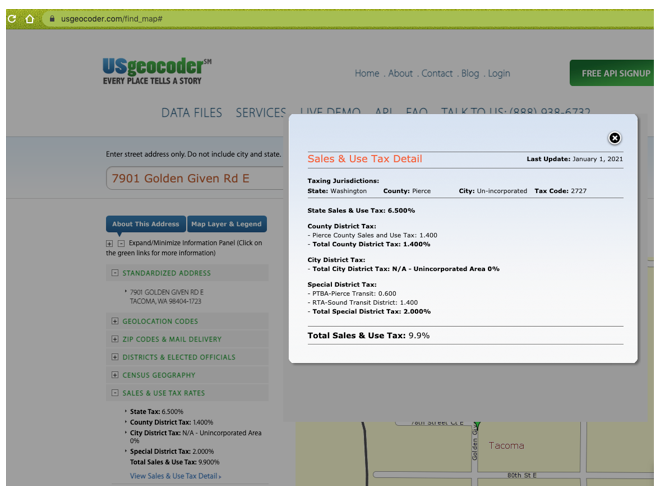

Washington State Sales Tax Rate – Usgeocoder Blog

Washington State Sales Tax Rate – Usgeocoder Blog

Washington Sales Tax Guide For Businesses

Washington State Sales Tax Rate – Usgeocoder Blog

Homes Sales Soaring In Everett Wa In 2021 Property Real Estate Things To Sell

2

Ford Section 179 Tax Benefits Epic Ford Fleet Fleet Benefit Ford

Earthquake Safety Tips Earthquake Safety Earthquake Safety Tips Safety Infographic

Lookup Sales Tax Rates

Top 10 Healthiest Cities In Us Centrum New Orleans Healthy

The Bombay Cat Is Family Cat And Takes Well To Children It Is Very Affectionate And Needs A Lot Of Attention This Is A Cat Breeds Cats American Shorthair Cat

Washington Sales Tax – Small Business Guide Truic

Beautiful Things Gungor Lyrics On Record Etsy You Make Beautiful Things Beautiful Typography Records

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 65

Spring Refi Special Prestige The Prestige Wa State Puget Sound

Washington State Sales Tax Rate – Usgeocoder Blog

Interactive Map Scopi Snohomish County Wa – Official Website

Pin On Snohomish Wa

2